Better investing starts here

Get Betashares Direct

Betashares Direct is the new investing platform designed to help you build wealth, your way.

Scan the code to download.

Learn more

Learn more

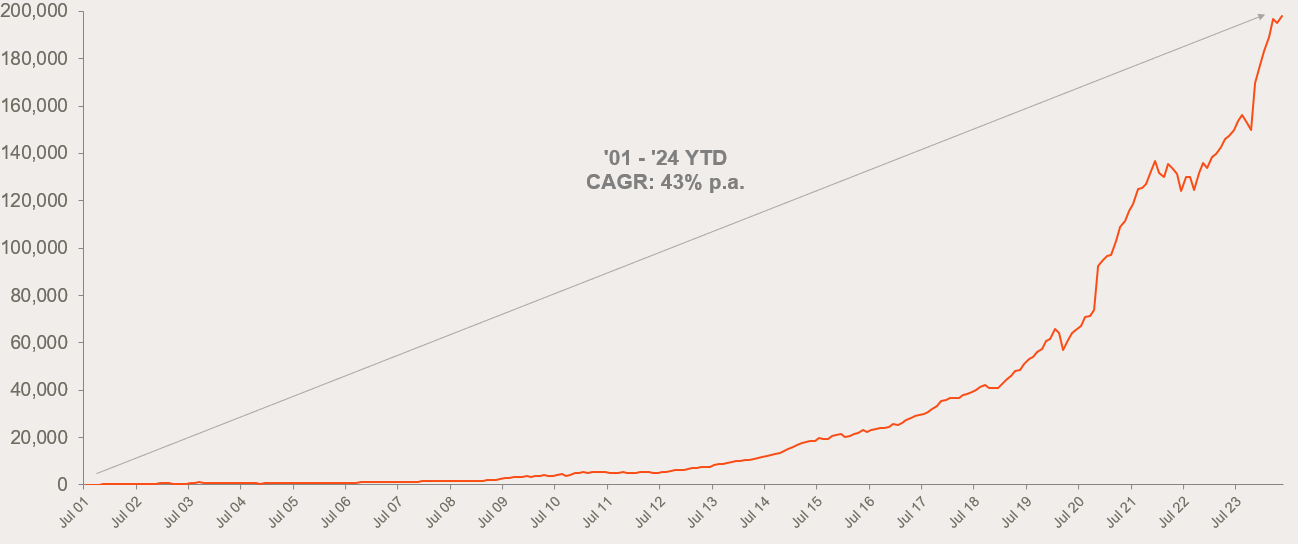

ETF assets reach new record as Industry returns to growth footing

- A combination of strong inflows and positive sharemarket performance helped the Australian ETF Industry to a fresh new high during May.

- May saw ETF industry assets return to growth, after recording a small decline in April. The Industry rose by 1.7% for the month, with total market cap increasing by $3.3B. Total industry assets now stand at $198.3B – a new all-time record high.

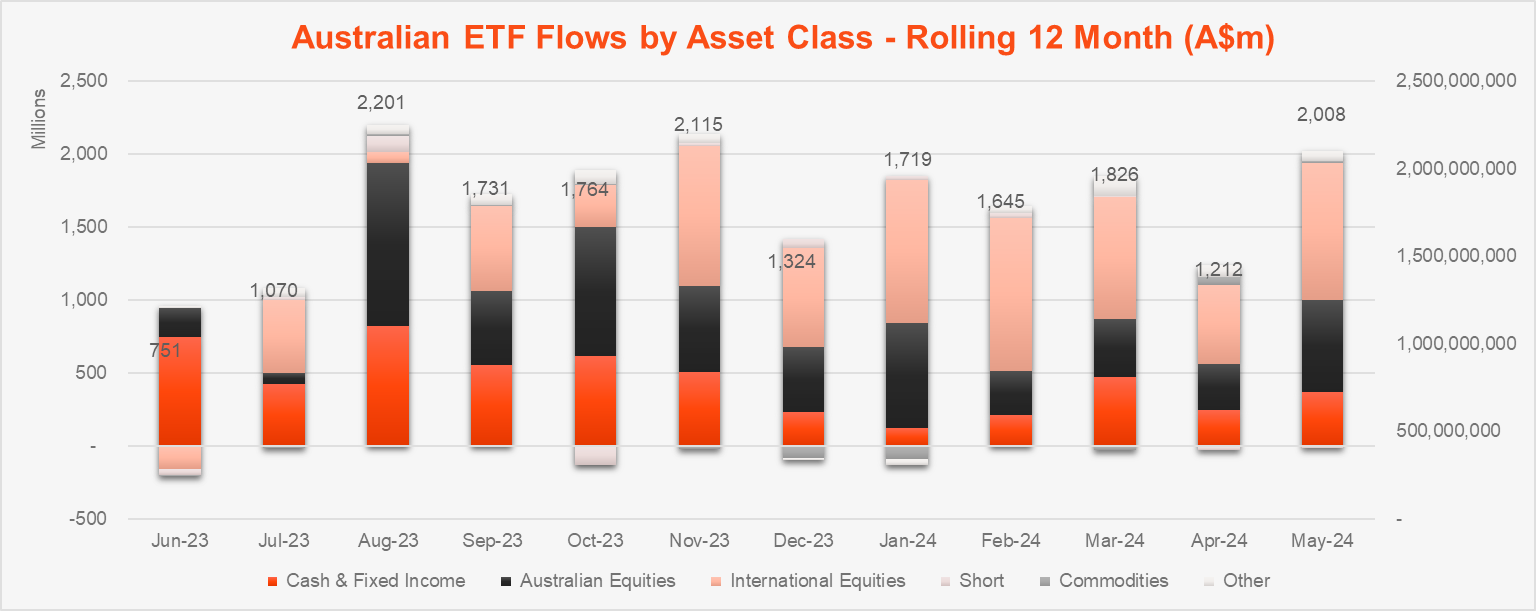

- Industry flows continued their long running positive streak – with a robust $2B of net flows recorded for the month, the highest level of monthly inflows so far in 2024. The net inflows represented ~2/3 of the monthly growth, with the remainder coming from market appreciation

- ASX trading value was ~$11B for the month, a number consistent with what was achieved in April.

- Over the last 12 months the Australian ETF industry has grown by 34.5%, or $50.9B.

- In terms of product launches, there were 7 new funds launched in May, including a new BSUB Australian Major Bank Subordinated Debt ETF and new Active ETFs launched by Fidelity and Macquarie Asset Management.

- The best performing ETF this month was an Ethereum exposure, as well as a ETFs providing exposure to alternative energy sources.

- Continuing the ongoing trend which started at the end of 2023, May saw International Equities products dominate in terms of the composition of net inflows ($939 million). Australian equities remained in 2nd position for flows, followed by fixed income in 3rd spot.

- Outflows were limited to very small amounts in Cash and Short funds.

Australian ETF Industry AuM: July 2001 – May 2024

CAGR: Compound Annual Growth Rate. Source: ASX, CBOE

Market Cap

- Australian Exchange Traded Funds Market Cap (ASX + CBOE): $198.3B

- ASX CHESS Market Cap: $168.9B1

- Market Cap change for April: 1.7%, $3.3B

- Market cap growth for last 12 months: 34.5%, $50.8B

New Money

- Net inflows for month: $2.0B

Products

- 377 Exchange Traded Products trading on the ASX & CBOE

- 7 new funds launched last month, including our new Major Bank Tier 2 Subordinated Debt ETF and new Active ETFs launched by Fidelity and Macquarie Asset Management.

Trading Value

- ASX trading value was ~$11B for the month, a number consistent with what was achieved in April.

Performance

- The best performing ETF this month was an Ethereum exposure, as well as a ETFs providing exposure to alternative energy sources.

Industry Net Flows

Top Category Inflows (by $) – Month

| Broad Category | Inflow Value |

| International Equities | $939,672,309 |

| Australian Equities | $628,255,096 |

| Fixed Income | $455,407,541 |

| Multi-Asset | $50,764,732 |

| Listed Property | $18,201,536 |

Top Category Outflows (by $) – Month

| Broad Category | Inflow Value |

| Cash | ($81,523,800) |

| Short | ($12,767,994) |

Top Sub-Category Inflows (by $) – Month

| Sub-category | Inflow Value |

| Australian Equities – Broad | $696,565,345 |

| International Equities – Developed World | $508,432,418 |

| International Equities – US | $388,035,019 |

| Australian Bonds | $324,608,529 |

| Global Bonds | $89,099,715 |

Top Sub-Category Outflows (by $) – Month

| Sub-category | Inflow Value |

| Australian Equities – E&R – Ethical | ($262,083,409) |

| International Equities – E&R – Ethical | ($172,476,349) |

| Cash | ($81,523,800) |

| US Equities – Short | ($8,993,835) |

| Australian Equities – Short | ($3,774,159) |

Performance

Top Performing Products – Month

| Ticker | Product Name | Performance (%) |

| EETH | Global X 21Shares Ethereum ETF | 22.0% |

| HGEN | Global X Hydrogen ETF | 19.1% |

| ETPMAG | Global X Physical Silver | 14.5% |

| LNAS | Global X Ultra Long Nasdaq 100 Hedge Fund | 13.7% |

| CLNE | VanEck Global Clean Energy ETF | 12.9% |

Footnotes:

1. Since February 2023, the ASX started reporting additional data on a CHESS-only basis. The primary use of such data is that it will exclude, amongst other things, the FuM and Flows in ‘dual class’ Active ETFs and potentially provide a more accurate picture of exchange traded activity. ↑

Investor & founder with a Financial Services & Fintech focus. Co-founder of Betashares. Passionate about entrepreneurship and startups.

Read more from Ilan.