4 minutes reading time

Global markets

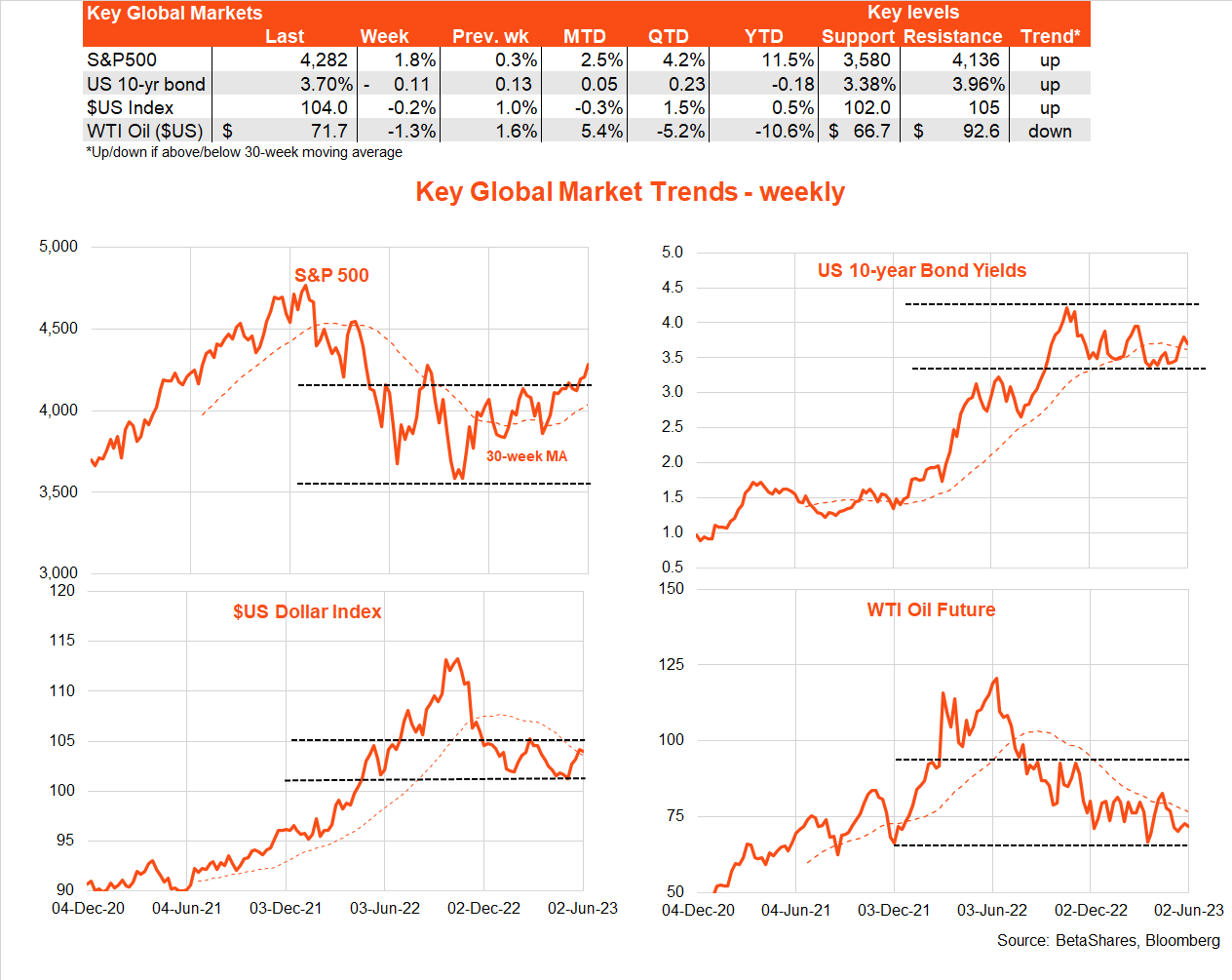

Passage of the US debt deal through both the Senate and House in Washington helped support equity markets last week, as did a ‘Goldilocks’ US payrolls report on Friday.

Although the May gain in US employment was much stronger than expected, also impressive was an increase in labour participation. This meant the unemployment rate also lifted to 3.7% (from 3.4%), while growth in average hourly earnings growth was a touch less than expected at 0.3% – keeping annual wage growth steady at 4.3%.

Meanwhile, the general sentiment from a range of Fed speakers last week seemed to be that the Fed will skip raising rates next week, though leave the door open for a potential hike in July. Along with avoidance of the debt crisis, this supported a decline in bond yields.

In short, despite all the talk of an impending US recession, global equity markets continue to trade on the hopes of a US soft landing – as they broadly have since last October – and will likely do so until the evidence proves otherwise.

While US manufacturing and housing activity are clearly ailing, US consumer spending, services and employment are still humming. Although still stubbornly high, US inflation is also at least easing, with recent encouraging signs of a slowdown in wage growth also.

Indeed, excess labour demand is easing, with more Americans returning to the workforce (after having run down their COVID savings) just as corporate America cuts back on job openings. Weekly jobless claims – a key US leading indicator of recession – remain stubbornly low.

That said, last week we learnt US job openings did bounce back somewhat in April – after declines over previous months – which raises the risk of the Fed eventually having to do more work.

It’s a largely data-light week for global markets, with US service sector indices – which are likely to remain firm – the main point of interest over Monday and Tuesday. Oil markets will also be a focus given Opec’s weekend decision to further cut production in an effort to support sagging prices.

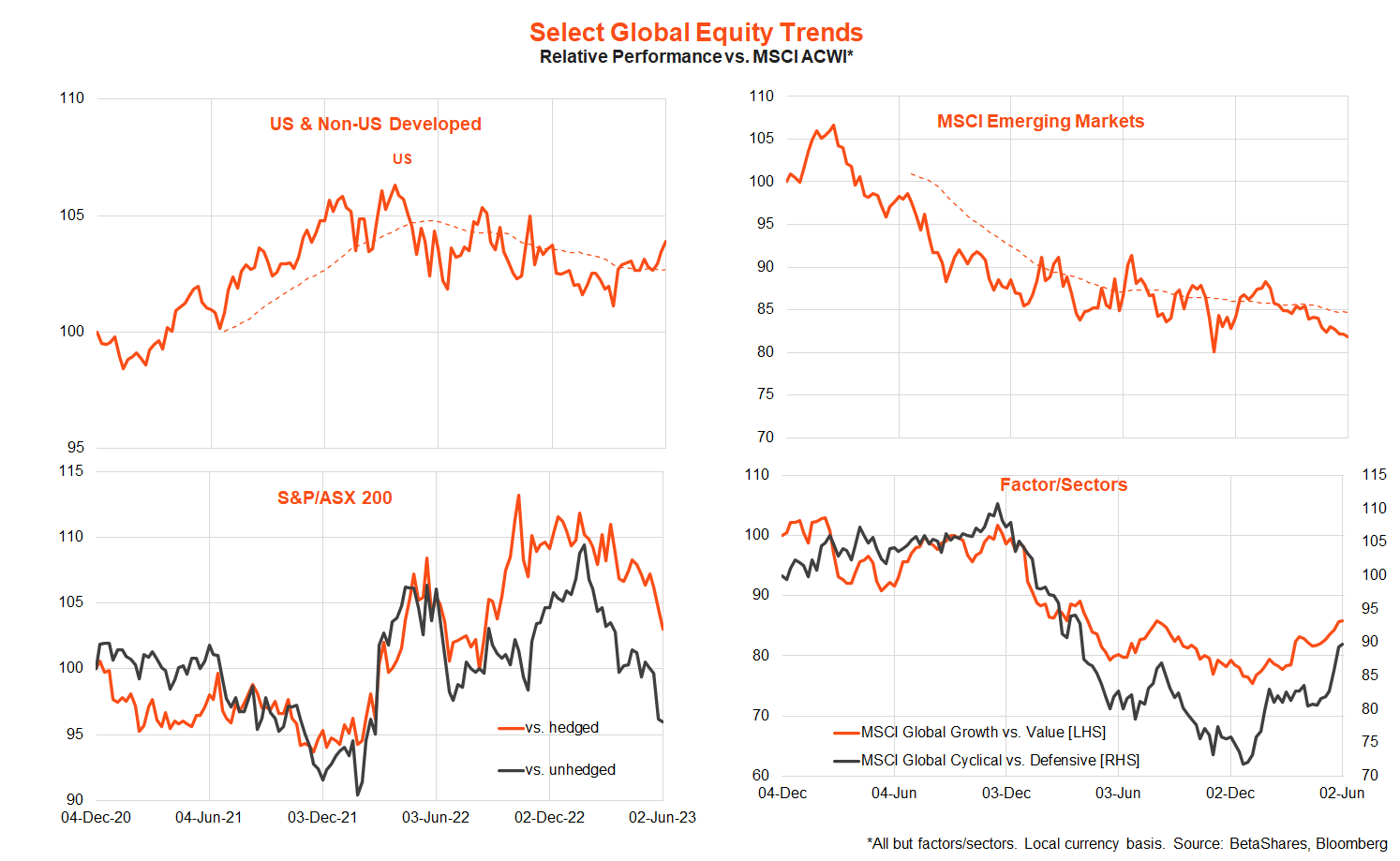

As evident in the chart set below, soft-landing hopes and the AI boom have fueled a return to favour of the US market and cyclical/growth exposures over defensive/value. Non-US developed markets (including Australia) and emerging market relative performance has suffered as a result.

Australian market

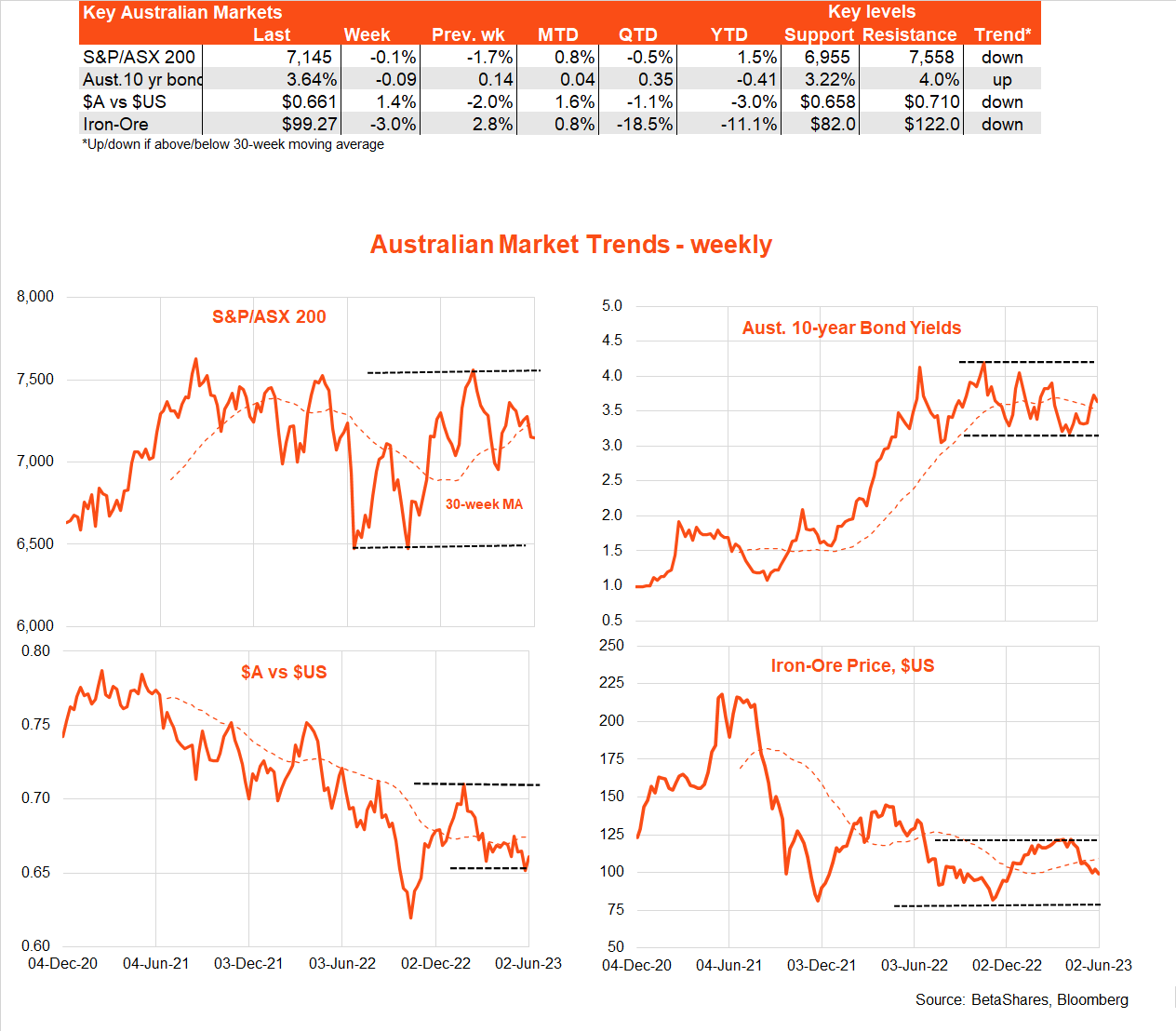

Local economic data was mixed last week, with weakness in home building approvals and mortgage lending, but the third consecutive monthly gain in national house prices.

The April consumer price index (CPI) report was also mixed, with a small monthly gain in seasonally adjusted prices (especially after excluding volatile items), though a rise in the annual rate of inflation, in part because of the very low gain in April last year due to the cut in fuel excise.

All up, with the new monthly CPI report proving to be somewhat volatile – and based on incomplete data – the mixed report card last week hardly seems the ‘red rag’ to justify an RBA rate rise this week, especially given other signs of slowing economic growth.

That said, RBA Governor Phil Lowe seemed especially feisty before a Senate Committee last week, leaving the impression the Bank retains a firm tightening bias. At 5.75%, last week’s minimum wage increase was also towards the top end of the expected range of outcomes and the early rebound in house prices is not helping. So given the RBA’s recent erratic signalling, and mixed local evidence, it’s hard to be definitive about what it might do at this week’s policy meeting.

That said, with the Fed likely on hold next week, recent weakness in local retail sales and employment, and a ‘noisy’ April CPI report, my base case view is the case for back-to-back rate increases is not in place, and so the RBA can afford to at least hold off raising rates this week. And if it does choose to skip raising rates this month, I also suspect enough evidence of local economic slowing will continue to emerge to rule out further rate hikes this cycle.

Indeed, one day after the RBA’s Tuesday policy meeting, the Q1 GDP report is likely to show the economy has slowed to a crawl so far this year, reflecting weakness in consumer spending and housing construction.

1 comment on this

Given the stronger-than-expected May gain in US employment, how did the increase in labor participation contribute to the rise in the unemployment rate to 3.7% from 3.4%? Additionally, what were the notable aspects of average hourly earnings growth, and how did it impact the annual wage growth, which remained steady at 4.3%?

Visit us telkom university