Bitcoin ETFs: What are they and how do they work?

5 minutes reading time

- Digital assets

Bitcoin, along with the broader crypto market, was slightly higher over the last week. The broader crypto market turned positive on China’s highly-anticipated stimulus announcement, which ultimately fell short of expectations.

Bitcoin and Ethereum were up 1.44% and 2% respectively over the seven days to 13 October. Bitcoin’s market capitalisation is up to US$1.24 trillion. The global crypto market cap is at approximately US$2.2 trillion, while bitcoin’s market dominance ended the week at 56.6%.

| Price | High | Low | Change from previous week | |

| BTC (in US$) | $62,863 | $64,136 | $59,075 | 1.44% |

| ETH (in US$) | $2,464 | $2,509 | $2,345 | 2.0% |

Source: CoinMarketCap. As at 13 October 2024. Past performance is not indicative of future performance. Performance is shown in US dollars and does not take into account any USD/AUD currency movements.

Source: Glassnode. Past performance is not indicative of future performance.

Crypto news we’re watching

Satoshi Nakamoto revealed?

A new HBO documentary claims to uncover the identity of the mysterious creator of bitcoin who goes by the pseudonym Satoshi Nakamoto. The documentary, Money Electric: The Bitcoin mystery, aired last week. One contender is American cypherpunk and cryptographer, Leonard Harris ‘Len’ Sassaman, who committed suicide in July 2011.

There are hundreds of bitcoin addresses that belong to Nakamoto that hold over a million BTC. Satoshi Nakamoto went silent two months before Sassaman’s death. Interestingly, Sassaman’s suicide note consisted of 24 random words similar to the 24-word seed phrases used in crypto wallets1.

Options approved for Bitcoin ETF

The US Securities and Exchange Commission (SEC) has given the green light to list options over BlackRock’s bitcoin ETF (IBIT). The approval will allow for physically settled options, meaning that when a contact is exercised, it will result in the delivery of bitcoin. Options are a type of contract that gives the buyer the right either to buy or to sell a security at a specified price at some point in the future.

The filing was approved on 20 September, but before trading can go live, additional approvals are needed from the Office of the Comptroller of the Currency (OCC) and the Commodities Futures Trading Commission (CFTC).

Only BlackRock’s ETF has been approved, but it is expected other managers will soon get approval too2.

CRYP company spotlight

MicroStrategy hits 25-year highs

Self-described bitcoin development company MicroStrategy is up over 210% YTD (to 11 October), and 568% over a 1-year period. Its performance has outpaced bitcoin, which has had a 47% increase since the beginning of the year. MicroStrategy accumulates BTC on its balance sheet. It was last reported that the firm now holds over 252,220 BTC, valued at approximately $15 billion3.

MicroStrategy is currently held in Betashares Crypto Innovators ETF (ASX: CRYP)4. According to its website, the company is a business intelligence software company, which helps organisations optimise data-driven decision making4.

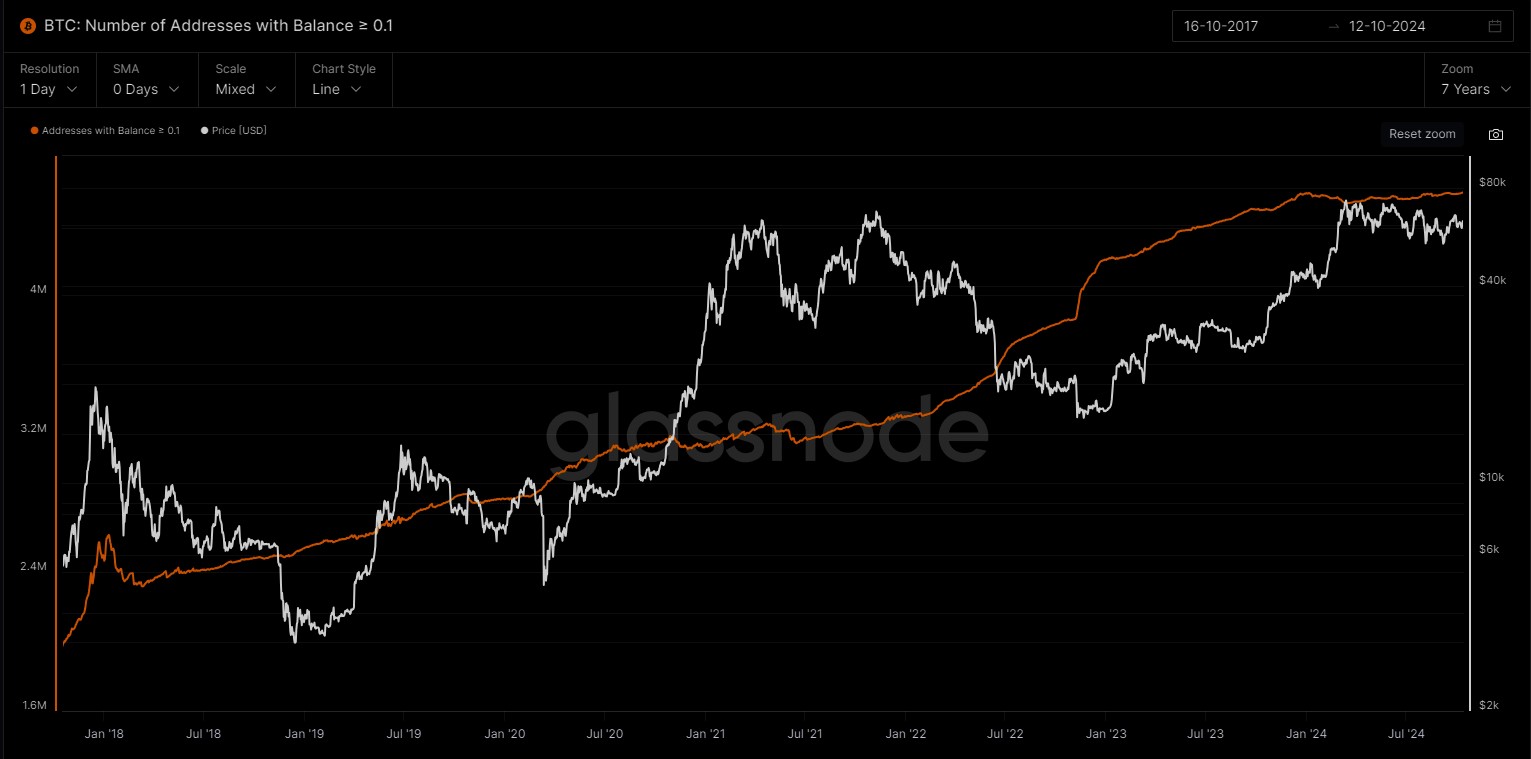

Bitcoin (BTC): Number of Addresses with Balance ≥ 0.1

This metric shows the number of unique addresses holding at least 0.1 coins.

According to data from Glassnode, the number of new addresses continues to be stagnant since the beginning of the year.

Source: Glasssnode. Past performance is not indicative of future performance.

Bitcoin (BTC): Number of Active Addresses (7d Moving Average)

According to data from Glassnode, there has been a noticeable trend down since September 2023, suggesting network activity is on the decline.

Altcoin news

In altcoin news, most of the Top 20 moved higher, but the standout was Sui (SUI). Over the seven days to 13 October, SUI was over 28% higher, and 458% over the last year. Helping SUI move higher has been network activity, seeing growth in Total Value Locked (TVL) and meme coin activity and number of daily transactions6.

According to the protocol’s website, SUI is a Layer-1 blockchain and smart contract platform designed to make digital asset ownership fast, private, secure and accessible. Use cases include gaming, commerce and finance7.

Investing in crypto assets or companies servicing crypto-asset markets should be considered very high risk. Exposure to crypto assets involves substantially higher risk when compared to traditional investments due to their speculative nature and the very high volatility of crypto-asset markets..

Investing in crypto assets or crypto-focused companies is not suitable for all investors and should only be considered by investors who (i) fully understand their features and risks or after consulting a professional financial adviser, and (ii) who have a very high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment. Any investment in crypto assets or crypto-focused companies should only be considered as a very small component of an investor’s overall portfolio.

References:

1. https://cryptopotato.com/crypto-community-discusses-len-sassaman-was-he-satoshi-nakamoto/

2. https://www.fxstreet.com/cryptocurrencies/news/bitcoin-etf-options-set-to-go-live-following-sec-approval-of-blackrocks-application-202409210045

3. https://news.bitcoin.com/microstrategys-stock-surges-185-in-2024-outpacing-bitcoin-holdings/

4. As at 28 September 2024. No assurance is given that this company will remain in the portfolio or will be a profitable investment.

5. https://www.microstrategy.com/

6. https://coinmarketcap.com/community/articles/670946fbefbf121e9351cd52/

7. https://sui.io/intro-to-sui

Off the Chain is published every second Tuesday. It provides the latest news on bitcoin and the rest of the crypto market, along with analysis and insights into the world of crypto.

It provides general information only and is not a recommendation to invest in any crypto asset, crypto-focused company or investment product.