Tariff mayhem

4 minutes reading time

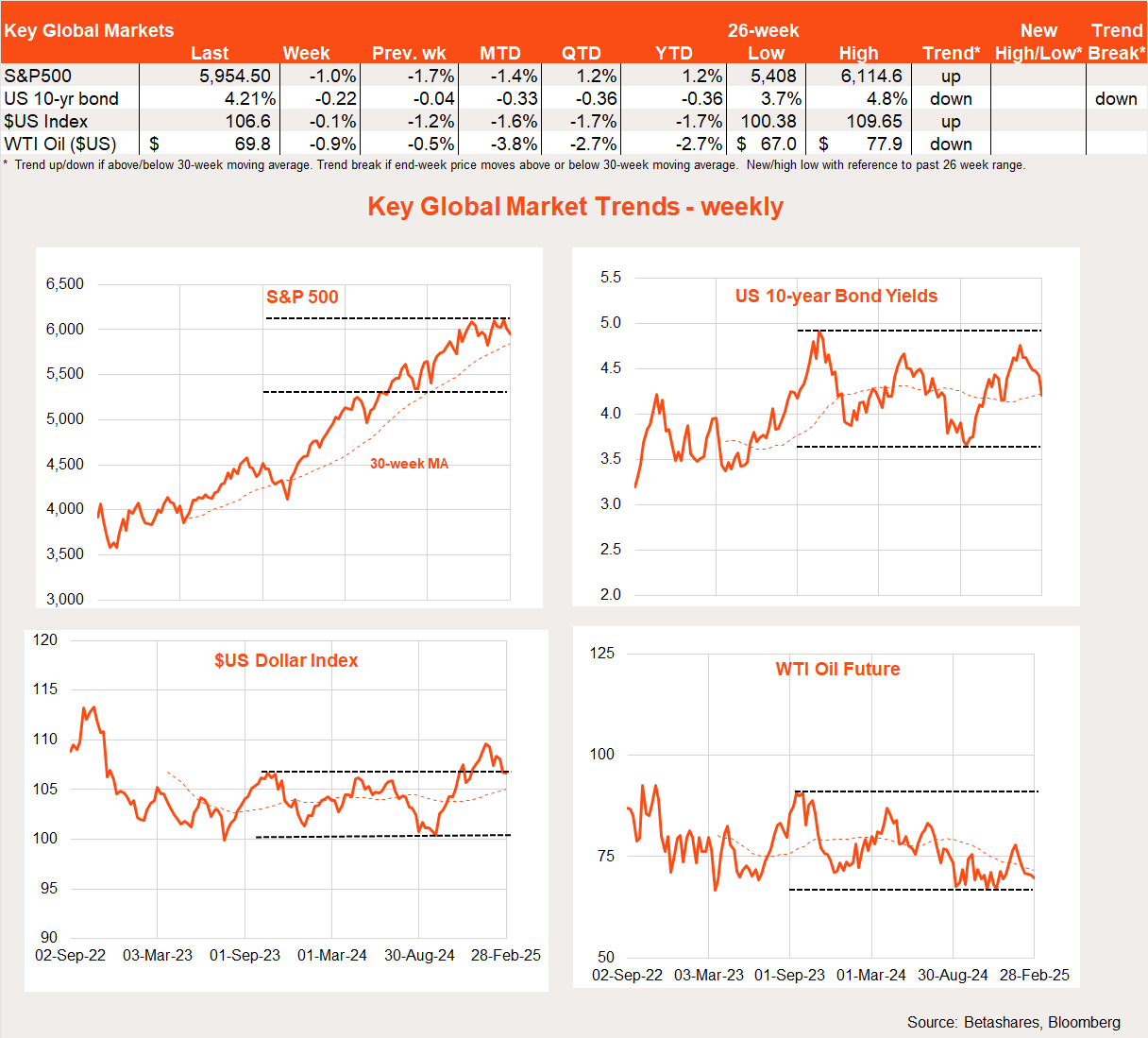

Global markets

Global equities retreated further last week due to ongoing US tariff concerns and additional evidence of negative effects on the US economy.

Last week’s major global highlight was US President Donald Trump’s ongoing on-again/off-again tariff threats. By the end of the week, the US seemed to settle on pressing ahead with its threatened 25% tariff on Mexican and Canadian imports (10% on Canadian oil), along with a further 10% tariff on China. This new 10% tariff on China is in addition to the existing 10% tariff imposed a few weeks ago.

The reasons for these tariffs, at least with regards to Canada and Mexico, remain unclear. At face value, it’s claimed they’re due to poor border control of illegal immigrants and drugs. In this case, tariffs may be temporary, but that assumes both countries can eventually satisfy Trump that more will be done.

But there is a suspicion that border concerns are just an excuse and that Trump really wants to impose an anachronistic 1950s-style tariff wall to raise revenue and boost local production.

Should it be implemented, this could be the worst US economic policy decision in decades. The US economy is already at full employment and global production chains are highly integrated across borders these days. Further, it will likely encourage trade retaliation, drive inflation higher, and depress economic activity.

These three countries account for around half of US imports. The proposed tariffs amount to an increase in the average US effective tariff of 10%. If fully passed on, these tariffs would add 1% to consumer prices. This calculation does not include a potential 25% tariff on European imports (which is being considered), the proposed 25% tariff on steel and aluminium, or any reciprocal tariffs.

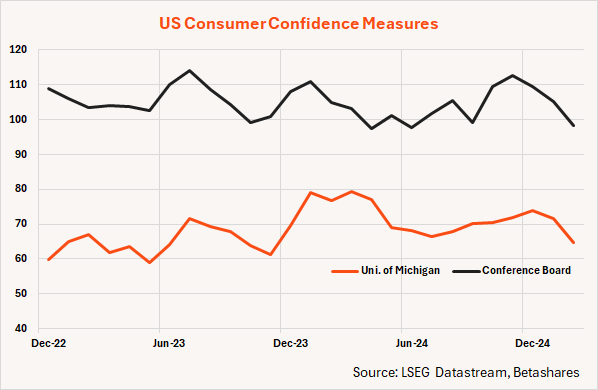

Consumer sentiment has already taken a hit. Two weeks ago, the University of Michigan consumer sentiment index dropped on inflation fears. Last week, the Conference Board measure of confidence also took a tumble. Equities sold off and bond yields fell. It appears markets are fearing the growth consequences of Trump’s misguided policies.

Over the weekend, Trump also announced a strategic crypto reserve largely comprising Bitcoin and Ethereum. This would have given the crypto space another reason for bullishness.

In other news, the US private consumption expenditure deflator (PCE) for January was in line with market expectations. The core PCE eased from 2.8% to 2.6%. Were it not for Trump’s trade interventions, markets would likely be celebrating a continued Goldilocks economy in the US.

Global week ahead

The week ahead will likely continue to be dominated by tariff news: Will he or won’t he proceed with planned tariff increases?

The February US payrolls report, being released on Friday, is expected to show that 150,000 jobs were added last month. Unemployment is expected to remain steady at 4%. Also on Friday, we’ll hear from US Federal Reserve Chair Jerome Powell.

Outside of the US, the focus will be on a series of key Chinese government meetings known as the ‘Two Sessions’. Markets will be looking for whether any new policy stimulus measures are announced. Excitement around the Chinese technology sector continues to build as private sector entrepreneurs are back in favour with officials.

Global market trends

European stocks continued to outperform last week while the NASDAQ 100 underperformed once again.

This year, we’ve seen a pullback in the relative performance of the NASDAQ 100 and global growth over value. Europe’s relative performance is rising in its place. There are also tentative signs of improved emerging market performance along with a potential bottoming out of global quality underperformance.

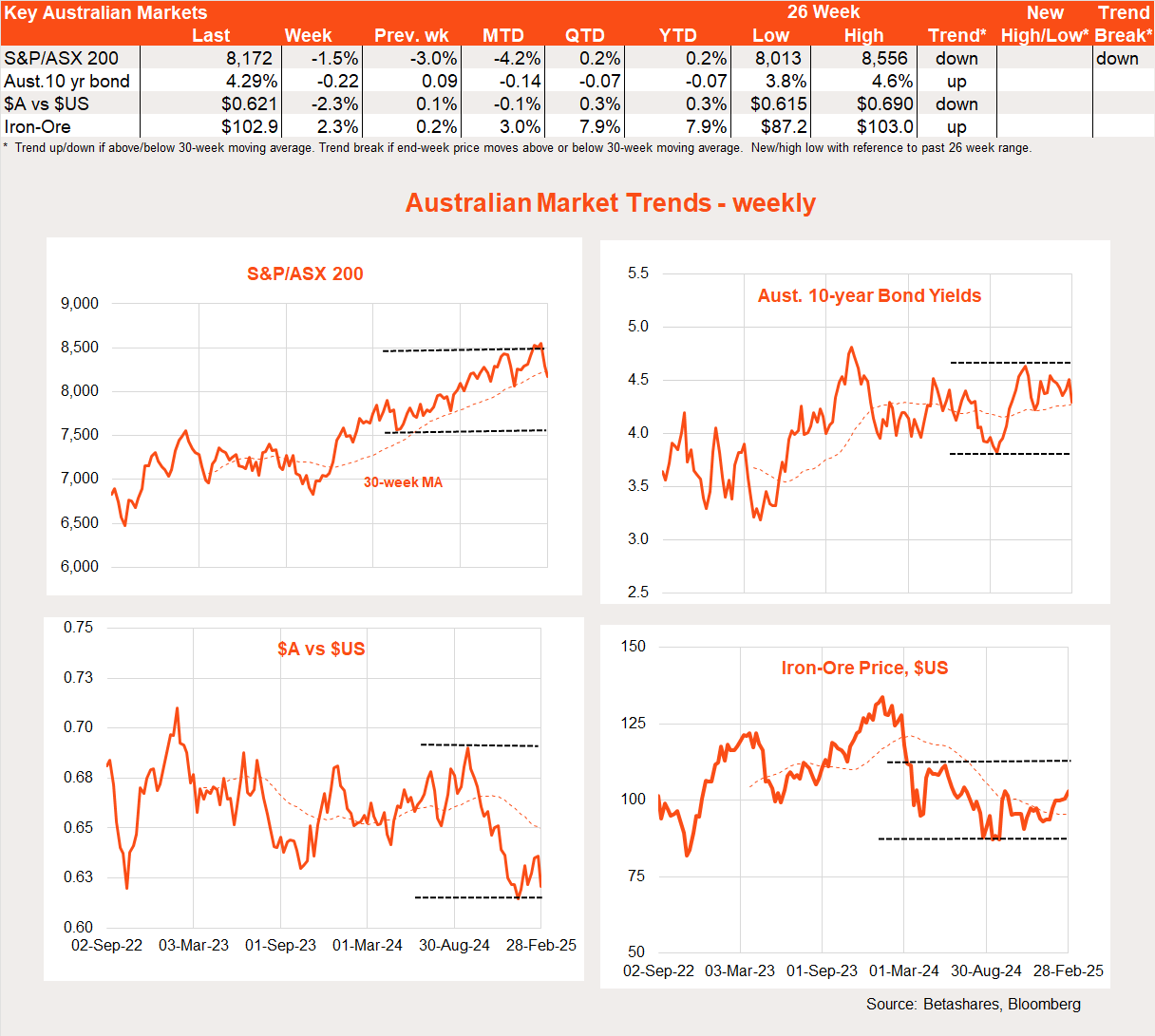

Australian market

Global trade concerns hurt local stocks last week, sending bond yields and the Australian Dollar tumbling.

Last week’s key local news was a small bounce in the monthly measure of annual trimmed mean inflation from 2.7% to 2.8%. This continues to bode well for another good quarterly CPI report in late April which should pave the way for another RBA rate cut in May.

Weak private activity data also supports the case for another rate cut. Q4 private capital expenditure and construction activity were both weaker than expected. Together, this suggests another subdued GDP report on Wednesday. The market is expecting only 0.5% GDP growth in Q4. If borne out, annual growth will lift from 0.8% to 1.2% – but that is still miserable.

Have a great week!