8 minutes reading time

Thursday 22 April was Earth Day 2021, a day that marks the anniversary of the birth of the modern environmental movement in 1970.

www.earthday.org nominated the theme for Earth Day 2021 as ‘Restore Our Earth’, which it said placed the focus on “natural processes, emerging green technologies, and innovative thinking that can restore the world’s ecosystems. In this way, the theme rejects the notion that mitigation or adaptation are the only ways to address climate change.”1

The scale of the climate change crisis needs little reiteration. Suffice to say that if global warming is not effectively addressed, the impact on our planet and the lives of future generations is likely to be catastrophic.

The size of the response required, and the amount of money needed to be spent on it, is correspondingly large. The United Nations Intergovernmental Panel on Climate Change (IPCC) estimates that to contain the rise in global temperatures to 1.5 to 2°C above pre-industrial levels by 2100 would require a halving in the level of greenhouse gas emissions (GGE) currently projected by 2050 under the current 2016 Paris Climate Agreement2.

The Energy Transitions Committee (ETC), a global organisation of energy producers, financial institutions and environmental groups, estimates that the additional investment required to achieve a zero carbon-emissions economy by 2050 will be US$1-2 trillion p.a.3

Sources and sinks

The more important question becomes how the world addresses this problem.

Project Drawdown, founded in 2014, is a non-profit organisation that has emerged as a leading resource for information and insight about climate solutions. Its goal is to help the world reach “Drawdown” – the “future point in time when levels of greenhouse gases in the atmosphere stop climbing and start to steadily decline”4.

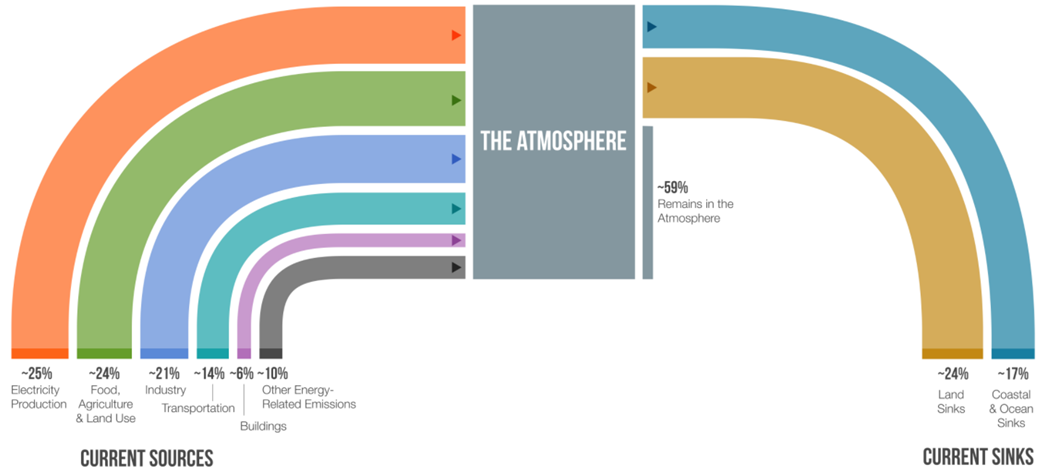

Project Drawdown has conceptualised a Drawdown Framework of ‘sources’ and ‘sinks’:

- Sources – activities that emit heat-trapping carbon dioxide (CO2) and other greenhouse gases into the air (e.g. burning fossil fuels, manufacturing steel, clearing forests, ploughing soils), and

- Sinks – nature’s means of rebalancing the climate system (e.g. natural biological and chemical processes such as photosynthesis, that bring a portion of the world’s greenhouse gases back to plants, soil, or sea).

Source: www.drawdown.org/drawdown-framework, IPCC (2014) and Global Carbon Project (2019)

Project Drawdown emphasises that to reach Drawdown, work is required on all aspects of the climate equation. Within the two broad areas of sources and sinks, there is a range of sectors and subgroups of diverse solutions—practices and technologies that can assist in the goal of stabilising and then lowering the levels of greenhouse gas in the atmosphere.

Renewable energy generation is clearly a crucial part of the solution, but the deep cuts to carbon emissions that are required cannot be achieved by clean energy alone. Furthermore, looking only at the ‘sources’ side of the equation, and ignoring the ‘sinks’, considers only part of the picture.

This has important implications for investors looking for exposure to the climate change thematic. The companies at the forefront of tackling the world’s climate and environmental problems will be found not just in the clean energy sector, but also in those providing innovative solutions across a broad range of areas including electric vehicles, energy efficiency technologies, sustainable food, water efficiency and pollution control.

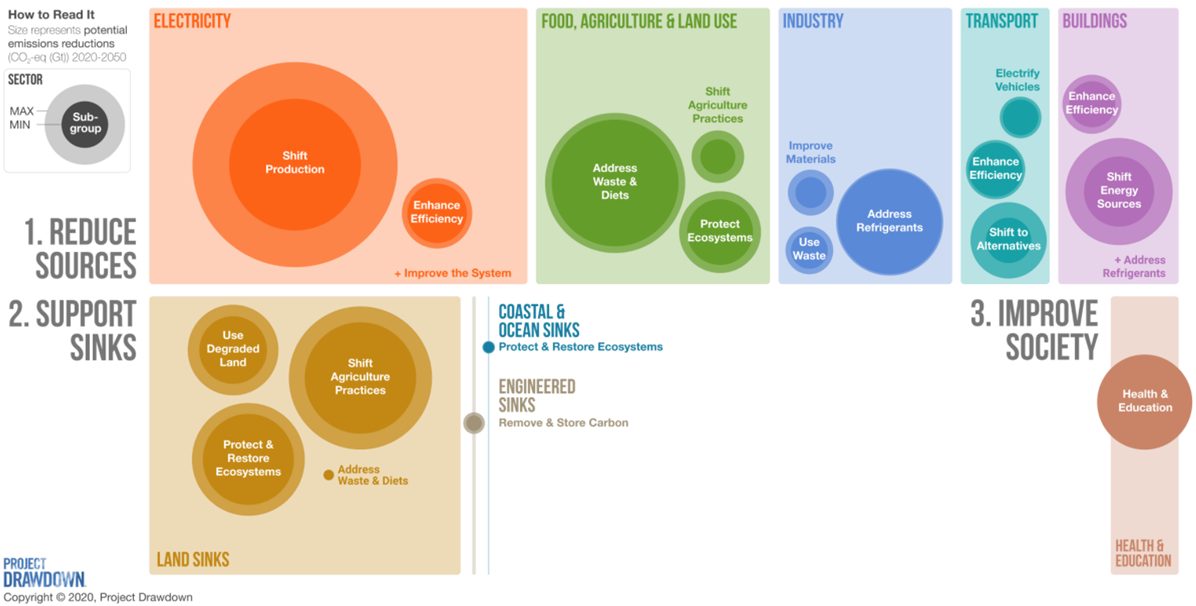

Project Drawdown divided sources into five broad areas, and quantified the potential for emissions reductions over the three decades from 2020 to 2050. While a shift in electricity production remains the single most important contributor, the chart below shows the sizeable potential contributions to emissions reductions to be found in other areas.

Source: Project Drawdown Analysis, www.drawdown.org

Project Drawdown has reviewed a range of solutions from these sectors, and projected their potential impact on reducing heat-trapping gases. It projected the global emissions impact of these solutions under two scenarios it deems both plausible and economically realistic:

Drawdown Scenario 1 – roughly in line with a 2˚C temperature rise by 2100

Drawdown Scenario 2 – roughly in-line with a 1.5˚C temperature rise by 2100.

For example, under Scenario 2, Project Drawdown projects a potential reduction of 95 gigatons of CO2 emissions from reduced food waste, which it defines as “minimising food loss and wastage from all stages of production, distribution, retail, and consumption”5. For context, this is not far behind the potential reduction in emissions of 119 CO2e gigatons from utility-scale photovoltaics.

An example of a solution within the food waste sector is meal kits, containing ingredients for cooking a meal that are pre-portioned, packaged, and home-delivered. Research indicates that meal kits have lower average greenhouse gas emissions than grocery store meals (meals where the consumer buys the individual ingredients)6.

Meal kits are pre-portioned, resulting in less food loss and waste. They have lower last-mile transportation emissions than grocery store meals, and streamlined and direct-to-consumer supply chains. While the research found a marginal increase in packaging for meal kits, the results indicated that, on average, total grocery meal greenhouse gas emissions are 33% higher than meal kits (8.1 kg CO2e/meal compared with 6.1 kg CO2e/meal kit).

On this basis, companies such as Hello Fresh or Tattooed Chef are valid inclusions in a portfolio focused on decarbonising solutions.

Scope 1, 2, and 3 emissions

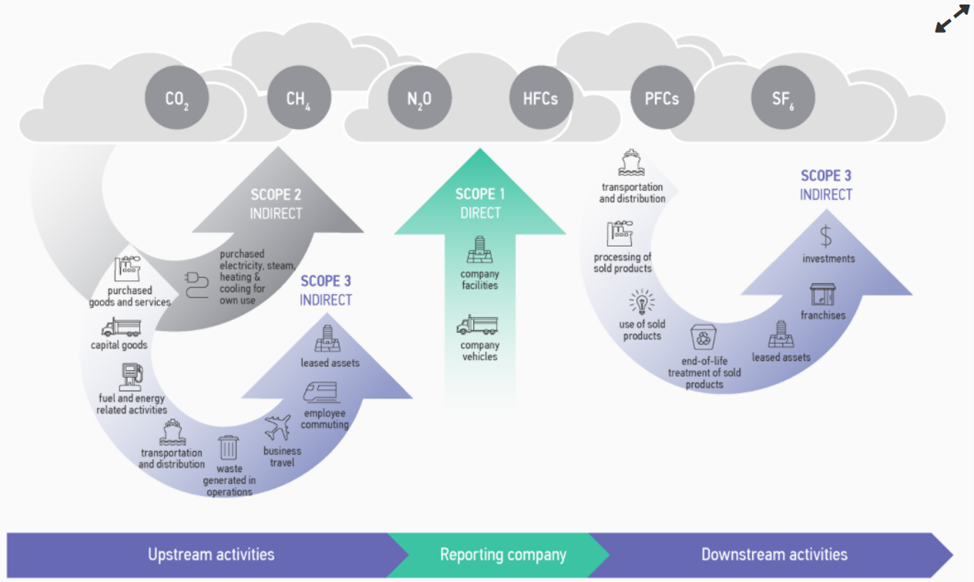

There are three types of carbon emissions for which every company is responsible7:

- Scope 1 Emissions: Direct emissions from owned or controlled sources

- Scope 2 Emissions: Indirect emissions from the generation of purchased energy

- Scope 3 Emissions: Indirect emissions (not included in Scope 2) that occur in the value chain of the reporting company, including both upstream and downstream emissions.

These are shown graphically below.

Source: Greenhouse Gas Protocol

In assessing the emissions impact of a company, all three types of emissions must be considered.

For example, Saint-Gobain is a French multinational corporation that operates in the traditionally carbon-intensive building materials segment. Saint-Gobain is making a material contribution to lowering emissions from this segment, through solutions in innovative materials, construction products, building distribution and packaging.

The company has committed to become carbon neutral by 2050 and set science-based targets to reduce their Scope 1 and Scope 2 emissions by 25% by 2025 and 33% by 2030 (relative to 2017 baseline).

Saint-Gobain produces a range of glass and insulation products that contribute significantly to insulation and energy savings in buildings. The products sold in one year enable the avoidance of over 100 times the Group’s greenhouse gas emissions, which represents the prevention of over 1,200 million tons CO2 equivalent over their lifespan.

The BetaShares Climate Change Innovation ETF (ERTH)

The ERTH Climate Change Innovation ETF provides investors with exposure to some of the world’s leading companies at the forefront of tackling climate and environmental challenges. ERTH’s portfolio comprises up to 100 leading global companies that derive at least 50% of their revenues from products and services that help to address climate change and other environmental problems through the reduction or avoidance of CO2 emissions.

Importantly, while ERTH provides significant exposure to clean energy providers, the portfolio also includes leading companies that are providing innovative solutions from other sectors that are critical in the fight against global warming.

As well as Saint-Gobain (4.5% of ERTH’s portfolio as of 21 April 2021) and Hello Fresh (1.8%), ERTH’s holdings include:

- Zoom (4.1%) – replacing in-person business meetings with video meetings is already having a significant impact on the carbon emissions associated with business travel. Between January and October last year, Zoom estimated that it had helped save 45 million metric tons of CO2, or the equivalent of what around 10 million cars produce per year8. Project Drawdown has projected that by avoiding emissions from business air travel, ‘Telepresence’ can reduce emissions by up to 3.8 gigatons of CO2 over the next thirty years9.

- DocuSign (4.3%) – DocuSign eliminates the need for paper documents through its electronic document-signing tool. Project Drawdown has projected that ‘Recycled paper’ can deliver up to 1.95 gigatons of CO2 reductions over the next thirty years (ranking it above, for comparison’s sake, electric trains)10. DocuSign goes a step further than recycling paper – avoiding paper consumption in the first place.

- Tesla (4.3%) – Project Drawdown has projected that if electric car ownership rises to 16-23% of total passenger km, by 2050, 11.9-15.7 gigatons of carbon dioxide from fuel combustion could be avoided as well as US$15.3-21.8 trillion in fuel costs11.

Conclusion

To achieve comprehensive exposure to the solutions that are required to effectively address climate and environmental challenges, investors need to look beyond the obvious solution of clean energy. Innovation will be called for in a range of sectors, to ‘reduce the sources’ and ‘support the sinks’.

The Betashares Climate Change Innovation ETF provides exposure to a broad range of solutions within these sectors, including clean energy, electric vehicles, energy efficiency technologies, sustainable food, water efficiency and pollution control.

There are risks associated with an investment in ERTH, including market risk, international investment risk, sector risk and non-traditional index methodology risk. Investment value can go up and down. An investment in the Fund should only be considered as a part of a broader portfolio, taking into account your particular circumstances, including your tolerance for risk. For more information on risks and other features of the Fund, please see the Product Disclosure Statement and Target Market Determination, both available on this website.

1. https://www.earthday.org/toolkit-earth-day-2021-restore-our-earth/

2. IPCC Special Report, Global Warming to 1.5°C, October 2018

3. Making Mission Possible: Delivering a Net-Zero Economy, Energy Transitions Committee, September 2020

4. https://www.drawdown.org/about

5. https://www.drawdown.org/solutions/reduced-food-waste/technical-summary

6. https://www.sciencedirect.com/science/article/abs/pii/S0921344919301703

7. https://ghgprotocol.org/sites/default/files/standards_supporting/FAQ.pdf

8. https://blog.zoom.us/zoom-cares-our-commitment-to-a-connected-sustainable-world/

9. https://www.drawdown.org/solutions/telepresence

10. https://www.drawdown.org/solutions/recycled-paper

11. https://www.drawdown.org/solutions/electric-cars