Wet lettuce

4 minutes reading time

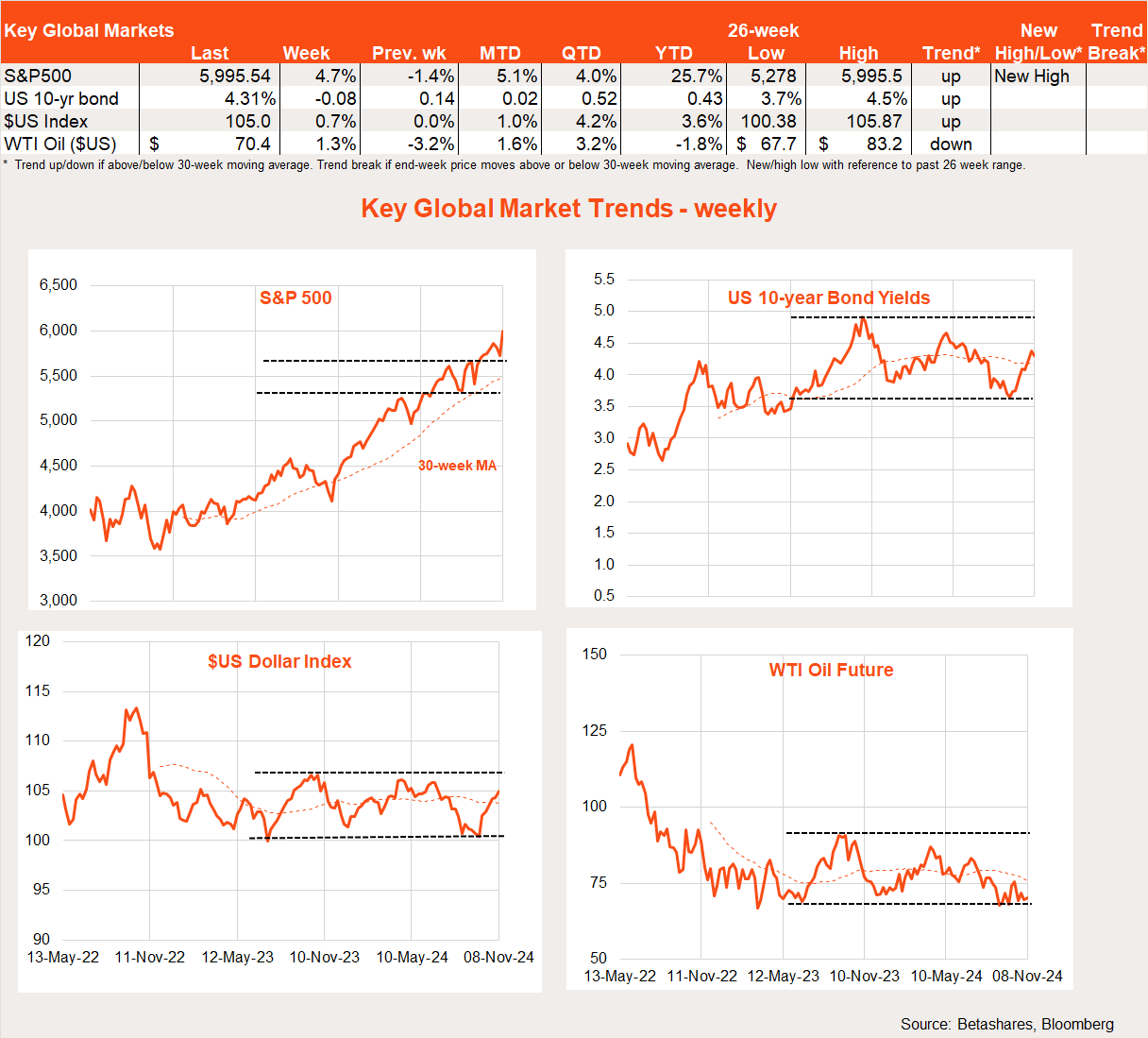

Global markets

Global equities bounced back strongly last week following Trump’s US Presidential victory and the Federal Reserve rate cut. Perhaps surprisingly, long-term bond yields eased over the week though the $US firmed.

My ill-fated foray into political punditry last week met its deserved outcome, with Trump winning the US Presidential election despite my suggestion Harris could win “by a comfortable margin”.

As it turned out, betting markets were not distorted after all and, if anything, understated the probability of Trump winning.

My thought there might be more “shy Harris” supporters this time around proved horribly misplaced – moderate Republicans did not flip! Instead, there appeared once again to be more “shy Trump” supporters (or, at least, pollsters did not survey enough of them) especially among a wide range of younger, non-white and non-college educated voters.

Simply put, Trump campaigned on what swing voters most cared about – the economy and immigration, rather than the issues of democracy and reproductive rights that Harris mainly focused on. It was a masterclass in political strategy from Trump – and, in hindsight, Harris/Biden either had to fight and win on the economy or concede and let a new face fight that fight without their legacy.

Either way, the Republicans appear on the brink of a clean sweep, with certain control of the Senate and likely control of the House of Representatives.

Investors are now focused on Trump’s policies, which include market-friendly tax cuts and deregulation, and less market-friendly tariff increases/trade wars. So far at least, equity markets are focused on the positives, helped by the fact the Fed is still talking rate cuts despite the potential upward pressure on inflation from Trump’s trade and tax policies.

Indeed, the Fed delivered its widely expected 0.25% rate cut last week – and indicated it will only respond to Trump’s potential new set of policies when and if they feed through to their forecasts on economic growth and inflation. That won’t happen any time soon. As such, another rate cut in December still seems likely – but it’s becoming a more data-dependent proposition.

Global week ahead

An obvious focus this week will be any hints on the early priorities of the incoming Trump administration – a focus on tax cuts would be market-positive, though a focus on trade wars less so.

In terms of the economy, another key focus will be Wednesday’s (US time) October consumer price index report. Markets expect the core CPI to rise another 0.3% – which is still a higher run-rate than the Fed would like. Such an outcome would keep annual core CPI inflation steady at 3.3% for the third month in a row – risking the narrative that inflation is continuing to fall. Of interest, however, will be how much of the increase in core CPI prices reflects lagging strength in officially-measured rents – which forward indicators suggest should ease in coming months.

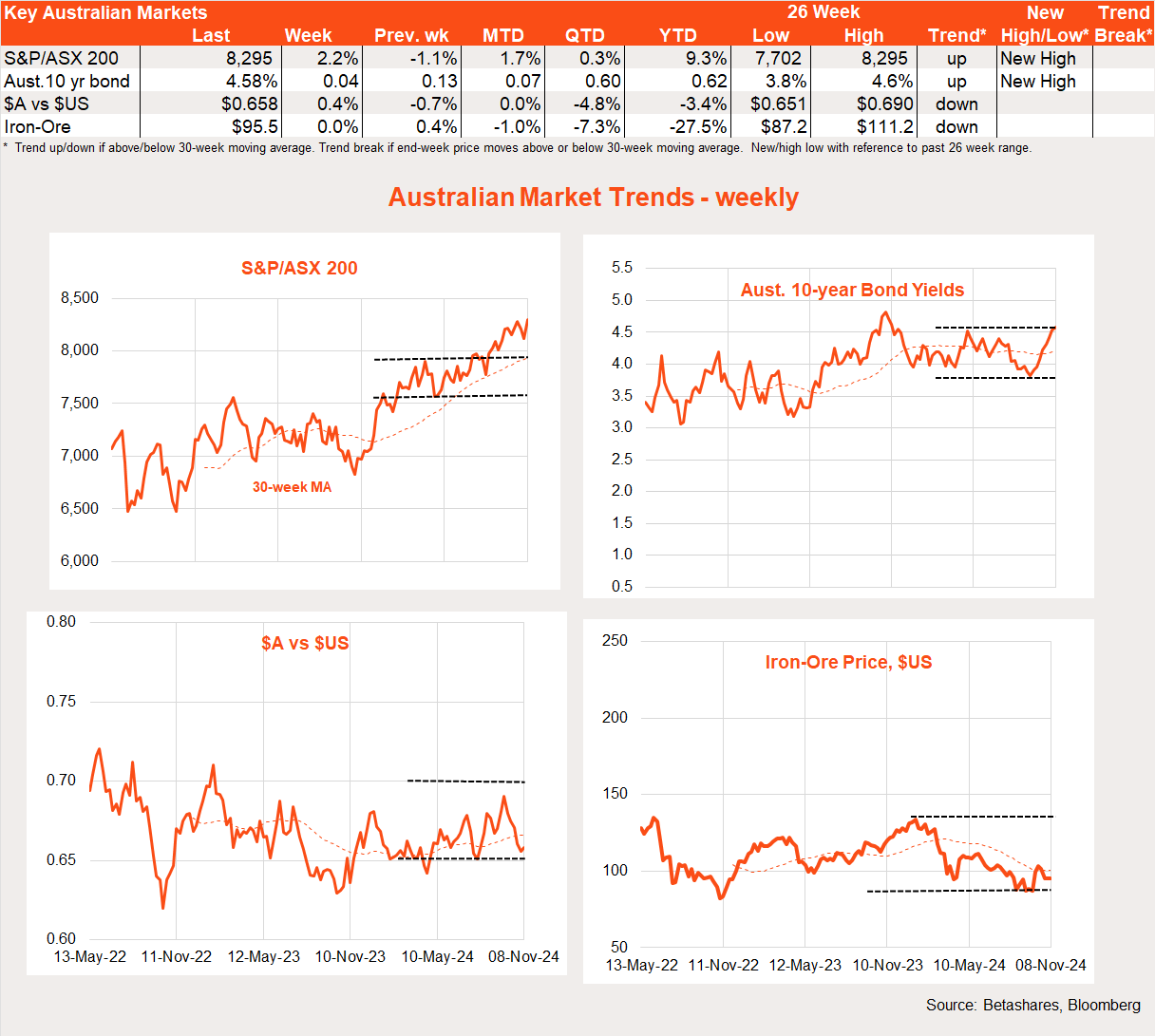

Australian market

Local stocks enjoyed the Trump bounce last week even with the RBA continuing to pour cold water on the prospect of a rate cut any time soon.

The major local highlight last week was the RBA meeting, though it offered few new insights. We are essentially waiting Godot -like for inflation to fall before the RBA can cut rates, and the only debate is how long this will take. My base case remains that rates will be cut in February, though this remains crucially dependent on a good Q4 CPI outcome in late January.

In other news, China again disappointed hopes of major fiscal stimulus with new measures last Friday. Ironically, it was again a case of “bad news is good news” in China, with markets hoping that the threats posed by Trump would goad officials into announcing a major package – alas not yet at least!

This week we’ll get updates on business and consumer sentiment in the NAB and Westpac surveys tomorrow, and the October labour market report on Thursday. Overall, the results are likely to remain just firm enough to allow the RBA to continue to worry about inflation rather than downside risks to the economy.

Consumer sentiment bounced last month but remains subdued overall. Business conditions also bounced back a little to return to long-run average conditions. Employment growth is likely to remain solid – tracking population growth – though not enough to place downward pressure on the current 4.1% unemployment rate.

Have a great week!