Betashares Australian ETF Review: November 2024

7 minutes reading time

- Technology

The market conditions facing us today are as complex and uncertain as many investors can remember. After a tough year for most equity sectors in 2022, investors are wondering where to find returns in 2023. One area which investors are re-assessing is technology. After a turbulent year, are we in the early stages of a tech recovery?

Time to revisit global technology?

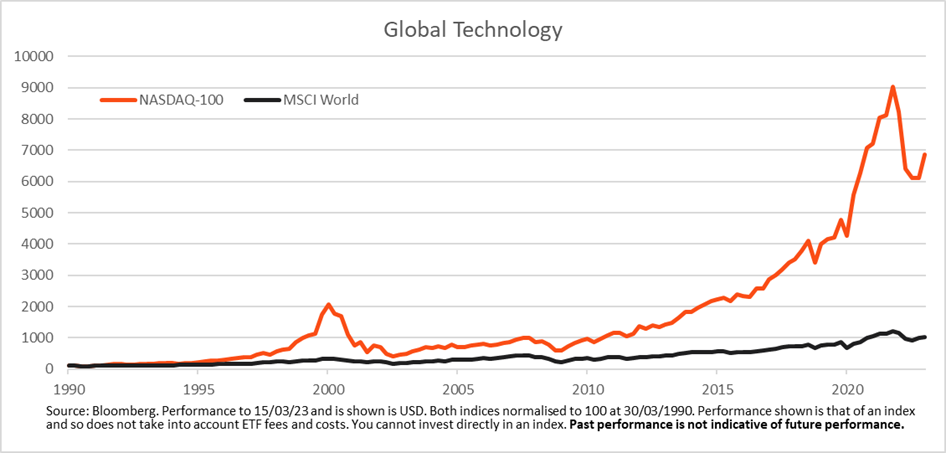

In the last decade, global tech has been the primary driver of equity market returns worldwide. Companies like Apple, Google and Amazon revolutionised our everyday lives and are well known for their relentless drive to innovate. These companies, heavily represented in the NASDAQ-100 index, have delivered enormous returns for those lucky early holders.

The sector sold off heavily in 2022, as rising interest rates discounted the future earnings that dominated the index’s valuation. Falling from a forward P/E of 29.8x in November 2021 to 19.1x in June 2022, the sector returned to more reasonable valuations compared to its 10-year average of 20.9x.1

More attractive fundamentals and the anticipation of peak interest rates have led investors to question whether global tech might soon come back into vogue. The recent weakness in the US banking sector is a cause for consternation, however the larger companies in the tech sector appear unlikely to fall victim to the contagion. These companies typically have high cash balances and low leverage2 which will make them resilient to any coming financial downturn. In fact, if financial instability forces the Fed to cut interest rates earlier than expected, the tech sector may even end up benefiting.

What makes Aussie tech different?

While many investors already have exposure to the US tech giants of the NASDAQ-100, the Australian technology sector offers unique characteristics that could potentially benefit investors.

The first thing that stands out when looking at Aussie tech – compared to the large global technology sectors in the US and China – is the prevalence of business-to-business (B2B) revenue models.

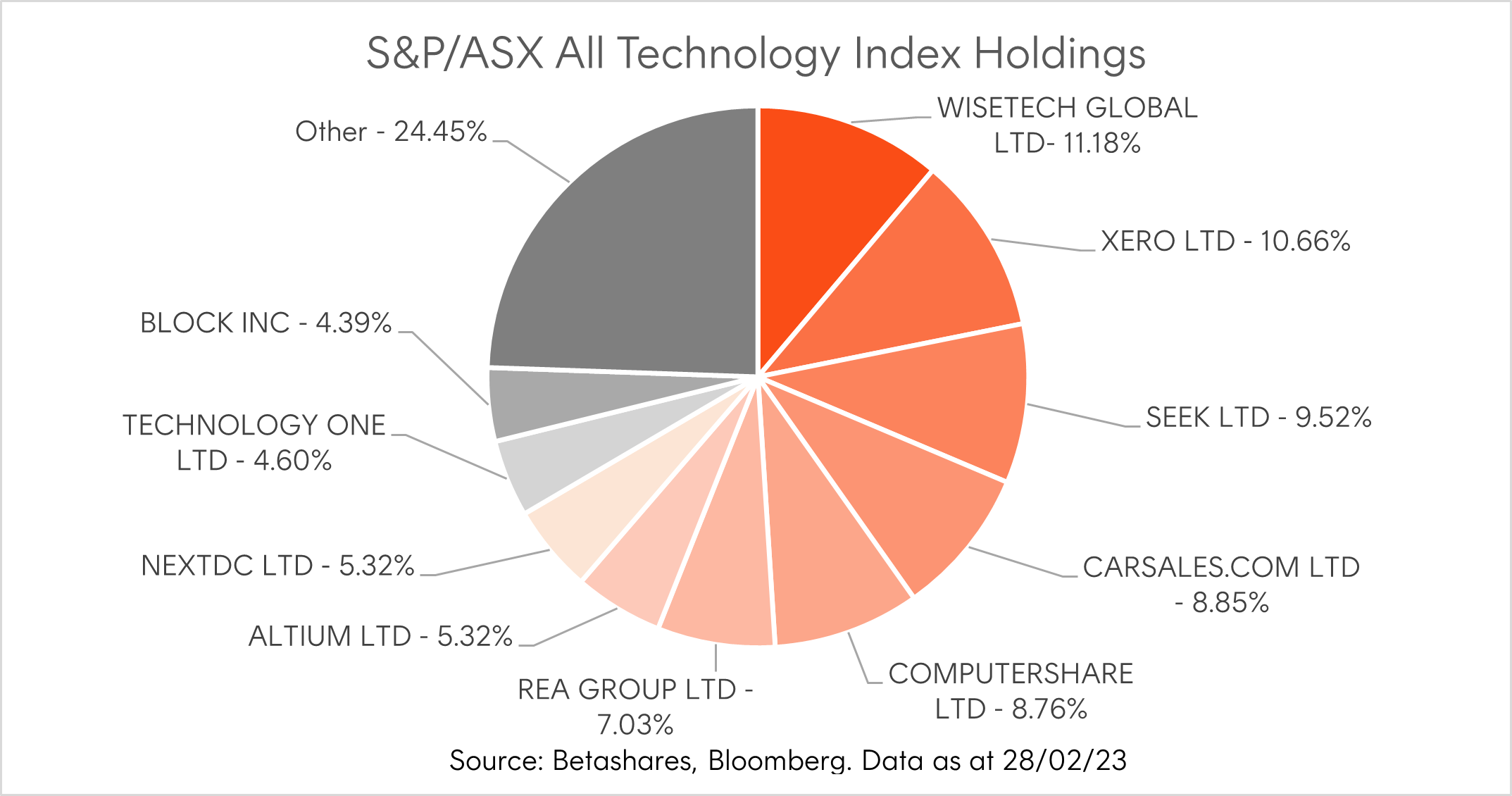

Of the top ten holdings in the S&P/ASX All Technology Index, which tracks a basket of Australia’s largest listed tech stocks, half are B2B software companies, comprising 37% of the index capitalisation.3 These include Wisetech, Xero and Altium, Australian companies which develop and sell globally recognised logistics, accounting and engineering software.

The revenue streams of these businesses tend to be stickier than those of consumer discretionary focused firms like some US tech giants, with long term contracts and the difficulty of businesses switching essential software likely to provide support in the event of an economic downturn.

The firms in the S&P/ASX All Technology Index derive a relatively high proportion (>50%) of their revenues overseas.4 As overseas revenue is priced in foreign currencies such as the US dollar, exchange rate fluctuations may have a significant impact on their AUD revenues.

In economic downturns, history suggests investors typically sell off Aussie dollars in favour of traditional safe haven currencies such as USD1. As a result, the services that Aussie tech firms provide become more attractive to foreign customers in terms of their own currencies – or sales denominated in foreign currencies become worth more in AUD terms.

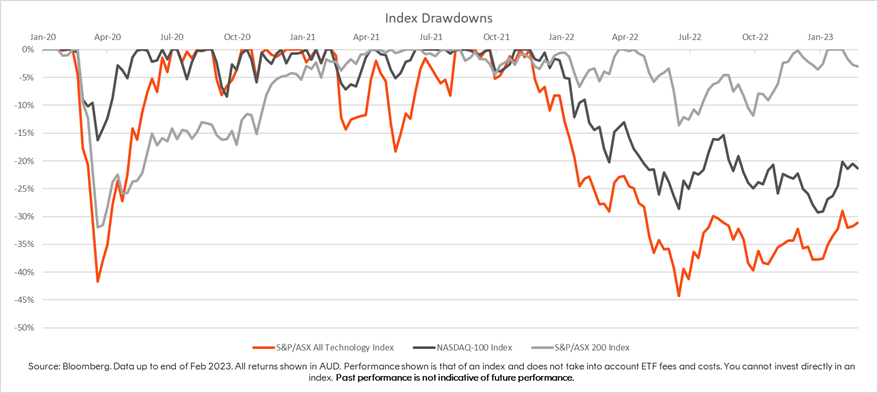

Despite these characteristics, Aussie tech still suffered badly during last year’s bear market. The S&P/ASX All Technology Index fell almost 45% between November 2021 and June 2022, far more than either the S&P/ASX 200 or the NASDAQ-100, as increasing interest rates caused the sector, which was trading at a forward P/E of 87x at its peak, to drawdown sharply. Forward P/E fell to 37.5x in June 2022, lower than its 3 year average of 56.11 but still high compared to the NASDAQ-100.

However, the appeal of Aussie tech remains largely the same as it was at the launch of the technology index in 2020, and looking forward it maintains characteristics that differentiate it from both the NASDAQ-100 and the S&P/ASX200.

Information Technology makes up only a small fraction of the S&P/ASX200, and the sector is less mature than the US tech industry. Yet, with our well-educated population and increasing government support,5 Australia’s nascent tech industry has the ingredients to become a powerful force in the economy.

The outlook

The macro environment largely drove markets for the past year, and will continue to play an important role. As we likely near the predicted interest rate peak, investors are yet to reach a conclusion on what the next 12 months hold.

The biggest question is the same one that dominated last year – will central banks be able to tame inflation before high interest rates tip our economies into recession?

Australian investors may wonder: how will Australia fare compared to the rest of the world, particularly the US?

And for those looking to reallocate to technology, how will our respective industries fare in the various scenarios we might face?

The US and Australian tech industries display unique characteristics that make them attractive in various market conditions.

If the US enters an earnings recession while Australia manages to avoid one, Aussie tech would likely outperform the NASDAQ-100 while allowing Aussie investors to maintain their tech exposure. If the US recession is caused by troubles in the banking sector, however, the tech giants’ strong balance sheets may shield them compared to the broader US market.

In the event of a recession, Aussie tech’s B2B tilt and exposure to AUD exchange rates potentially makes it an attractive tech exposure.

If an economic downturn in either market is accompanied by a drop in inflation, a decrease in interest rates would likely deliver a boost to that country’s tech sector.

Looking past the short term macro outlook, Aussie tech’s growth runway appears attractive for long term investors. The sector is less mature than the US tech industry (or for that matter the Australian banking and resources sectors that dominate the S&P/ASX 200), and while not as headline grabbing as some of the global tech giants, Australian home grown technology players such as WiseTech and Xero have already become globally recognised players in their respective fields.

Looking overseas, as a more mature industry, the US tech giants continue to play an integral role in our everyday lives, with their size giving them perfect position to take advantage of emerging technological trends such as AI and blockchain.

How can Australian investors gain technology exposure?

Investors can gain convenient, cost-effective exposure to the Australian technology sector via the ATEC S&P/ASX Australian Technology ETF , which aims to track the S&P/ASX All Technology Index. For those looking for a US exposure, Betashares offers the NDQ Nasdaq 100 ETF , which aims to track the NASDAQ-100 Index, and the HNDQ Nasdaq 100 Currency Hedged ETF , a currency hedged version of NDQ.

There are risks associated with an investment in each of ATEC, NDQ and HNDQ, including market risk, sector risk and concentration risk. Investment value can go up and down. An investment in any of the funds should only be considered as a part of a broader portfolio, taking into account your particular circumstances, including your tolerance for risk. For more information on risks and other features of each fund, please see the relevant Product Disclosure Statement and Target Market Determination available at www.betashares.com.au.

Resources:

1: Bloomberg. Best P/E Ratio Fwd 12M. Calculate by taking the weighted average of the current fiscal year and the next fiscal year estimated in proportion to the amount of time between now and the end of the current fiscal year.

2: https://www.investors.com/etfs-and-funds/sectors/sp500-companies-stockpile-1-trillion-cash-investors-want-it/, Bloomberg Terminal (PORT Function)

3: Bloomberg Terminal (PORT Function)

4: Morningstar Direct, as of 28/2/23. Data used is ‘Revenue Exposure by Region: Fund-level’.

5: https://www.afr.com/technology/australia-gets-its-second-shot-at-being-a-tech-nation-20220523-p5ants