Cause to pause

5 minutes reading time

Global markets

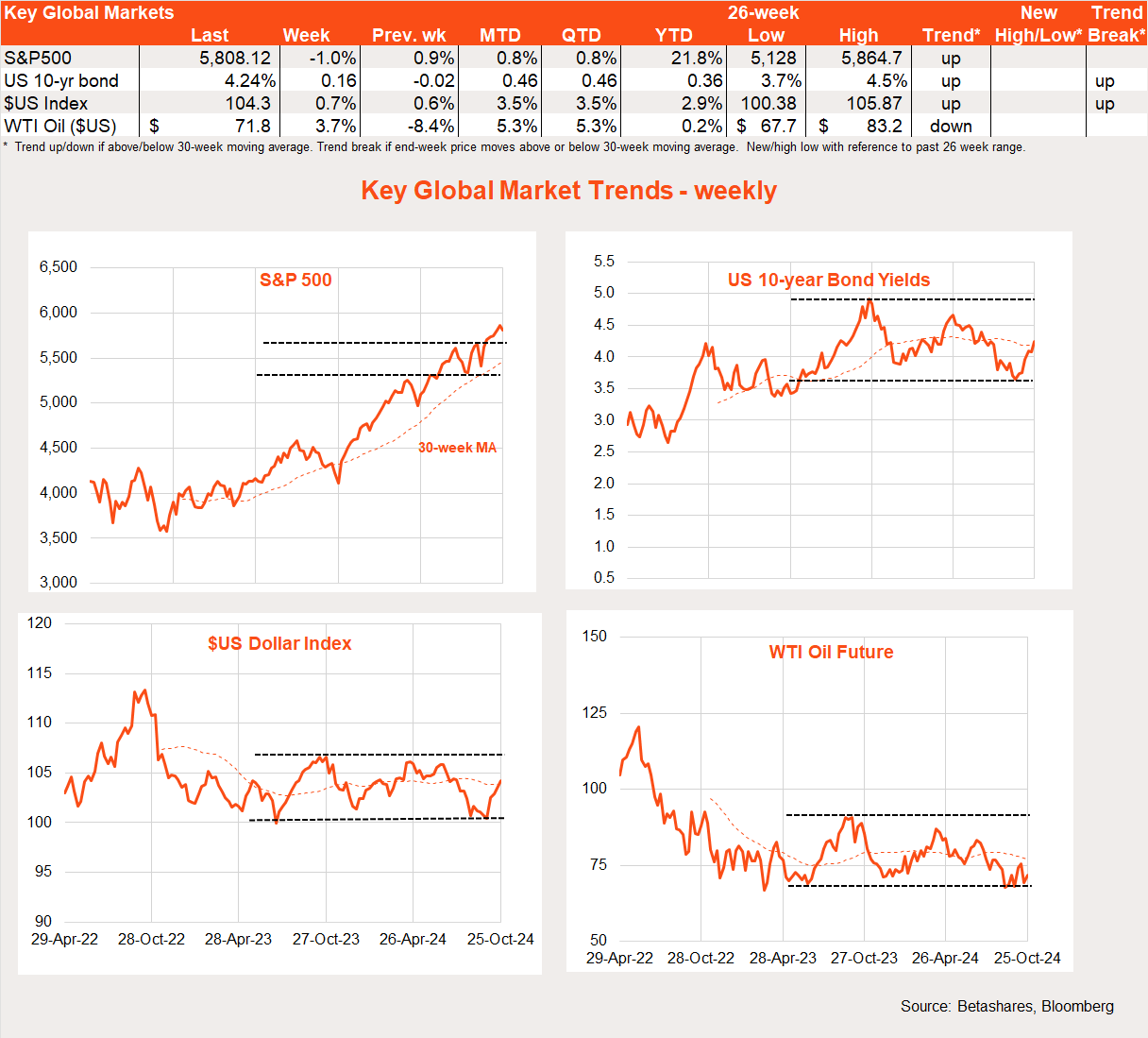

Global equities edged back last week as higher bond yields and trepidation ahead of the US Presidential election caused at least a brief lull in the “soft-landing” celebratory party.

There was little in the way of major global economic data last week, leaving markets some time for introspection. Of immediate concern has been the rebound in global bond yields, which reflects both scaled back Fed rate cut expectations but also a return of the “Trump trades” with polls and betting markets suggesting the odds were swinging back in his favour.

US 10-year bond yields have lifted from 3.61% on the eve of the Fed’s September 18 rate cut to 4.24% as at last Friday. With US equity valuations still elevated (at over 20 times forward earnings), this has pushed an already low equity risk premium even lower. This makes Wall Street even more vulnerable to at least a decent correction on the flimsiest of bad news.

As regards the Fed, with US growth still broadly holding up pretty well, it’s hardly surprising markets have scaled back the odds of another 0.5% rate cut next month. Most Fed rhetoric, however, continues to suggest a gradual pace of rate cuts or “re-normalisation” going forward so it’s hardly a reason for pessimism. It would be worse if rates cuts were being scaled back due to stubbornly high inflation rather than stubbornly solid economic growth.

On Trump, his promises of higher tariffs and tax cuts have bond markets understandably on edge – and there is a risk that Wall Street focuses more on the inflationary impact of these policies this time around than was the case in 2016, when the US budget deficit and inflation were both lower. That said – contrary to the betting markets – my general sense of the myriad of polls is that the contest remains close, with Harris still retaining a slight edge.

In other key global news last week, the Bank of Canada met market expectations and cut rates by an aggressive 0.5% – after three consecutive 0.25% cuts – reflecting its weak economy and speedy declines in inflation in recent months. Could this be a taste of what we experience by early next year?

In the Middle East, Israel’s inevitable retaliation again Iran was finally unveiled and proved to be somewhat limited – targeting mainly military assets, rather than oil or nuclear facilities. As we saw a few months ago, the hope is that both sides now try to de-escalate the direct threats they pose to each other.

Global week ahead

It is a more data-rich environment this week, with the highlight being October US payrolls on Friday. That said, Friday’s result is likely to be distorted by strike activity at a few key companies and Hurricane disruptions, with the market expecting only a relatively modest employment gain of 120k.

More signal as to underlying labour demand could come from September job openings on Tuesday (US time), which are expected to drop from 8 million to a still relatively high 7.9 million.

Also of interest will be the September private consumption expenditure (PCE) deflator – the Fed’s preferred inflation measure. Reflecting the recent higher-than-expected CPI result, the core PCE is expected to rise 0.3% in the month – which markets may again tolerate for now, provided it settles back toward 0.1-0.2% in following months.

The first cut of Q3 US GDP is also released on Wednesday, which is expected to show solid 3% annualised growth – the same rate as in Q2.

Last but not least, it’s a mega-week for US corporate earnings, with 5 of the “Magnificent 7” companies reporting (Alphabet, Meta, Microsoft, Apple and Amazon). Arguably the least magnificent of the Mag-7, Tesla shares surged 22% last Thursday – following a surprise earnings beat and yet another upbeat sales forecast from Musk.

Market trends

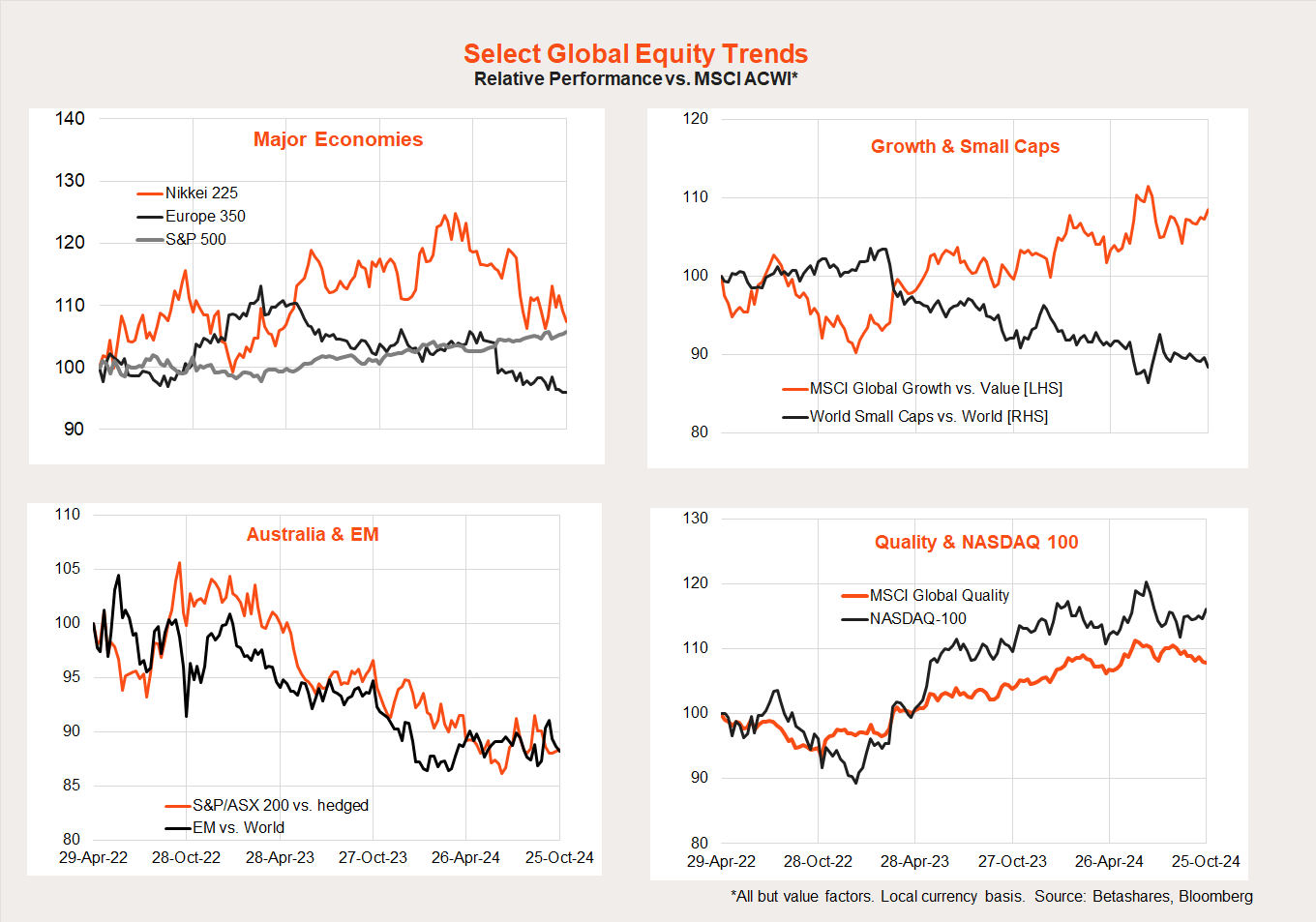

Despite rising bond yields, the global tech sector and the Nasdaq 100 held up relatively better last week.

Amid choppy relative performance trends, the one enduring trend remains that of US outperformance, with global growth also appearing to edge out value once again. The “great rotation” toward small caps, value, and non-US markets is at this stage still less than convincing.

Australian market

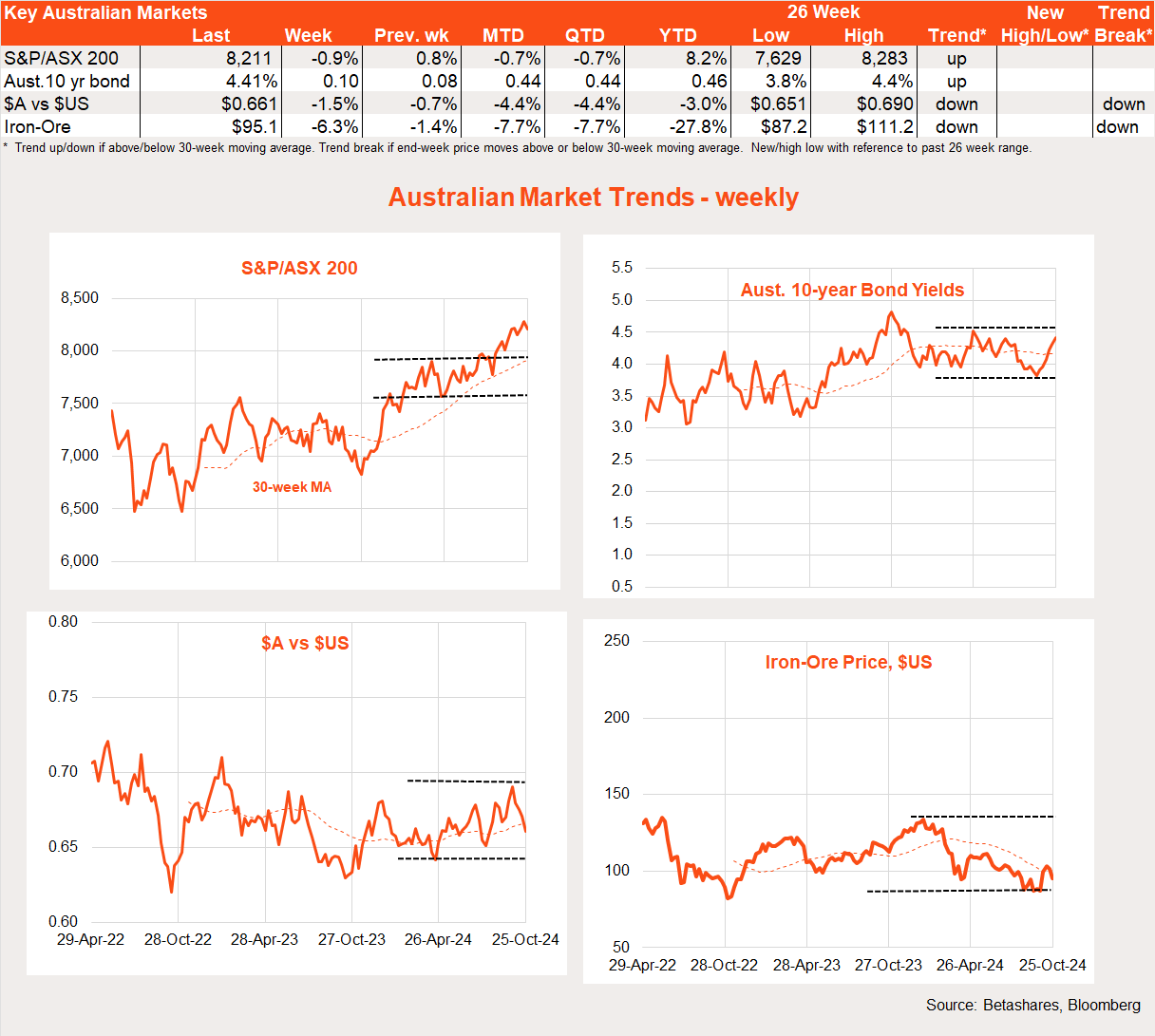

With little local data to mull over, the local S&P/ASX 200 index edged back in line with global markets last week. The $A also fell back further, reflecting weaker iron-ore prices and a firmer $US.

Data signals pick up, however, this week with the Q3 CPI report due on Wednesday. Recent encouraging declines in the monthly CPI reports – helped by Government cost-of-living measures bode well for a reasonably good outcome this week, with annual trimmed mean (underlying) inflation expected to drop from 3.9% to 3.5%.

Note the RBA forecast annual trimmed mean inflation to fall to 3.5% in the December quarter, so a result in line with the market would suggest the RBA’s forecast is at least on track – and could be a little conservative.

Of course, one caveat is the suspicion that some of the recent welcome declines in underlying inflation are carry-over distortions from government measures to reduce electricity and other cost of living pressures.

Also of note this week will be September retail sales on Thursday, with a focus on whether the 0.7% pop higher in spending in August was a one-off or reflective of a tax-cut induced rebound in spending. The market is expecting a more modest 0.3% gain in September spending.

Have a great week!

1 comment on this

Great reading the bites each week, concise and to the point. Keep it going.