Bitcoin ETFs: What are they and how do they work?

5 minutes reading time

- Digital assets

Bitcoin hit highs last week that haven’t been seen in over a month. The cryptocurrency, along with the broader crypto market, finished the week higher. Helping push prices higher was the increased likelihood of a second Trump presidency following the assassination attempt a week ago. In addition, a global IT outage caused by a software update by cybersecurity service provider CrowdStrike impacted many industries, but blockchains were not affected.

Bitcoin and Ethereum were up 10.72% and 8.57% respectively, over the 7 days to 21 July. Bitcoin’s market capitalisation is up to US$1.31 trillion. The total crypto market cap rose to US$2.43 trillion, while bitcoin’s market dominance is at 54.2%.

| Price | High | Low | Change from previous week | |

| BTC (in US$) | $66,835 | $67,528 | $59,640 | 10.72% |

| ETH (in US$) | $3,489 | $3,538 | $3,178 | 8.57% |

Source: CoinMarketCap. As at 21 July 2024. Past performance is not indicative of future performance. Performance is shown in US dollars and does not take into account any USD/AUD currency movements.

Source: Glassnode. Past performance is not indicative of future performance.

Crypto news we’re watching

Ether ETFs expected to debut on 23 July

The first US spot ether (ETH) ETF will most likely begin trading on 23 July, as the SEC has given preliminary approval to at least three out of the eight asset managers that have filed to launch an ETF, according to three industry sources. More may be greenlit by the evening of 22 July, with one source expecting all eight to be launched simultaneously on 23 July1.

Ethereum is the second largest cryptocurrency with a US$422 billion market cap, and accounts for just over 17% of the crypto market. Spot bitcoin ETFs have attracted over US$33 billion in inflows to the end of June since their launch in late January, but it is expected that ETH will have more modest flows.

Trump running mate a crypto advocate

Former US president and presidential candidate Donald Trump has selected a pro-crypto advocate to be his running mate. Senator JD Vance has been named to assume the position of Vice President should Trump win.

Vance is a member of the Senate Banking Committee and has been pushing for clear crypto regulations. He has also criticised the SEC’s enforcement-based regulatory approach. Vance is aligned with Trump’s broadly supportive stance on bitcoin, and the ex-President’s stated intention to end Biden’s ‘anti-crypto’ policies.2

TeraWulf pushes into A.I.

Bitcoin miner TeraWulf repaid a debt of $77.5 million ahead of schedule, which may allow it to better capitalise on the increasing demand for energy infrastructure which can be used for powering generative AI technology. The company is looking to convert part of its infrastructure to high-performance computing data centres, which can power artificial intelligence applications3. Its shares have more than doubled so far this year.

TeraWulf is currently held in Betashares Crypto Innovators ETF (ASX: CRYP)4. According to the company’s website, TeraWulf develops, owns and operates “fully integrated Bitcoin mining facilities in strategic locations across the United States, generating attractive investor returns while providing sustainable benefits for our communities”.

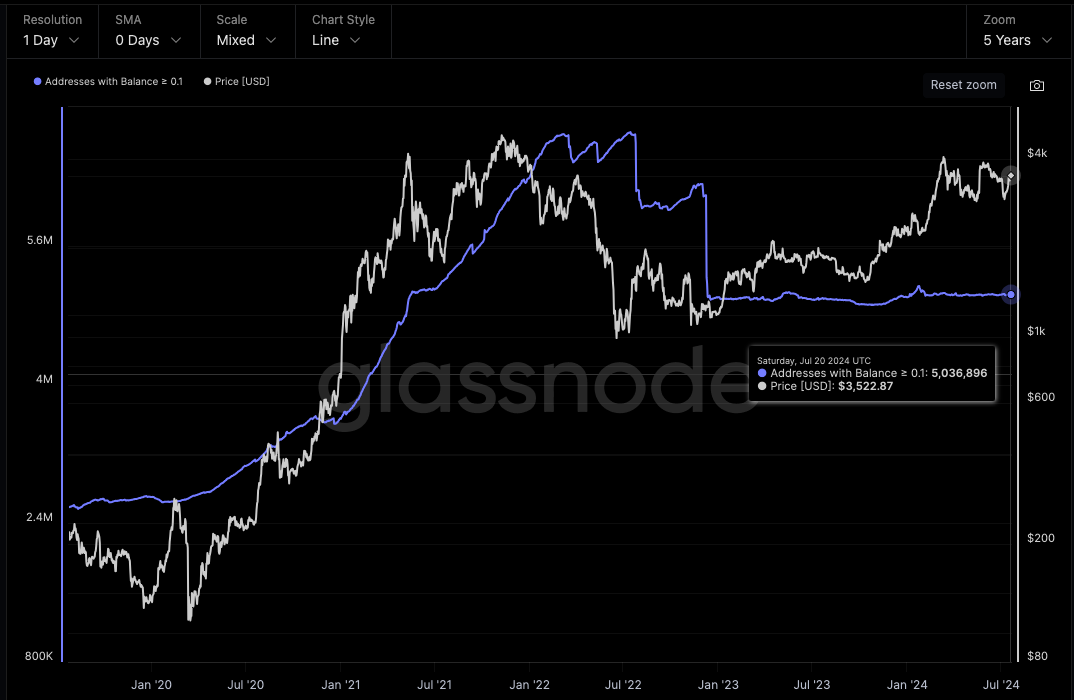

Bitcoin (BTC): Number of Addresses with Balance ≥ 0.1

This metric records the number of unique addresses holding at least 0.1 coins.

According to data from Glassnode, the number of unique addresses continues to stagnate since January when spot bitcoin ETFs were introduced in the US.

Source: Glassnode. Past performance is not indicative of future performance.

Ethereum (ETH): Number of Addresses with Balance ≥ 0.1

This metric shows the number of unique addresses holding at least 0.1 coins.

According to data from Glassnode, the number of addresses with at least 0.1 ETH fell dramatically in late December 2022 and hasn’t recovered since.

Source: Glassnode. Past performance is not indicative of future performance.

Altcoin news

Trading volumes were heavy on ‘Top 20’ altcoin Ripple XRP, which returned over 11% over the seven days to 21 July, but is still down more than 25% over the last year. Helping drive up the price was the news that indices and reference rates for XRP will make their debut on CME and CF Benchmarks. Additionally, in a recent interview with Bloomberg, CEO of Ripple Labs, Brad Garlinghouse, said he expects a “resolution very soon” in the legal dispute between the SEC and Ripple, which has been plaguing the company for years5.

Ripple is a money transfer network designed to serve the needs of the financial services industry. XRP is the cryptocurrency tailored to work on the Ripple network.

Investing in crypto assets or companies servicing crypto-asset markets should be considered very high risk. Exposure to crypto assets involves substantially higher risk when compared to traditional investments due to their speculative nature and the very high volatility of crypto-asset markets.

Investing in crypto assets or crypto-focused companies is not suitable for all investors and should only be considered by investors who (i) fully understand their features and risks or after consulting a professional financial adviser, and (ii) who have a very high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment. Any investment in crypto assets or crypto-focused companies should only be considered as a very small component of an investor’s overall portfolio.

References:

1. https://www.reuters.com/technology/spot-ether-etfs-likely-begin-trading-july-23-industry-sources-say-2024-07-15/

2. https://news.bitcoin.com/trump-chooses-crypto-advocate-senator-jd-vance-as-running-mate/

3. https://www.bloomberg.com/news/articles/2024-07-09/bitcoin-miner-terawulf-to-expand-energy-infrastructure-used-for-ai-hosting?utm_source=website&utm_medium=share&utm_campaign=copy

4. As at 21 July 2024. No assurance is given that this company will remain in the portfolio or will be a profitable investment.

5. https://www.coindesk.com/markets/2024/07/19/ripple-settlement-hopes-pushed-xrp-volumes-above-bitcoin-on-s-korean-exchanges-this-week/?_gl=1*3k290o*_up*MQ..*_ga*MTIxMzgxMTA1MS4xNzIxNjA3OTE4*_ga_VM3STRYVN8*MTcyMTYwNzkxOC4xLjAuMTcyMTYwNzkxOC4wLjAuMTQ5MDIzMzk2MQ..

Off the Chain is published every second Tuesday. It provides the latest news on bitcoin and the rest of the crypto market, along with analysis and insights into the world of crypto.

It provides general information only and is not a recommendation to invest in any crypto asset, crypto-focused company or investment product.