5 minutes reading time

After two years of robust performance across many markets globally, investors are wondering if – and where – gains will be found in 2025. As we settle into the new year, it can be helpful to think in terms of themes: where do present trends suggest the most growth will take place in the year ahead?

In this article we explore four thematic investment opportunities that align with prevailing global trends: gold, cybersecurity, the broadening US bull market and digital assets.

1. Finding resiliency in uncertainty with gold

For millennia gold has been seen as a safe haven during periods of geopolitical and economic volatility.

With talk of trade wars and tariffs under Donald Trump’s upcoming administration, a high degree of unpredictability characterises the economic outlook for 2025. This level of uncertainty has historically bolstered gold’s appeal and, as uncertainties persist, gold remains a strong hedge against market fluctuations.

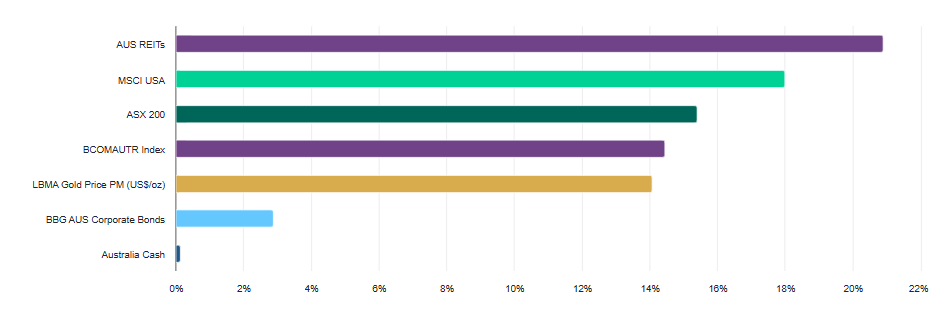

The chart below, provided by the World Gold Council, highlights gold as one of the least volatile major asset classes1. Remarkably, over a 20-year period to 17 January 2025, gold delivered an impressive annualised return of 9.78%2 and 7.83% on a 10-year basis.

Source: Bloomberg, ICE Benchmark Administration, World Gold Council. Annualised volatility is computed based on daily returns in US dollars between 16 January 2015 and 17 January 2025. Past performance is not indicative of future performance.

ETFs offer a variety of options for investors seeking exposure to gold without the need to buy, store and insure physical gold:

- QAU Gold Bullion ETF – Currency Hedged : This ETF offers direct exposure to the performance of gold, with holdings 100% backed by physical gold bullion bars stored at JP Morgan Chase in London.

- MNRS Global Gold Miners Currency Hedged ETF : Provides exposure to the largest global mining companies outside of Australia, primarily focused on gold mining but also including silver, precious metals and minerals.

2. Meeting digital threats with cybersecurity

The digital age, along with its incredible opportunities and innovations, has ushered in an era in which data breaches and cyber threats run rampant. Cybercrime is projected to cost the global economy a staggering US$10 trillion or more annually by this year, underscoring the critical need for robust cybersecurity solutions3.

Investing in the cybersecurity sector offers investors a strategic opportunity to tap into the escalating demand created by cyber threats. HACK Global Cybersecurity ETF makes investment in this thematic easy, providing exposure to a diversified portfolio of leading global cybersecurity companies.

3. Beyond tech in a broadening US bull market

The story of the US sharemarket over the last few years has been all about tech. But with the downward trajectory of interest rates likely to boost consumer demand, there is potential for a rotation into value sectors such as financials, utilities and industrials.

QUS S&P 500 Equal Weight ETF offers a way to gain greater exposure to the sectors that may benefit from this shift, while still maintaining exposure to the tech giants.

By equally weighting each stock in the S&P 500, QUS currently has tech exposure at approximately 13.8% as at 31 December 2024 (compared to 32% for a traditional S&P 500 index tracker), positioning investors to capture opportunities with a broadening market by providing balanced exposure across “value-oriented” sectors including industrials, financials and utilities.

4. Burgeoning digital assets in a new era of deregulation

One of Donald Trump’s election promises was to make the US “the crypto capital of the planet”4, and that pledge drove the price of Bitcoin past a record US$100,000 during the November 2024 election.

Investors looking to benefit from this trend might consider CRYP Crypto Innovators ETF , which provides exposure to companies involved in the digital asset ecosystem, including those engaged in cryptocurrency mining, trading and infrastructure development. This way, investors can access a diversified entry point into the burgeoning digital assets sector through the familiar vehicle of ETFs, without the need to directly invest in cryptocurrencies.

Riding the trends into a wealthier 2025

No one has a crystal ball, and investing always involves a degree of uncertainty. But as we look to the year ahead, the four thematic investment opportunities explored here – gold, cybersecurity, the broadening US bull market and digital assets – present compelling avenues for investors.

Each theme aligns with current global trends and offers investors the potential to benefit from sectors and assets that are well-positioned to grow in 2025. By incorporating ETFs like QAU, MNRS, HACK, QUS and CRYP, investors can gain diversified exposure to these promising sectors.

There are risks associated with an investment in each of the Funds. Investment value can go up and down. An investment in any Fund should only be made after considering your particular circumstances, including your tolerance for risk. For more information on the risks and other features of a Fund, please see the relevant Product Disclosure Statement and Target Market Determination, available at www.betashares.com.au.

An investment in CRYP should be considered very high risk and should only be considered by informed investors seeking a small allocation to a very high volatility investment. CRYP provides focused exposure to companies involved in servicing crypto-asset markets or which have material investments in crypto-assets. Risks associated with an investment in CRYP includes market risk, crypto-innovators risk, technology risk, international investment risk and concentration risk. CRYP will not invest in crypto assets directly and will not track price movements of any crypto assets. For more information on risks and other features of CRYP, please see the TMD and PDS, available at www.betashares.com.au.

References:

1. World Gold Council – gold as a strategic asset

2. World Gold Council – gold and major asset class returns

3. Unmasking the True Cost of Cyberattacks: Beyond Ransom and Recovery

4. The Lowy Institute – Donald Trump and the “crypto capital of the planet”