Cause to pause

5 minutes reading time

Global markets slumped last week, reflecting the much higher than expected suite of ‘reciprocal tariffs’ announced by US President Trump. Markets are now pricing in the very real chance of a US recession unless either Trump relents or the Fed steps in some time soon.

Global markets last week

The so-called ‘great moderation’ of the pre-COVID era is dead and buried. The past few years have given investors many thrills and spills, beginning with the COVID collapse, the V-shaped recovery, the return of 1970s inflation and then a miraculous shift into a soft-landing, with easing inflation and low unemployment.

And just when we thought 2025 could be a continuation of the soft-landing/Goldilocks scenario, we’ve now been handed potentially the worst US economic policy decision of the post-WW2 era. The size and breadth of Trump’s tariff increases were gobsmacking, amounting to an increase in the average effective US tariff rate of around 20% (from 3% to 23%). And the method used to derive these tariffs has been widely derided – penalising countries irrespective of the actual trade barriers they impose on the United States.

The US warned countries not to retaliate. That seems a pipedream, especially as retaliation would increase the bargaining position of each country (assuming Trump even wants to negotiate) and would likely be politically popular. China almost immediately announced a 34% higher tariff on US imports. The European Union will also likely respond in coming days, with measures thought to target US service exports (which are more important in Europe) and the tech giants especially.

Where to from here? Sadly, it’s likely conditions will get worse before they get better. My base case is that the US will run very close to recession – or at least it will look like that for a while – unless either Trump or the Fed responds some time soon.

Why the gloom? For starters, the tariff increases represent a major tax increase on both US households and business, which will dent spending. There’s also likely to be a slowing in spending and hiring simply because of the massive shift in relative prices across global supply chains that needs to be worked through – and uncertainty of what further tariff changes could still lie ahead (will Trump negotiate or not?). US exporters also face retaliation in major markets across the globe.

Given the short-run boost to inflation – which could be as high as 1-2% – the Fed will be late in providing any support unless activity indicators really start to drop quickly.

Of course, Trump could quickly pivot to tax cuts – pledging to use any or all of the revenue increases from higher tariffs. But Trump’s proposed household income tax cuts later this year really only amount to avoiding a tax increase that would have taken place anyway (extending a temporary tax cut). Corporate tax cuts would be a new stimulus, but must be set against the negative shock from Trump’s tariff lunacy.

What’s more, any possible boost to US manufacturing due to reduced import competition would be, at best, years away – if at all. After all, many manufacturers will face import cost increases, US workers will still be very expensive compared to emerging markets, many imports simply can’t be replaced and few businesses would make long-term investment decisions if tariffs could easily be removed by the next US President in four years’ time.

In short, it’s hard to believe we’ve seen the bottom in equity markets – again, unless Trump relents soon. He may not relent – or if he does, he may likely need to see more blood in the water first.

Global week ahead

While the US consumer price index is released this week, market attention is likely to be focused on any further fallout from Trump’s tariff increases. Markets are awaiting especially Europe’s response. And will Trump retaliate against China and Europe’s retaliation?

High frequency US economic indicators – such as weekly jobless claims – will also take on increased importance in the weeks ahead. In short, we know the iceberg has hit the good ship US, and we are now waiting to see the damage.

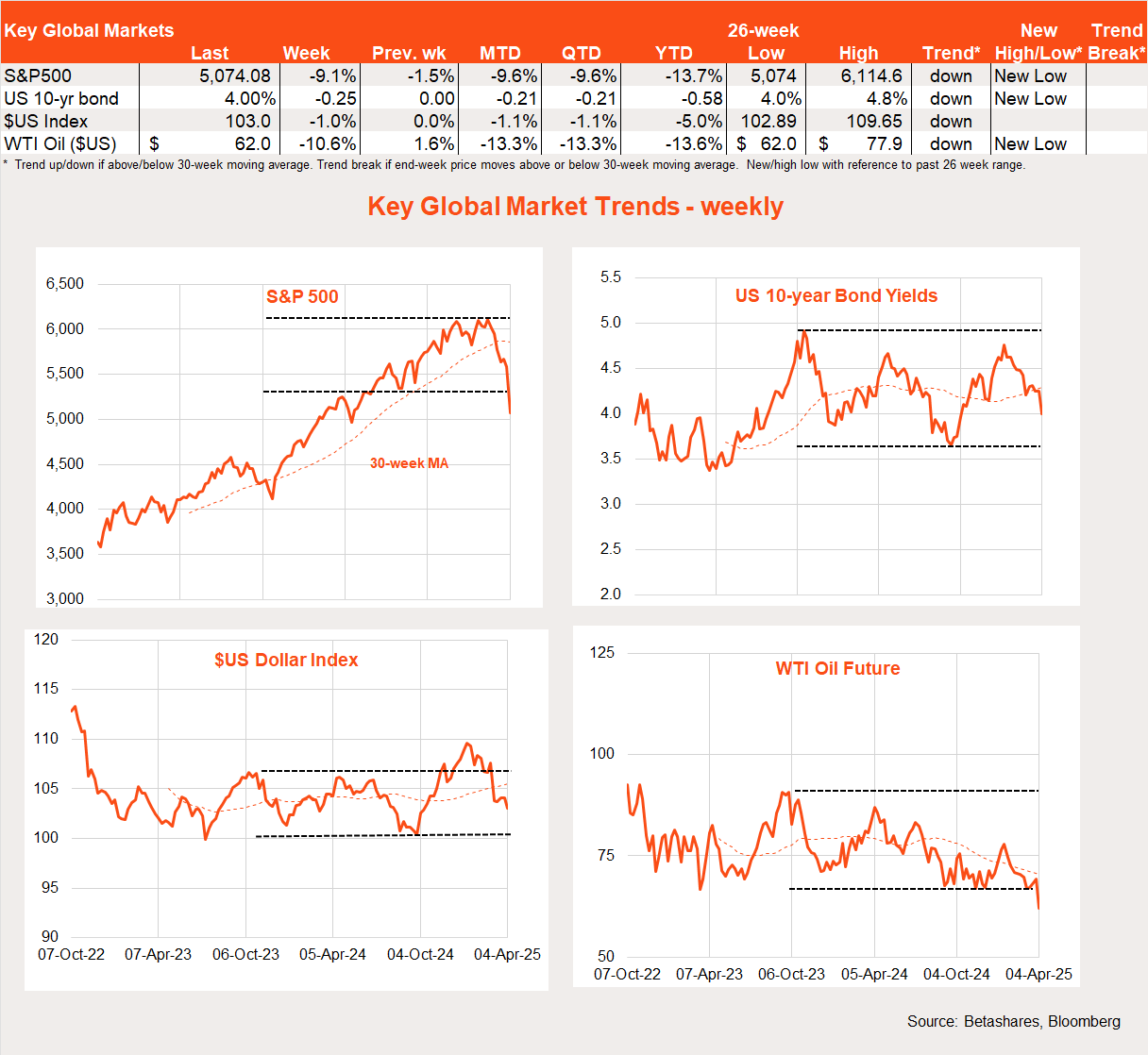

Global market trends

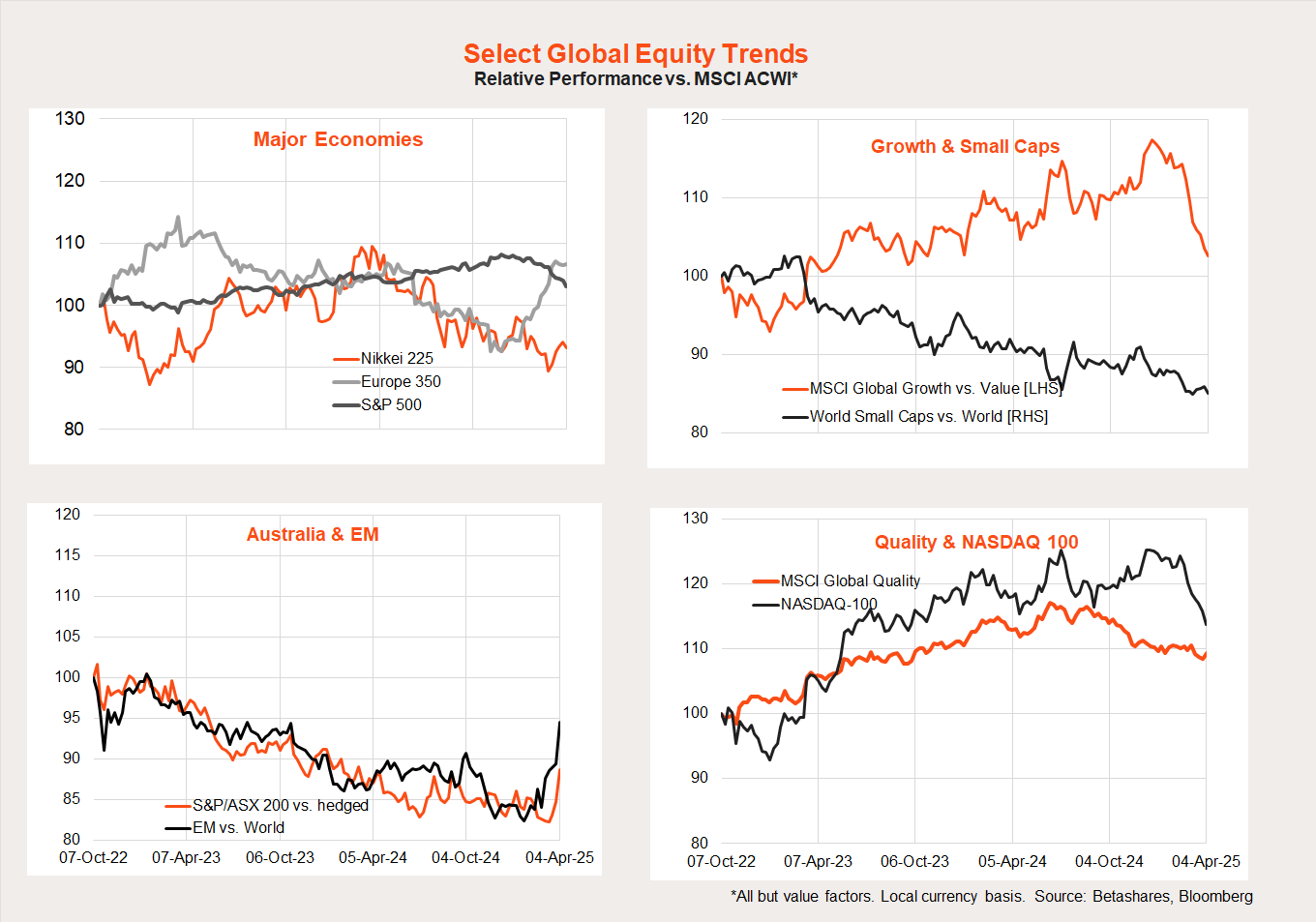

Few equity markets were spared last week, but overall US stocks remained the worst hit.

This has continued the pullback in the relative performance of the Nasdaq 100 and global growth over value. Australian stocks outperformed again last week, although they are yet to reflect Friday’s Wall Street bloodbath.

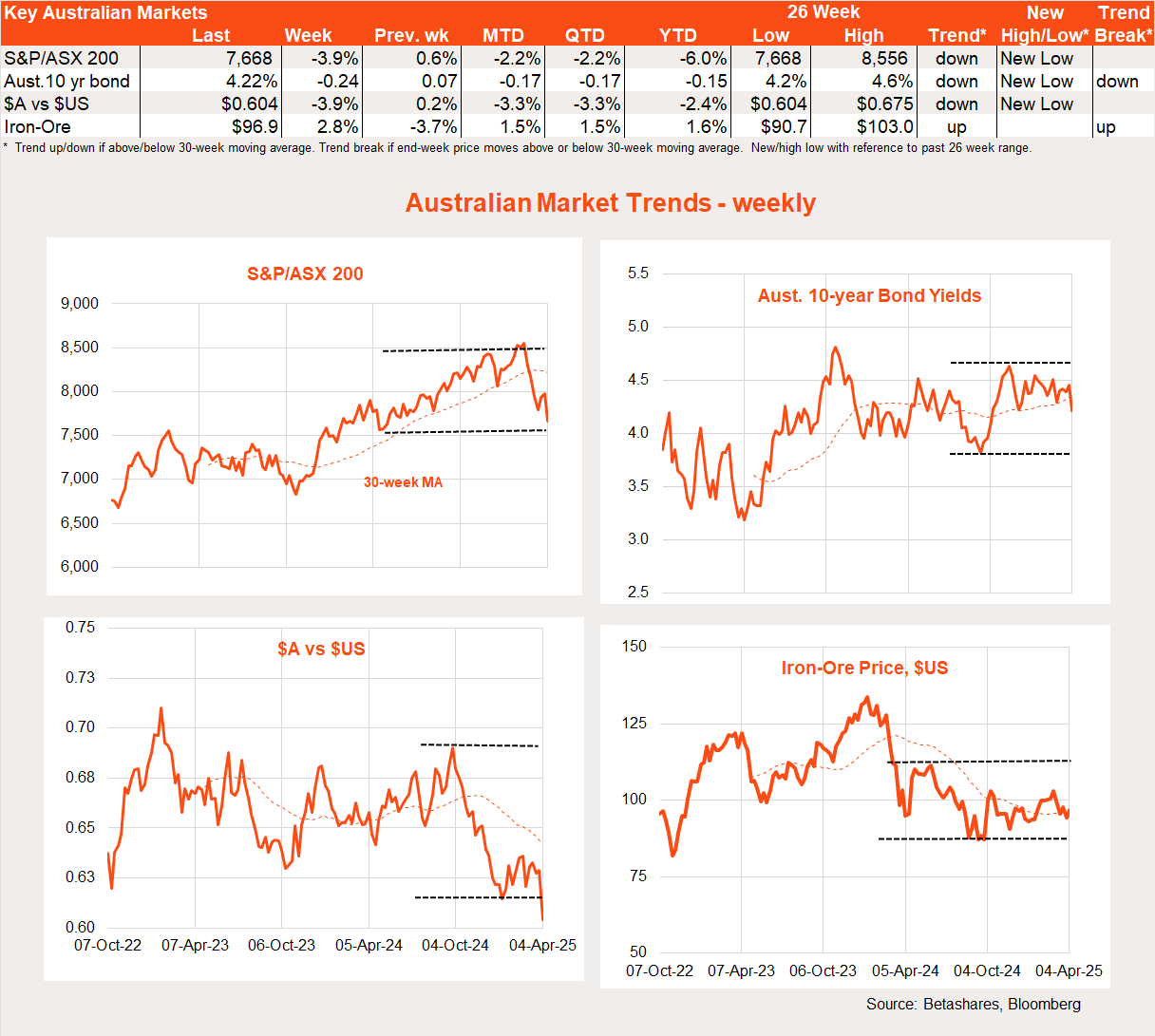

Australian market

Local stocks fell last week along with the global sell-off. The $A has also been hit hard, reflecting its status as a proxy for global growth and the health of the Chinese economy.

Last week’s local highlight was the RBA’s April Board meeting, in which rates were left on hold as widely expected. Nothing in the post-meeting statement shifted my view that the RBA will cut rates in May, assuming the Q1 quarterly CPI report later this month will show annual trimmed mean inflation below 3%.

Indeed, given the tariff mayhem, the bar to a rate cut in May has likely been lowered (Q1 trimmed mean inflation of 3.0% could be good enough) and I feel the RBA can and should now cut rates by 0.35%, taking the official cash rate to 3.75%.

Local economic data remains on the soft side, with a small 0.2% increase in February retail sales and a 4.5% drop in quarterly job vacancies in the three months to end-November.

Local highlights this week

RBA Governor Bullock gives a speech on Thursday evening and will obviously be asked about the policy implications of the recent market upheaval.

We also get the Westpac and NAB surveys of consumer and business sentiment respectively.

Have a great week!

1 comment on this

Great summary and forecast. Thanks David.