Defaults: Systemic or idiosyncratic?

5 minutes reading time

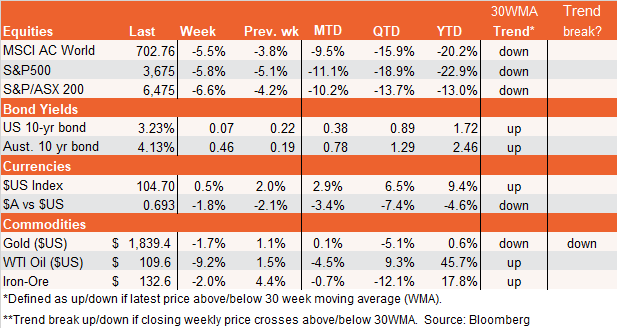

Global markets

It was another horror week for global equity (and bond) markets as the previous week’s hotter than expected U.S. consumer price index report led to fears that the Fed would hike by 0.75% at last week’s meeting. Following a well-timed media leak, those fears were realised. The Fed’s updated ‘dot plots’, moreover, suggested a further 1.75% worth of rate hikes this year, taking the mid-point of the Fed funds target range from 1.6% to 3.4%. That’s a full 1.5% more than the Fed expected back in March. Of course, not to be outdone, the market still reckons the Fed will do a bit more – with a year-end Fed funds expectation of 3.6%.

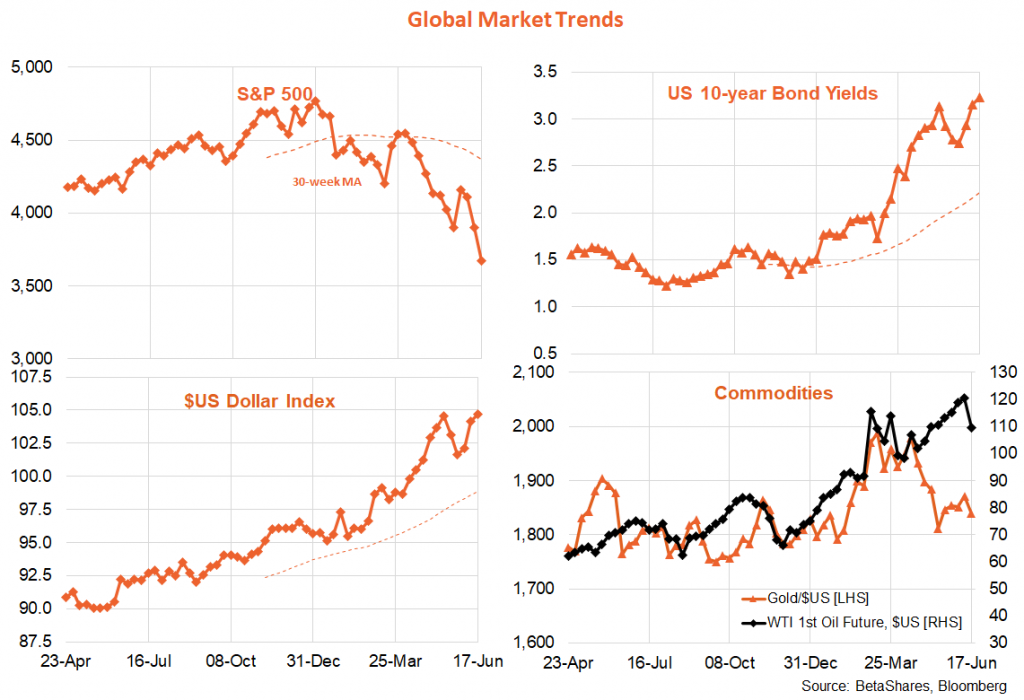

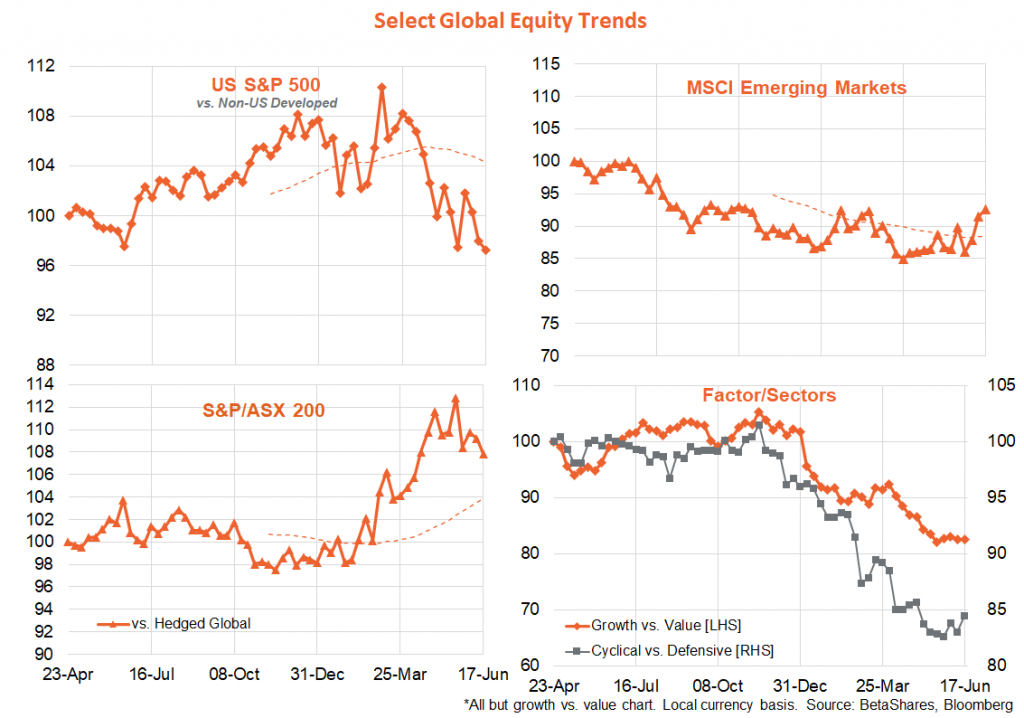

As evident in the chart below, the broad trend in equities remains to the downside, with trends in bonds yields, the US dollar and energy prices still to the upside. That said, fears of slowing global growth due to rate hikes appeared to sap the strength of oil prices last week.

With U.S. inflation reports likely to remain uncomfortably high for at least a few more months, chances are the Fed will remain very hawkish – and equity markets remain under downward pressure. Indeed, I’m now calling a U.S. recession will kick in over the next 12 months, with already emerging signs of weakness in consumer spending and the housing sector. That may mean we’re close to the highs in global bond yields (my call is U.S. 10-year yields won’t break above 3.5% this year), though potentially not the lows in global equity markets – especially as still overly optimistic earnings expectations need to be slashed. The average U.S. equity downturn during a recession has been around 35%.

In terms of the week ahead, the major highlight will be Fed chair Powell’s testimony to Congress over Wednesday and Thursday. He’s likely to be pressed on the probability of recession and whether he’s really prepared to risk one to get inflation down. Given deeply oversold markets (in the short-term at least) it would not surprise to see a bounce on reassuring Powell commentary that he does not anticipate a recession and is hopeful it can be avoided.

The market is also likely to start paying more attention to emerging signs of economic weakness, given recent weakness in retail sales, consumer sentiment and housing starts. In this regard new and existing home sales will be closely watched, as will be weekly jobless claims and purchasing manager surveys of manufacturing and services. I suspect bond yields will peak and the market will stop aggressively pricing in ever more rate hikes once we finally start to see stronger signs of slowing demand.

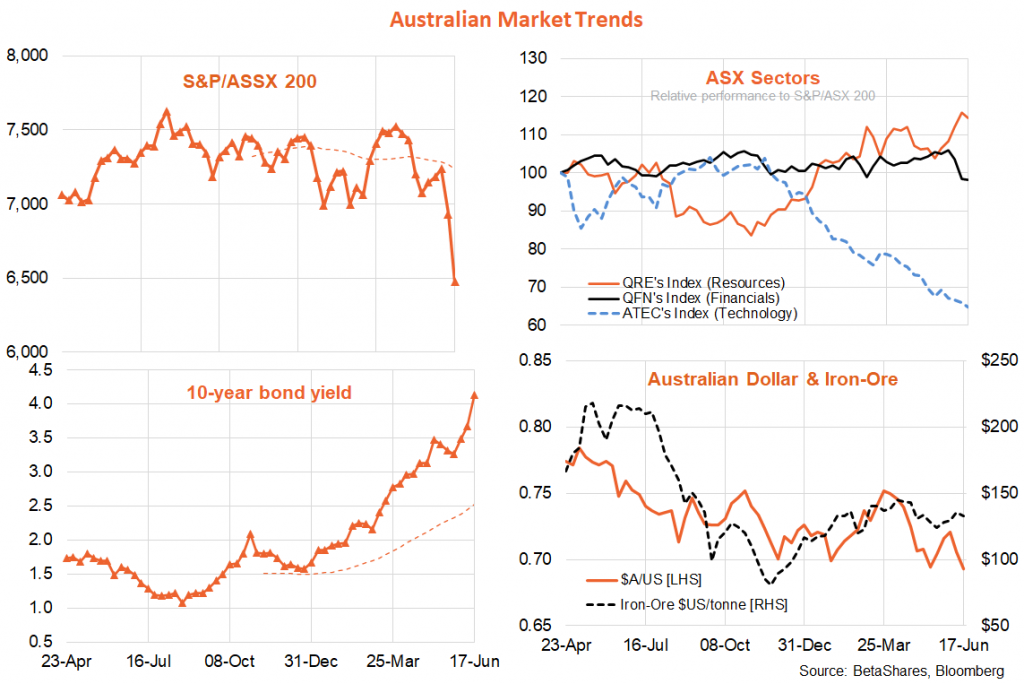

Australian market

Last week’s economic data were fairly mixed. While the NAB survey of business conditions took a knock, it remained comfortably above long-run average levels. Households are much less optimistic, with the Westpac measure of consumer sentiment declining further to be wallowing at levels seen in past crisis periods (though still above the 1990s recession lows). As in the U.S., the rise in interest rates and inflation has left consumers feeling despondent despite a strong labour market. Indeed, last week’s local May employment report revealed 60k new jobs were created, thanks to high workforce participation that has kept the unemployment rate steady at 50-year low of 3.9%.

Equity investors have also got the blues – with the S&P/ASX 200 down almost 10% in two weeks, unwinding part of its outperformance versus global markets so far this year. A more aggressive RBA plus emerging fears of slower global growth (and hence weaker commodity prices) have conspired to cause the local market to play catch-up with the global equity sell-off.

While the local equity market outlook remains largely at the mercy of Wall Street, the RBA is not likely to provide much support either – with more rate hikes expected in the face of stubbornly high inflation. In a rare television interview last week, RBA Governor Lowe indicated headline inflation could hit 7% by year-end (an upgrade from its May forecast of 6%), and it was “plausible” that the cash rate could move above his estimated neutral rate of 2.5%. The market, meanwhile, expects the cash rate to hit around 3.8% by year-end – or effectively a 0.5% hike at each of the remaining six policy meetings this year!

Due to a likely continued more benign local wage outlook, I don’t anticipate the RBA will feel the need to push the local economy into recession to get inflation under control – something that can’t as easily be said for the U.S. Federal Reserve. Indeed, market expectations of a cash rate of more than 3.5% by year-end I still see as overly pessimistic. Even if the RBA wanted to create a recession, it would probably achieve this well before the cash rate got much above 3%.

There is little on the local data front this week, with minutes to the recent eventful RBA meeting likely to be a focus, along with a speech tomorrow by RBA Governor Lowe on the economic outlook. The key issue for markets – is the RBA still to follow up with another aggressive 0.5% rate hike next month? Markets are certainly priced that way, so it does seem likely unless the Bank indicates otherwise before then.