7 minutes reading time

Tech stocks have traditionally been favored by growth investors for their potential to deliver substantial capital gains, often at the expense of paying dividends. However, a surprising trend is emerging: an increasing number of these companies are starting to share their success through dividend payouts.

This shift marks a pivotal moment, signaling a new era of financial maturity and strength within the tech industry.

But what does this mean for investors? Do dividends signify slowing growth, or is it a cultural shift towards being more shareholder-friendly? We explore these questions further in this blog.

2024: A new chapter in tech dividends

Investors who have observed the tech sector’s rally are well aware of the sheer earnings power of the “Magnificent Seven”—NVIDIA, Microsoft, Amazon, Apple, Alphabet, Meta, and Tesla. These companies are not only leading the charge in their respective technologies, they collectively hold over US$500 billion in cash1.

While select names like Microsoft, Qualcomm and Apple have been paying dividends for over a decade2, other major brands in the sector have been reluctant to return cash back to shareholders for an extended period.

But this year, a new wave of tech giants, including Google and Meta, finally entered the realm of shareholder payments3. Meanwhile, market darling NVIDIA made a significant move toward becoming a more shareholder-friendly company by increasing its quarterly payout by a whopping 150%4.

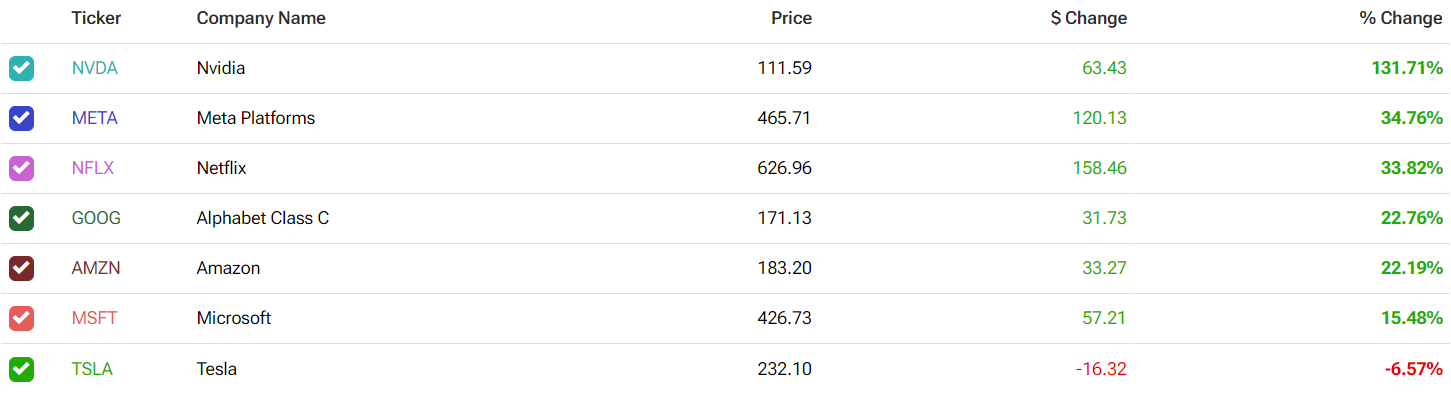

The market has responded enthusiastically. Meta’s stock surged 20% on 2 February 2024 after announcing its first-ever dividend in conjunction with earnings that exceeded Wall Street expectations. Alphabet followed suit on April 25, with its stock soaring over 10%. These companies, including NVIDIA, have enjoyed strong investor support throughout the year (see table below).

Source: Tipranks (as at 31 July 2024). Past performance is not indicative of future returns.

The fact that five of the Magnificent Seven companies are paying dividends may also pressure Amazon to join its Big Tech peers in sharing a portion of their earnings with shareholders through cash distributions5.

Is the growth story over?

Some investors may worry that tech companies’ increasing focus on dividends signals diminishing growth prospects. However, this perspective is often misguided.

Several analysts point out that new dividends are accompanied by significant stock buybacks, indicating a renewed emphasis on shareholder returns6. This trend coincides with artificial intelligence (AI) acting as a catalyst for growth, creating a dynamic that investors believe will continue to support share price appreciation.

In reality, after years of substantial investment to secure market dominance, management teams at many tech companies believe they have reached a level of financial strength that allows them to balance returning cash to shareholders with reinvesting in future growth.

Notably, US companies that start paying dividends typically aim to increase them regularly, maintaining conservative payout ratios to support this practice (see table below).

| Company | Dividend yield (trailing) | Dividend growth* | Earnings growth* | Payout ratio** | 2024 P/E ratio (estimated) |

| Microsoft | 0.72% | 10% | 20% | 32% | 34.1 |

| Apple | 0.45% | 5% | 16% | 15% | 28.2 |

| Meta Platforms | 0.44% | N/A | 14% | 10% | 23.7 |

| Alphabet | 0.47% | N/A | 22% | 6% | 23.4 |

| Nvidia | 0.04% | 20% | 50% | 2% | 40.2 |

Sources: Bloomberg (as at 31 July 2024), FactSet, Wall Street Journal. Note: N/A = not applicable as dividends were initiated this year; *Five-year average growth rate; ** Based on 2024 free cash flow estimates. Past performance is not an indicator of future performance.

For example, Microsoft has increased its dividend for two decades. Over that time, its shares have climbed around 1,500%, with total returns, including dividends, surpassing 2,400%7. This success has been achieved alongside securing its dominant position in operating systems, cloud computing, productivity and enterprise software and gaming.

Catalysts for the sector’s momentum

The fact that tech companies are paying dividends should inspire investor confidence. With ongoing growth opportunities, particularly in AI and automation, these tech giants are likely to invest in a financially disciplined way, moving away from the pursuit of growth at all costs.

The generative AI sector, bolstered by advancements like Google Gemini and OpenAI’s ChatGPT, is poised for growth. Bloomberg Intelligence projects that the market will surge from US$40 billion in 2022 to US$1.3 trillion over the next decade, reflecting a compound annual growth rate (CAGR) of 42%8.

They forecast that rising demand for generative AI technologies could generate approximately US$280 billion in new software revenue, fueled by innovations such as specialised assistants, new infrastructure products, and coding copilots. Major players like Amazon Web Services, Microsoft, Google, and Nvidia are likely to be key beneficiaries as more enterprises transition their operations to the cloud.

While AI offers substantial growth opportunities, it’s important to recognise tech companies are also expanding by innovating their existing products, launching new offerings, exploring new markets, and pursuing mergers and acquisitions.

For instance, Microsoft’s 2022 US$69 billion acquisition of Activision Blizzard bolstered its position in digital gaming, a market projected to grow over 10% annually to nearly US$230 billion by 20339.

Similarly, Google’s US$5.4 billion acquisition of cyber defense firm Mandiant in 2022 underscores the importance of cybersecurity, with spending in this sector expected to reach nearly US$300 billion by 2026, up around US$80 billion from 202310.

Meanwhile, analysts estimate that Amazon’s booming cloud and digital advertising divisions could generate a combined US$160 billion in 2024, driving a 221% year-on-year increase in operating income and accounting for a quarter of the company’s total revenue11.

These companies, along with Apple, are also pursuing strategic growth opportunities12 in the massive U.S. healthcare market, where spending on software, data, and payments is expected to be the fastest-growing segment within the US$650 billion sector13.

This optimistic outlook is already being reflected in projections for Nasdaq listed companies, particularly the “Magnificent Seven,” who are expected to see their earnings and revenues grow by over 10% in the next two years14.

| Year | Earnings growth (est) | Revenue growth (est) |

| 2025 | 15.8% | 12.3% |

| 2026 | 17.6% | 11.8% |

Source: Zacks Investment Research. Estimates aggregated for Apple, Amazon, Microsoft, Google, Meta, Nvidia and Tesla.

Investing in tech for income

The sub-1% yields from Big Tech may be too low for Australian investors seeking high dividends, as tech companies are not traditionally seen as income stocks.

However, QMAX Nasdaq 100 Yield Maximiser Fund (managed fund) presents an alternative for those looking for both growth and income through technology exposure. This fund employs a covered call strategy that aims to generate higher income with lower volatility than the Nasdaq 100 Index.

A covered call strategy involves holding a security and selling a call option on it; in QMAX’s case, the securities within the Nasdaq 100. This strategy allows the portfolio to earn premiums from call options, providing additional cash flow. While the strategy can help manage risk by softening losses during downturns, it may also limit potential gains.

Covered call ETFs are an option for investors who prefer not to manage their own call writing strategy but desire regular income. Betashares’ range of covered call products offers quarterly distributions. As of July 31, 2024, QMAX had a trailing 12-month distribution yield of 5.7%, with the option to reinvest fund distributions through a Distribution Reinvestment Plan (DRP).15

Watch the following video for a detailed explanation of how covered calls work:

Conclusion

For many investors, the dividends from tech stocks may initially appear as mere spare change, but they signify much more. Big Tech is shifting from an era of relentless growth to a more balanced approach, focusing on strategic capital allocation and sharing a greater portion of rewards with shareholders.

Meanwhile, the sector’s future looks promising, driven by advancements in AI and growing demand for its products and services.

While income is not the primary reason investors turn to the Nasdaq, QMAX offers an attractive option for those seeking a blend of growth and income from this exposure.

There are risks associated with an investment in QMAX, including market risk, use of options risk, sector concentration risk and currency risk. QMAX should only be considered as a component of a diversified portfolio. For more information on risks and other features of QMAX, please see the Product Disclosure Statement and the Target Market Determination (TMD), available at www.betashares.com.au.

References:

2. Dividend history pages of Qualcomm, Microsoft and Apple

3. Reuters

5. Reuters

6. Bloomberg & Morningstar

7. Bloomberg

10. IDC

11. Forbes

12. eMarketer

15. Past performance is not indicative of future performance. Yield will vary and may be lower at time of investment. ↑

2 comments on this

Good insights.

Does the introduction of dividends by tech giants suggest a slowdown in growth, or is it a strategic move to be more shareholder-friendly?

Greeting : Telkom University