6 minutes reading time

An exchange hack of around US$1.5 billion, in addition to US President Donald Trump’s tariff plans, caused Bitcoin and the broader crypto market to sell off over the last week. Some cryptocurrency prices hit lows investors have not seen for three months.

However, Bitcoin and Ethereum spiked on Sunday night after social media posts from President Trump revealed the cryptocurrencies which will be included in the US strategic reserve.

Bitcoin and Ethereum were down 10.54% and 20.57% respectively over the seven days to 2 March 2025. Bitcoin’s market capitalisation, as of writing, has fallen to US$1.7 trillion. The global crypto market capitalisation sits at around US$2.85 trillion, while Bitcoin’s market dominance has climbed to 60.1%.

| Price | High | Low | Change from previous week | |

| BTC (in US$) | $86,173 | $96,296 | $78,411 | -10.54% |

| ETH (in US$) | $2,221 | $2,833 | $2,082 | -20.57% |

Source: CoinMarketCap. As at 2 March 2025. Past performance is not indicative of future performance. Performance is shown in US dollars and does not take into account any USD/AUD currency movements.

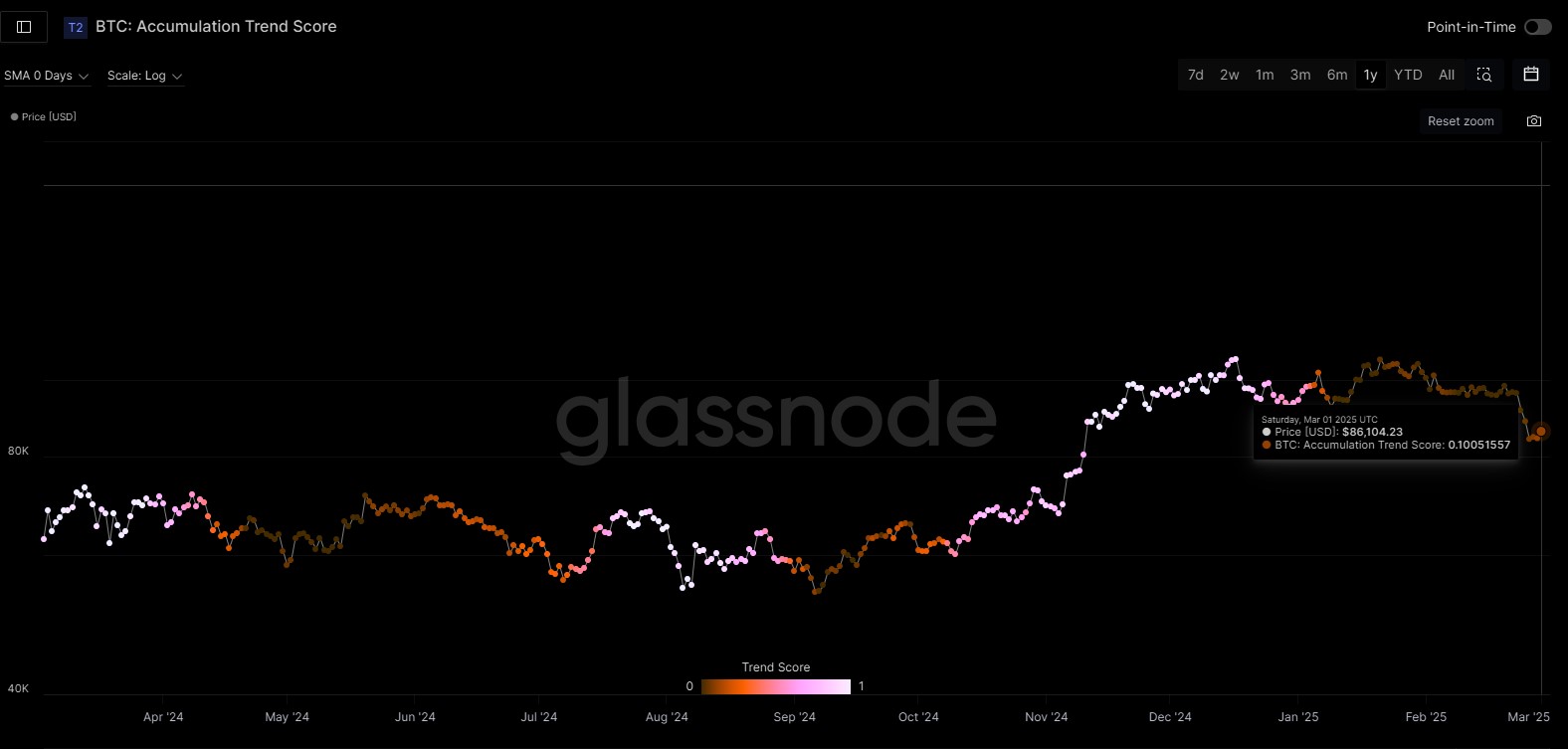

Source: Glassnode. Past performance is not indicative of future performance.

Crypto news we’re watching

Crypto markets move on Trump announcement

Overnight, President Trump declared the five digital assets he expects to include in the US strategic reserve. The cryptocurrencies announced were Bitcoin, Ethereum, XRP, Solana, and Cardano. The President had mentioned plans for the strategic reserve, but hadn’t confirmed which coins may be included until now.

On Truth Social, Trump said:

“A US Crypto Reserve will elevate this critical industry after years of corrupt attacks by the Biden Administration, which is why my Executive Order on Digital Assets directed the Presidential Working Group to move forward on a Crypto Strategic Reserve that includes XRP, SOL, and ADA. I will make sure the U.S. is the Crypto Capital of the World. We are MAKING AMERICA GREAT AGAIN!”

An hour later he followed up with:

“And, obviously, BTC and ETH, as other valuable Cryptocurrencies, will be at the heart of the Reserve. I also love Bitcoin and Ethereum1.”

Bybit fully closes “ETH gap”

In the aftermath of what’s being called the ‘largest crypto heist of all time,’ Bybit has successfully closed a US$1.5 billion gap in funds stolen by hackers. On 21 February, the exchange lost 403,996 ETH (around US$1.14 billion) from its cold wallets due to a smart contract exploit. Together with the loss of other cryptocurrencies, the exchange hack amounted to around US$1.5 billion. These outflows also affected Bitcoin and stablecoins.

However, on 24 February, Bybit CEO Ben Zhou shared on X that: “Bybit has already fully closed the ETH gap. A new audited PoR [proof of reserves] report will be published very soon to show that Bybit is again back to 100% 1:1 on client assets through Merkle Tree [data structures that enhance the efficiency of cryptocurrencies]. Stay tuned.”

In a show of confidence for the exchange and its ability to stay solvent, the gap was filled using a combination of loans from competitor exchanges, buybacks from reserves, and deposits from whale investors2. The FBI says that North Korean hackers are responsible for the US$1.5 billion Bybit hack.

CRYP company spotlight

Marathon has blockbuster fourth quarter

Bitcoin miner Marathon Digital Holdings Inc. reported record-high revenue, net income, and adjusted EBITDA for Q4 and the 2024 fiscal year.

- The company beat earnings estimates, reporting Q4 earnings per share (EPS) of US$1.24, versus the forecasted loss of US$-0.16.

- Q4 revenue also exceeded estimates, increasing 37% year-over-year to US$214.4 million. Estimates were for around US$180 million.

- Fiscal 2024 revenue jumped 69% to US$656.4 million.

- Finally, quarterly net income hit US$528.3 million while adjusted EBITDA reached US$794.4 million3.

Marathon Digital Holdings Inc. (MARA) is currently held in the Betashares Crypto Innovators ETF (ASX: CRYP)4. CRYP provides exposure to global companies at the forefront of the crypto economy5.

Bitcoin (BTC): Price drawdown from ATH

The following chart shows the percentage drawdown in Bitcoin’s price since its previous all-time high.

According to Glassnode data, the Bitcoin price has declined over 21% from its previous all-time high (as at 1 March 2025). Although this fall is significant, the Bitcoin price has historically dropped significantly while remaining in a structural bull cycle.

Source: Glassnode. Past performance is not indicative of future performance.

While the majority of Top 20 altcoins were in the red last week, Hedera (HBAR) is well into the green with a seven-day and one-year return of 16.7% and 119% respectively (as at 2 March 2025). It is now the 11th largest cryptocurrency by market capitalisation.

One factor helping to move prices higher was an announcement by Swift, the world’s leading financial messaging network. Swift has confirmed plans to integrate Hedera’s blockchain across North America, Europe, and Asia. This move positions Hedera as a key player in global financial transactions and may help increase institutional adoption6.

According to Hedera’s website: “Hedera is the only public ledger that uses hash graph consensus – a faster, more secure alternative to blockchain consensus mechanisms7.”

Investing in crypto-assets or companies servicing crypto-asset markets should be considered extremely high risk. Exposure to crypto assets involves substantially higher risk than traditional investments due to their speculative nature and the extremely high volatility of crypto-asset markets. Investing in crypto assets or crypto-focused companies is not suitable for all investors and should only be considered by investors who (i) fully understand their features and risks or after consulting a professional financial adviser, and (ii) who have an extremely high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment. Any investment in crypto assets or crypto-focused companies should only be considered as a very small component of an investor’s overall portfolio.

References:

1. https://www.reuters.com/world/us/trump-says-cryptocurrency-strategic-reserve-includes-xrp-sol-ada-2025-03-02/

2. https://cointelegraph.com/news/bybit-purchases-742-million-ether-days-after-hack

3. https://www.blockhead.co/2025/02/27/marathon-stock-jumps-as-bitcoin-miner-defies-market-downturn/

4. As at 28 February 2025. No assurance is given that this company will remain in the portfolio or will be a profitable investment.

5. CRYP will not invest in crypto assets directly, and will not track price movements of any crypto assets. For more information on risks and other features of CRYP, please see the Product Disclosure Statement and Target Market Determination (TMD), available at www.betashares.com.au.

6. https://www.tronweekly.com/hedera-hbar-soars-24-overtakes-litecoin-following-swift-partnership-confirmation/

7. https://hedera.com/how-it-works