10 steps to successful investing in 2025 and beyond

5 minutes reading time

Week in review

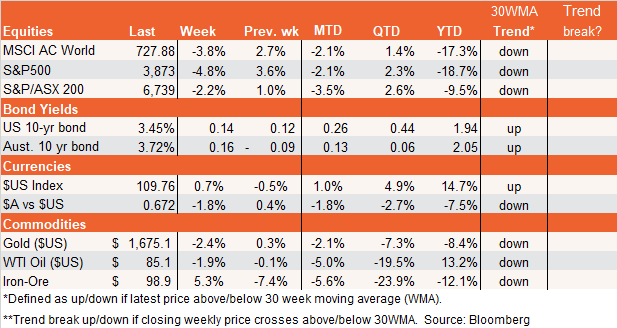

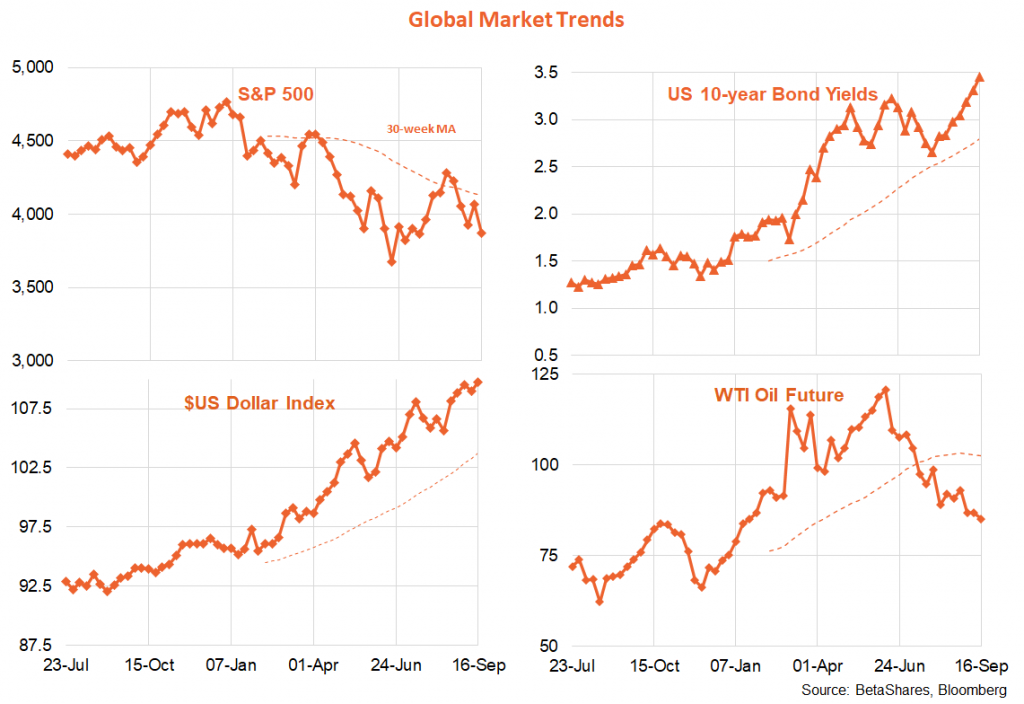

Without doubt the highlight of the past week was the higher than expected US CPI result, with both headline and core inflation worse than market expectations. The big shock was core inflation (excluding food and energy) which rose 0.6% compared to a market expectation of 0.3%. In turn, this result reflected stubborn stickiness in a range of areas such as rents, health care and even home furnishing. With supply pressures easing and declines in some commodity prices, to my mind the result highlights the ability of business to preserve – and even boost – profit margins through price increases at a time of still strong consumer demand.

As would be expected, both equities and bonds slumped on the news, as it meant the Fed would likely be even more determined to raise interest rates and slow the economy. The market briefly flirted with the view that the Fed could raise rates by a full 1% at this week’s policy meeting, but lacking follow-up media stories highlighting this risk, the market starts the week with this as a relatively low (20%) probability.

The other global highlight this week came on Friday, with the CEO of America’s major delivery company FedEx warning of a global recession in light of falling company sales. Although FedEx has a history of dark warnings (perhaps to excuse poor company performance at times) it nonetheless came at a vulnerable time for the market, which helped send US stocks – and FedEx’s share price in particular – down on Friday.

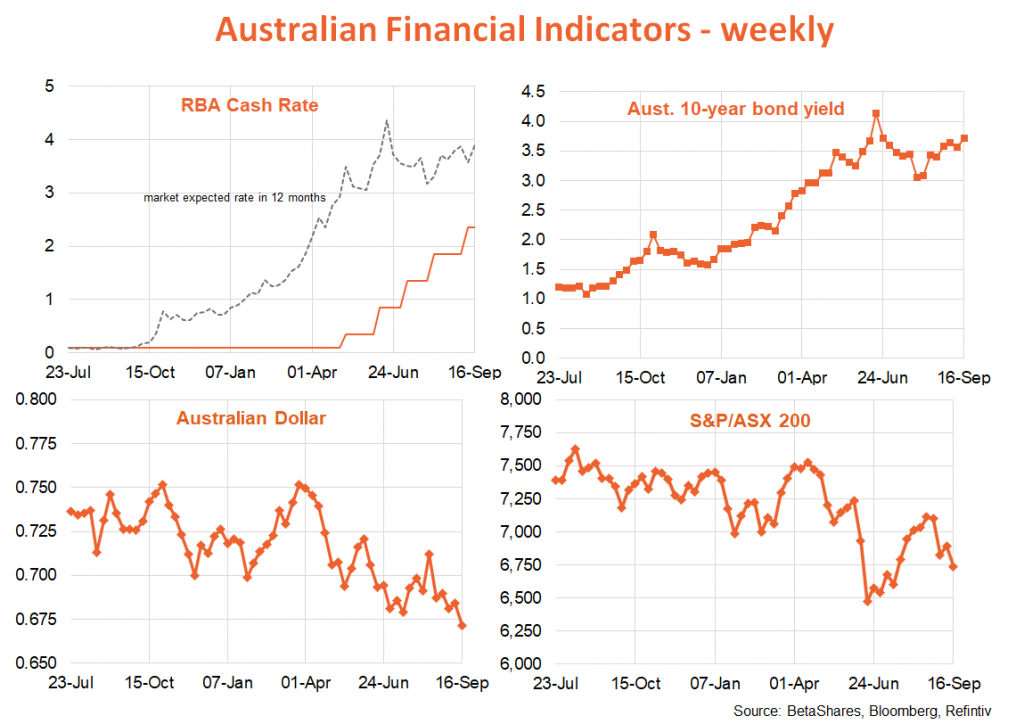

In Australia, last week’s data suggested the economy retains strong momentum and capacity constraints – leaving open the debate over whether the RBA will hike by 50bps or 25bps at the October policy meeting. At present, the market reckons it’s a 50-50 call between a 25 or 50 point move, though I’m still inclined to the former.

Underpinned by solid consumer spending, the NAB survey of business conditions remained upbeat in all sectors excepting construction. The Westpac/Melbourne Institute measure of consumer sentiment bounced back a little last month – likely reflecting a fall in petrol prices – though still remains at weak levels. After a steep decline in July (which has been blamed on NSW flooding and quirky seasonal factors), employment also bounced back in August – though overall it still implied no net employment growth over the past two months. At this stage it’s unclear whether this reflects some slowing in employment demand or just the sheer difficulty in finding available workers. Job vacancies, after all, remain strong.

Week ahead

The highlight this week (in an otherwise event-light week) is the Fed two-day policy meeting which concludes on Wednesday (Thursday morning Australian time). It seems likely that the Fed will stick with a 0.75% hike (taking the Fed funds range from 2.25-2.5% to 3-3.25%), though a shock and awe 1% move can’t be ruled out. Indeed, it could be the Fed has not alerted its usual media buddies as it wants to surprise the market!

Apart for the size of the rate hike, the other important insights from the meeting will be the Fed’s revised ‘dot plot’ of expected future policy moves and forecasts for inflation and unemployment. It’s likely the Fed will revise up its expected path of interest rates, with the Fed funds rate expected to be around 4-4.25% by year-end (which would imply two further 0.5% rate hikes in the remaining policy meetings this year in November and December). Also of interest will be whether the Fed projects further significant rate hikes in 2023 (potentially with a 4.5-4.75% Fed funds rate expected by end-23), and the degree to which it revises up its expected level of unemployment and inflation next year.

What’s curious, however, is that the equity market has managed to rally on each day of Fed policy meetings so far this year – on relief that the outcome was not a lot worse than the already extremely bad outcome expected. It’s for this reason there is a risk the Fed might deliberately try to surprise this week – with a 1% hike without any warning. Of course, even in this case the equity market could still rally – on the view that we’d potentially be closer to the end of Fed tightening.

Closer to home, we get minutes to the recent RBA policy meeting on Tuesday, which may shed some light on the likely size of the next rate hike. It seems likely the minutes will point to the merits of reducing the size of rate hikes at some point in the future now that the cash rate is closer to neutral – though whether that will be as early as the October meeting remains to be seen.

I have revised up my expected peak in the Fed funds rate range from 3.75-4% to 4-4.25% – which implies one further 0.25% rate hike early next year after a significant 1.75% tightening over the remainder of this year (including 0.75% this week). Regarding the RBA, I now see a peak cash rate of 3.35% instead of 3%, with four further 0.25% rate hikes between now and mid-2023.