5 minutes reading time

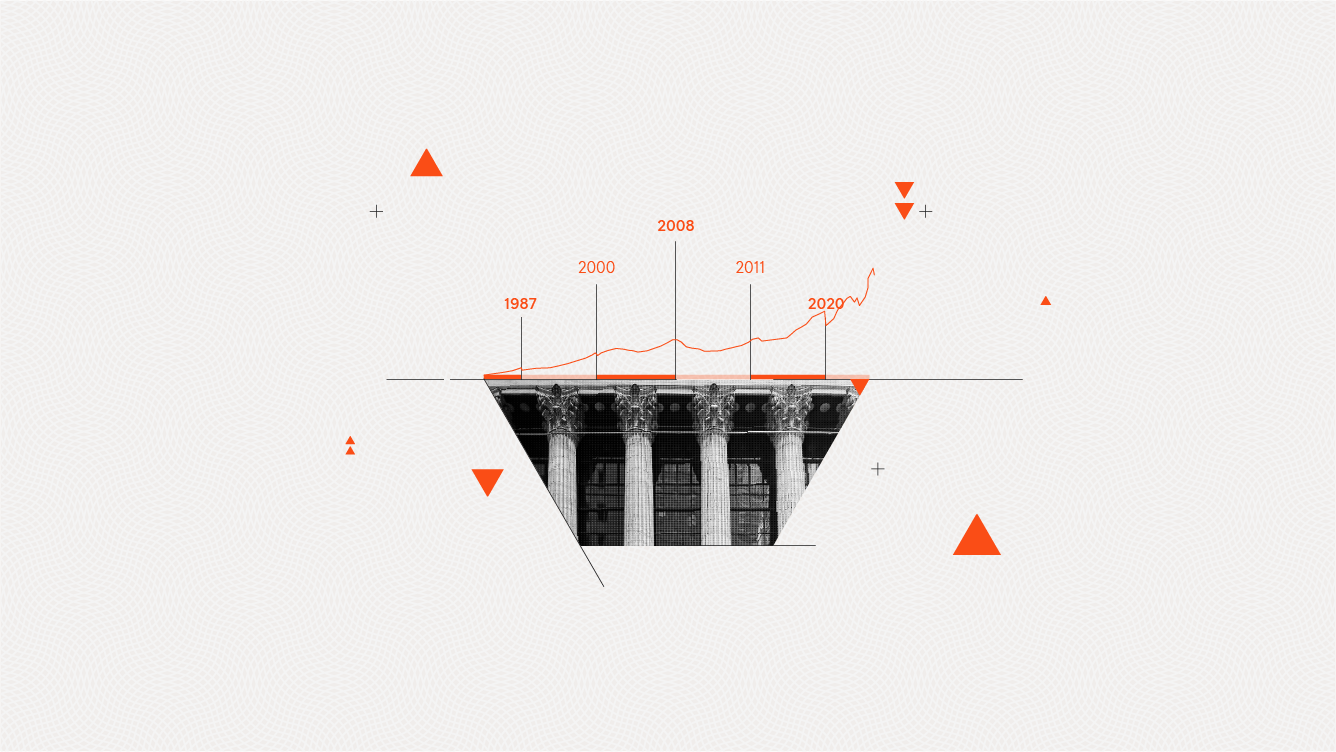

It’s natural for investors to feel uneasy when markets stumble. But if history has taught us anything, it’s that market corrections – periods when share prices drop significantly – are not only common but are often temporary.

ETF investors with a long-term view can think of downturns or pullbacks as potential buying opportunities. Here’s why.

A brief history of market corrections

Over the past 50 years, the ASX has seen several significant drops1:

1989 crash (Black Monday)

On 20 October 1987, the ASX 200 fell 25% in one day and 50% overall between January 1973 and October 19741. Despite the drama, the market reached its low within a month and recovered to pre-crash levels in around four years.

Dot-com crash (2000-2002)

Driven by speculative tech stocks, the ASX 200 declined about 22%, bottoming out over two years. It took around three years for the losses during the dot-com crash to be erased.

Global Financial Crisis (2008-2009)

The ASX 200 dropped 54% over approximately 17 months. But investors who held firm saw markets fully recover within about five years.

Similarly, global markets have historically reflected the same resilience2:

COVID-19 crash (2020)

In the US, the S&P 500 and Nasdaq fell roughly 34% and 30% respectively between 19 February high to the 23 March bottom2. However, both bounced back to pre-crash highs within about six months, driven by rapid economic intervention.

European Debt Crisis (2011-2012)

The Euro Stoxx 50 declined around 35% over two years due to a slew of sovereign debt concerns. Yet, within three years, markets fully recovered.

Despite the panic surrounding market crashes, the long-term picture tells a different story:

- Australian equities have delivered an 8.33% total return over the past 25 years3.

- Global equities have returned 8.60% annually since 19874.

In other words, markets recover, and disciplined investors are rewarded over time.

Why are investors nervous now?

The recent market volatility in late February and early March 2025 has largely been driven by heightened geopolitical tensions and uncertainty surrounding US trade policy. Investors have become anxious due to mixed signals from US leadership on imposing significant tariffs and other protectionist measures.

These unpredictable policy shifts could disrupt global trade and economic growth, creating uncertainty that unsettles markets and prompts investors to seek safer assets5.

What triggers market corrections?

Market corrections are usually triggered by a combination of economic, geopolitical and financial factors. Common causes include rising interest rates, economic recessions, unexpected geopolitical events or simply excessive optimism leading to speculative bubbles. Understanding that these triggers are often temporary can help ease anxiety and encourage discipline in your investment strategy.

Some common mistakes investors make

During market downturns, investors commonly make emotional decisions that can negatively impact their long-term returns:

Panic selling

Selling out of fear locks in losses and prevents investors from benefiting when markets recover.

Trying to time the market

Predicting short-term movements is nearly impossible. History shows that investors who stay invested tend to achieve better long-term results.

Drastic asset allocation shifts

Making sudden changes – such as shifting large amounts from one asset class to another – can derail a long-term strategy and reduce future returns.

Halting regular investments

Many investors consistently add money during market upswings but hesitate when prices drop. However, adding to your investments during downturns may help you to improve your long-term returns when markets rebound.

Holding too much cash

While having a cash buffer is important, keeping too much on the sidelines may mean missing out on potential market recoveries and long-term growth.

Making any of these mistakes, or a combination of them, can significantly hurt long-term returns. Investors often panic during downturns and chase markets after they rebound, missing some of the best days of performance in between. We cover this topic in more detail here.

The power of diversification

ETFs may help you avoid these mistakes by providing diversified exposure that removes the temptation to pick individual winners or losers.

In addition, by spreading investments across various markets, sectors and regions, you may avoid the worst impacts of any single downturn. Diversified portfolios, especially those with global exposure, are historically better positioned to absorb shocks and recover more quickly.

Turning downturns into opportunities

ETFs provide a practical way to navigate market corrections. When markets fall, adding steadily to your investments (known as dollar-cost averaging) allows you to gain exposure to more of your preferred investment for less. For numerous historical reasons, those who stay invested during downturns tend to see stronger long-term returns3. Note that here, we are talking about staying the course in your long-term investment strategy during a downturn and not about dip-buying. The latter strategy is both very difficult to execute and could cost you a small fortune in fees.

As Warren Buffett famously put it: “The stock market is a device to transfer money from the ‘impatient’ to the ‘patient’.”

Stay calm, stay invested

The next time markets wobble, remember that market corrections aren’t disasters. They’re part of the journey. By sticking to your investment strategy, especially with ETFs that provide broad, diversified exposure, you’re positioned well for long-term growth.

Stay calm, stay invested and stay diversified. If history is any guide, patience and discipline will be rewarded.

References:

1 & 2. Price performance sourced from Bloomberg and FactSet data.

3. S&P Global – S&P/ASX 200 Total Returns (as at March 18 2025)

4. MSCI – MSCI World Gross Performance in USD (as at 28 February 2025)

5. David Bassanese, Will he or won’t he? (3 March 2025)

Other sources:

1. https://www.marketindex.com.au/news/is-the-asx-200-about-to-crash-lessons-from-50-years-of-stock-market-crashes ↑

2. https://www.cnbc.com/2021/03/16/one-year-ago-stocks-dropped-12percent-in-a-single-day-what-investors-have-learned-since-then.html ↑

3. https://www.schwab.com/learn/story/should-you-stay-invested-during-market-downturn ↑