Fed meeting recap: hawkish quarter point rate cut

7 minutes reading time

- Fixed income, cash & hybrids

Fixed-rate bonds form an important part of most well-diversified investment portfolios.

However, to this day, bond investors still largely need to choose between high-cost active managers and low cost – yet very simple – passive index approaches.

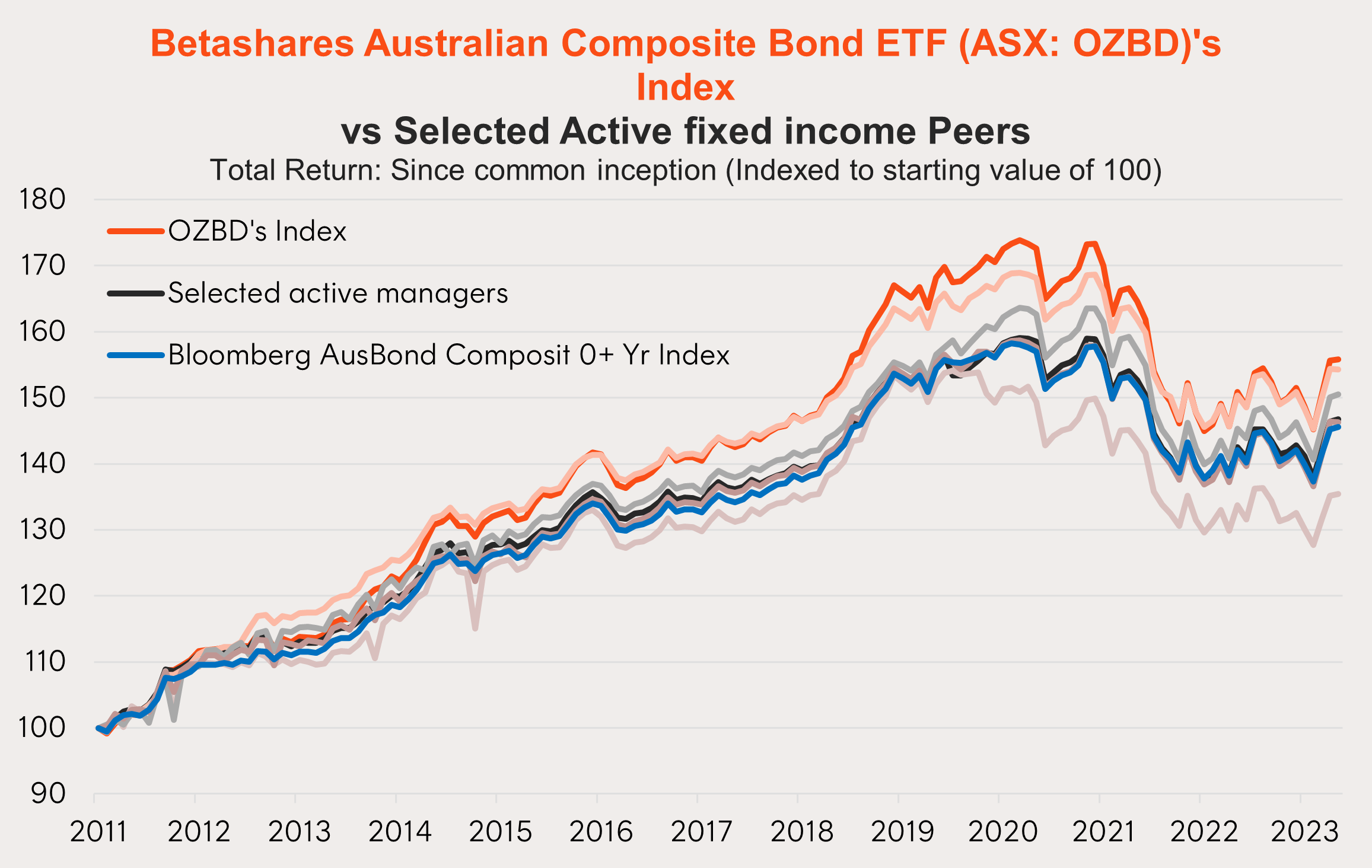

Betashares and Bloomberg designed the Bloomberg Australian Enhanced Yield Composite Bond Index which Betashares Australian Composite Bond ETF (ASX: OZBD) aims to track to address these shortcomings and provide investors with a better core portfolio allocation for Australian fixed income.

Unlike a traditional market cap weighted bond index, OZBD’s index weights bonds on the basis of their risk-adjusted income potential, while still controlling for overall interest rate and credit risk. The result is a well-diversified portfolio of high-quality Australian corporate and government bonds weighted to enhance yield by utilising the same return levers as active managers, but at a fraction of the cost.

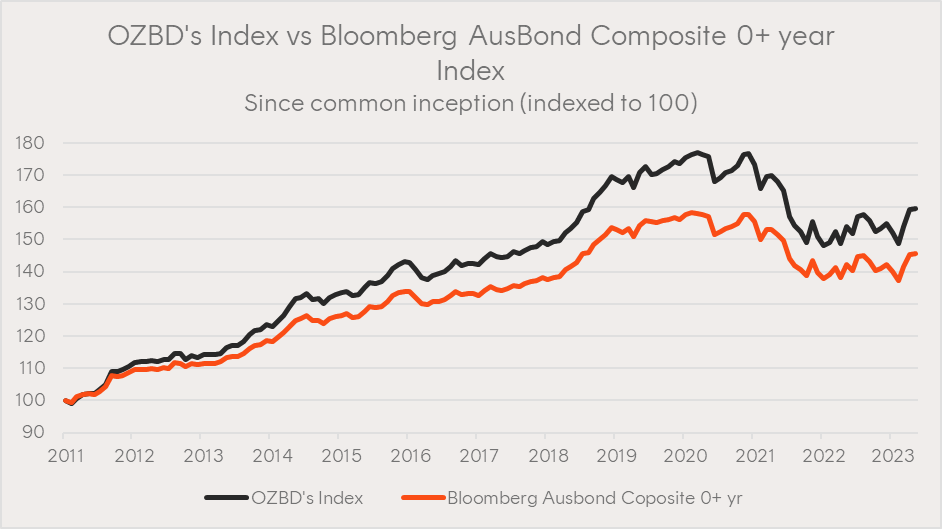

Source: Bloomberg; Betashares Capital, as at 31 January 2023. You cannot invest directly in an index. Does not take into account OZBD’s ETF fees of 0.19%p.a. Past performance is not an indicator of future performance of any index or ETF.

Traditional fixed income indices have inefficiencies

Traditional bond indices, like the Bloomberg Ausbond Composite 0+ year Index (AusBond Composite), use liability weighted methodologies. Applying a logic similar to market capitalisation weighted equity indices, the bonds with the largest issuance size will also carry the greatest weight in the index.

Importantly for asset allocators this weighting methodology has influenced the diversification of traditional bond indices over time.

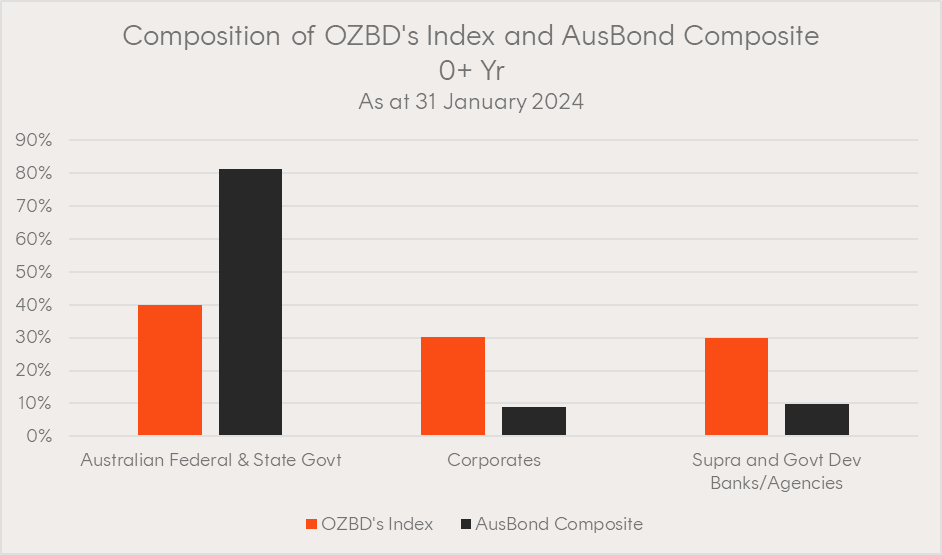

For example, following the substantial government bond issuance since the GFC, the AusBond Composite has transitioned from a well-diversified blend of Australian corporate and government bonds to currently holding 81% of its allocation in Australian government bonds, and just 10% in corporate bonds, the remainder being held in supranational issuers.

By contrast, OZBD’s index has parameters designed to ensure better diversification is maintained at an issuer level. Specifically, OZBD’s index divides the universe of eligible bonds into sub-components such as the Australian government 1-5 year and Australian non-government 1-5 year components. These sub-components are then required to contribute a minimum weight within the index.

Combined with the index’s smarter weighting approach, the result is a better diversified core portfolio of Australian issued bonds, offering the potential for enhanced yield.

Importantly, OZBD’s index achieves this whilst mechanically maintaining overall risk characteristics similar to those of the AusBond Composite. As at the time of writing, the credit rating of the AusBond Composite is just one notch above OZBD’s index, AA+ compared to AA (as at 31 January 2024).

Sources: Bloomberg; Betashares. As at 31 January 2024.

How do active fixed income managers generate alpha?

Most investors are familiar with the concept of active managers using security selection to generate alpha. By picking specific securities, managers aim to provide investors with better returns than a benchmark that indiscriminately invests in the entire universe of eligible securities.

However, for active fixed income managers, security selection may not offer the same alpha generation potential as their equity counterparts.

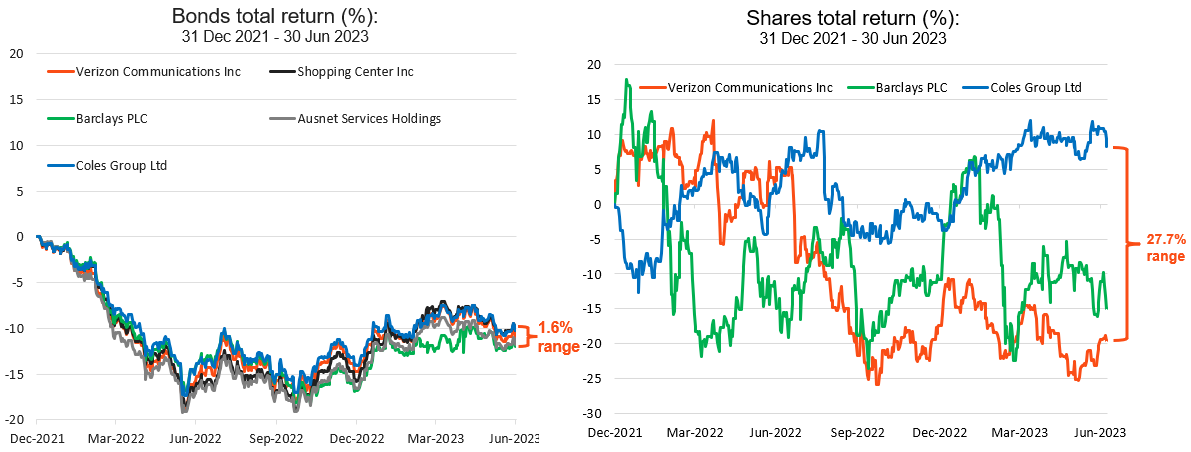

The example below involves 5 bonds with similar maturities and credit characteristics issued in Australia by a range of listed and unlisted companies across different regions and sectors. By comparing the returns of these bonds to the returns of the shares issued by these listed companies, we can visualise the challenges that active fixed income managers face.

If you are an active manager attempting to generate alpha through security selection, you need the potential for a large differential between the best and worst performing securities (i.e. significant ‘return dispersion’). Over the 18-month period in the graph below, the shares exhibited return dispersion of 27.7%, whereas the bond returns only provided managers with 1.6% of possible alpha through the selection of the best performing issuer.

With such low dispersion in Australian investment grade credit, generating any outperformance after trading costs from issuer selection could be difficult.

Source: Bloomberg. AUD fixed rate bonds selected from Betashares Australian Investment Grade Corporate Bond ETF (ASX; CRED) portfolio as at 30 June 2023, with term-to-maturity 5-7years and S&P credit rating of BBB+. Where the bond issuer has listed shares the total return of those shares is also shown. Past performance is not indicative of future performance.

Rather than security selection, active fixed income managers use the levers of duration and credit to generate alpha.

Duration relates to the sensitivity of a bond’s market price to changes in market interest rates over time, and is positively related to a bond’s remaining term to maturity. Generally speaking, longer duration bonds tend to offer higher yields, in part due to the compensation demanded by investors for the increased interest rate sensitivity.

Credit risk relates to the risk that the issuer of the bond could get into financial difficulty and default on either interest or principal repayments. All else constant, corporate bonds tend to offer higher yields than government bonds, given their higher risk.

With this understanding, OZBD’s index is designed to achieve a more optimised balance between duration and credit risk than the AusBond Composite with the ultimate aim of maximising yield from the chosen bonds. As a result, the portfolio comprises bonds with characteristics more closely resembling those of an actively managed bond fund, whilst retaining the advantages of a passive index approach—namely, lower fees.

These features have led to compelling long-term outperformance for OZBD’s strategy against the benchmark AusBond Composite and active fixed income peers alike.

Source: Morningstar. As at 31 January 2024. Common inception date is 31 October 2011. Active Fixed Income Peers selected from Morningstar Australian fixed income active funds with similar fund profile to OZBD (as determined by Betashares). OZBDs performance is a blend of live and historical index performance less OZBDs MER. You cannot invest directly in an index You cannot invest directly in an index. Past performance is not indicative of future performance of any index or fund.

You can find more information on OZBD at its fund page here.

OZBD is rated ‘Recommended’ by Lonsec. You can request the research reports from your BDM or by filling in the form under the following link.

For more information on Betashares ETF platform availability please use the following link.

There are risks associated with an investment in OZBD, including market risk, interest rate risk, credit risk and index tracking risk. An investment in the Fund should only be made after considering your client’s circumstances, including their tolerance for risk. For more information on risks and other features of the Fund, please see the Product Disclosure Statement (PDS) and Target Market Determination, both available here.

This information is for the use of financial advisers and other wholesale clients only. It must not be distributed to retail clients.

The Lonsec Ratings (assigned 20 March 2023) presented in this document is published by Lonsec Research Pty Ltd ABN 11 151 658 561 AFSL 421 445. The Rating is limited to “general advice” (as defined in the Corporations Act 2001) and based solely on consideration of the investment merits of the financial product. Past performance information is for illustrative purposes only and is not indicative of future performance. It is not a recommendation to purchase, sell or hold any Betashares fund, and you should seek independent financial advice before investing in this product. The Rating is subject to change without notice and Lonsec assumes no obligation to update the relevant document following publication. Lonsec receives a fee from the Betashares for researching the product using comprehensive and objective criteria. For further information regarding Lonsec’s Ratings methodology, please go to http://www.lonsecresearch.com.au/research-solutions/our-ratings.