8 minutes reading time

Commentary from the Betashares portfolio management desk by Head of Fixed Income Chamath De Silva, providing an overview on fixed income markets:

- DeepSeek is more than just a big cap tech story.

- What the trade war of 2018/19 tells us about the growth and inflation risks of tariffs.

- Could “DOGE” cause a US recession?

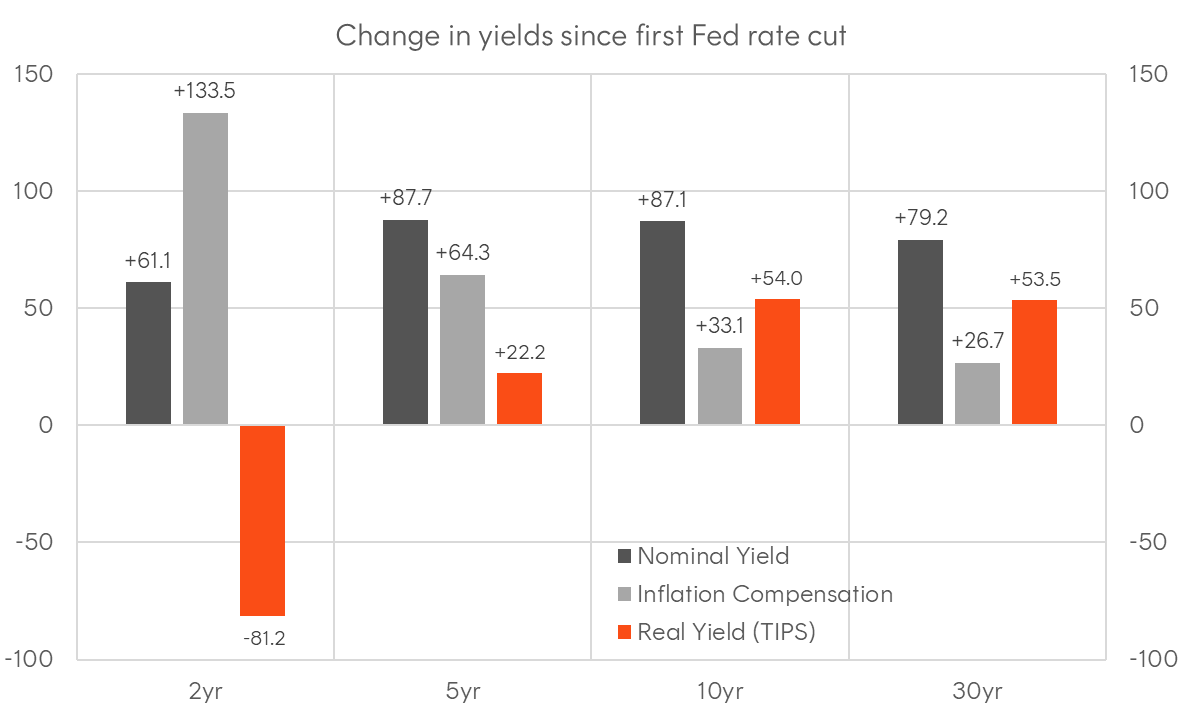

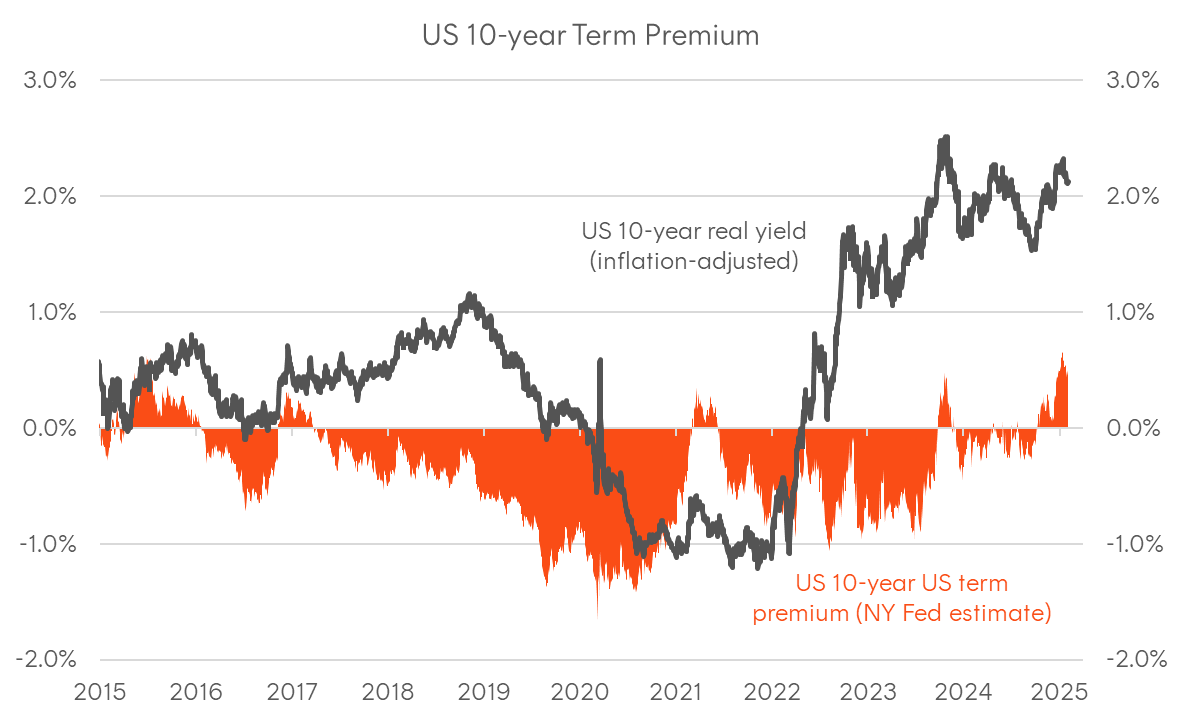

There’s no shortage of things to talk about since the US Presidential inauguration, but in the interests of brevity, I’ll focus on some of the biggest stories recently and their relevance to bonds. Before diving into the macro implications of DeepSeek, trade wars, and DOGE, it’s worth mentioning that the broader narrative hasn’t changed a whole lot the past fortnight. US Treasury yields might have put in a peak for the cycle as the term premium tantrum is now a mainstream talking point and real yields are too compelling to ignore. In addition, the Fed has clearly been dialling down the dovishness and has returned to being data dependent, resulting in very few further cuts being priced in. Credit spreads are still around cycle lows, but the fresh policy and geopolitical uncertainty could pose a headwind and drive a widening over the rest of this year. The miss to Q4 Australian CPI will likely force the RBA into a downward revision to its inflation forecasts, pulling forward the likely start of the rate cutting cycle to this month, with the risk-reward arguably now favouring duration over credit for Australian and global fixed income.

Why the bond market should care about DeepSeek

The news that a small AI team in China built an open-source model that’s functionally just as good as the best US built closed-source LLMs, but at a fraction of the cost, is a story with broader implications than just big cap tech stocks. Because the macro narrative of US exceptionalism is so closely tied to US dominance of AI, bonds and FX should be paying attention.

The potential democratisation of AI, as seen with DeepSeek, will likely follow the path of earlier “general purpose technologies” such as electricity, automobiles, aviation, and the internet. These innovations historically reduced costs and transformed productivity, yet the primary economic benefits went to consumers and those who used them effectively rather than the providers of the underlying technology. In AI, this means that while semiconductor and data centre companies may see transient benefits, the real economic impact will be in businesses that integrate AI to redefine processes, enhance efficiency, and expand margins, in addition to consumers that can get much more advanced products and services at a lower cost.

The comparisons between Nvidia and Cisco are apt. Cisco, being the “picks and shovels” poster child of the dot com boom, ended up contributing to the excess capacity of network and internet infrastructure that brought down web and data costs, removing barriers to entry for all manner of value-add services and enabled the software layer than the next generation of software companies took advantage of during the late 2000s and 2010s. Commoditisation of AI models and less need for the most powerful, high margin GPUs, might do the same for AI applications over the next few years, and this is likely to put downward pressure on prices in an increasingly services-based economy.

Such a development would reinforce the secular trend of technology-driven disinflation. A step change in so-called “total factor productivity”, will likely suppress prices and inflation expectations, influence central bank policy in a more dovish direction, and result in a sustained trend lower in bond yields.

Lessons from the 2018/19 trade war

With a new trade war upon us (the backtracking aside), the prevailing fear being expressed by commentators is that US and global inflation pressures will re-accelerate. While it’s true that tariffs do effectively raise prices of the goods effected immediately, “inflation” in how it’s typically viewed by markets and policy makers is much broader and more sustained than selected price increases. It’s important to remember that first, it’s unclear if price rises will be transmitted to the rest of the CPI basket and if price rises will accelerate, especially given that much of the US and global economy is now based on services.

The earlier trade war of 2018-2019 is also instructive, in that the negative growth shock dominated any inflationary impact. 2017 was a strong year for the global economy, seeing broadly synchronised growth, with the US economy buoyed by tax cuts at the commencement of Trump’s first term. However, this narrative was dramatically upended following the imposition of US tariffs on Chinese goods and retaliatory Chinese tariffs on US agricultural and energy exports, with the global economy experiencing a major downturn in the second half of 2018. In addition, the Fed had probably overestimated the inflationary impacts of that trade war and left policy too restrictive, contributing to the dramatic collapse in inflation expectations and a large equity market sell-off in Q4, with growing problems in US credit markets forcing the Fed into a dovish pivot.

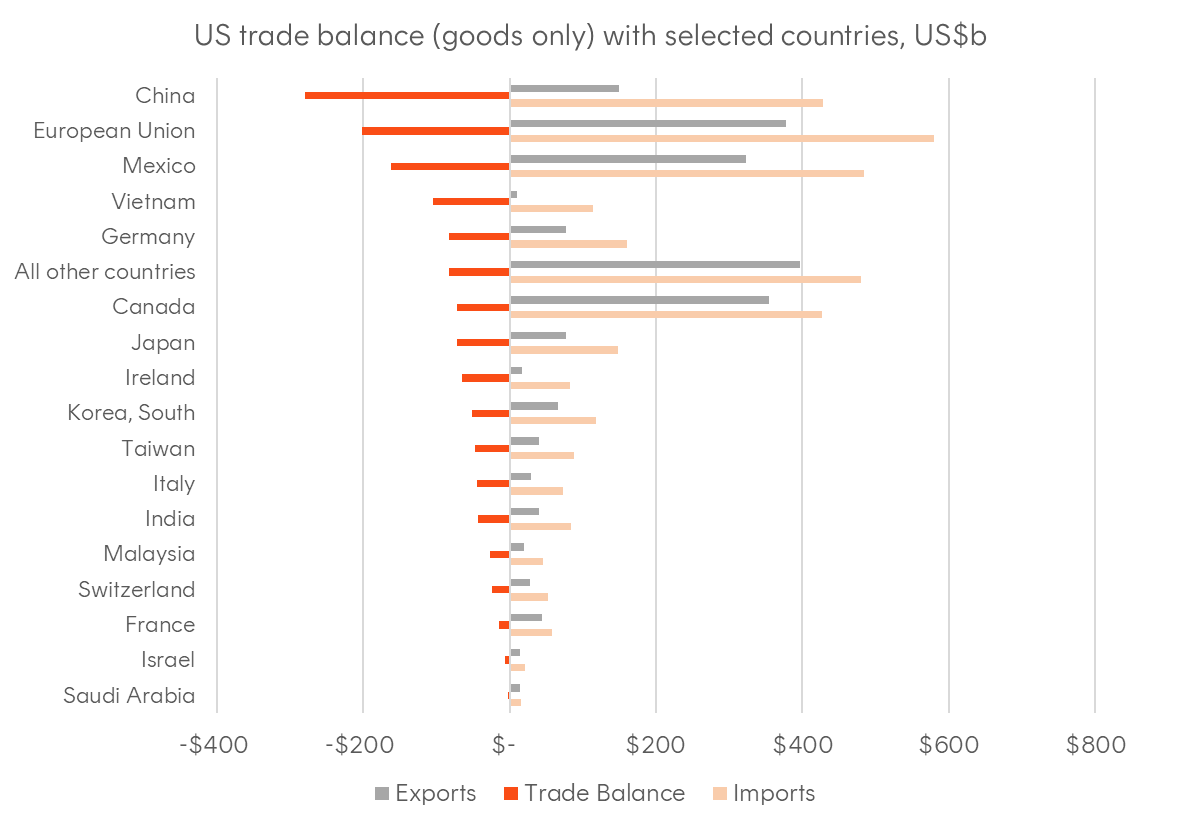

The range of estimates I’ve seen suggest that just the Mexican and Canadian tariffs (assuming they’re re-instated) would remove 0.8-1.2% points from US GDP, and I can only assume a full-scale trade war with China would require a further upward revision to the GDP hit. In addition, the broader impact on investment from the increased uncertainty is much harder to quantify. As to the motivation of tariffs, there’s a case that it’s not only designed to improve the US trade balance with selected countries, but also to pre-emptively raise tax revenue to help pay for the tax cut extensions, which could be contentious given the very slim Republican majority in Congress. So far, the market has jumped on the pro-growth aspects of Trump’s policies – both tax cuts and expected deregulation – without considering the sequence of events.

Regardless of whether the US and China come to a deal, it’s fair to say that the injection of fresh volatility into the outlook for global trade is probably not a positive for risk assets, and because markets might be overestimating the inflationary effects and underestimating the growth impacts, government bonds

Is DOGE a US recession catalyst?

One of the most curious aspects of the raft of executive orders from the new Administration was the creation of the so-called Department of Government Efficiency (DOGE), which raised eyebrows initially and was seen as more of a meme than an effective policy tool. If the latest news is any guide, DOGE appears to have more power than most people assumed and has already impacted spending from some government agencies. As a result, I believe the market is under-pricing the risks to US growth if this initiative achieves the US$2 trillion in spending cuts it has promised.

At least on the surface, DOGE is an example of structural reform, with the purported aim of improving efficiency and modernising the US public sector, in addition to downsizing the Federal government workforce. However, structural reforms, while potentially improve long-term outcomes, often involve significant economic pain over the short to medium term.

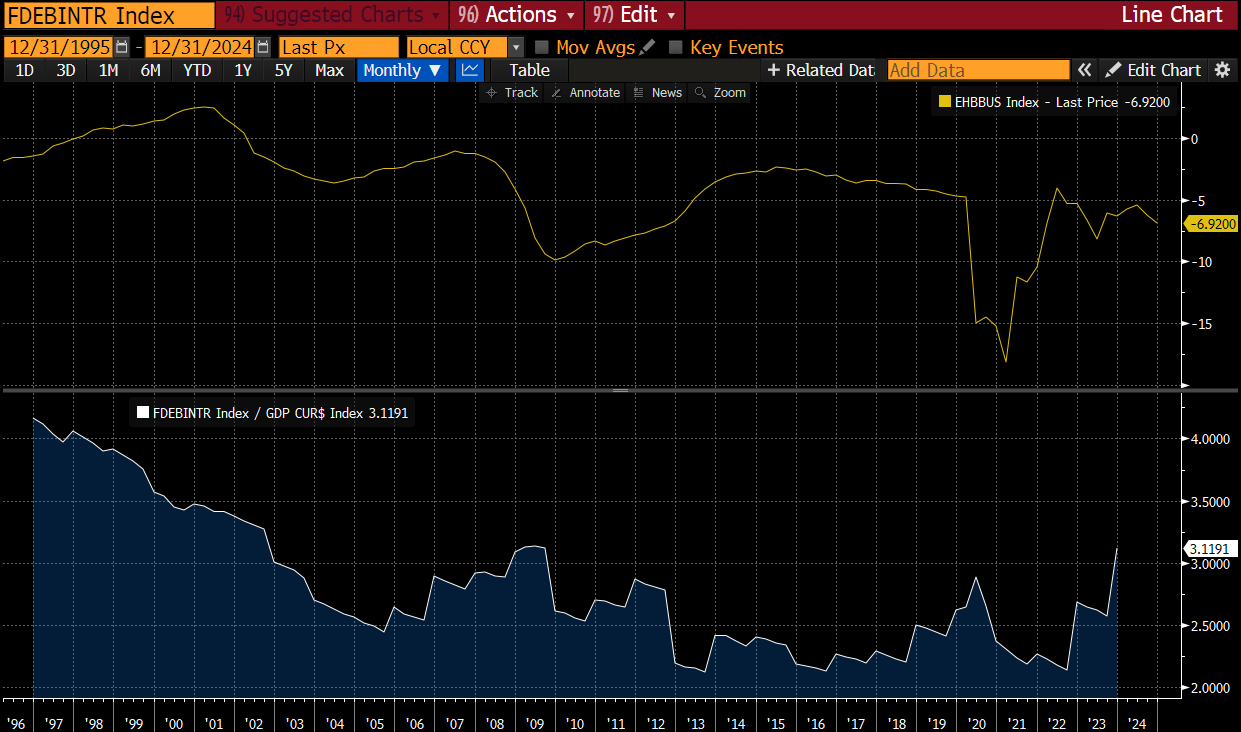

Although the US government deficit is exceptionally large at 7% of GDP (excluding interest expenses, the “primary deficit” is still around 4% of GDP), it’s worth pointing out a few important points about government spending that investors often forget:

- In aggregate, public-sector spending is the private sector’s income and the deterioration in the US government’s balance sheet post-pandemic coincided with an improvement in household and corporate balance sheets.

- The US federal government workforce, at 3 million employees, is the country’s largest single employer and makes up not an insignificant part of the US middle class labour force.

- Many US corporates, small businesses, and other private sector organisations rely on government grants and contracts.

One of the mistakes the macro community made in the immediate post pandemic period was underestimating the impact of fiscal stimulus on growth. In addition, while US economic outperformance is heavily tied to the US exceptionalism narrative, it’s unclear how much of the economic growth differential vs the rest of the West is down to superior labour market productive or just higher levels of government deficits. If DOGE’s success effectively amounts to austerity, then that’s not being reflected in either the price of stocks or bonds.

Figure 1: Change in US Treasury yields since first Fed rate cut, as at 1-Feb-2025

Source: Bloomberg

Figure 2: US 10-year Treasury term premium

Sources: Bloomberg, NY Fed

Figure 3: 10-year Treasury yield and inflation breakeven during 2018-2019

Source: Bloomberg

Figure 4: US trade balance (goods) with selected countries: as at Dec-2023

Source: BEA

Figure 5: US budget deficit (top panel, as at Dec-2024); Interest expense as % of GDP (as at Dec-2023)

Source: US Treasury

Figure 6: Size of the US federal government (civilian) workforce in 000s; share of total labour force in lower panel

Source: BEA