7 minutes reading time

Financial adviser use only. Not for distribution to retail clients.

As global regulations, corporations, and trillions of dollars of investment mandates increasingly align to environmental, social or governance (ESG) principles, funds that consider companies’ ESG alignment as part of the selection process may deserve greater investment consideration beyond just ethical clients.

Many broad global equity ESG funds barely deviate from a standard market benchmark, with limited negative screening of certain industries, like tobacco and gambling.

Other ESG funds labelled as ‘impact investments’ hold companies that are having a direct measurable impact on climate change, such as renewable energy providers and electric vehicle manufacturers. These impact funds tend to hold portfolios that are skewed towards certain industries and sectors, rather than being a diversified representation of global equity markets.

ETHI Global Sustainability Leaders ETF on the other hand, is a global broad market ESG fund with stringent negative and positive screening. ETHI can be used by investors as a part of their core portfolio.

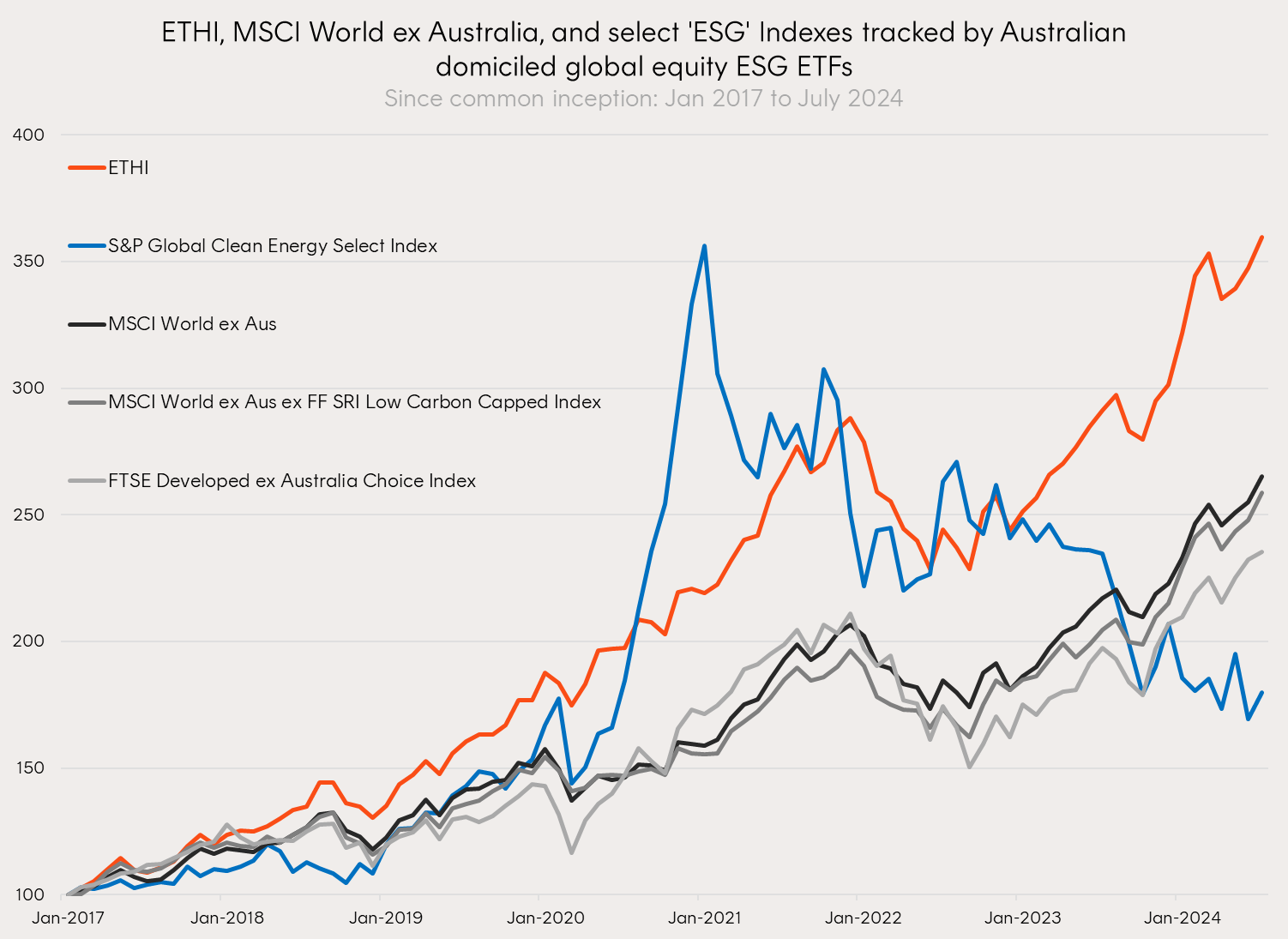

Since its inception to July 2024, ETHI has outperformed other ESG indices and the broad benchmark MSCI World ex Australia, as shown in the chart below.

Source: Bloomberg. January 2017 to July 2024. ETHI shows fund performance returns net of ETHI’s management costs of 0.59% p.a. You cannot invest directly in an index. ETHI’s inception date was 5 January 2017. Past performance is not an indicator of future performance.

ETHI holds a broad portfolio of global equities including names like Apple, Mastercard and Novo Nordisk1.

ETHI’s index selects companies in the top third of their industry for carbon efficiency, alongside superior scope 4 carbon emissions performers, that have all passed screens to exclude those with direct or significant exposure to fossil fuels or materially engaged in other activities deemed inconsistent with responsible investment considerations.

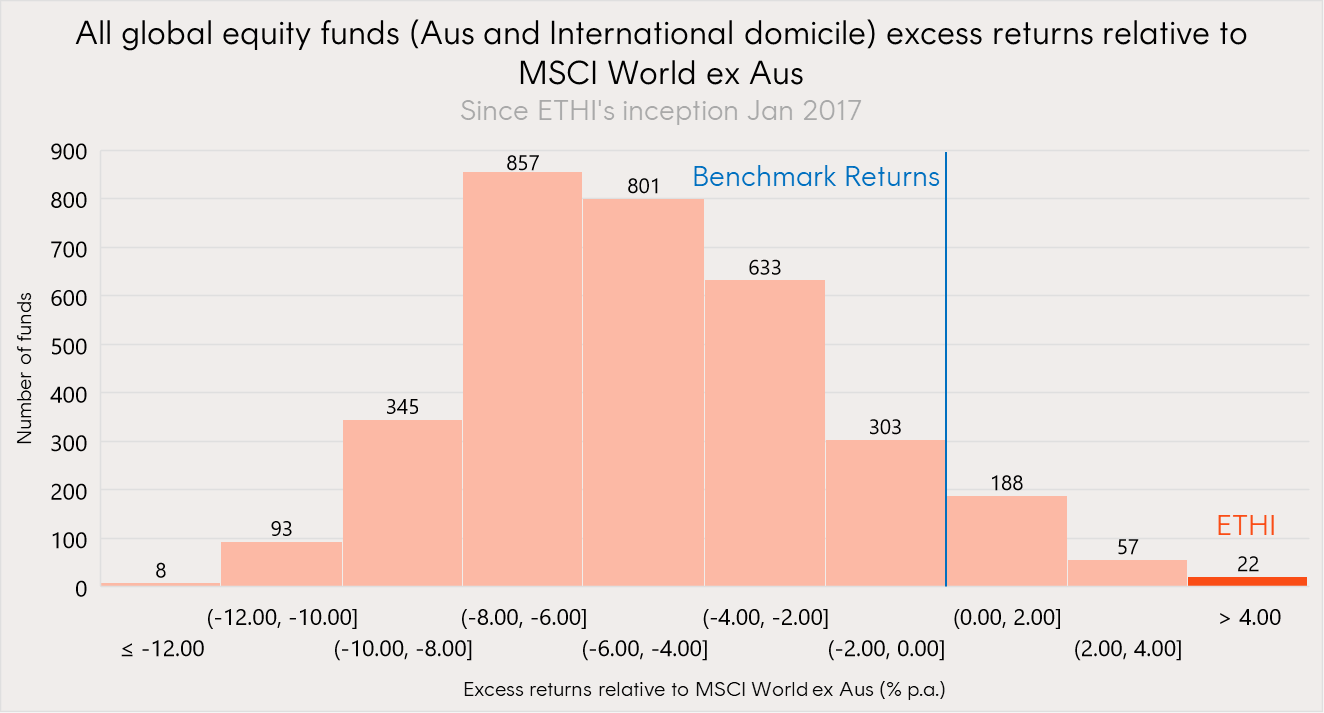

For the period since its inception in 2017 to end July 2024, ETHI’s performance has been in the top percentile of all global equity large cap funds worldwide (as captured in the Morningstar universe)2 – having returned on average 4.7% p.a. of excess returns above the MSCI World ex Australia Index.

Source: Morningstar Direct. Period 5 January 2015 to 31 July 2024. Includes funds in the ‘Global Equity Large Cap’ Morningstar ‘Global Category’. All fund performance is net of fees and costs. Past performance is not an indicator of future performance.

ESG or factor in disguise

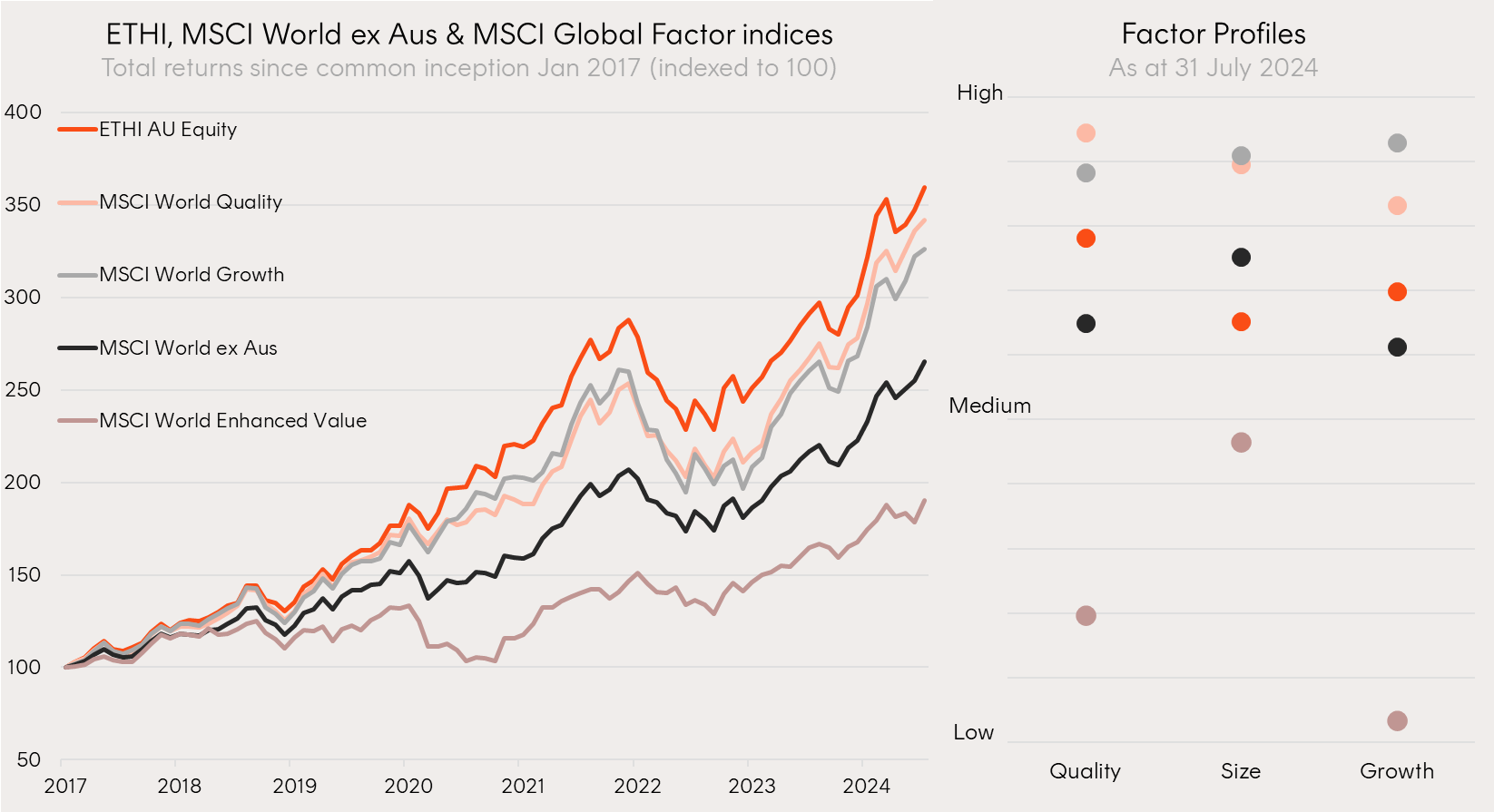

Proponents of ESG investments as a source of outperformance have historically been met by criticism that this may simply be due to their skew to high quality and/or growth companies over the past decade.

While this could equally be viewed as a merit of ESG methodologies, rather than an excuse for their strong performance, since its inception ETHI has outperformed broad market pure quality and growth indexes while maintaining a more neutral factor profile.

ETHI’s index methodology also includes a single stock cap of 4% and a rule ensuring sector weights remain within 3% of a broad global benchmark on each rebalance.

These rules are aimed at maintaining a portfolio that more closely resembles a broad global equity index, improving diversification, and reducing concentration risk.

Source: Bloomberg, Morningstar Direct. Total return data from Feb 2017 to July 2024. Factor profiles as at 31 July 2024. ETHI shows fund performance returns net of ETHI’s management costs of 0.59% p.a. . ETHI’s inception date was 5 January 2017. You cannot invest directly in an index. Past performance is not an indicator of future performance.

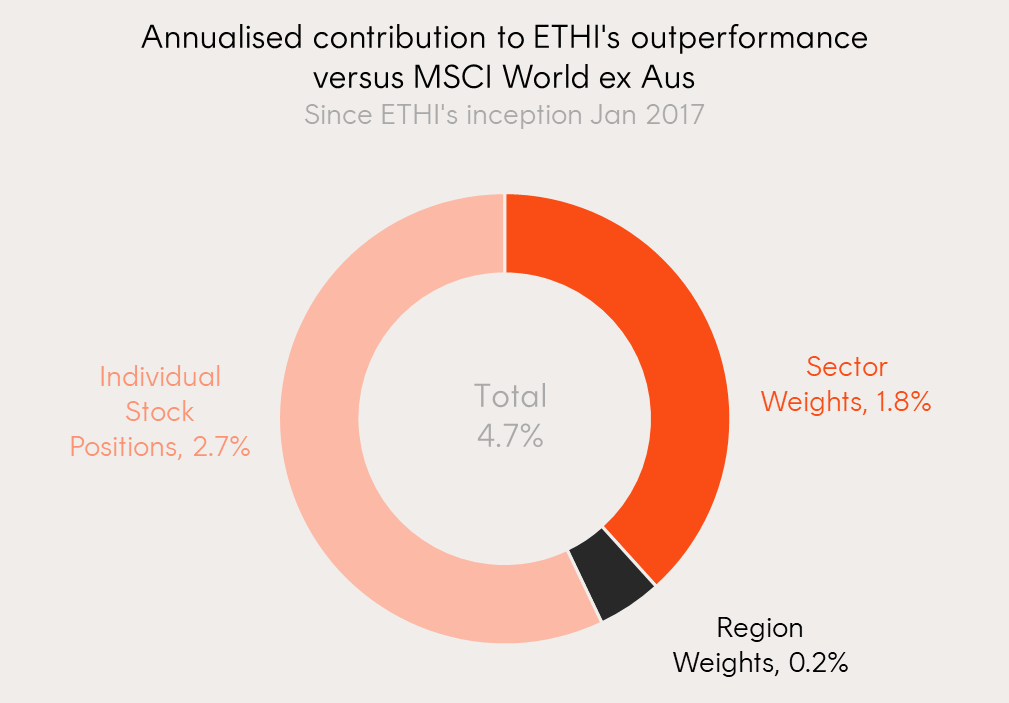

Using attribution analysis, the below chart allocates the contribution to ETHI’s outperformance of sector and regional over/underweight positions that ETHI’s index has taken, and then of the individual stock over/underweight positions that ETHI’s index has taken within those regions and sectors since inception.

Source: Morningstar Direct. Attribution analysis from ETHI’s inception Feb 2017 to July 2024. Past performance is not an indicator of future performance.

The results show ETHI has derived most of its outperformance, on average 2.7% p.a., from the individual stock positions selected for inclusion in the index – more so than under/overweights to particular regions or sectors.

Betashares Global Sustainability Leaders ETF (ASX: ETHI)

Suitable as a core global equities allocation for Australian investors looking to align their investments and values, ETHI has also provided significant outperformance against the MSCI World Index since inception.

In our view, ETHI’s considered portfolio construction, namely the sector constraints to a global benchmark and stock caps, makes it appealing for Australian investors seeking a core global equities allocation.

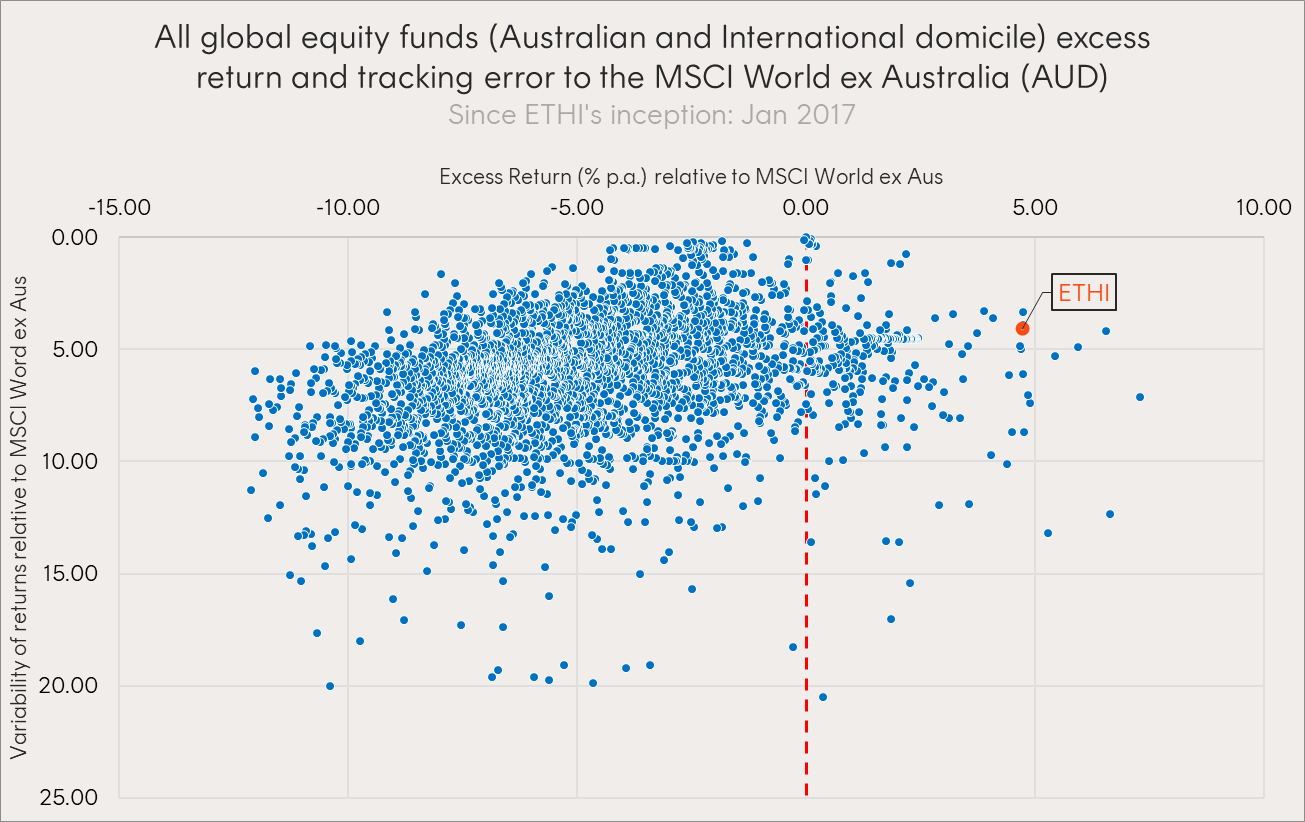

These features have also resulted in ETHI having one of the lower tracking errors to the MSCI World ex Australia Index compared to funds with a similar level of outperformance since its inception3.

Source: Morningstar. Excess Return is measured relative to MSCI World ex Australia NR (AUD), based on 7-year annualised returns as at 31 July 2024. Variability of returns is measured by the annualised standard deviation of return differences between the total return performance of the selected funds, and the total return performance of MSCI World ex Australia NR (AUD). Funds shown are those in the ‘Global Equity Large Cap’ Morningstar ‘Global Category’. Chart shows ETHI and comparison fund performance net of management fees and costs. Past performance is not an indicator of future performance.

For more information on ETHI, fund performance, holdings, and index construction please visit the fund page here.

There are risks associated with an investment in ETHI, including market risk, international investment risk, non-traditional index methodology risk and foreign exchange risk. Investment value can go up and down. An investment in the Fund should only be made after considering an investor’s particular circumstances, including their tolerance for risk. For more information on risks and other features of the Fund, please see the Product Disclosure Statement and Target Market Determination, both available on this website.

References:

1. No assurance is given that these companies will remain in ETHI’s portfolio or will be profitable investments. ↑

2. Source Morningstar Direct: Includes funds in the ‘Global Equity Large Cap’ Morningstar ‘Global Category’. Past performance is not an indicator of future performance. ↑

3. ETHI does not aim to track the MSCI World ex Australia NR (AUD). ETHI’s investment objective is to provide an investment return that aims to track the performance of the Nasdaq Future Global Sustainability Leaders Index before fees and expense. Nasdaq®, Nasdaq Future Global Sustainability Index Leaders Index ™ are registered trademarks of Nasdaq Inc. (which with its affiliates is referred to as the “Corporations”) and are licensed for use by Betashares. The Fund has not been passed on by the Corporations as to its legality or suitability. The Fund is not issued, endorsed, sold, or promoted by the Corporations. The Corporations make no warranties and bear no liability with respect to the Fund. ↑