Day one of Trump 2.0 – A threat to US exceptionalism?

2 minutes reading time

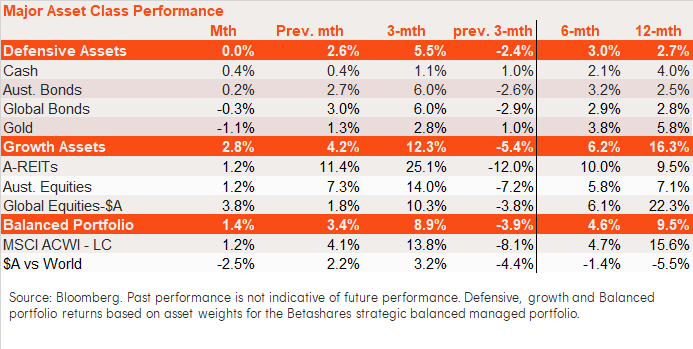

Defensive assets returns were flat in January, reflecting muted cash and Australian bond returns, and a small decline in global bond returns. Gold prices also eased a little. The major theme of the month was solid US economic growth and reduced expectations of near-term US rate cuts. The trend in global bond yields since October last year has been downward.

Growth assets returned 2.8%, with global equities in unhedged AUD terms rising 3.8%, in part due to AUD weakness. The trend in global equities has been upward since bottoming in late 2022.

Australian equities and listed property both returned 1.2% in January. Relatively soft Australian equity returns unwound some of the outperformance versus global equities seen since late last year. That said, the trend in relative Australian equity performance has been downward since early 2023. Relative returns for Australian versus global bonds have been choppy over the past year.

The Market Trends report and video update are available below.

1 comment on this

Thanks ,good stuff for retirees +. Several Beta ETF such as Hack, and now URNM. As Member of Probus fun financial group I often Beta.

Pls ensure our Beta are where possible REINVEST.