Our rules for momentum investing

4 minutes reading time

- Global shares

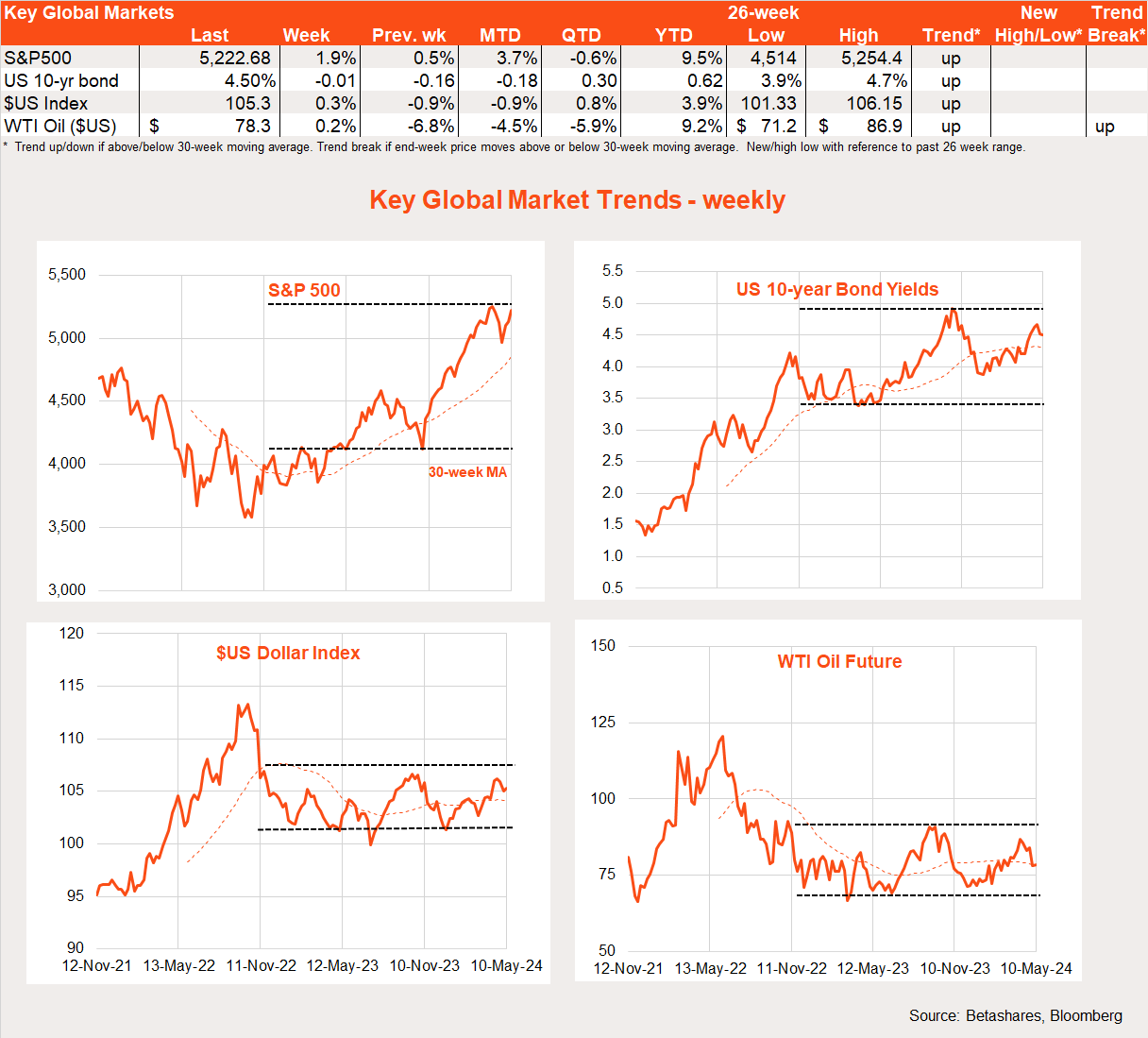

Global markets – week in review

The global equity market rebound continued into its third week as softer-than-expected US labour market data encouraged markets into believing the Fed could still cut rates a couple of times later this year.

Following on from the previous Friday’s soft payrolls report, the main news last week was a higher-than-expected rise in weekly jobless claims – albeit they remain at quite low levels.

Market chatter about an overdue slowing in the US labour market intensified, causing markets to price in a greater risk of a second US rate cut later this year. Also supported by still encouraging corporate earnings and reassuring Fed rhetoric (to the effect that a rate hike is unlikely), equity markets ground higher. Bond yields, the $US and oil prices have all retreated from recent highs.

The week ahead

Of course, whether the improved sentiment continues this week will crucially depend on the April CPI on Wednesday (US time). The market anticipates a still firm 0.3% gain in the core CPI, which would see annual core inflation ease further to 3.6% from 3.8%. After three consecutive higher-than-expected monthly CPI reports, the hope is that this week will be 4th time lucky – a result at least no worse than expected.

Also of relevance will be April retail sales on the same day, given the continued underlying strength in consumer spending. Producer prices will be released the day before.

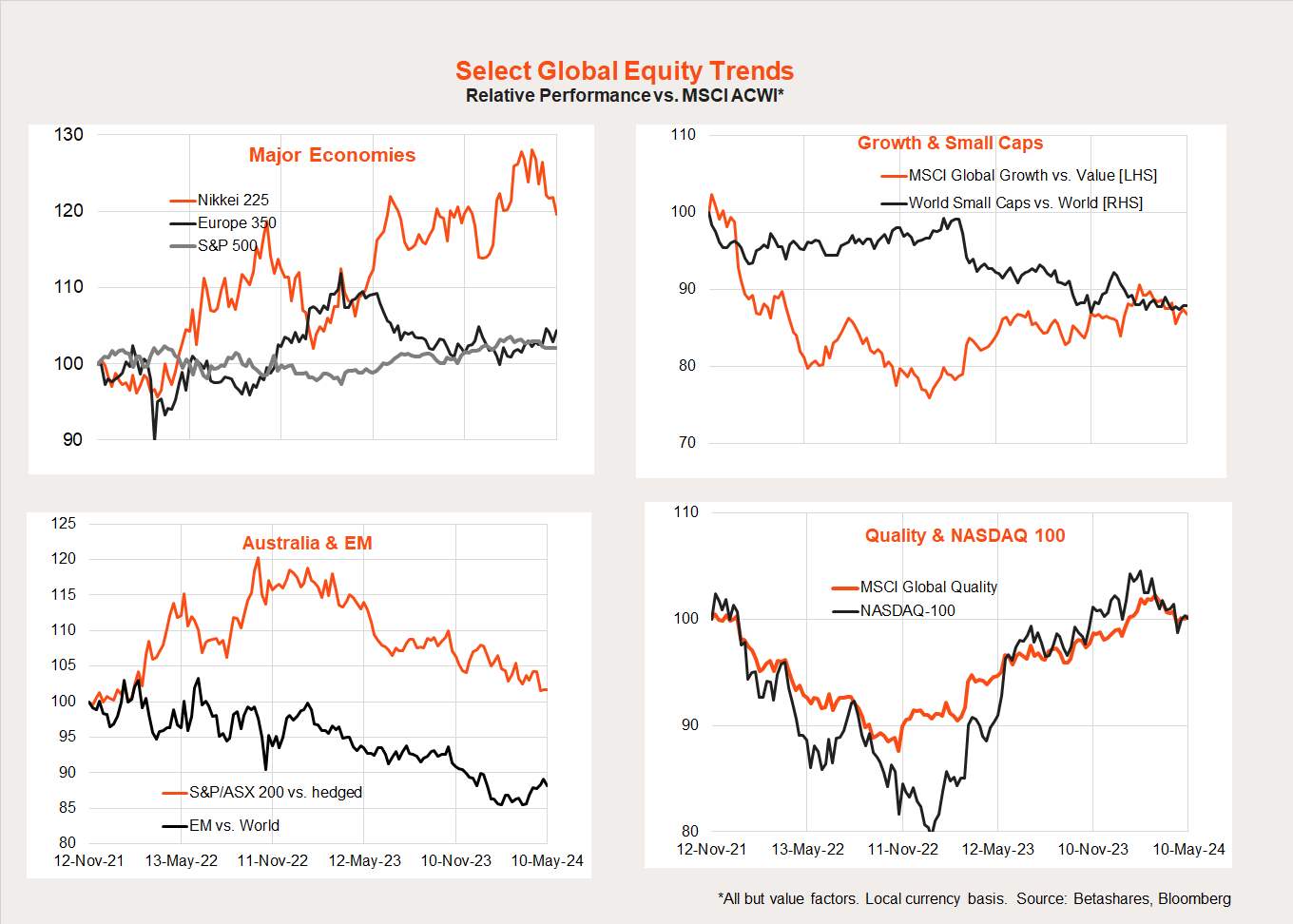

Global equity trends

Looking at global equity trends, the main development over recent weeks has been the pullback in relative performance by growth/technology exposures such as the Nasdaq 100 along with Japan, and a tentative improvement in European and emerging market performance.

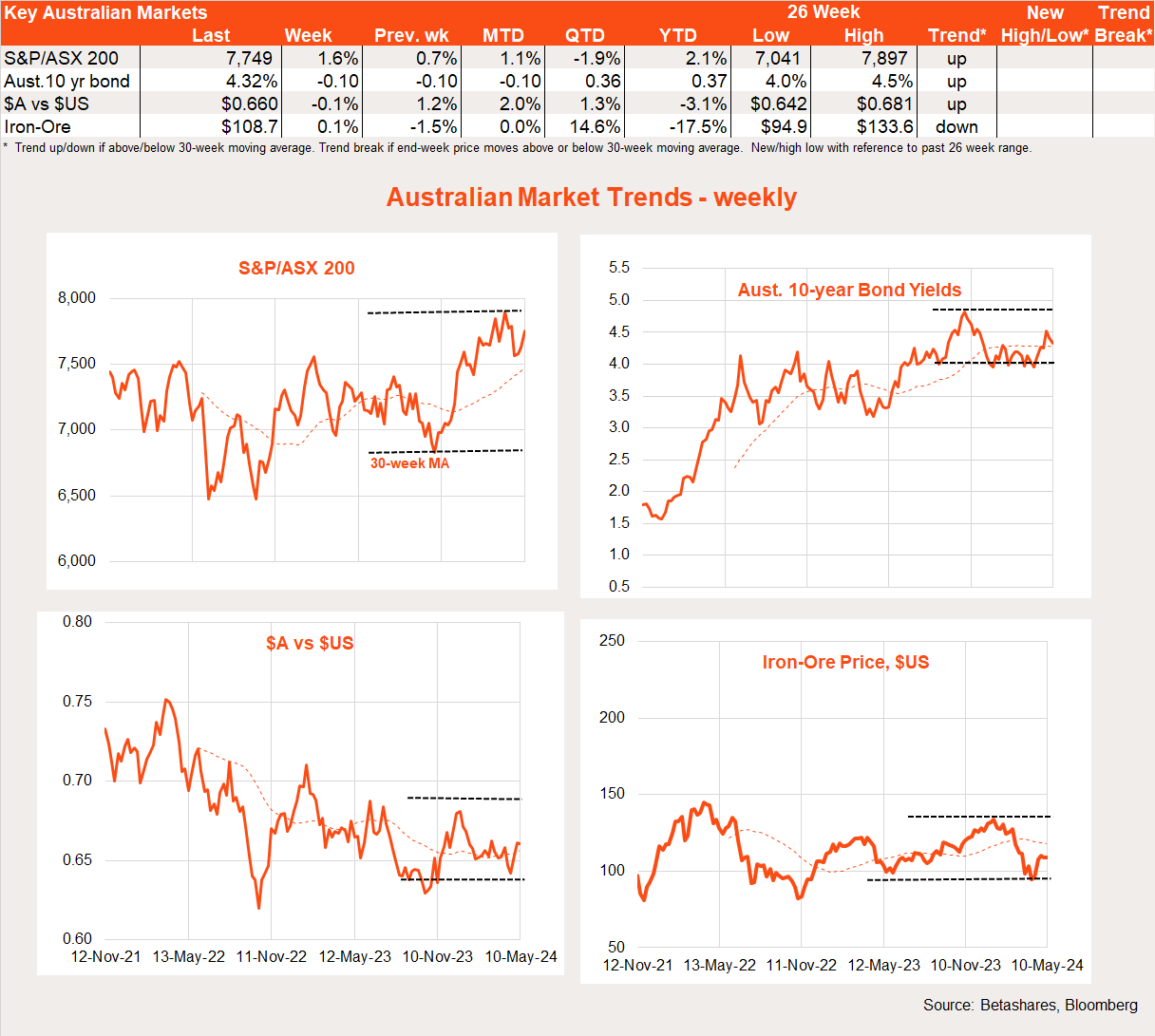

Australian markets

The S&P/ASX 200 lifted 1.6% last week, helped by stronger global markets and a less hawkish than feared RBA policy meeting. 10-year bond yields dropped 0.10% to 4.32%.

The main local highlight was the RBA meeting, with the Bank notably refusing to reinstall language of earlier this year to the effect that “another rate rise can’t be ruled out”. Instead, the RBA reiterated its new mantra that it’s ruling “nothing in or out.” In its quarterly Statement on Monetary Policy, the RBA noted inflation and the labour market had surprised on the upside so far this year even while consumer spending has remained weaker than expected.

Indeed, last week we learnt that real retail sales in the March quarter slumped by 0.4%, even as ANZ job ads bounced back 2.8% in April. Job vacancies remain at high levels though, well down from their peak.

Of course, the major highlight this week will be the Federal Budget on Tuesday – with market focus on the extent to which it provides further economic stimulus, thereby undermining the efforts of the RBA to bring down inflation.

Of course, it’s most likely the Treasurer will avoid just giving households another fistful of dollars (especially given the tax cuts that kick in from 1 July), but rather extend price subsidies – such as for electricity and rents – to support households while also directly help lower measured inflation.

Indeed, thanks to extended price subsidies and a soft near-term economic outlook, weekend reports suggest the Government will forecast annual headline inflation falling to 2.75% by the June quarter 2025 – well below the RBA’s updated forecast last week of 3.2%.

Cooking the books? Maybe. Either way, the prospect of lower inflation along with weak economic growth has markets excited once more about the possibility of an RBA rate cut by Christmas.

Have a great week!

1 comment on this

the books have been cooked for a long, long time. The truth about inflation levels is always hidden and yet excuses are easily found. What excuses will the RB and government find when stagflation is confirmed and recession is the next step. Gotto laugh at who is steering the ship.