10 minutes reading time

Commentary from the Betashares portfolio management desk by Head of Fixed Income Chamath De Silva, providing an overview on markets:

- The volatility in Japanese yen FX pairs and the largest deleveraging event in the post-Covid era has put currency markets back into focus.

- The “yen carry trade”, which involves borrowing low-yielding yen to invest in higher-yielding currencies, has been a popular strategy for decades. This trade only grew from 2022 onwards, supported by trend-following and other systematic strategies during a period of growing policy divergence between Japan and other developed economies, leading to a large, and highly leveraged short position in the JPY, vulnerable to any change in the macro environment.

- Despite the turmoil in JPY FX pairs, Japanese equities, and the US equity volatility complex, broad FX volatility indicators and credit spreads are relatively low, suggesting that the recent market movements were largely driven by positioning and deleveraging in specific markets, rather than a material deterioration in economic fundamentals.

FX back in focus

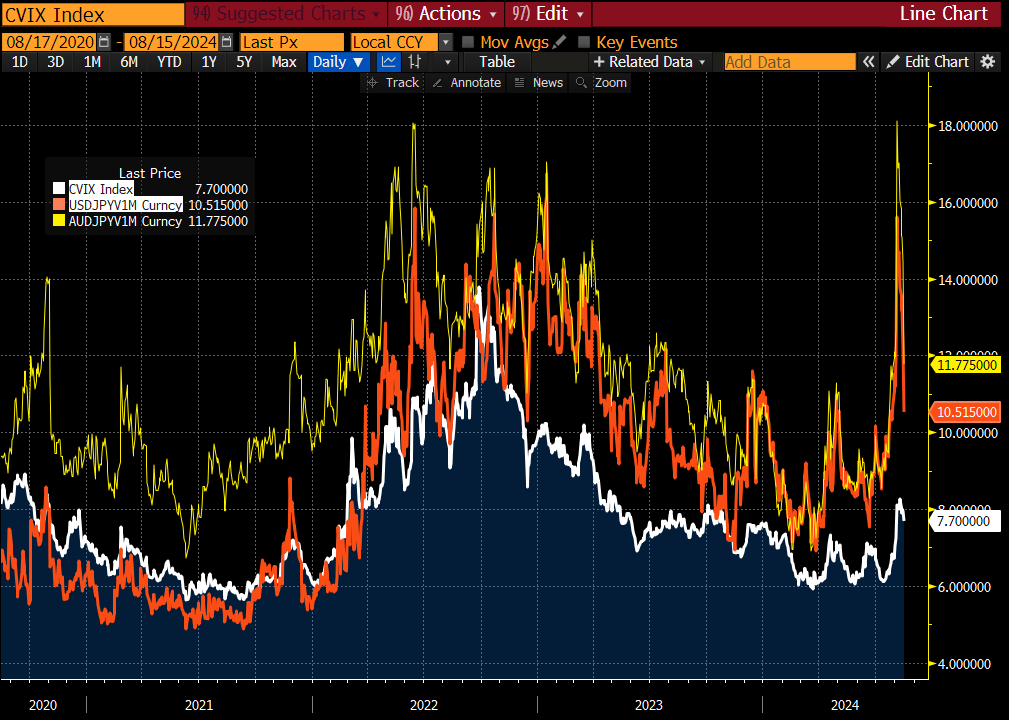

With the “yen carry trade unwind” a mainstream topic of conversation and the dust settling on the largest deleveraging event in the post-Covid era, it’s worth taking stock of what’s happening in the world of FX. Over the past 18 months, volatility in the FX market had been trending lower, with Deutsche Bank’s CVIX index, the VIX-equivalent for FX, hitting a cycle low of 5.9 vol points in March this year, just as the soft-landing narrative was gathering momentum.

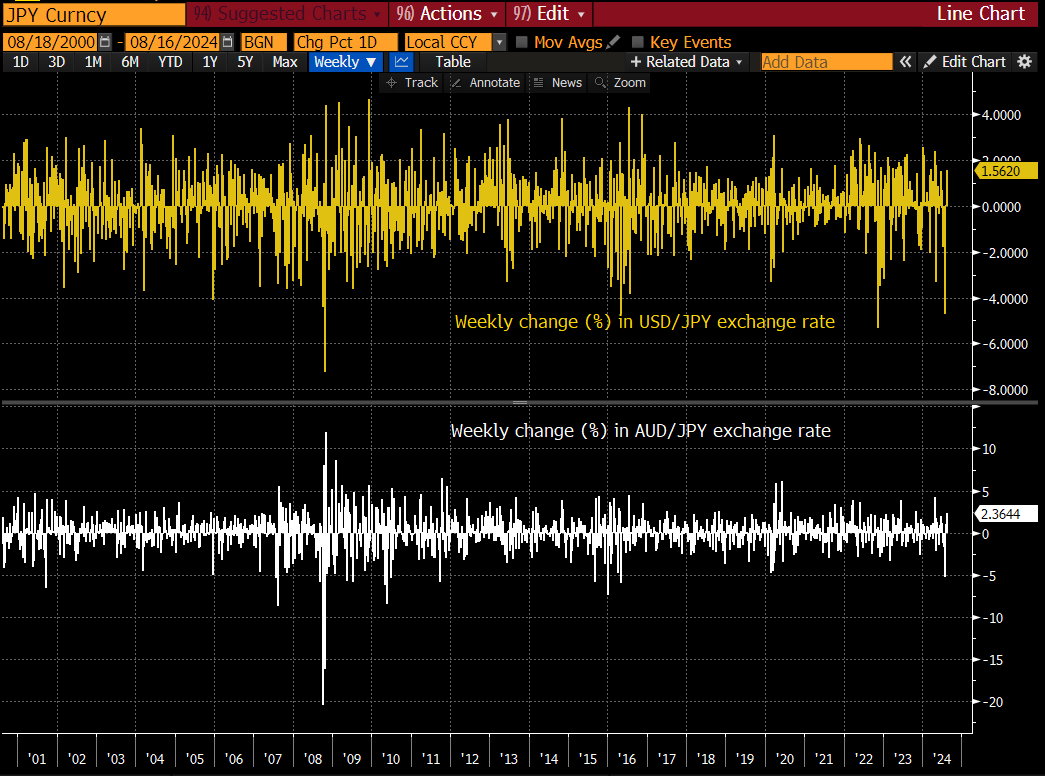

The recent softening in US labour market data in July, coupled with the pull-forward of Fed rate cut expectations and Bank of Japan rate hikes, acted as a catalyst to unwind many legacy positions based on a ‘higher for longer’ US outlook and widening interest rate differentials versus Japan. This also affected highly leveraged carry strategies, both within FX and other asset classes, which rely on low volatility and relatively stable markets. As a result, the unwinding of positions pushed the CVIX index to its highest level in over 12 months. The epicentre was naturally the yen, where 1-month implied USD/JPY volatility rose from around 7 vol points in March to over 15 during the first week of August, alongside a 12% peak-to-trough decline in the USD/JPY exchange rate and a 17% decline in the more vol-sensitive and risk-sensitive AUD/JPY.

The focus on volatility – both implied and realised – is crucial, given it often serves as the exposure toggle for various leveraged strategies, such as traditional carry trades and trend following. While the emergence of yen strength is supported by changes in macro fundamentals and compressing yield differentials between the US and Japan, the rally observed in late July and early August (and the negative spillovers to other markets like Japanese equities and US tech stocks, culminating in the 5 August market crash) was amplified by short covering, stemming from the rise in volatility and the sheer size of the yen short base.

The FX carry trade explained

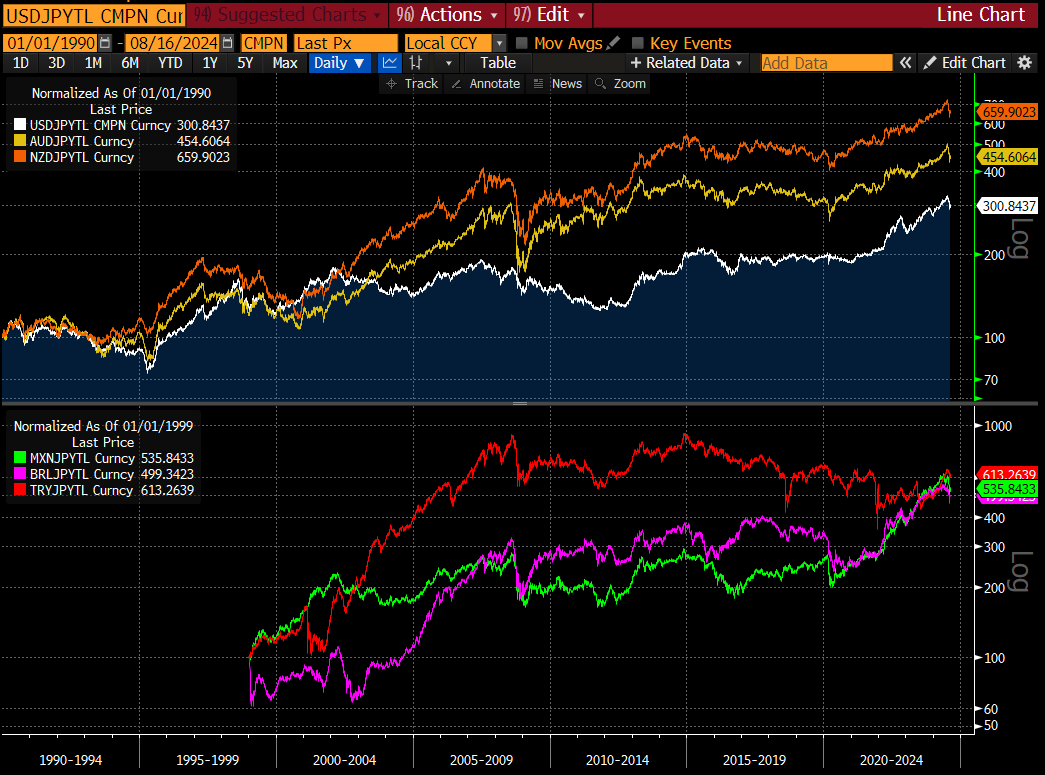

An FX carry trade, in its simplest form, involves borrowing a low-yielding currency and investing the proceeds in a higher-yielding currency, betting that the interest rate differentials more than offset any adverse spot exchange rate movements over time. This can be implemented in many ways, including through derivatives markets, such as using forward contracts where the interest rate differentials are embedded in the forward exchange rate. While the yen has often been the preferred funding currency, the ‘carry’ currency of choice has varied over the years. Throughout the 2000s, it was the AUD and NZD; during other periods, it was emerging market currencies like the Turkish Lira or Mexican Peso. More recently, the US dollar has largely been the main carry currency. Overlapping with outright carry trading were other systematic strategies like trend-following and managed futures (the main strategies employed by so-called commodity trading advisers or CTAs), which use futures and other derivative markets to take long positions in assets trending higher and short positions in markets in a downtrend (such as the JPY since late 2021).

Since volatility sets gross exposure in such strategies and an extended period of low vol can mechanically increase the level of leverage employed, it doesn’t take a large increase in the absolute level of volatility to trigger a meaningful position liquidation. Given that the yen was main funding currency over the past three years, it was naturally going to be the ground zero for short covering during a shift in the market narrative.

Finally, beyond trades and strategies focused on riding carry and price trends, many FX hedging overlay strategies over equities and fixed income are also indirectly carry trades, even if the reason for the trade is different. For example, investors hedging Japanese equities back to AUD are typically aiming to mitigate FX risk, but they still capture the positive carry from rolling forwards and remain exposed to the dynamics of the FX forward position moving against them. Specifically, losses on the FX forward overlay require raising cash on contract expiry, which might demand selling down the underlying asset, which partly explains why correlations between certain FX pairs and equity markets are so strong (the causality also works the other way, where gains or losses on the underlying asset create foreign currency P&L that forces changes in the forward position simply to maintain a hedging ratio). Another way investors might hedge currency risk is by issuing debt denominated in that currency. For instance, Berkshire Hathaway issued large volumes of JPY-denominated debt over the past three years, which provided hedging of FX risk of their Japanese equity purchases. Either way, a carry trade is involved, and currency hedging involves a funding leg that must be rolled.

The largest carry trade ever?

Much has been written about the events of early August, with some commentators arguing that the ‘yen carry trade’ (shorting the yen while going long on higher-yielding currencies) was the largest of its kind ever. This is partly due to the yen consistently being the lowest-yielding currency over the past 30 years, making it a popular funding vehicle, and because yen-funded carry trades have typically delivered strong long-term returns. The other key catalyst was the global tightening cycle that accelerated in 2022, where Japan was a notable exception, making the yen the funding currency of choice in expressing policy divergence and widening interest rate differentials.

Naturally, when a trade is working, it tends to pull in more investors to the strategy, and if a trade is generating high volatility-adjusted returns, it encourages a ‘grossing up’ of existing exposures and even more leverage. This continues until a macro catalyst drives a volatility spike, triggering a vicious cycle of deleveraging and liquidation, which drives more volatility, further reinforcing the deleveraging process until a new positioning equilibrium is reached. It’s probably impossible to fully quantify the size of the yen carry trade, but if you combine all the outright carry trades, all the trend-following and systematic strategies that were short JPY, and all the indirect carry trades (e.g., currency hedging overlays), it may well have been the largest ever.

Another dimension to the carry trade unwind is the role that Japanese retail investors might have played, which could help explain the spillovers we saw in US equities. For a long time, FX carry trades have been favoured by Japanese households looking to earn better returns than the meagre interest available on local deposits and Japanese government bonds. This phenomenon spawned the term “Ms Watanabe” – the stereotypical Japanese retail FX trader, which as a cohort, had a meaningful impact on FX markets during the 2000s. While outright FX carry trading by Japanese retail investors has declined in recent years, participation in foreign equity markets, especially in the US, has increased markedly, coinciding with the recent expansion of the Japanese Government’s NISA tax-advantaged savings scheme, which now covers stocks, ETFs, and other funds. Japanese retail investors, looking not only to gain exposure to US tech stocks but also to protect themselves against a weakening local currency, and were attracted to the sizeable unhedged returns being generated by US equities. With the yen suddenly staging a major rally, any leveraged positions in US stocks funded in yen would have faced margin calls, driving a wave of forced selling.

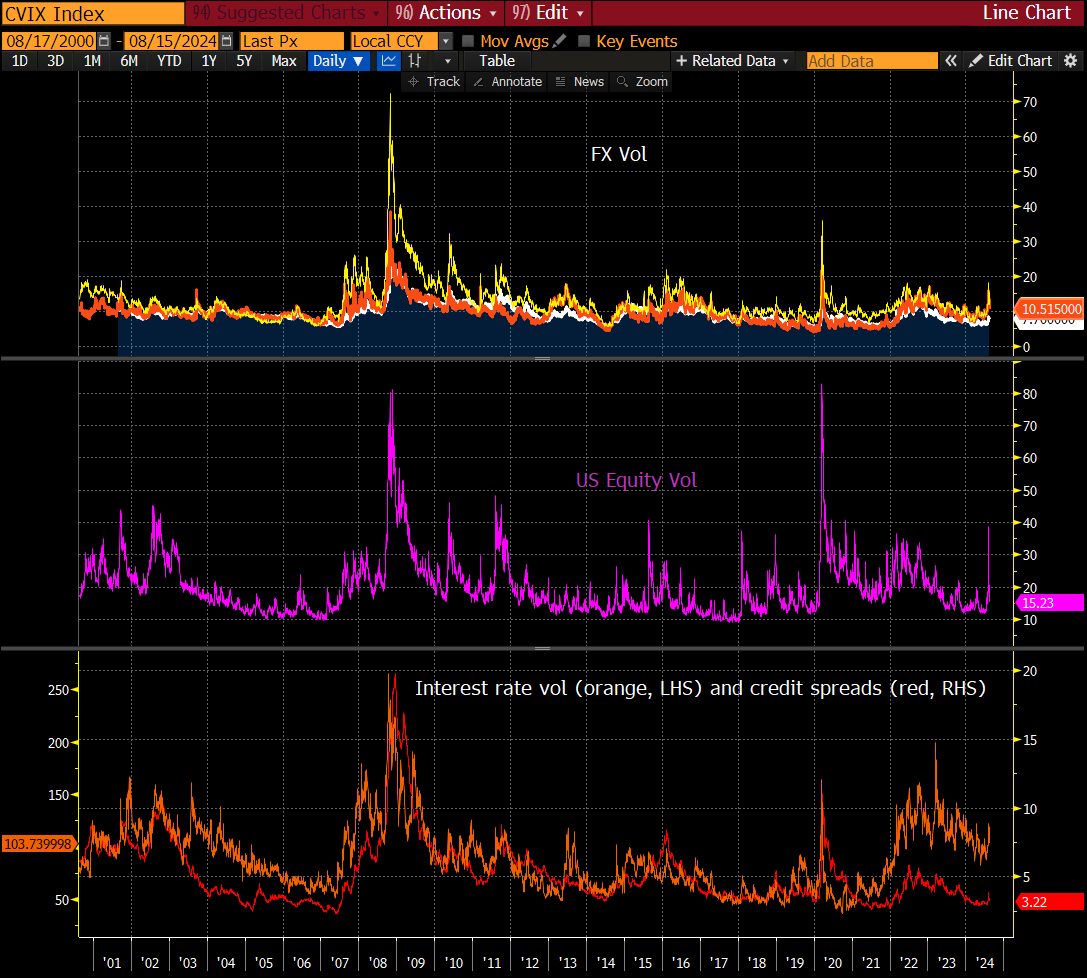

Positioning over fundamentals and markets over macro

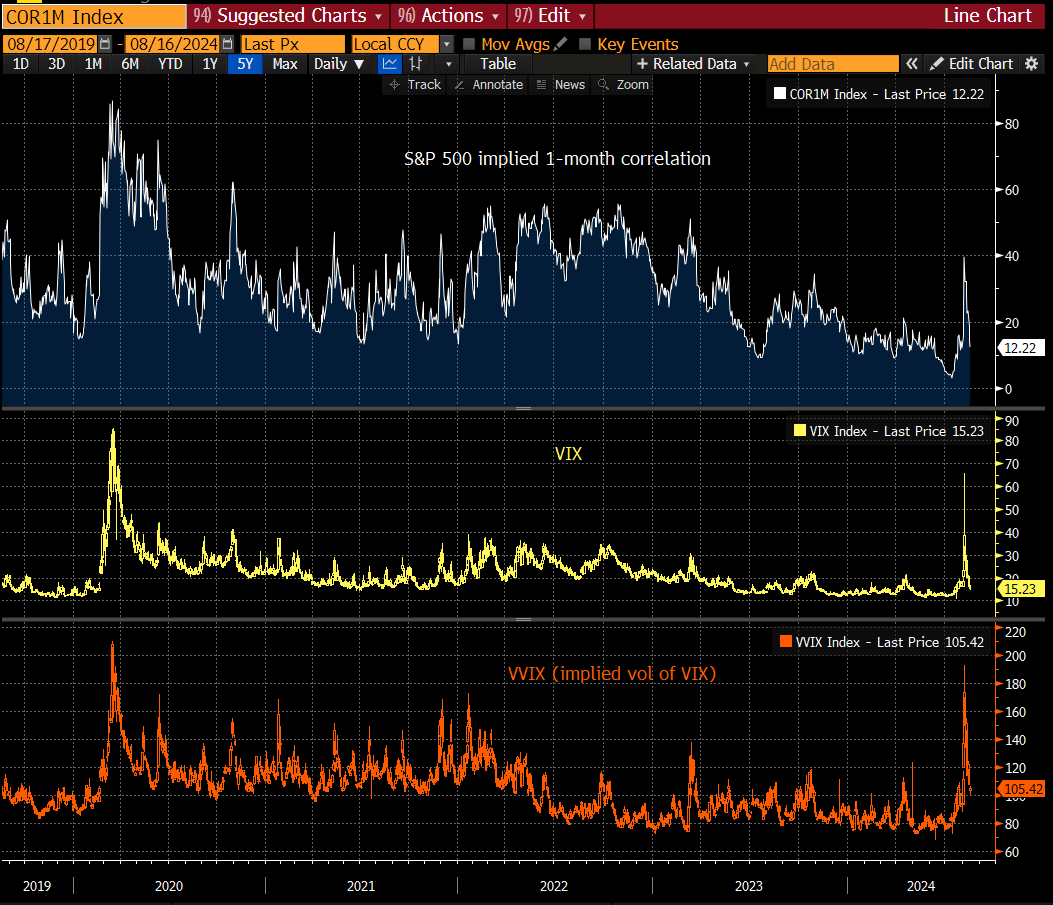

With normalcy returning to markets over the past week, it raises the question of whether the events of early August were purely due to market structure and positioning or if there is also a fundamental story, such as rising recession risks. Some clues may reside in the dynamics of FX volatility mentioned earlier. It should be noted that while we’ve seen a rise in implied FX volatility across a broad currency basket, the peak was far below the levels seen in 2022 when inflation was the main concern for policymakers and markets. The recent peak in FX vol was also well below levels typically associated with US recessions.

Additionally, the rise in broad FX volatility was very muted compared to the surge in US equity vol in early August, where the VIX and VVIX (the implied volatility of the VIX itself) reached new post-Covid highs on an intraday basis as short volatility and “correlation/divergence” trades between index and single stock volatility were flushed out (after option implied correlations reached an all-time low of 0.03).

Furthermore, amid all this chaos in JPY FX pairs and the US equity volatility space, other carry-style exposures like credit, only experienced a very modest impact, with spreads on US dollar investment grade and high yield corporate bonds only widening slightly, and far less than what would normally be associated with such a VIX spike. This suggests that what we saw in early August was primarily a positioning and deleveraging event rather than a sign of a US hard landing being imminent.

Chart 1 – 1mth implied FX volatility – AUD/JPY, USD/JPY, and Deutsche Bank broad FX volatility index

Source: Bloomberg

Chart 2: USD/JPY and AUD/JPY

Source: Bloomberg

Chart 3: USD/JPY and AUD/JPY weekly % changes

Source: Bloomberg

Chart 4: JPY-funded carry trade total return performance; top panel: DM – USD/JPY, AUD/JPY and NZD/JPY total returns (yen denominated), indexed to 1-Jan-1990

Lower panel: EM – MXN/JPY, BRL/JPY and TRY/JPY, indexed to 1-Jan-1999; Log scale

Source: Bloomberg

Chart 5: Total return on a US-listed managed futures ETF (proxy for broader trend following strategies; white, RHS, indexed to 100 in Aug-2019) and USD/JPY exchange rate (LHS)

Source: Bloomberg

Chart 6: US equity vol deep dive – implied correlation (top panel), VIX (middle panel), VVIX (lower panel)

Source: Bloomberg

Chart 7: Volatility as a recession signal; top panel – FX vol; middle panel – VIX; lower panel – US interest rate vol and high yield credit spreads (in % pts)

Source: Bloomberg