David Bassanese

Betashares Chief Economist David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

5 minutes reading time

- Global

Global markets – week in review

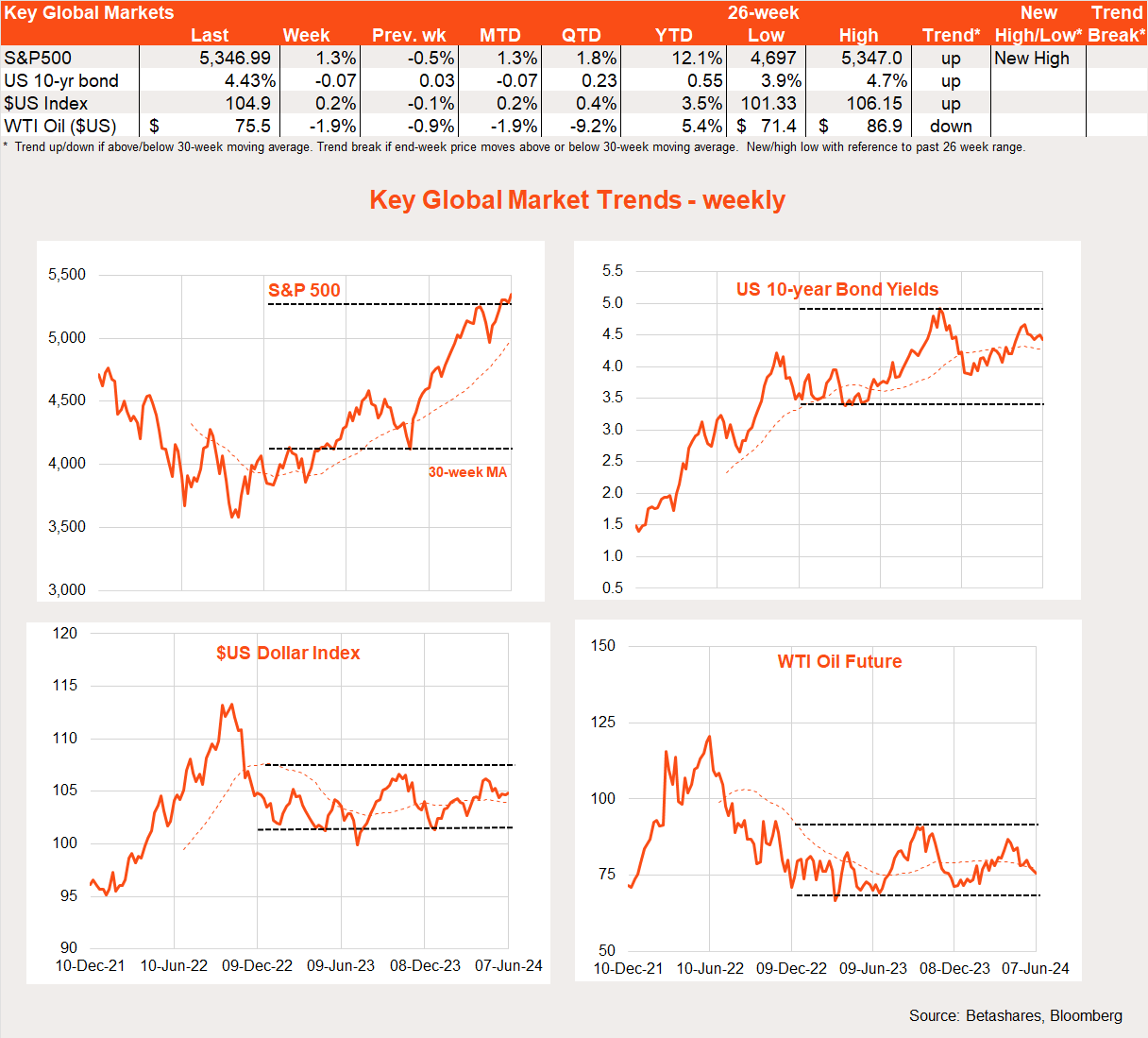

Global stocks bounced back last week after a 2-week mini-consolidation – reflecting rates cuts in Europe and Canada along with some softer-than-expected US data that raised hopes the Fed would also cut rates later this year. Overnight, the S&P 500 pushed on to another record high.

Overall US economic data last week could be characterised as mixed. A soft US manufacturing survey and a larger-than-expected drop in job openings raised hopes early in week that the economy was slowing by enough to allow the Fed to cut rates potentially as early as September.

Also supporting market sentiment was confirmation of already anticipated rate cuts in Canada and Europe. With weaker growth and lower inflation, neither the Bank of Canada nor the European Central Bank saw reason to keep waiting for the Fed to go first – an indulgence the RBA can’t yet follow due to stubbornly higher core inflation.

All that said, the week was not without setbacks. Friday’s US payrolls report was stronger-than-expected, with a solid 272k jobs again and firm 0.3% growth in average hourly earnings, partly offset by a small increase in the unemployment rate to 4%. Another strong showing by far right parties in European elections – and France’s decision to hold a snap national election as a result – also unnerved investors over the weekend. The ECB also likely only cut rates because it felt boxed in to deliver what it has long promised – as it then raised its inflation forecast and attempted to play down the chance of further cuts any time soon.

The week ahead

Key global events this week again centre around the US. On Wednesday (US time) comes the release of the May consumer price index inflation report (CPI), with markets hoping for another reasonably benign 0.3% gain in core prices – as was the case last month. Easing energy prices and a flattening out in surprisingly firm core service prices (such as car insurance) is expected to help.

If so, this would likely indicate the Fed’s preferred inflation measure – the private consumption expenditure deflator (PCE) – to be released later this month, will show core prices up a reassuringly benign 0.2%. In turn that would mark two months in a row of good US inflation news, after a series of higher-than-expected results early this year.

Also critical on Wednesday will be the Fed meeting. While no-one expects any move on rates, the focus will be on the ‘dot plot’ of voting member expectations for the Fed funds rate over the next few years. Last time around, the dot plot implied a median expectation among voting Fed members of three rate cuts this year. Given recent higher than expected inflation results, the Fed has already hinted it would likely scale back this expectation – the only question remains by how much. Will the new dot plot imply one, two or even no rate cuts this year?

We can likely rule out the latter more hawkish outcome (most Fed officials are still talking about some rate cuts this year), and I suspect the median will likely still imply two rate cuts this year instead of only one – which would be of some relief to markets.

Global equity trends

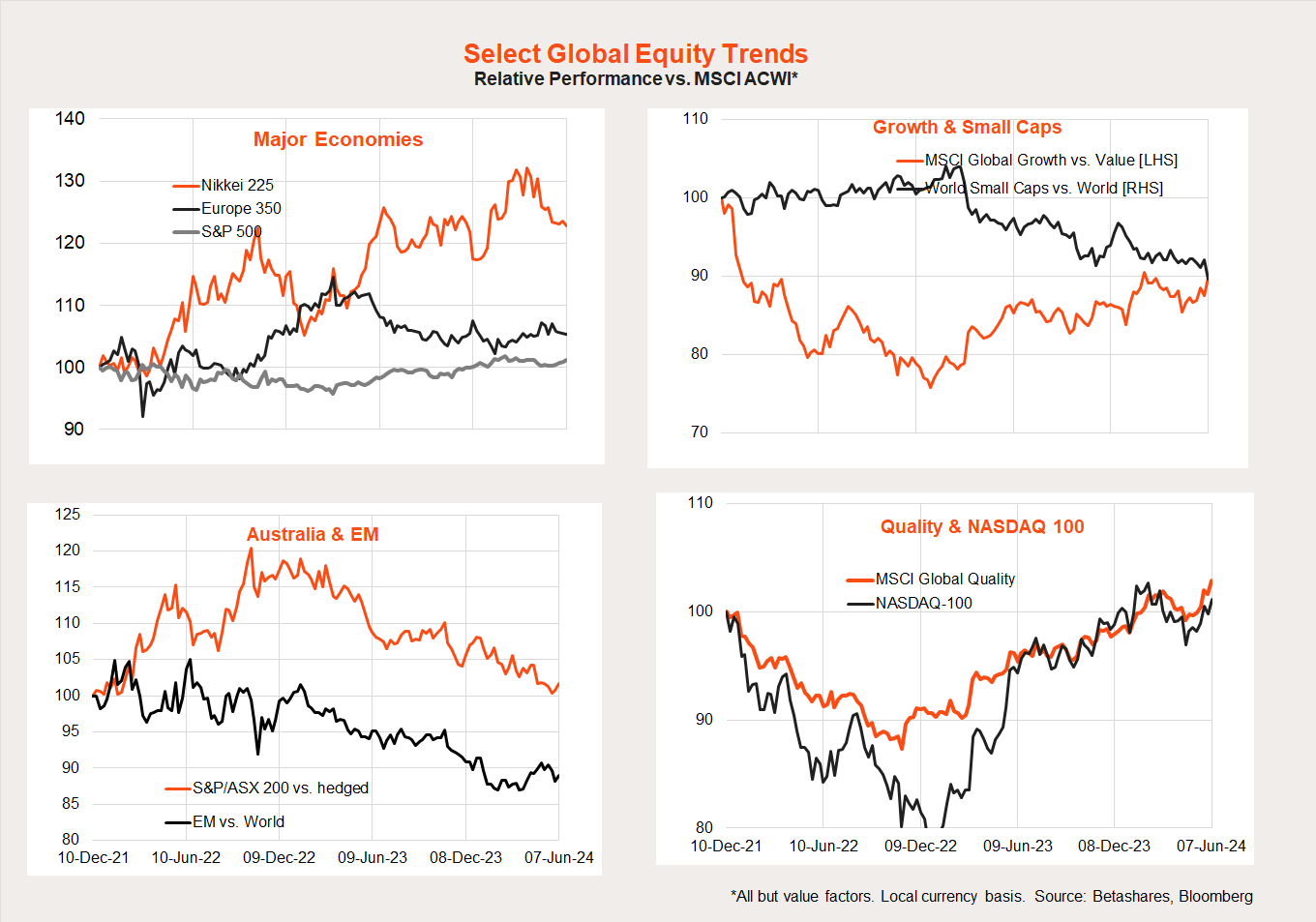

Looking at global equity trends, the equity rebound over recent weeks has favoured a bounce back in the relative performance of Nasdaq 100/global quality exposures. There are also growing signs of a broader rebound in global growth over value.

At the same time, the China-led rebound in emerging market relative performance has stalled a little. Japan is enduring a relative performance correction after recent strong gains while Australia and global small caps continue to underperform.

Australian markets

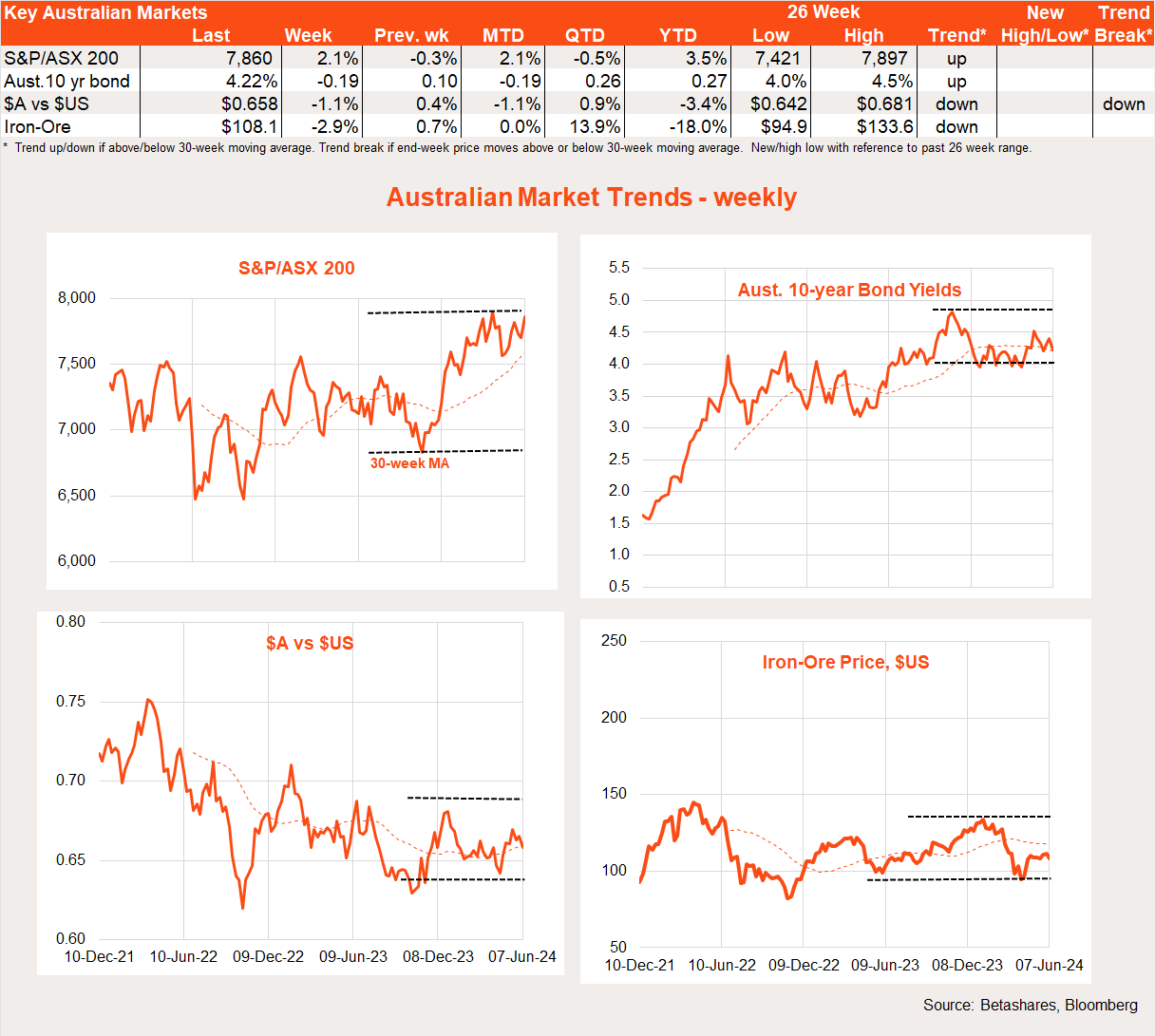

The S&P/ASX 200 bounced back 2.1% last week, supported by stronger global markets and a soft local Q1 GDP report which kept hopes for a local rate cut this year alive. As in the US, the local equity market seems to be going through another “bad news is good news” mindset.

The highlight (or lowlight) last week was the miserable 0.1% gain in Q1 GDP. That said, GDP was weak not for the usual reasons – consumer spending was a bit firmer than expected, while it was weakness in exports and business investment that held the economy back. Weakness in the latter two areas should likely not last, meaning ongoing subdued growth (which the RBA is keen on seeing to help bring down inflation) will rely on persistent weakness in consumer spending.

The outlook for consumer spending is increasingly mixed. Nearer-term, some of the strength in spending – such as higher electricity usage due to an especially warm summer, the bringing forward of the Grand Prix and the one-off Taylor Swift phenomenon – should unwind in Q2. But by Q3, households will have tax cuts to play with.

Against this backdrop, another surprise element of last week’s GDP report was a large upgrade to household spending on foreign holidays – which is neutral for GDP as it revises up both consumer spending but also tourism imports.

What it does suggest, however, is that households have run down their COVID savings buffers by more than previously thought (with around half having now been spent, rather than a quarter). The fact households are spending more overseas also arguably lessens some domestic retail price pressure (it’s a further negative for hard-pressed local retailers) – at least in areas apart from international air travel.

Turning to the week ahead, the highlight will be Thursday’s May employment report. Underpinned by strong immigration, another solid employment gain of around 30k is expected (following 38k in April), with an easing back in the unemployment rate from 4.1% to 4%. This would be consistent with an ongoing glacial slowing in the labour market.

Have a great week!

David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

Read more from David.

1 comment on this

Oh, I now feel all warm and Fuzzy after reading our economic outlook is in safe hands.