4 minutes reading time

The technology industry is one of the most dynamic and exciting sectors of the global economy. Tech stocks have the potential to provide significant returns for investors, but at the same time can come with some risks.

What are tech stocks?

Tech stocks usually represent a share in a company that develops or provides products or services based on new technologies. These companies are typically at the forefront of innovation, and their stock prices can be highly volatile, but they also have the potential to generate strong long term returns for investors.

As such, it is important to remember that investing in tech stocks does not come without risk. These companies are often highly sensitive to changes in the market and are often valued on future growth potential, which in turn means that they can be overvalued if market expectations are not met.

Advantages of investing in tech stocks

Potential for high returns

- Technology stocks have tended to be high-growth, and while not immune to market volatility, can offer long-term growth potential.

Portfolio diversification

- Offers access to a high-growth potential sector that is often under-represented in the Australian sharemarket.

Access to innovation

- Some technology stocks are revolutionary companies that are changing the way we live.

Risks of investing in tech stocks

Potential volatility

- Tech stocks can be volatile because of factors such as share price fluctuations off the back of valuations and the impact of rising inflation and interest rates.

Overvaluation

- Some market professionals view tech stocks as overvalued following the significant rally in the first half of 2023.

Top tech stocks in ASX: NDQ (By Market Capitalisation)

Microsoft Corporation (MSFT)

- Market capitalisation (*as at 12/01/2024): US$2.86 trillion

- Recent updates: Microsoft announced an A$5 billion investment in computing capacity and capability to help Australia seize the AI era. Microsoft has acquired Nuance Communications, a leader in cloud-based speech recognition and AI software.

Apple Inc. (AAPL)

- Market capitalisation (*as at 12/01/2024): US$2.89 trillion

- Recent updates: On 2 November 2023, Apple announced financial results for its fiscal 2023 fourth quarter ended 30 September 2023. The company reported revenue of US$90.1 billion and earnings per share of US$1.29.

NVIDIA Corporation (NVDA)

- Market capitalisation (*as at 12/01/2024): US$1.35 trillion

- Recent updates: NVIDIA reported record revenue of US$13.51 billion for the quarter ended 30 June 2023, up 88% from the previous quarter and 101% from the same quarter a year ago. NVIDIA and Foxconn have entered into a partnership to build factories and systems for the AI industrial revolution. The two companies will work together to develop and deploy AI solutions for a variety of industries, including manufacturing, logistics, and healthcare.

Amazon.com, Inc. (AMZN)

- Market capitalisation (*as at 12/01/2024): US$1.6 trillion

- Recent updates: Amazon announced its financial results for the third quarter of 2023 on 3 November 2023. Net sales increased 13% to $143.1 billion in the quarter. On 26 September 2023, Amazon announced that it would be investing more than $6 billion in the AI startup, Anthropic.

Alphabet Inc. (GOOG)

- Market capitalisation (*as at 12/01/2024): US$1.79 trillion

- Recent updates:Alphabet announces third-quarter 2023 results; highlights include a record quarterly revenue of $76 billion, up 25% YoY. In early 2024 Google and Samsung collaborate on cross-Android file sharing solution by merging Nearby Share and Quick Share.

Meta Platforms, Inc. (META)

- Market capitalisation (*as at 12/01/2024): US$950 billion

- Recent updates: Meta announced on 20 June that it would be laying off 3,000 employees. The layoffs are part of a broader restructuring effort at Meta. Meta Platforms is set to announce its fourth quarter and full-year 2023 results on January 30th, 202, revenue of $38.69 billion, indicating a 20.28% increase YoY

Tesla, Inc. (TSLA)

- Market capitalisation (*as at 12/01/2024): US$711.99 billion

- Recent updates: Reported on January 2nd, 2024, Tesla produced approximately 495,000 vehicles and delivered over 484,000 vehicles in Q4 2023. This represents a slight increase in production and a modest decline in deliveries compared to Q3 2023. Tesla announced on November 28th, 2023, Tesla will hold a Cybertruck delivery event in Los Angeles on January 26th, 2024. This event marks the official start of deliveries for the highly anticipated electric pickup truck.

*As at 12/01/2024.

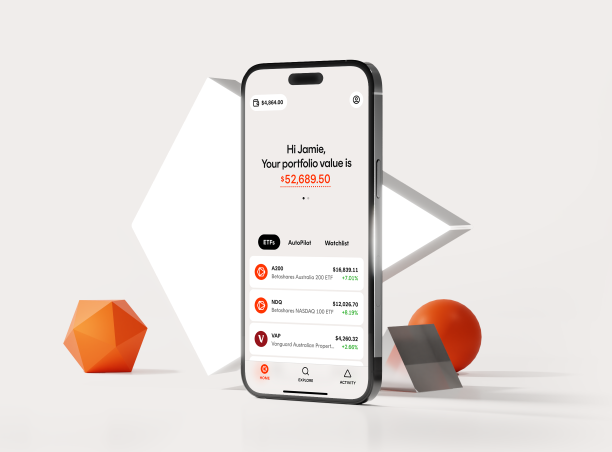

How to invest in tech stocks

For investors looking to gain portfolio exposure to technology while minimising the risks related to individual stock-picking, investing in an technology-focussed ETF can provide exposure to a basket of tech companies in a single trade.

The Nasdaq-100 Index has become synonymous with innovation and is the home to some of the world’s most revolutionary companies including Apple, Amazon and Google.

With a heavy focus on technology, the NDQ Nasdaq 100 ETF provides exposure to these companies and other global innovators at the forefront of the new economy in a single ASX trade.