6 minutes reading time

Financial intermediary use only. Not for distribution to retail clients.

Even before the US election, 2024 was turning out to be another year of US exceptionalism, with the S&P 500 index up more than 20% by 5 November 2024.

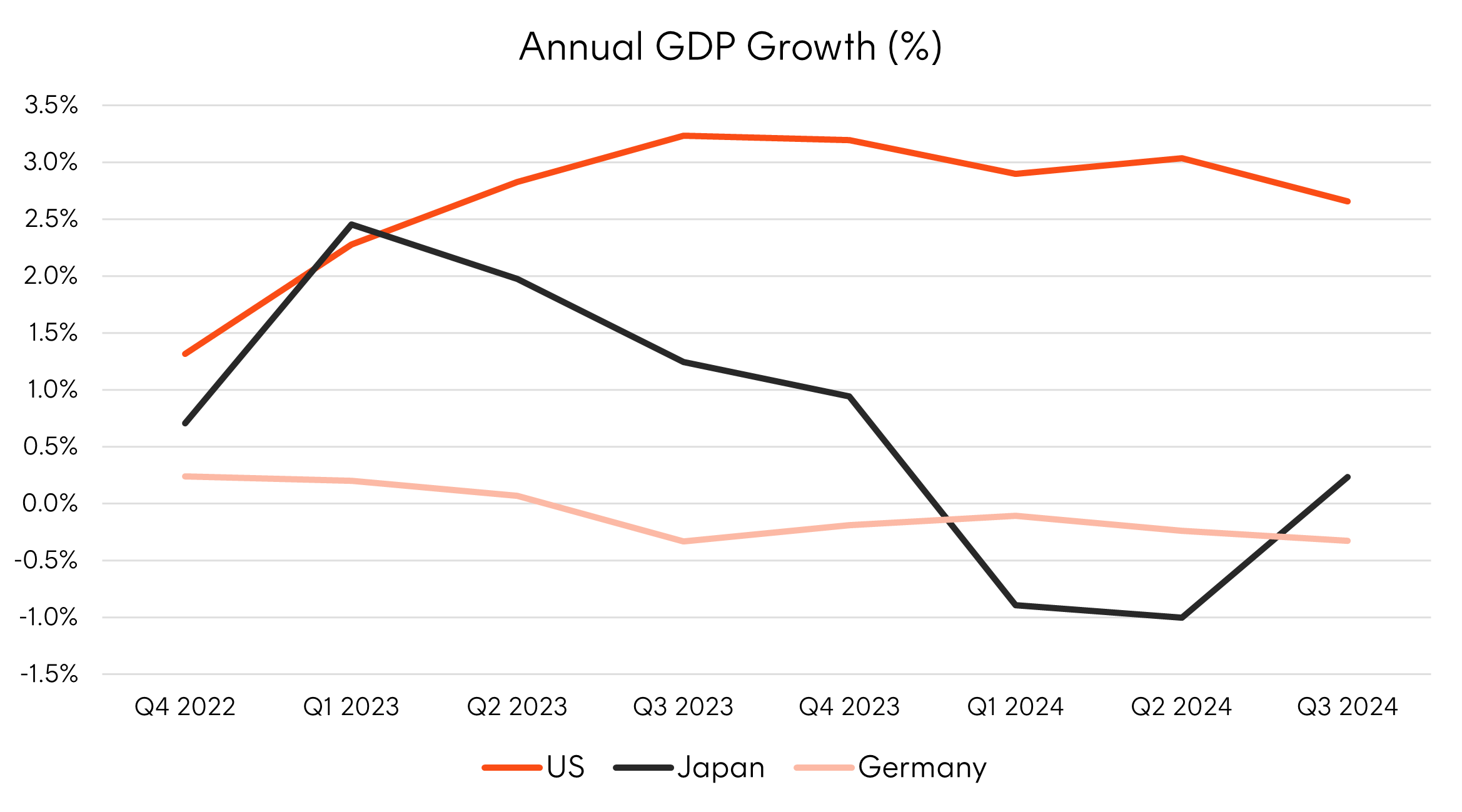

Despite higher interest rates, US economic growth has remained surprisingly robust. So far, fighting inflation has not come at the cost of higher unemployment. With this healthy backdrop US equities have enjoyed strong earnings growth in 2024, largely unwritten by the Mag 7.

Other major developed market economies are struggling with anaemic growth at best, and this has flowed to more muted stock market returns.

Source: Refinitiv, as at 25 November 2024.

The decisiveness of Trump’s victory, winning the popular vote and a Republican sweep of Congress, provides him with a clear mandate for change that has caused a recalibration in equity markets. Trump 2.0 is thought to be good for US growth, thanks to tax cuts and deregulation, as well as a potential wreaking ball for countries whom the US has large trade deficits against.

The commonly held view is that “America First” will provide a significant tailwind to US company earnings, but after years of outperformance US equities look “expensive”. We agree with the first part of that statement, but not necessarily the second.

The chart below shows the trailing price to earnings ratio of the S&P 500 index (in black). Ignoring the aberration of Covid, on this measure US equities do look expensive, especially relative to current government bond yields.

Source: Bloomberg. You cannot invest directly in an index. Past performance is not an indicator of future performance.

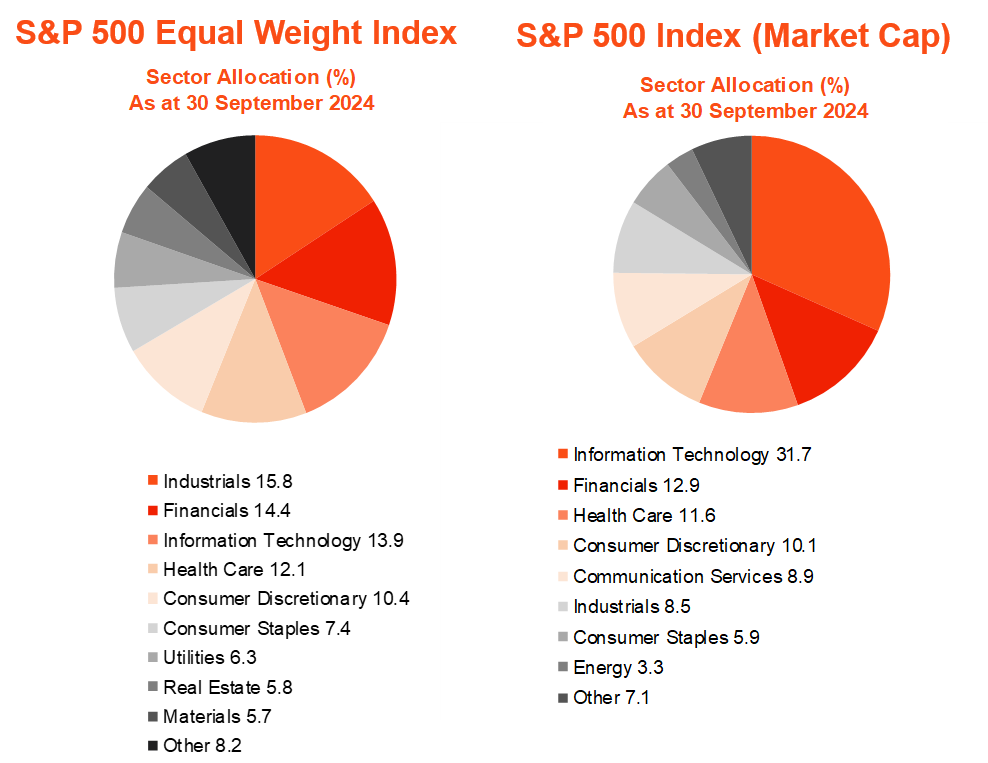

But the S&P 500 index is a market capitalisation weighted index, with an incredible 30% allocation to the Mag 7, that distorts the picture.

The S&P 500 Equal Weight index is arguably a broader representation of the US equity market. Its price to earnings ratio, shown above in orange, is around it’s long run average, not expensive in an absolute sense or relative to bonds.

A more balanced exposure to the US Economy

The S&P 500 Equal Weight index also has a sector mix which is likely to more favoured by Trump’s policy settings. Financials are likely to benefit from greater deregulation and Industrials may benefit from increased tariffs and support for US manufacturing, the two largest sectors in the Equal Weight index.

S&P 500 Index (Market Cap)

S&P 500 Equal Weight Index

Source: Bloomberg, Betashares, as at 30 September 2024.

The proportion of total revenues sourced from the US is 69% for the Equal Weight index, the market cap weighted S&P 500 is much lower, at 59%.

The largest company in the market cap weighted index, Apple, sources ~20% of its revenue from China. If there is blow back from Trump’s tariffs, companies like Apple that generate substantial revenue offshore revenue are most exposed.

Domestically oriented companies also generally tend to pay more tax, making them bigger beneficiaries of Trump’s proposed corporate tax cuts.

Some commentators have suggested that the Russell 2000 index – the US small caps benchmark – is also well placed to benefit from a Trump presidency. In our view, the case for the Russell 2000 is overstated and risks are unappreciated.

- Firstly, about 40% of the companies in the Russell 2000 are unprofitable, in order to benefit from a tax cut you need to be paying tax in the first place.

- Secondly, the Russell 2000 is far more sensitive to elevated interest rates, and the potential inflationary impulse from Trump’s policies risk a higher for longer rate regime. 55% of Russell 2000 debt is floating rate (versus only 9% for the S&P 500) and of the other 45% that is fixed rate, the majority is due in the next four years.

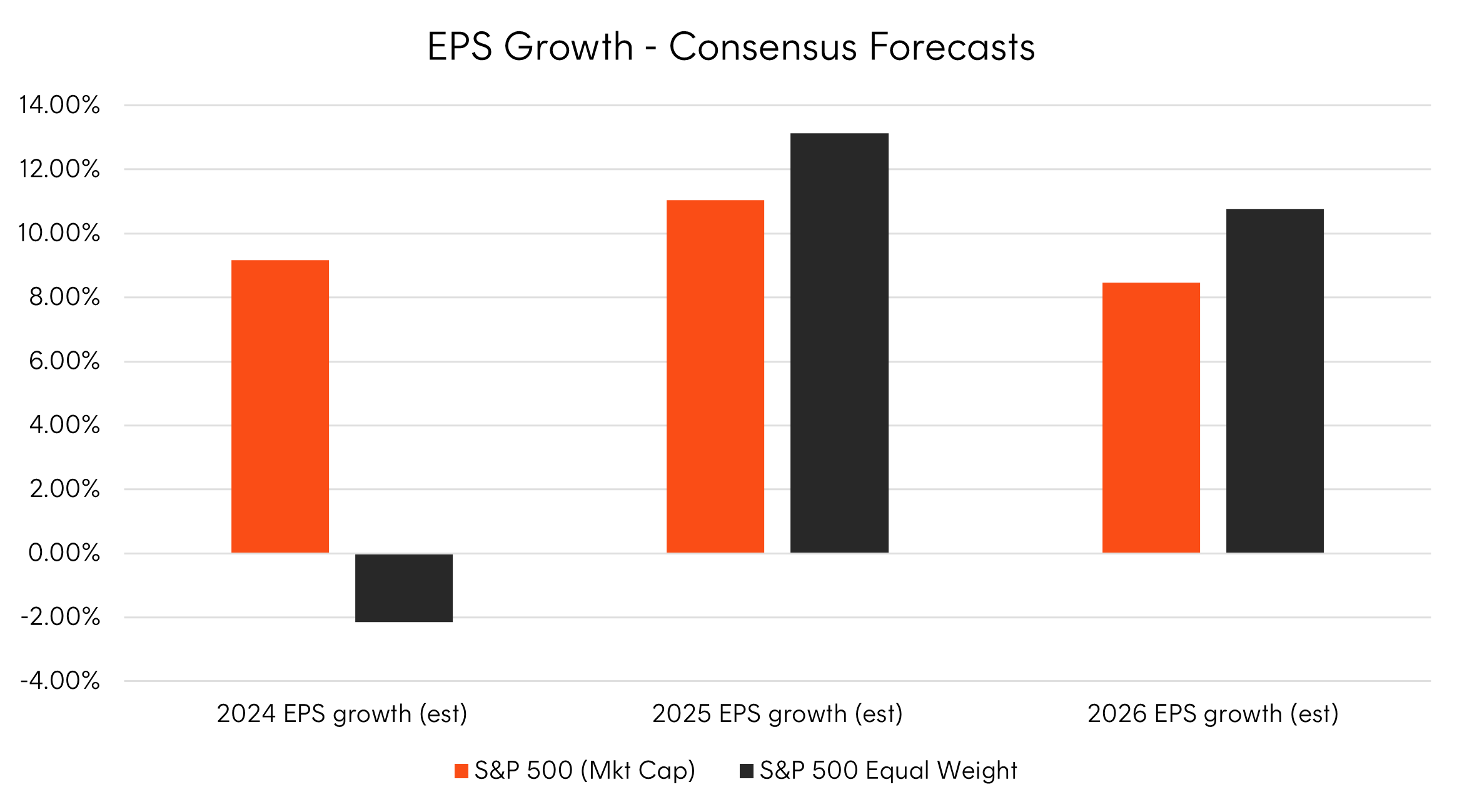

Strong earnings growth, but trading at a discount

Analyst consensus forecasts show earnings growth for the S&P 500 Equal Weight index rebounding strongly in 2025 and 2026.

Source: Bloomberg, as at November 2024. Estimates are Bloomberg consensus estimates. Actual results may differ.

Yet the S&P 500 Equal Weight index trades at a 20% discount to the S&P 500 market cap index (Forward PE Ratio of only 17.4x versus 21.84x).

Betashares S&P 500 Equal Weight ETF (ASX: QUS)

Since the US election, Australian investors have increasingly allocated to US Equity market ETFs. Betashares offers investors the only US equity market equal-weighted ETF available on the ASX QUS S&P 500 Equal Weight ETF , which aims to track the S&P 500 Equal Weight Index before fees and expenses.

We believe QUS is a high-quality core allocation that is uniquely positioned to benefit from Trump’s “America First” policies.

QUS may be appropriate for advisers seeking a more diversified exposure to the US economy, at reasonably valuations.

QUS is rated ‘Highly Recommended’ by Lonsec. You can request the research reports from your BDM or by filling in the form under the following link.

For more information on Betashares ETFs’ platform availability please use the following link.

There are risks associated with an investment in the QUS, including market risk, index methodology risk, country risk and currency risk. Investment value can go up and down. An investment in the Fund should only be considered as a part of a broader portfolio, taking into account your client’s particular circumstances, including their tolerance for risk. For more information on risks and other features of the Fund, please see the Product Disclosure Statement and Target Market Determination, both available at www.betashares.com.au.

The Lonsec rating (assigned 20 October 2024) presented in this document is published by Lonsec Research Pty Ltd ABN 11 151 658 561 AFSL 421 445 (Lonsec). Ratings are general advice only, and have been prepared without taking account of your objectives, financial situation or needs. Consider your personal circumstances, read the product disclosure statement and seek independent financial advice before investing. The rating is not a recommendation to purchase, sell or hold any product. Past performance information is not indicative of future performance. Ratings are subject to change without notice and Lonsec assumes no obligation to update. Lonsec uses objective criteria and receives a fee from Betashares. Visit lonsec.com.au for ratings information. © 2023 Lonsec. All rights reserved.