5 minutes reading time

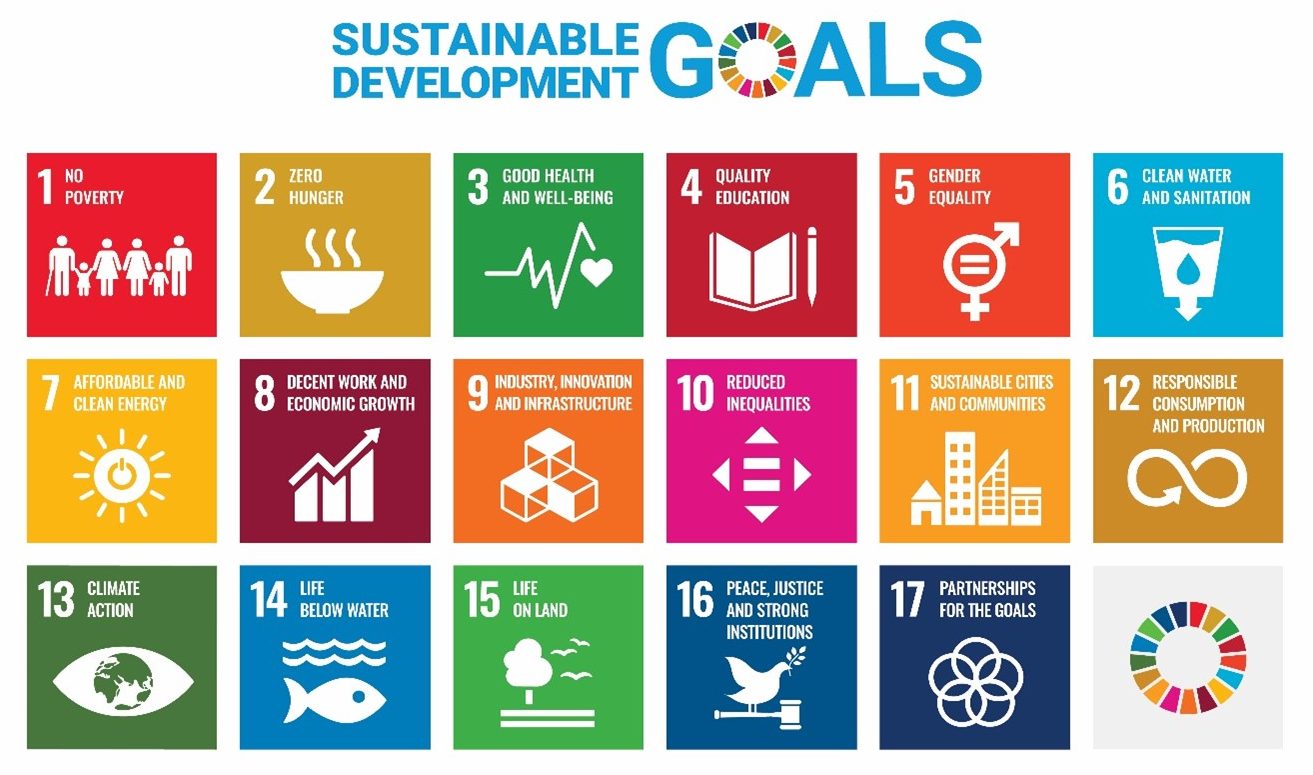

In August 2022, Betashares and index provider, NASDAQ, announced changes to the Nasdaq Future Australian Sustainability Leaders Index (the Index), which is the index tracked by the FAIR Australian Sustainability Leaders ETF . The Index gives preference to companies defined as ‘Sustainability Leaders’. The changes to the Index explicitly link the definition of ‘Sustainability Leader’ to the United Nations Sustainable Development Goals (SDGs).

The SDGs are 17 goals which have been designed to act as a blueprint for sustainable development. The genesis of the SDGs was the United Nations Conference on Environment and Development (UNCED), also known as the ‘Earth Summit’, held in Rio de Janeiro in 1992. The Earth Summit was a landmark conference in which political leaders, scientists and non-government organisations recognised that existing patterns of economic development were unsustainable, with issues of poverty, inequality, climate change, pollution, and the build-up of toxic compounds in the environment increasingly impacting human health, society, and the natural world.

The Earth Summit led to the formation of the UN Foundation Convention on Climate Change (UNFCCC) and the UN Commission on Sustainable Development (UNCSD). In 1996, the Organisation for Economic Co-operation and Development (OECD) published a report titled “Shaping the 21st Century”1 which synthesised much of the UNCSD’s work into six monitorable ‘International Development Goals’. These ultimately led to the September 2000 Millennium Declaration, and the creation of the Millennium Development Goals (MDGs), eight goals and 21 targets to be achieved by the year 2015.

The SDGs were developed as the framework to succeed the MDGs. They consist of 17 goals (the Goals) and 169 targets (the Targets).

Most of the Targets specify an objective or end date of 2030, however some do not have a set end date. In 2017, the United Nations published a list of indicators which it would use to track progress towards achieving the SDGs2, which now stands at 232 individual metrics.

While the SDGs initially came in for some criticism for having too many targets and not adequately prioritising goals deemed by some as being of greater importance, at their heart the SDGs recognise that environmental, social, and economic progress are ultimately and holistically linked, and sustainability must be central to future progress.

Over time, the UN SDGs have increasingly been recognised as a framework for determining the extent to which investment and financial activity is consistent with principles of sustainability. The Principles of Responsible Investment (PRI) in 2020 published a report titled “Investing with SDG Outcomes”3 which sets out guidance for aligning investment activity with the SDGs.

“…expectations of investors from stakeholders – including beneficiaries, clients, governments and regulators – are shifting, driven by increased visibility and urgency around many issues – such as climate change, income inequality and human rights.”

- PRI, Investing with SDG Outcomes, 2020

The PRI report recognises that traditional approaches to investing and ESG incorporation are insufficient to mobilise sufficient capital to make material progress on closing the SDG gap by 2030. In addition, some interpretations of the responsibilities of fiduciaries may compromise the extent to which large institutional investors, such as pension or superannuation funds, are prepared to invest for SDG outcomes.

Progress towards achieving the Goals is published annually in the Sustainable Development Goals Report which is more commonly known as the ‘SDG Tracker’ or ‘Gap Report’. Unfortunately, progress towards achieving the SDGs has been limited, and for the past two years we’ve been going backwards, substantially impacted by the COVID-19 pandemic. The number of people living in extreme poverty has increased since 2019 and the number of unemployed people in low-income countries has steadily increased. At the end of 2020, 160 million children, or 1 in 10, were engaged in child labour.

Source UN SDG Report 2022.

Around the world, 22.0% of children under the age of five suffer from stunted growth due to malnutrition. While this is a decline from 24.4% in 2015, the annual rate of decline must double to achieve the 2030 target of a 50% reduction.

To avoid the worst effects of climate change, global green gas emissions need to peak before 2025. Energy-related CO2 emissions increased by 6% in 2021 and worryingly, under current national commitments to climate action, green gas emissions will rise by nearly 14% by 2030.

Source: AGL.

Currently the world is witnessing the largest number of violent conflicts since 1946, with one quarter of the global population now living in conflict zones. As of May 2022, 100 million people had been displaced from their homes by conflict, 41% of which were children.

Our marine resources have suffered as oceans and waterways come under the combined assault of overfishing, ocean warming, acidification, and plastic pollution. More than 17 million tonnes of plastic waste entered our oceans in 2021.

Achieving the SDGs will require considerable investment. A meta-study funded by the European Research Council (ERC) estimated the required level of investment to achieve SDGs 6 (Clean Water and Sanitation) and 13 (Climate Action) at US$1 trillion annually (around 1% of global GDP)4 while most others will require investment of hundreds of billions of dollars. Much of this investment must come from the private sector.

Conclusion

The decision to align FAIR’s criteria for identifying Sustainability Leaders with the SDGs recognises their importance as a widely accepted framework for sustainable development. For financial markets to be sustainable, and for investors to continue to benefit from long-term value creation, our economy must operate within planetary boundaries5.

Unfortunately, progress towards achieving the SDGs has been slow and mixed. We approach too many thresholds in terms of irreversible environmental damage, and injustice and inequality affect too many of the world’s people. Considerable investment from the private sector, as well as government, is needed if we hope to achieve the SDGs and their Targets by 2030.

1. Source: https://www.oecd.org/dac/2508761.pdf

2. Source: https://unstats.un.org/sdgs/indicators/indicators-list/

3. Source: https://www.unpri.org/download?ac=10795

4. Source: https://journals.plos.org/sustainabilitytransformation/article?id=10.1371/journal.pstr.0000020#:~:text=Five%20additional%20sources%20estimating%20the,USD%201.1%20trillion%20per%20year.

5. Source: https://www.stockholmresilience.org/research/planetary-boundaries/the-nine-planetary-boundaries.html