Is your portfolio really diversified?

6 minutes reading time

Momentum is a powerful phenomenon in the physical world – characterised as an object’s ability to maintain or increase its speed or force. But what if we applied this concept to investing? By buying stocks that are increasing in price while avoiding or selling those that are not, can we potentially harness the power of momentum in financial markets?

There is a considerable body of academic research and empirical data that demonstrates the benefits of momentum investing.

Investors can now access a convenient, systematic way to implement momentum investing in Australian equities, with Betashares MTUM Australian Momentum ETF , the first ETF to provide access to a momentum strategy over Australian shares.

MTUM aims to track an index (before fees and expenses) comprising a portfolio of Australian companies with above-average momentum scores, as measured by their risk-adjusted returns.

Reasons to consider MTUM:

- Proven investment approach

Momentum investing aims to identify stocks that show a recent trend of outperforming the broad market, and is an approach supported by economic theory and empirical data.

- Portfolio diversification

Momentum investing provides a unique return profile that can blend well with other active and passive equity funds.

- Convenient, systematic way to implement momentum investing

Momentum investing can be difficult to implement and is susceptible to human bias. MTUM’s index is purely rules-based, prioritising stocks with strong and consistent momentum, while cutting the worst performers quickly.

What is momentum investing?

Momentum investing is an investment strategy that involves buying companies that have outperformed and selling or avoiding those that have underperformed in the recent past.

Rather than aiming to profit from underlying company fundamentals, momentum investing instead is based on the theory that rising asset prices tend to continue rising, and falling prices tend to continue falling.

The initial research on momentum was published by Jegadeesh and Titman in 19931, and has been found to be persistent since that time and pervasive across a range of countries and asset classes.2

Why should investors consider a momentum-based investment strategy?

Momentum can play a key role in investors’ portfolios, by potentially providing enhanced returns when compared to a broad based, market cap-weighted equity fund, or as a complement to other equity funds.

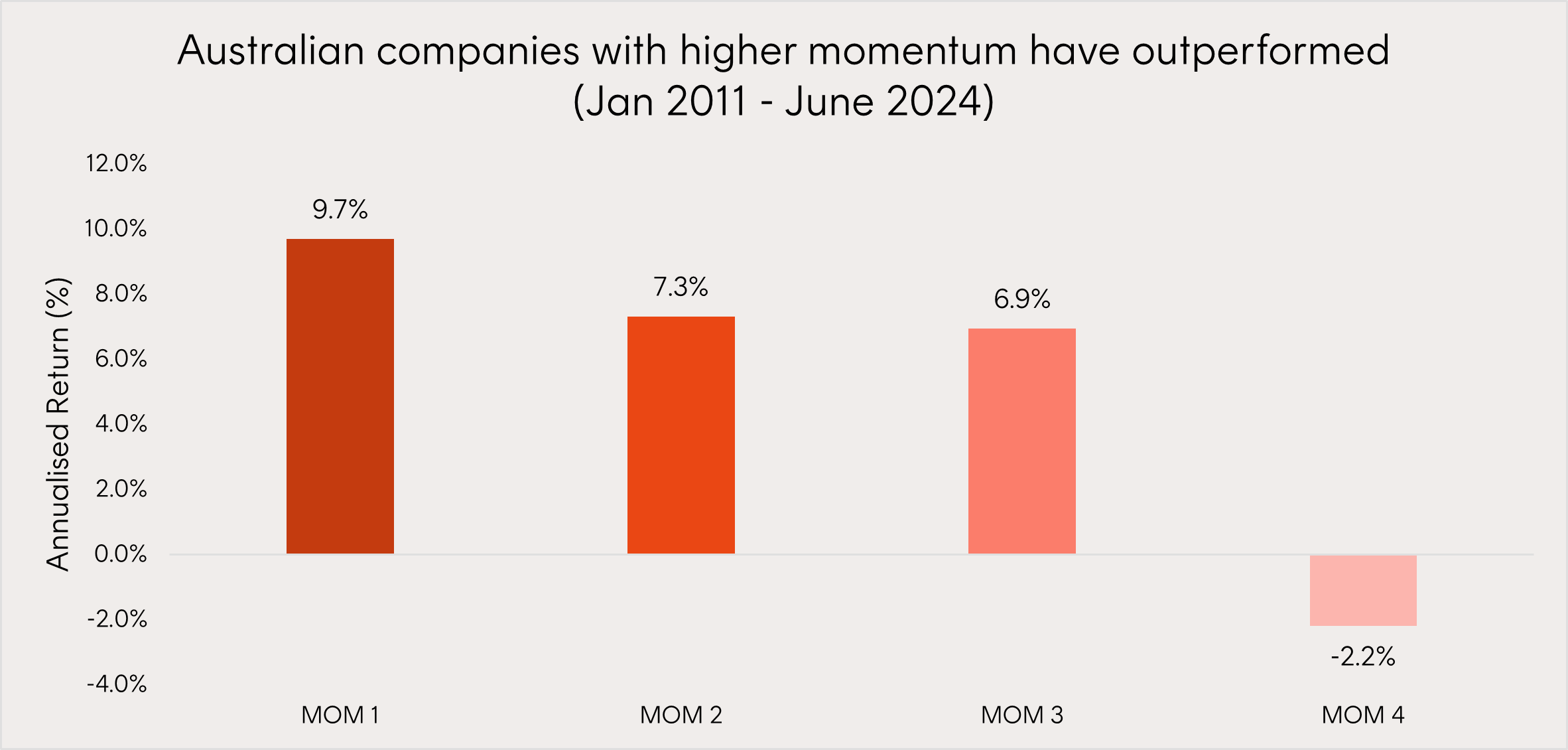

The below analysis illustrates the performance of 200 of the largest Australian companies grouped into quartiles by their momentum rankings measured by their risk-adjusted returns (12-month total return/12-month volatility), weighted equally and rebalanced semi-annually.

The top 50 stocks by momentum ranking are grouped into the first quartile (MOM1) with MOM2 consisting of stocks with the next 50 highest risk-adjusted rankings, and so on.

Source: Solactive, Betashares as at 25 June 2024. Past performance is not indicative of future returns.

The chart above shows that, over this period, stocks with the highest momentum scores (MOM 1) achieved far superior performance (by around 12% p.a.) to stocks with the lowest momentum scores (MOM 4), while both MOM 2 and 3 lie somewhere in between.

Introducing Betashares Australian Momentum ETF (ASX: MTUM)

Betashares Australian Momentum ETF (ASX: MTUM) aims to track an index (before fees and expenses) comprising a portfolio of Australian companies with above average momentum scores, as measured by risk adjusted returns.

MTUM’s index, net of MTUM’s management fees and costs, has outperformed the S&P/ASX 200 index by 2.3% p.a. from MTUM’s index inception in May 2011 to end June 2024, as well as outperforming that benchmark over most time periods as shown in the table in the chart below.

Source: Bloomberg, Betashares as at 28 June 2024. Returns shown for the period since MTUM’s index inception on 31 May 2011 to 28 June 2024. Chart shows index performance, net of MTUM’s management fees and costs (MER) of 0.35% p.a. MTUM’s inception date was 22 July 2024. You cannot invest directly in an index. Past performance is not indicative of future performance of MTUM’s index or MTUM.

An individual investor seeking to implement a momentum based strategy themselves faces various challenges, including the time required to manage such a strategy, the identification of outperforming stocks, an unbiased selling discipline and execution costs.

MTUM provides a professionally managed, cost-effective approach to momentum investing for Australian investors.

MTUM’s systematic approach to momentum

MTUM’s index (the Solactive Australia Momentum Select Index) employs a systematic or ‘rules based’ approach to momentum investing. This removes human biases from the investment process, as these biases can cause irrational behaviour.

The index ranks 200 of the largest stocks on the ASX by their momentum scores, as measured by each stock’s 6- and 12-month risk-adjusted returns, and selects the top 50 stocks based on those rankings. This selection and rebalance process is repeated every two months.

Stocks that qualify in the top 50 are gradually added to the portfolio, with effectively a quarter of the portfolio rebalanced every 2 months (bi-monthly). That means for a stock to reach its potential ‘full weight allocation’ it must show consistent momentum and remain in the top 50 ranked stocks for four consecutive bi-monthly selection days.

Any stock that is ranked in the lowest 10% of the most recent 200-stock universe based on its 6-month total return at the latest selection day is removed from the final portfolio, ensuring the worst performers are cut quickly.

For further details of MTUM’s index methodology, please refer to the PDS.

How to use MTUM in a portfolio

Investors may consider MTUM:

- as an efficient way of accessing the performance potential of high momentum stocks, and

- as a complement to other equity exposures, including both passively and actively managed funds.

MTUM is now available on the ASX. You can read more about MTUM here.

There are risks associated with an investment in MTUM, including market risk, index methodology risk, portfolio turnover risk and concentration risk. Investment value can go up and down. An investment in the Fund should only be made after considering your particular circumstances, including your tolerance for risk. For more information on risks and other features of the Fund, please see the Product Disclosure Statement and Target Market Determination, both available on this website.

Sources:

1. Jegadeesh, N. and Sheridan, T., (1993). “Returns to Buying Winners and Selling Losers: Implications for Stock Market Inefficiency.” Journal of Finance. 48, 65-91. ↑

2. Your Complete Guide to Factor-Based Investing by Andrew L. Berkin & Larry E. Swedroe (2016). See Chapter 4 ‘The Momentum Factor’ pp. 76-80. ↑