Reality check

4 minutes reading time

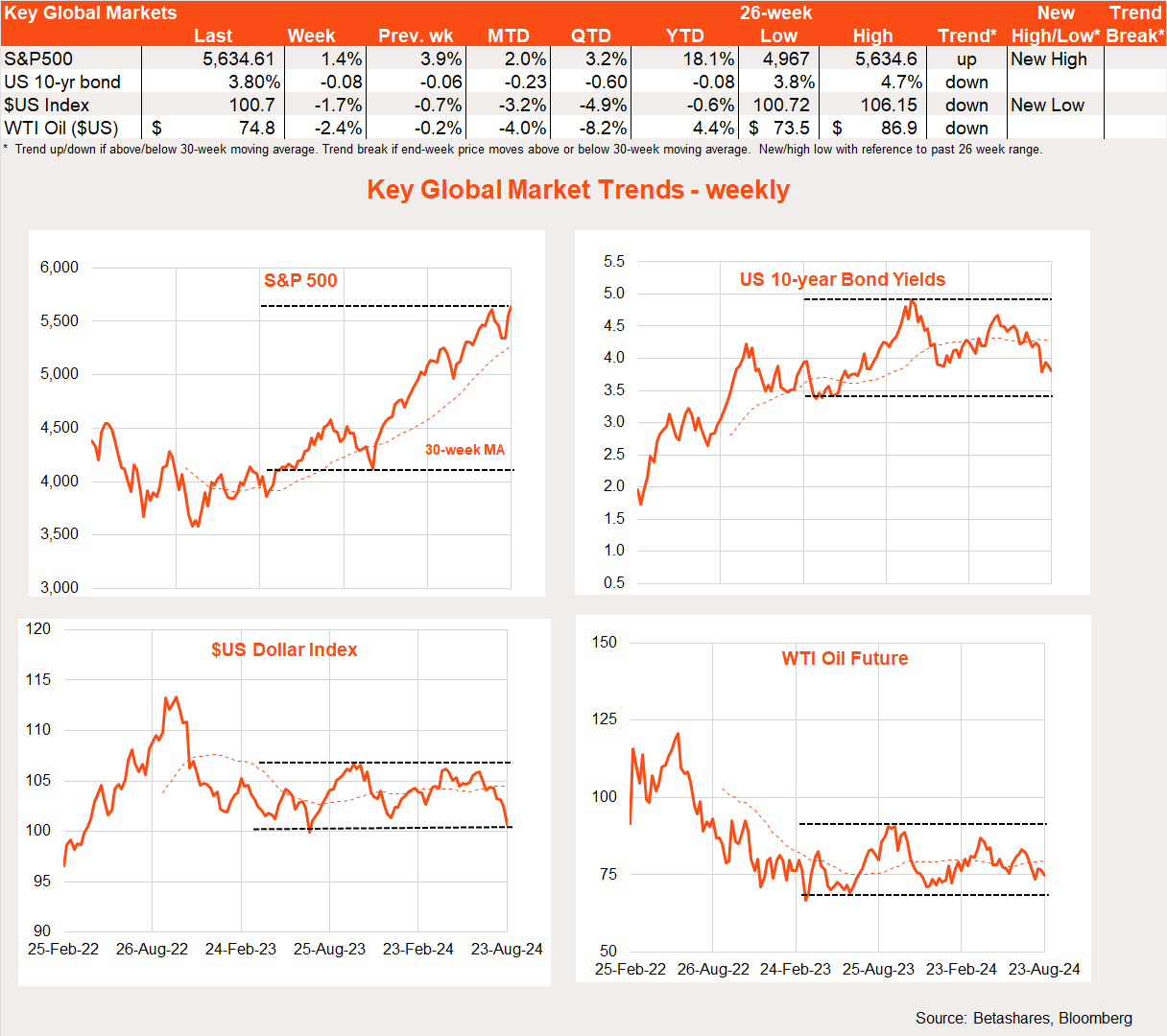

Global markets

The global equity rebound continued last week, buoyed by confirmation of a US rate cut next month by Fed chair Jerome Powell.

Markets waited all week for Powell’s speech at the Jackson Hole central bank talkfest, and were not disappointed. Powell declared “the time has come” to start easing rates, which makes a move next month all but certain. At this stage, however, a 0.25% rather than 0.5% rate cut seems likely – given the continued underlying health of the economy and the risk that a larger move could have a perverse negative impact on market sentiment.

That said, any notable slippage in economic activity indicators between now and the next Fed meeting on September 17-18 could easily bring a 0.5% cut back into play. Indeed, Powell suggested labour market conditions were now modestly softer than in the immediate pre-COVID period – when inflation was running below 2%. Accordingly, the Fed does “not seek or welcome further cooling in labour market conditions”. Unlike in Australia, the US central bank is happy for the unemployment rate to stay where it is – currently at 4.3%.

Supporting the Fed’s more sanguine view of the labour market was news last week that, due to data revisions, the US economy created 880k fewer jobs over the year to March than previously thought. To be sure, overall job growth of 2 million was still very solid, but more in line with the growth in the labour force – and so consistent with a better balance between demand and supply. Despite the recent lift in the unemployment rate, moreover, US weekly jobless claims last week remained reassuringly low.

In other key global news, European wage data and Canadian inflation data both continued to ease – supportive of both their central banks continuing to cut rates in the months ahead.

Global week ahead

Key highlights this week will be the US July private consumption deflator on Friday, with core prices expected to rise by a benign 0.2%, implying a small lift in annual inflation to 2.7% from 2.6%. Weekly jobless claims on Thursday will also be watched closely for signs of a more material weakening in labour demand.

In corporate news, the major highlight will be Nvidia’s earnings result on Wednesday – given all the excitement surrounding AI of late. As other tech companies have found in this reporting season, anything less than a blowout result and strong outlook could lead to profit taking given the strong share price gains this year and lofty valuations.

Market trends

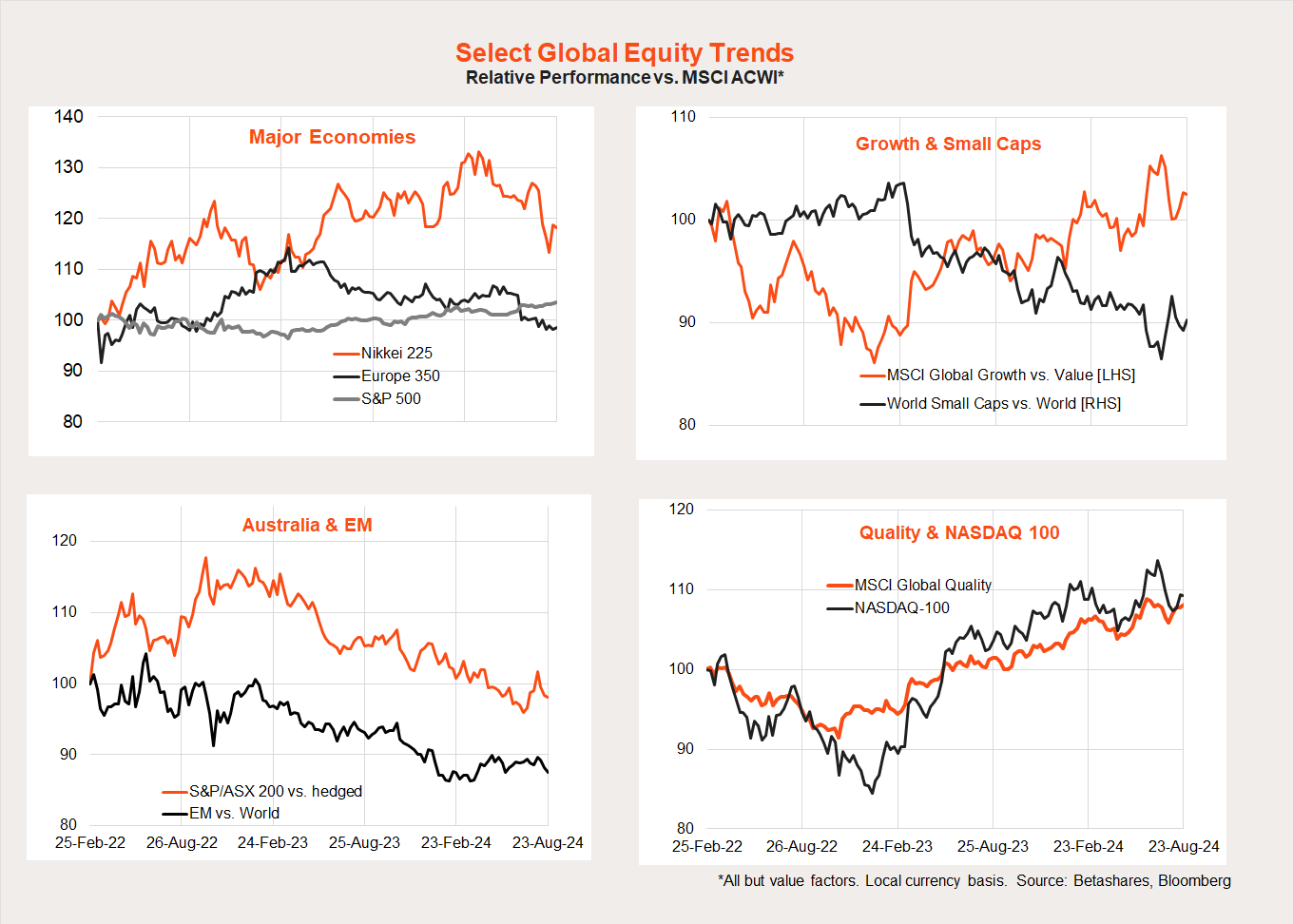

There were tentative signs of a broadening in the equity rebound last week with beaten-down small caps posting relatively strong returns. A bounce in material stocks also supported returns of value relative to growth.

That said, recent tentative signs of improvement in the relative performance of Australia and emerging markets have unwound a little of late.

As such, the battle between expensive large-cap growth stocks and cheaper value stocks continues – we’ll need the dust to settle from recent market volatility to discern whether the much-debated broadening in the global equity rally beyond Japan/large-cap technology will gather steam.

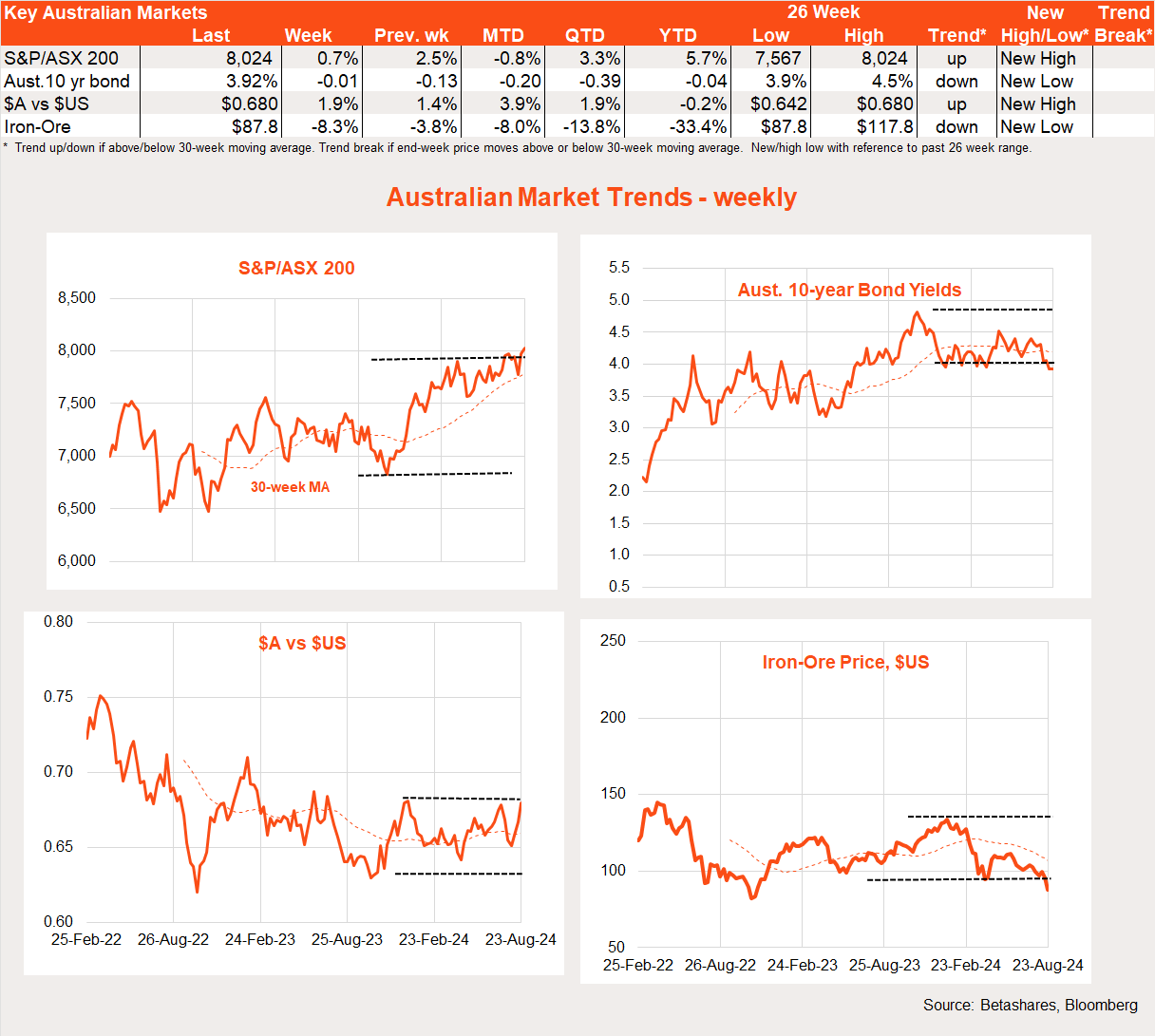

Australian market

Local stocks edged up further last week – enjoying the global optimism – despite continued hawkish talk from the RBA. Among sectors, technology returned a lazy 8.6% while energy slumped 3.3%.

In a data-light week, the main highlight last week was the minutes from the August RBA policy meeting – which reiterated the Bank’s well-known concerns with sticky inflation and demand running ahead of supply.

Key highlights this week include the July monthly CPI on Wednesday, along with Friday’s retail sales report, and Q2 building work and private investment data on Wednesday and Thursday respectively. All up, the results are unlikely to sway the outlook for steady rates for the time being.

After all, the monthly CPI has been so volatile of late that Wednesday’s results are likely to be taken with a grain of salt. Retail sales on Friday could show a post tax-cut spike in spending.

Have a great week!