7 minutes reading time

- Australian shares

Originally published on March 1st, 2023. Last updated on August 7th, 2024.

It’s an age-old question, is it possible for a person to time the share market? All the data seems to be pointing very firmly to no. It’s simply too hard to do.

Many investors try to pick the bottom of the share market to take advantage of any following rebound. This approach is referred to as ‘market timing’ and involves making investment decisions based on short-term market movements.

In contrast, a buy-and-hold approach involves buying shares and holding them over the long-term, irrespective of market movements. An overwhelming body of research finds that this passive buy-and-hold, long-term approach to owning shares produces better long-term results.

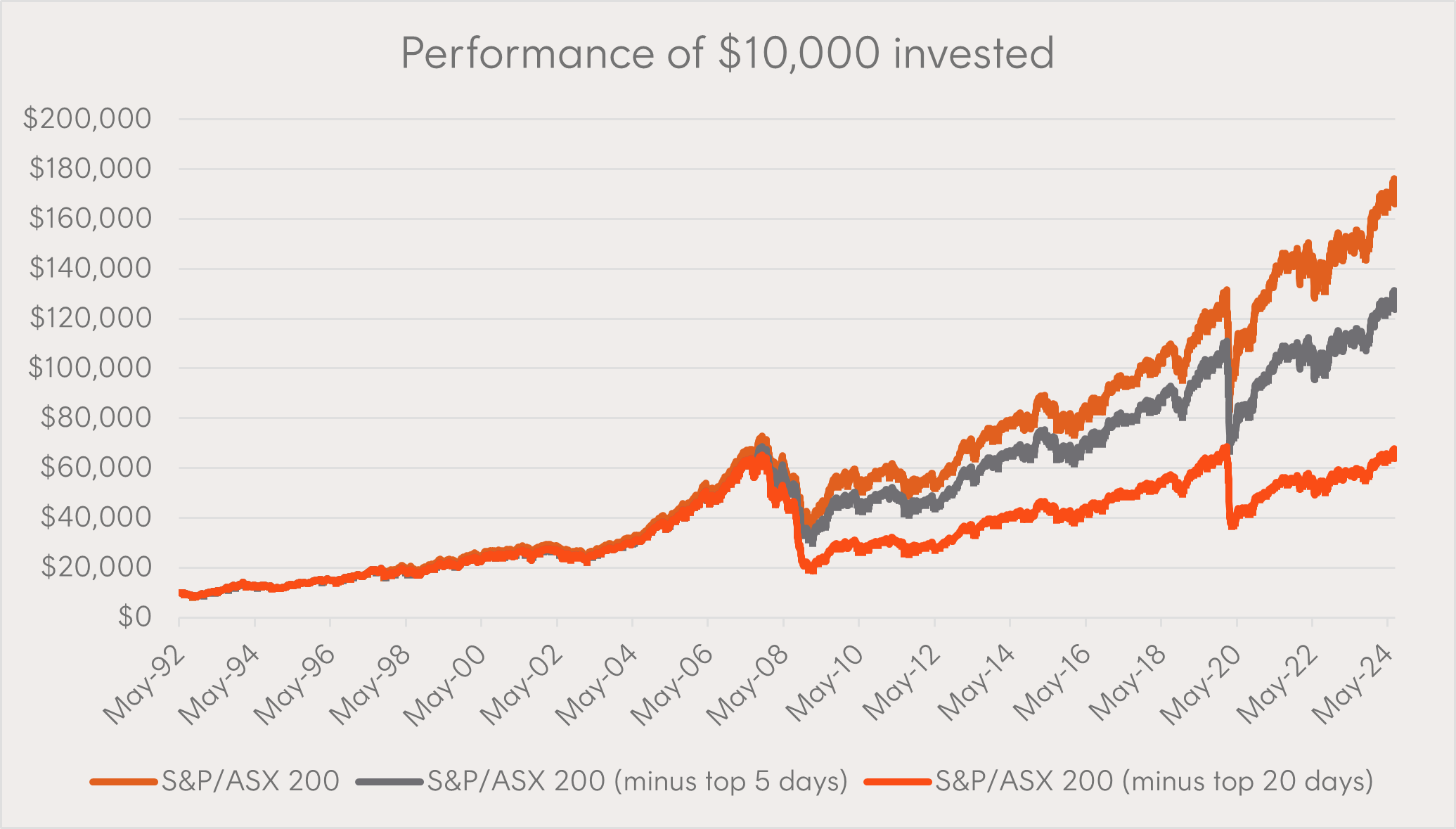

We crunched the numbers using the S&P/ASX 200 benchmark index, and our analysis showed just how big a difference it can make when investors miss out on a handful of the biggest rallies.

| S&P/ASX 200 | S&P/ASX 200 (minus top 5 days) | S&P/ASX 200 (minus top 20 days) | |

| 1 Year (%) | 12.21% | 12.21% | 12.21% |

| 3 Years (%, p.a.) | 5.96% | 1.66% | -4.28% |

| 5 Years (%, p.a.) | 8.51% | 5.84% | 2.09% |

| 10 Years (%, p.a.) | 8.79% | 7.44% | 5.52% |

| 20 Years (%, p.a.) | 9.31% | 8.04% | 4.52% |

| 30 Years (%, p.a.) | 9.80% | 8.73% | 6.36% |

Source: Bloomberg, Betashares. As at 31 July 2024. Past performance is not indicator of future performance. Top five and top 20 days since over the last 30 years have been removed from the respective data sets. None of these days occurred in the past year so one year returns are unaffected.

This might seem like ‘cherry-picking’, but in reality, if you tried market timing, there’s a good chance you’d miss out on some of the biggest rallies. Humans have a tendency to avoid loss, (called loss-aversion bias) which can cause investors to throw their strategy out the window and sell when markets turn bad. However, this can be precisely the worst time to sell, as the biggest rallies can happen in the middle of major market falls (see table below). And the more of those big rallies that you miss out on, the lower your gains over the long term.

The 20 biggest 1-day rallies have occurred during or soon after a major crash

Source: Bloomberg, Betashares. As at 31 January 2024. Past performance is not indicator of future performance.

In contrast, by staying invested in the benchmark share market index, you would automatically capture all market movements, which over time may prove to be advantageous.

By way of example, consider a hypothetical investor who sells a $10,000 investment that provides exposure to a broad share market index during the March 2020 market downturn caused by Covid. From 20 March 2020 to 5 August 2024, the ASX 200 returned 58.8%, which would have resulted in a $5,880 return on the initial investment of $10,000. Over the same period, the S&P 500 returned 125.01% and the Nasdaq 100 returned 155.85%, which would have resulted in $12,501 and $15,585 in returns respectively. These return figures assume reinvestment of any dividends from the relevant holdings.

The hypothetical investor who sold their investment and stayed out of the market from that point until now would have forgone thousands of dollars in potential gains from the recovery that has followed.

| Total cumulative return

(20 March 2020 to 5 August 2024) |

Value of $10,000 initial investment | Potential gains forgone by selling investment at start of period | |

| ASX 200 | 58.80% | $15,880.00 | $5,880.00 |

| S&P 500 | 125.01% | $22,501.00 | $12,501.00 |

| Nasdaq 100 | 155.85% | $25,585.00 | $15,585.00 |

Source: Bloomberg. 20 March 2020 to 5 August 2024. For illustrative purposes only. You cannot invest directly in an index. Past performance is not an indicator of future performance. Not a recommendation to invest or adopt any investment strategy. These return figures assume reinvestment of any dividends and does not take into account franking credits.

Independent research points to the same result

It is not just our research that is coming to this conclusion. A recent paper from JP Morgan, Is market timing worth it during periods of intense volatility? revealed that timing the market is almost impossible to achieve given that good and bad trading days fall so closely together.1

As at the end of 2021, seven of the best days in the US had occurred within two weeks of their corresponding worst day; but often the gap between the best and worst days was much shorter.

For example, March 12, 2020 was the second-worst day of the year in US share markets, yet that was immediately followed by the second-best day of the year.

JP Morgan’s study found that the worst days overwhelmingly occurred before the best days: over the last 20 years, six of the seven best days occurred after the worst day.

The close proximity of the best and worst days makes it virtually impossible to buy shares at the bottom before they climb again as most people are not that quick or lucky.

In other words, it is very unlikely that an investor could be lucky enough to consistently miss the worst days while being invested in the market for the best days.

JP Morgan’s final thought is this: “It is important to remind investors that success is achieved through time in the market, not timing the market. And, to quote Dolly Parton, ‘If you want the rainbow, you gotta put up with the rain’.”

We’d have to agree with that.

The pain of missing out

Separate research from the Schwab Center for Financial Research, Does Market Timing Work? found that even badly timed stock market investments were much better than having no share market investments at all.

That’s because investors who procrastinate and do nothing are likely to miss out on the stock market’s potential growth.

“Procrastination can be worse than bad timing. Long term, it’s almost always better to invest in stocks—even at the worst time each year—than not to invest at all,” according to their research.

“Given the difficulty of timing the market, the most realistic strategy for the majority of investors would be to invest in stocks immediately.”

If you don’t have a large single sum to invest or like the discipline of investing small amounts regularly, then dollar-cost averaging can assist in mitigating market timing risk and can help you gradually accumulate wealth.

Similar to a regular savings plan, dollar cost averaging involves investing the same amount of money at set intervals over a long period – whether market prices are up or down.

The key takeaway

It is almost impossible to time the market consistently whether it is over a short term time frame or over the long term.

Instead, investors should consider having a well-diversified portfolio and holding it over the long-term.

ETFs are well-suited to this investment approach by providing a convenient, cost-effective way to get exposure to all the major asset classes. ETFs track benchmark indices for various markets, including Australian and global equities, fixed income, cash and commodities.

You can use ETFs to build the core of your portfolio – investments that will provide your portfolio with a foundation for the long term, through the market’s up and down cycles. For example, A200 Australia 200 ETF provides exposure to the largest 200 companies on the ASX at an annual management cost of just 0.04%.

So you can sit back and enjoy your investment growing over time, without trying to time the market.

There are risks associated with an investment in A200, including market risk, security specific risk, industry sector risk and index tracking risk.

BetaShares Capital Limited (ABN 78 139 566 868 AFSL 341181) (BetaShares) is the issuer of the BetaShares Funds. This information is general in nature and is not a recommendation or offer to make any investment or adopt any investment strategy. This information does not take into account any person’s objective’s financial situation or needs. Investments are subject to investment risk, investment value may go down as well as up, and investors may not get back the full amount originally invested. Past performance is not indicative of future performance. Before making an investment decision, investors should consider the Product Disclosure Statement (PDS), available at www.betashares.com.au, and obtain financial advice. You may also wish to consider the relevant Target Market Determination (TMD) which sets out the class of consumers that comprise the target market for the BetaShares Fund and is available at www.betashares.com.au/target-market-determinations.

Resources:

1. https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/market-updates/on-the-minds-of-investors/is-market-timing-worth-it-during-periods-of-intense-volatility/

11 comments on this

for most investors, true. which makes it more lucrative for those that can.

Hi George,

If you’ve found a reliable way to time markets make sure you guard that information carefully! It would be extremely valuable.

In the source referenced for this article, Jack Manley, Global Market Strategist at JP Morgan, addresses this point.

Regards,

Patrick

Good article however the table showing the returns minus the top 5 & 20 days over different time periods has failed to take out the top 5 & 20 days over the 1 year period.

If you update with the correct figures can you let me know so I can access it.

Thanks

Jeff

Hi Jeff,

The data removes the top five and top 20 days respectively over the entire 30-year period of the data series, not the top five and top 20 of each individual period. Because none of those top five or top 20 days occurred within the last year, there are no days removed from those numbers.

Thanks for raising this. I’ve updated the caption to explain this a little more clearly.

Regards,

Patrick

I’m a little late to the party but…

By the article’s very own observations, it infers that “managing” loss aversion could contribute to a comparatively superior performance vs simply time-in-market. In other words, buying on those very days when everyone panics can contribute to an above average return.

It does take courage and conviction but given that “it’s almost always better to invest in stocks—even at the worst time each year”, timing the market on these days is just a subset of dollar-cost averaging (with opportunity).

Of course “there is no guaranteed ‘signal’ to get out of the market” but if historical records of significant drops in the market (>5%) demonstrate that they are usually associated with quick bounce-backs (no guarantees I know), one could argue that these are a “signal” to consider a buy in.

Furthermore, contrary to the popular mantra of owning “a well-diversified portfolio” (aka I’ve got no idea so I’ll gamble on a bit of everything) I would suggest that owning a select number of researched “good” companies is preferable to a corresponding index fund, which has to own good, bad and ugly. Hoping that a dud company turns good is the real “fool’s errand”.

Re table biggest ever one day rallies. This tables misleading as many of the days quoted were cancelled out by subsequent falls ie they were not kept as profit. So if you were out of the market you didn’t miss anything, if you were in the market you didn’t get to keep the gains.

That’s entirely the point though, Christine. There’s no good way to time or predict when those good and bad days are going to be so trying to is a fools errand. If you get it wrong you lose out big time by missing the wrong days.

If someone really could accurately and consistently time the market, both ups and downs, they would be able to accumulate the entire wealth of the stock exchange within their own lifetime.

I get so tired of this hypothetical argument. Most “best days” follow the “bad days”. It is impossible to be out of the market for those 20 days in 5 years. However if the general top and the general bottom can be captured then returns are significantly improved and this is possible.

The obvious solution?

Buy during market dips to hold long term (several years…many years?)

Then you earn the long-term growth rate #, plus a few extra % bonus from buying cheap in the dip.

#15% pa (or more) for NDQ.AX

Timing the market works for many Technical analysts. They were out of the Mkt in Jan 2008 and stayed out until March 2009. The monthly Coppock indicator has never missed an re-entry into the market for 100 years (only works on an Index – XAO, XJO), a change in sentiment is a turn up from below zero. You got back in in April 2009 missing out on the first few weeks which 90% of investors would have from being fearful. The exit in Jan 2008 was pretty obvious with prices closing below various EMAs or Heikin Ashi give an obvious signal. Warren Buffet knew a thing or two – be fearful when everyone is greedy and be greedy when everyone is fearful so after a 28% fall in NVDA, ASML, TSM on the US market, this week was the time to buy against the trend of the fearful. At the moment this downturn is nothing more than one weekly red candle on the index charts, worse on some individual stocks, especially those with debt.

Why is market timing difficult during periods of intense volatility?

Greeting : IT Telkom