Liberation Day

4 minutes reading time

- Global shares

Global markets

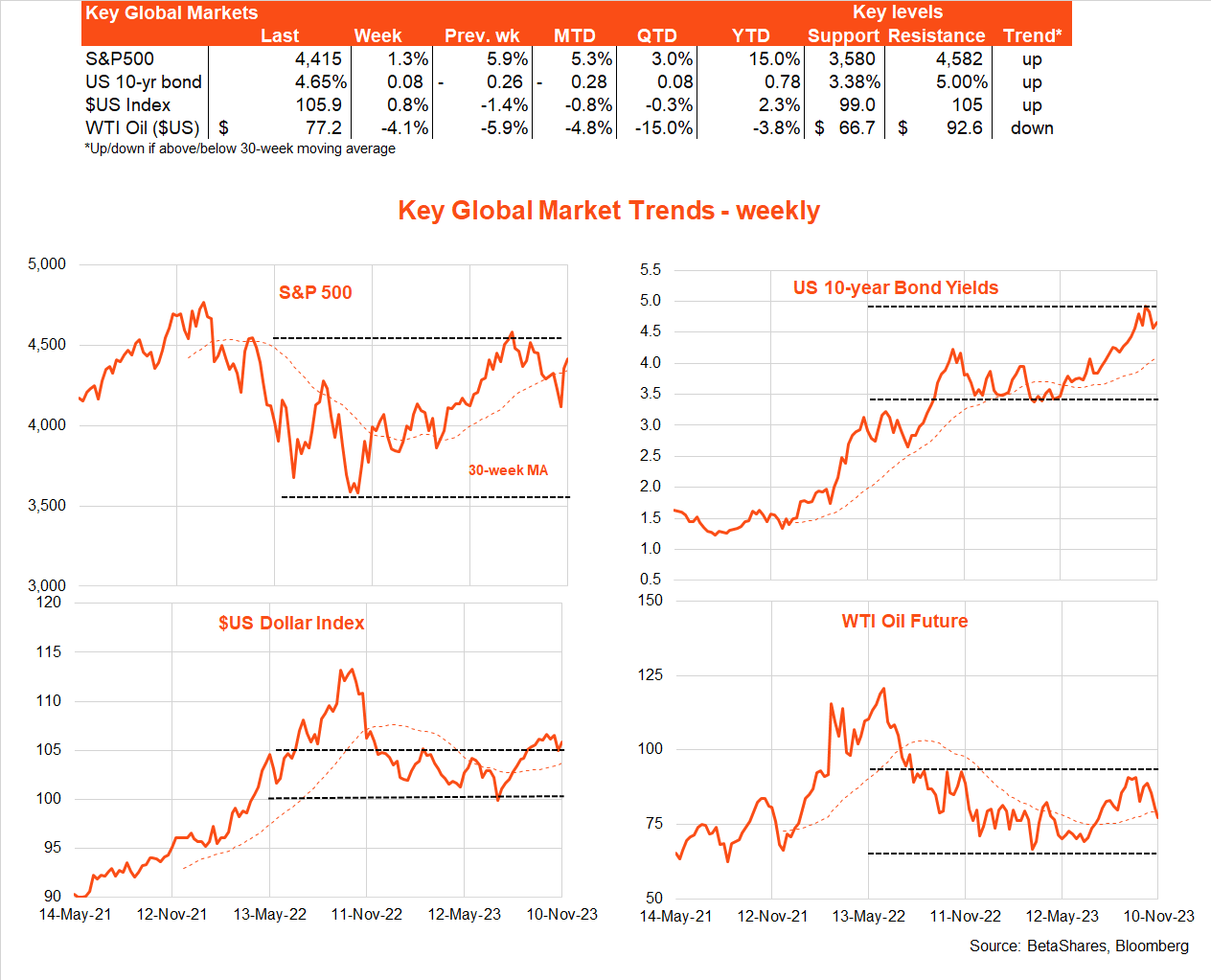

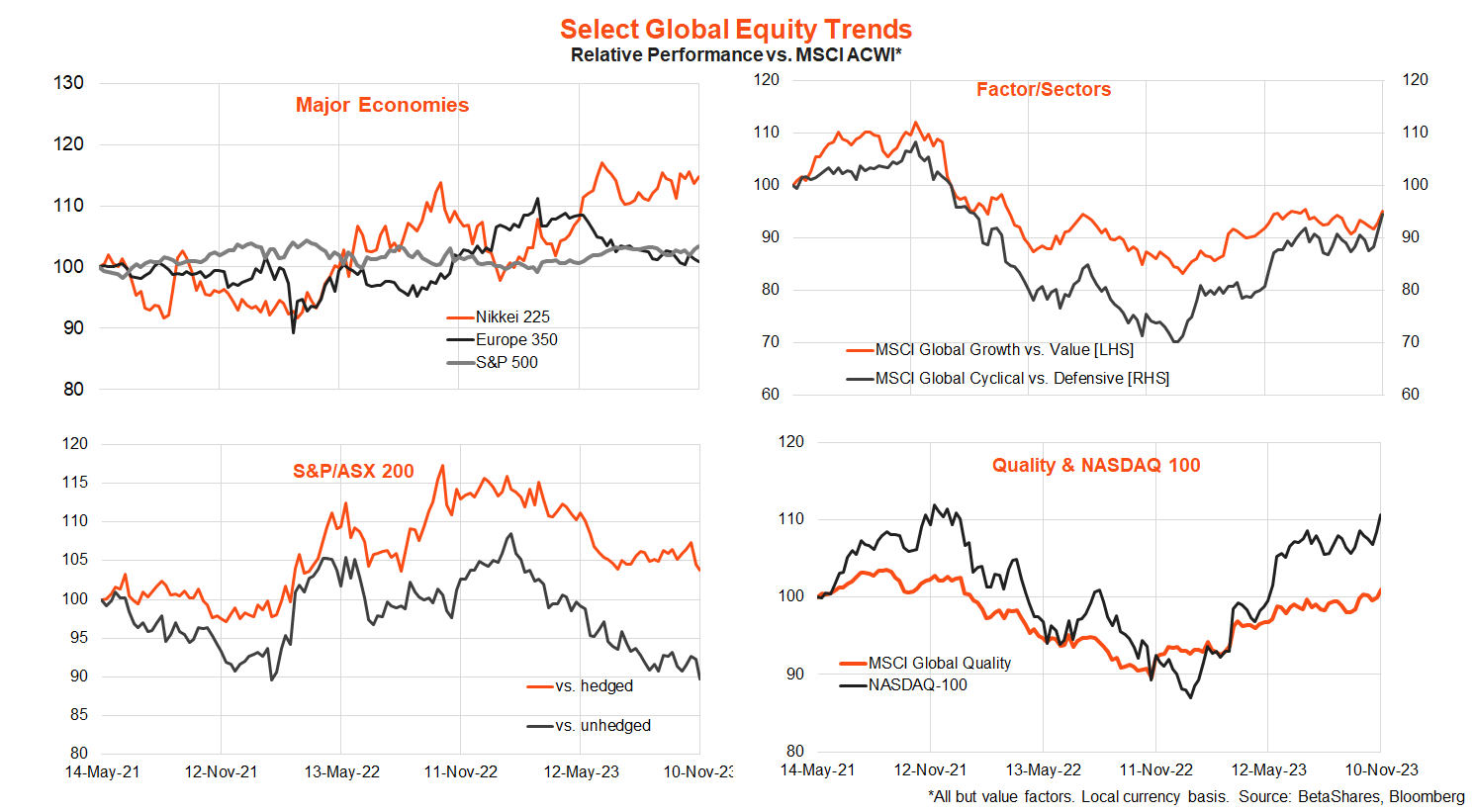

Global equities eked out further gains last week despite a modest rebound in bond yields. As feared, it was a return to more hawkish commentary from US Fed chair Powell that was the main event – in particular, he indicated he was “not confident” the Fed had yet done enough to ensure inflation will fall back to its 2% target level.

To a degree, Powell’s comments likely were intended to stem the sharp decline in bond yields that had followed the Fed’s policy meeting the week before. In what’s become a confusing feedback loop, the earlier rise in bond yields had caused the Fed to become less hawkish – but the ensuing decline in bond yields saw the Fed ramp up its hawkishness once again!

So where are we left? The US market has a modest 30% chance of a December rate hike priced in – and it may well hike rates if growth remains firm and bond yields fall too far too fast in coming weeks as markets try to front run the “rates have peaked” narrative. The Fed may well be done, but it does not want markets to celebrate too quickly lest inflation pressures start to return before the job is complete. Indeed, Friday’s University of Michigan consumer survey revealed household inflation expectations have edged higher again in recent months – which would not have gone unnoticed at the Fed.

Against this backdrop, Tuesday’s US October consumer price index report is the major global event of the week. Helped by lower oil prices, headline inflation is expected to drop back to 0.1% after a largish 0.4% gain in September, with the monthly gain in core prices expected to be steady at 0.3%. If realised, annual headline inflation will ease back to 3.3% from 3.7% with core annual inflation steady at a still uncomfortably high 4.1%. That’s hardly good enough for the Fed to signal a neutral policy stance any time soon.

US retail sales will also be of interest, given last month’s stronger than expected 0.7% gain. The market anticipates a small 0.1% decline.

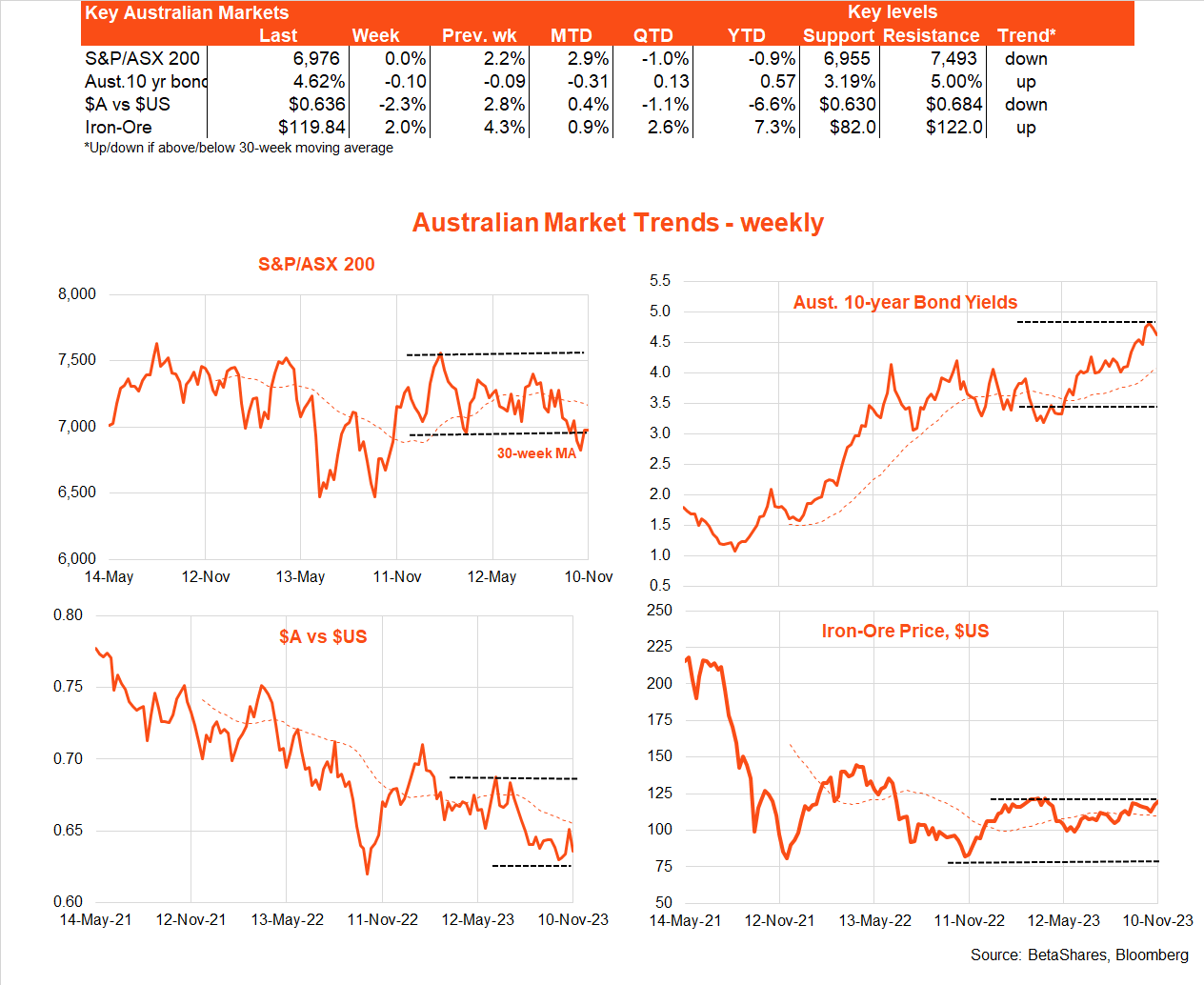

Australian markets

The key local highlight last week was the RBA’s widely expected decision to hike rates a further 0.25% on Tuesday. Justifying the move, the RBA upgraded its end-December 2024 trimmed-mean annual inflation forecast in Friday’s Statement on Monetary Policy from 4.0% to 4.5% (which is material!), though it still expects annual core inflation to be back at 3% by mid-2025. Last week’s rate rise was likely needed for the RBA to reasonably keep its mid-2025 core inflation forecast unchanged.

While the RBA conceded consumer spending had slowed, the economy has generally been a bit firmer than expected so far this year, reflecting high immigration and strong public and private business investment (particularly public infrastructure). It also expressed disappointment that core services inflation had declined “only slowly” due to a still tight labour market and firm service sector demand. I would add a questionable degree of competition in some sectors is not helping!

That said, we also learnt last week that ANZ Job ads fell a further 3% in October to be down 11% from their September 2022 peak. Labour demand is easing, though job ads remain at a relatively high level by pre-COVD standards.

It’s another big week of data in Australia, with the Q3 Wage Price Index on Wednesday and October employment report on Thursday. Wages are expected to rise a firm 1.3%, though this will partly reflect the flow through of the recent minimum wage increase.

Employment meanwhile is expected to bounce back with an 18k gain after a smaller-than-expected 7k gain in September, with the unemployment rate expected to edge up to 3.7% from 3.6%. All up, such a result will suggest the labour market is slowing (as is inflation) albeit only gradually with overall conditions still firm.

At this stage, it seems unlikely the RBA is inclined to raise rates again as quickly as December. Instead, it will await the Q1 CPI result in late January, before considering its next move in February 2024. On balance, my base case is that both the Fed and RBA are done raising rates, though risks remain firmly to the upside over the next three to six months.