5 minutes reading time

There’s little doubt that ESG is playing an increasingly important part in the investing landscape. In the U.S., ESG investments saw record flows from investors in 2020, just as they did the year before, and the year before that1.

ESG aims to drive positive change in society by evaluating how companies operate in three key areas: environment, social and governance. The Betashares Climate Change Innovation ETF (ASX: ERTH) focuses on the environmental aspect.

ERTH holds a portfolio of companies that have created and are creating products and services that enable the user, amongst other green initiatives, to reduce or eliminate direct emissions. A large component of the net zero emissions goal is made possible through electric vehicles (EV). As of 10 July 2021, ERTH held eight companies associated with the EV sector, comprising ~14% of the portfolio.

In this piece we will briefly explore the development and use of EV, the outlook for the industry and its importance to the global ESG effort.

The electrifying change in transportation

Around the world, governments and automakers are promoting EV as a key technology to curb oil use and fight climate change. During the 2020 Presidential debate, Joe Biden pledged to transition the U.S. away from the oil industry2. This will be no small feat considering that in 2020, petroleum products accounted for about 90% of the total U.S. transportation sector’s energy use3.

However, the larger players in the automotive world are already starting to pivot to EV:

- General Motors has said it aims to stop selling new petrol-powered vehicles and will move to battery-powered models4.

- Volvo said it would move even faster and will aim to only sell EV by 20305.

- Volkswagen has greenlit a plan to launch roughly 70 battery-powered models by 20306.

Alongside Biden’s pledge to reach net-zero emissions, Europe is fast becoming the driving force in its support for EV. In the UK, PM Boris Johnson announced almost GBP2.4 billion of subsidies and support for charging infrastructure, EV development and production. Chancellor Angela Merkel’s government is offering carmakers and suppliers EUR5 billion to help weather the coronavirus crisis and invest in electric cars7.

The chart below shows how sales of global plug-in vehicles have grown over the last decade.

Source: EV-Volumes

While the electric car has had a difficult past, and its sales figures are small in comparison to traditional vehicles, “there is a consensus among auto industry executives and analysts that a tipping point is approaching where mass adoption will become unavoidable because of falling battery costs, pressure from regulators and generous government subsidies”8.

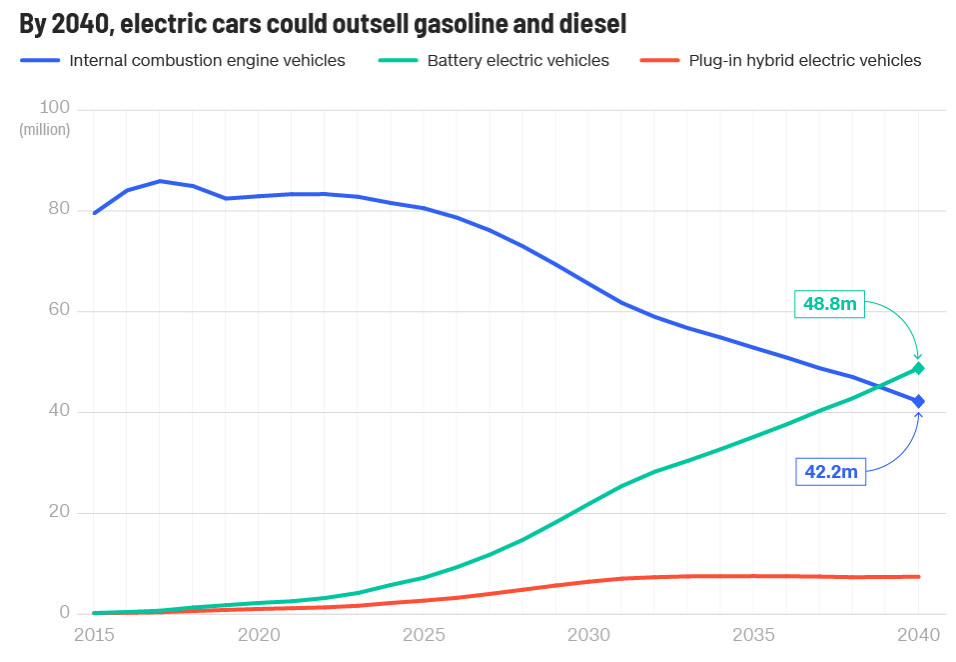

Global EV sales rose an impressive 65% from 2017 to 2018, for a total of 2.1 million vehicles, with sales figures steady through 2019. The subsequent global lockdowns caused by COVID-19 resulted in a 25% decline in EV purchases during the first quarter of 20209. Despite this, EV sales recovered strongly throughout the remainder of 2020, and are expected to continue to rise further according to Bloomberg New Energy Finance. This is due to the likelihood of EV use becoming a long-term structural trend thanks to the factors mentioned in the previous paragraph, alongside more readily available charging infrastructure, new markets, and price parity with traditional internal combustion engines10.

Source: Bloomberg New Energy Finance

The EV makers: Start your…

EV adoption is becoming one of the major trends of not only ESG

ESG

ESG (environmental, social, and governance) refers to three areas that can define how sustainable, responsible, or ethical a business is.

The Chinese government is implementing measures to support its homegrown major players in the space (such as Nio, Li Auto and Xpeng which respectively had a 3.9%, 2.2% and 2.4% weighting in ERTH as at 10 August 2021).

Alongside their first mover advantage, these companies should benefit from an infrastructure package whereby the Chinese government is looking to add around 600,000 more charging stations (on top of the 1.2 million that were available at end of 2019)11. Further, in order to promote the development and usage of EV in China, the government changed its subsidies policy at the end of 2020 and imposed a mandate that a certain proportion of all vehicles sold by a manufacturer each year must be battery-powered12.

Summary

The adoption of EV is playing an important part in the ‘ESG transition’, and is likely to continue to do so. To gain exposure to the growth in ‘green transportation’, investors can consider the Betashares Climate Change Innovation ETF (ASX: ERTH) which holds a portfolio of companies that includes those focused on the manufacturing and distribution of EV.

|

There are risks associated with investment in ERTH, including market risk, international investment risk, sector risk and non-traditional index methodology risk. ERTH’s returns can be expected to be more volatile (i.e. vary up and down) than a broad global shares exposure, given its concentrated sector exposure. ERTH should only be considered as a component of a diversified portfolio. For more information on risks and other features of ERTH, please see the Product Disclosure Statement, available at www.betashares.com.au. |

1. https://www.cnbc.com/2021/02/11/sustainable-investments-hit-record-highs-in-2020.html

2. https://www.forbes.com/sites/arielcohen/2020/10/26/plugging-into-the-future-the-electric-vehicle-market-outlook/?sh=7a442f539812

3. https://www.eia.gov/energyexplained/use-of-energy/transportation.php

4. https://www.nytimes.com/2021/01/28/business/gm-zero-emission-vehicles.html

5. https://www.bbc.com/news/business-56245618

6. https://www.bloomberg.com/news/articles/2021-06-17/vw-readies-massive-rejig-to-u-s-plans-on-biden-s-ev-shift

7. https://www.bloomberg.com/news/articles/2020-11-18/europe-s-mix-of-shoves-and-sweeteners-hastens-electric-car-shift

8. https://edition.cnn.com/interactive/2019/08/business/electric-cars-audi-volkswagen-tesla/

9. https://www.iea.org/reports/global-ev-outlook-2020

10. https://about.bnef.com/electric-vehicle-outlook/

11. https://www.greenbiz.com/article/look-inside-chinas-timely-charging-infrastructure-plan

12. https://news.mit.edu/2021/chinas-transition-electric-vehicles-0429