Equity Markets Quarterly Commentary Q1 2025

5 minutes reading time

Gold is on the move and the rally is turning heads, and not least because it’s happening contrary to the traditional drivers of strength for the yellow metal. The recent breakout has occurred alongside a rise in US real yields, the broad US dollar is hardly in a bear market, and gold ETFs globally have been experiencing steady outflows in aggregate. So, what’s going on?

Physical demand

There are all manner of possible technical explanations, but let’s start with the other side of ETF sales: physical buying. Such buyers of gold are a diverse group, ranging from individual collectors of coins and bars to some of the largest institutions on the planet – central bank reserve managers and related entities in the foreign official sector.

Within this space, we’ve seen central banks diversifying their holdings of FX reserves away from traditional assets like US Treasuries for several years now, either as a way of defending themselves against potential sanctions, as a broader geopolitical hedge, or as protection against US monetary and fiscal policy increasingly seen as too lax. More recently, China has been a major gold buyer of note. The PBoC has now increased its gold holdings for a 17th consecutive month, while households are also looking to protect their wealth against a vulnerable domestic property market.

Perhaps it’s not worth searching for new fundamental catalysts to explain the price action at all, and instead trust the market signals themselves. Indeed, technicians and chartists would likely tell us that simply because gold is rallying in spite of the traditional fundamentals, it’s a bullish sign. That being said, how can you trade it?

The hedging question

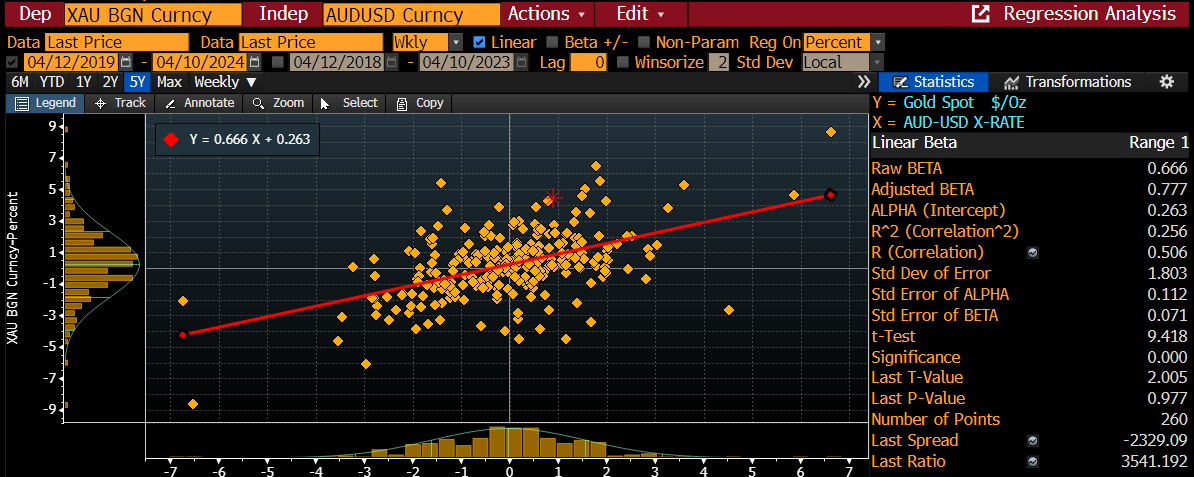

For investors looking to trade gold directly via ASX listed ETFs, it’s worth noting that the weekly correlation between gold returns denominated in USD and changes in the AUD/USD spot exchange rate has been around +0.5 over the past five years, implying that the AUD/USD tends to appreciate when the US dollar price of gold increases. As a result, investors looking to capture further strength in gold might be doing themselves a disservice by being unhedged.

Aside from the positive weekly return correlation, the largest moves historically in the US dollar gold price have occurred during periods of significant broad USD weakness and AUD strength (e.g., mid-2000s, early 2010s, and the immediate post-COVID period). Furthermore, we’re now at a point where industrial commodities are also breaking out. This should support the AUD at the margin, which is already trending higher against energy-importer currencies like the Euro and Yen.

Gold miners

The past three years have been tough for gold miners, with higher production costs and a rising cost of capital having taken its toll. However, with the US rate-hiking cycle now likely at an end, the companies that have come through it are likely stronger and better able to exploit the natural operating leverage they have to any gold rally.

The breakout in gold miners over the past month has been notable, and it’s a sign that this sector is now more resilient than before and well-positioned to be one of the biggest beneficiaries in global equity markets from ongoing strength in precious metals.

Like spot gold, the biggest rallies from gold miners historically have been during periods of AUD strength, making it sensible to hedge to get the most out of this trade.

TIPS

One of the biggest conundrums of late has been gold diverging from the performance of US Inflation-Protected Securities (TIPS) and rallying despite higher US real yields.

Being a non-income-producing asset that’s expected to maintain its purchasing power over time, real yields are seen as the opportunity cost of holding gold. As such, gold has historically tended to move with TIPS.

With TIPS trading back around 2% and heading towards cycle highs, the strength of the gold rally is more than a little surprising. However, it’s possible that gold is sniffing out something that the TIPS market is either yet to come around to, or unable to.

Specifically, gold may be pre-emptively factoring in shifts in the economic landscape and future declines in real interest rates that TIPS are yet to reflect, due to the Fed’s balance sheet run-off occurring just as Treasury issuance is on the rise (TIPS were a larger component in the latest round of QE, in contrast to previous episodes of balance sheet expansion).

It’s also possible that the foreign official sector is hedging against what they see as overly accommodative US fiscal policy and structural budget deficits, which raises the risk of an extended period of so-called ‘fiscal dominance’. Such a regime can span everything from outright debt monetisation to simply keeping monetary policy deliberately loose for nominal growth to eventually erode the stock of public debt over time.

If these concerns turn out to have merit and the Fed relaxes its commitment to maintaining the 2 per cent target, adopting a policy of keeping real interest rates well below ‘neutral’, TIPS will likely benefit and be the only type of US Treasury instrument worth owning. Either TIPS will benefit in the medium term through a repricing higher in inflation break-evens and much lower real yields, or in the long run through inflation consistently realising above the market’s pricing of inflation (as coupons and principal of TIPS growth with US CPI), which is currently only around 2.37% p.a. over the next 10 years.

Chart 1: Gold and 10-year US real (TIPS) yields; Source: Bloomberg

Chart 2: Gold price and AUD/USD scatter plot of weekly returns; Source: Bloomberg

Chart 3: Gold price and known ETF holdings; Source: Bloomberg