Is your portfolio really diversified?

8 minutes reading time

- Thematic

Online retail and e-commerce has changed the way billions of people around the world shop. Instead of visiting a physical ‘brick and mortar’ store, devices like your smartphone and laptop have become an access point to buy anything, from the latest electronic gadgets, to cars, and everyday groceries, anywhere.

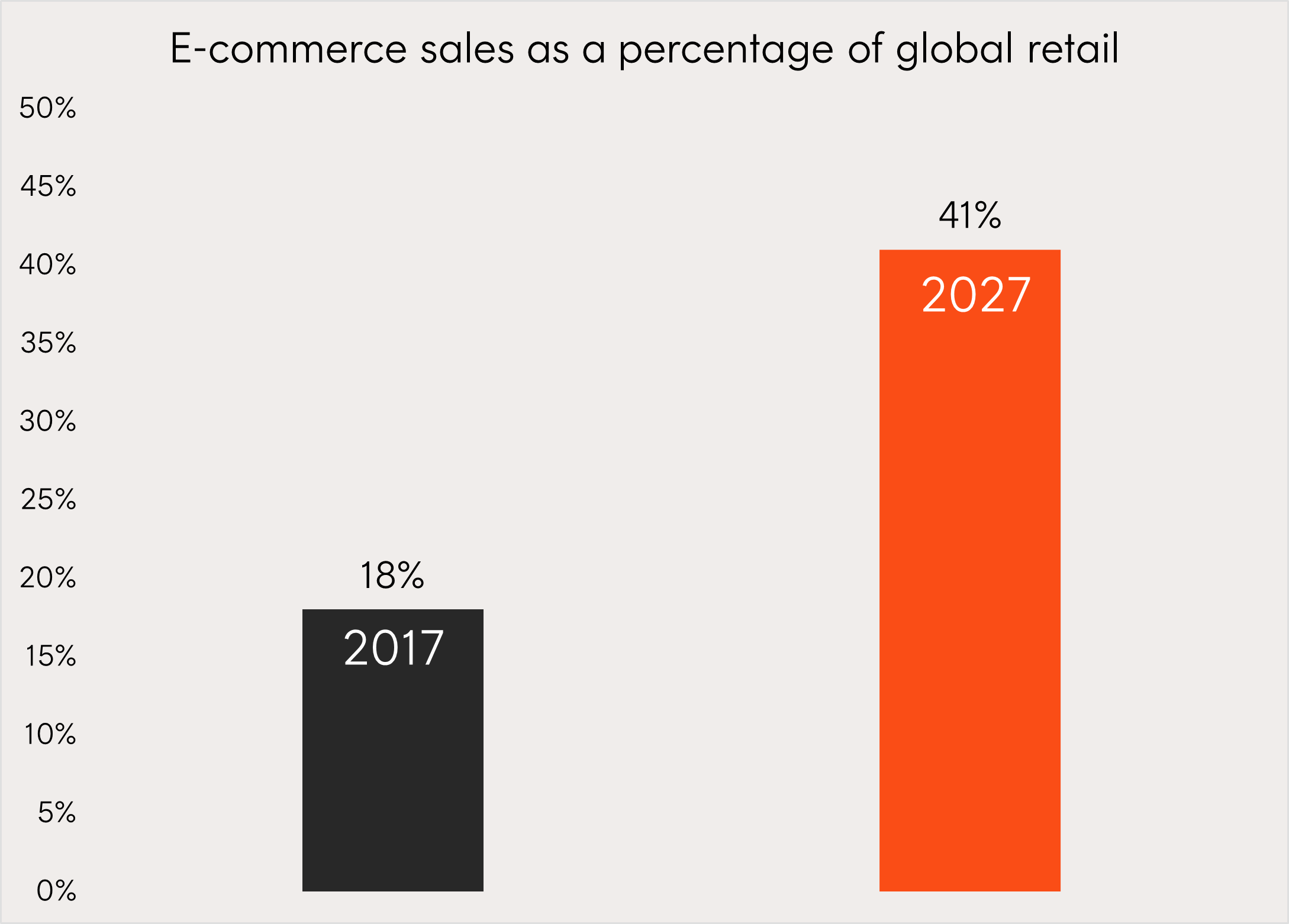

According to research by Boston Consulting Group (BCG), e-commerce sales are forecast to achieve a 9% compound annual growth rate (CAGR) through to 2027, with BCG predicting the sector to capture almost half of all global retail sales by then – up from just one fifth in 20171.

Source: Boston Consulting Group “Winning Formulas for E-Commerce Growth” report published 31 October 2023. Actual results may differ materially from forecasts.

As new online retail disruptors enter the market and internet penetration continues growing across emerging markets, the outlook remains positive for e-commerce.

In this article, we look at two companies2 held within the Betashares IBUY Online Retail and E-Commerce ETF and explore the changing nature of e-commerce through their rapid growth over recent years.

The next generation

While incumbents, like Ebay and Amazon, paved the way for e-commerce’s growth, disruptors are carving out a path for new generations of shoppers.

Only launched in 2022, Pinduoduo’s (PDD) Temu has been one of the fastest growing e-commerce platforms globally with Goldman Sachs estimating that the total value of goods sold on Temu’s platform may reach $45bn by the end of this year, up from $18bn in 2023, and less than $1bn in 20223.

Challenging the likes of Amazon with a cost-centric approach, new entrants like Temu are going a step further with a compelling proposition for consumers in a higher cost of living environment.

‘Gamification’ has become a key feature to the rise of disruptors, like Temu, which has significantly increased the amount of time active users spend shopping.

The lure of free shipping, accumulating credits to use as a discount on future purchases, and referral systems are captivating the attention of Millennials and Gen Z.

Source: Goldman Sachs Global Investment Research, Betashares. Actual results may differ materially from forecasts.

The Chinese operated online marketplace is also having a big impact in Australia, gaining 1.4 million monthly active users in in just over a year. These users accounted for a total spend of around $1.4 billion annually4. In countries where the cost-of-living crisis is becoming more pronounced, like in Australia, Temu has captured the attention of budget conscious consumers with its ultra-low-cost value proposition. Temu is aiming to continue this growth as it expands geographically and builds out its category range.

Tailwinds in emerging markets

Looking abroad, Mercadolibre (MELI) is another rapidly growing platform which has captured the relatively nascent shift to online retail across Latin America.

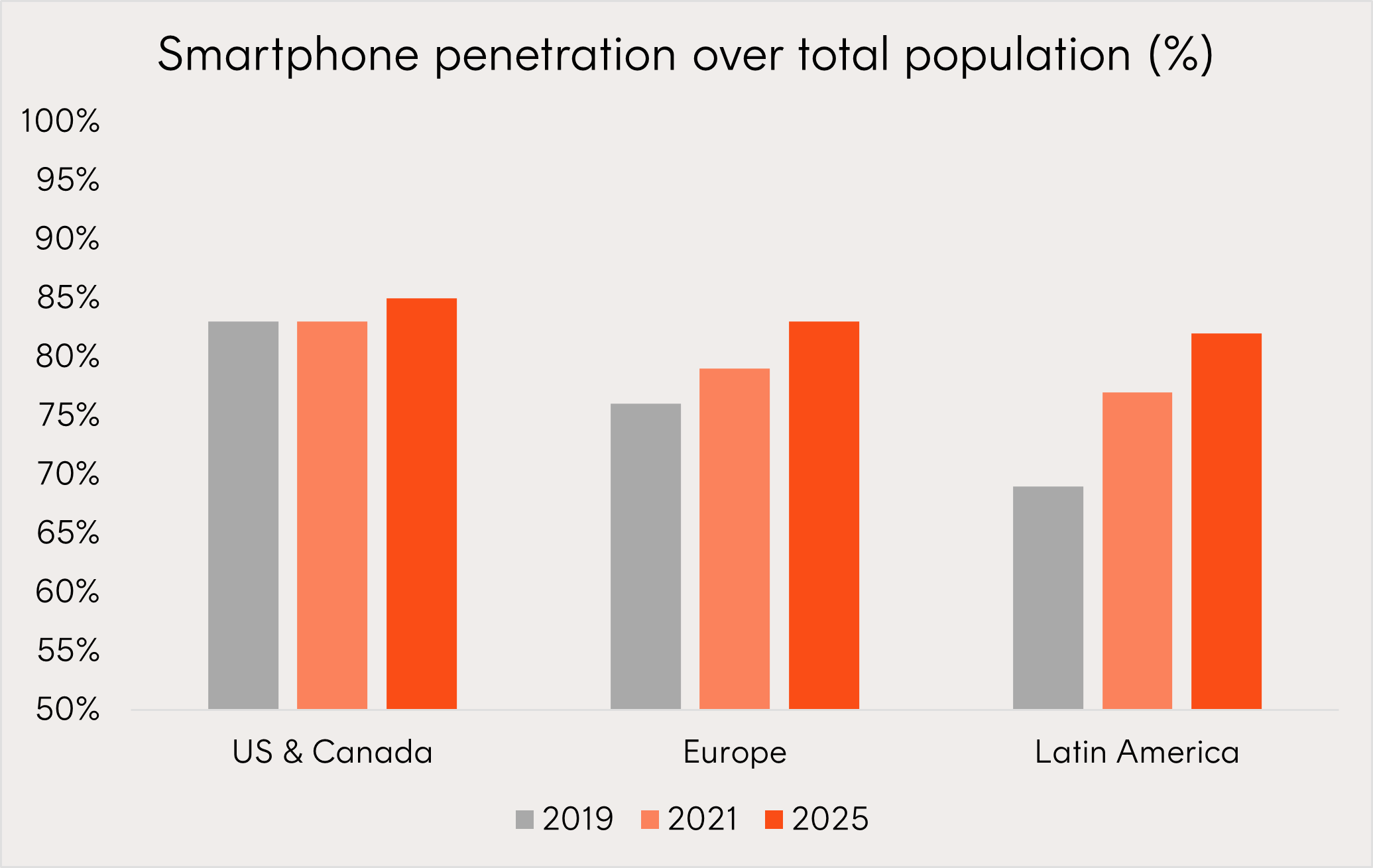

Smartphone penetration rates have grown rapidly over recent years in this region, from 69% in 2019 to a forecast of 82% by 2025 (as shown in the chart below).

Compared to more saturated markets like the US and Europe, rising smartphone usage by Latin America’s middle class has the potential to drive continued online retail sales growth.

Source: Goldman Sachs Global Investment Research, Betashares. Actual results may differ materially from forecasts.

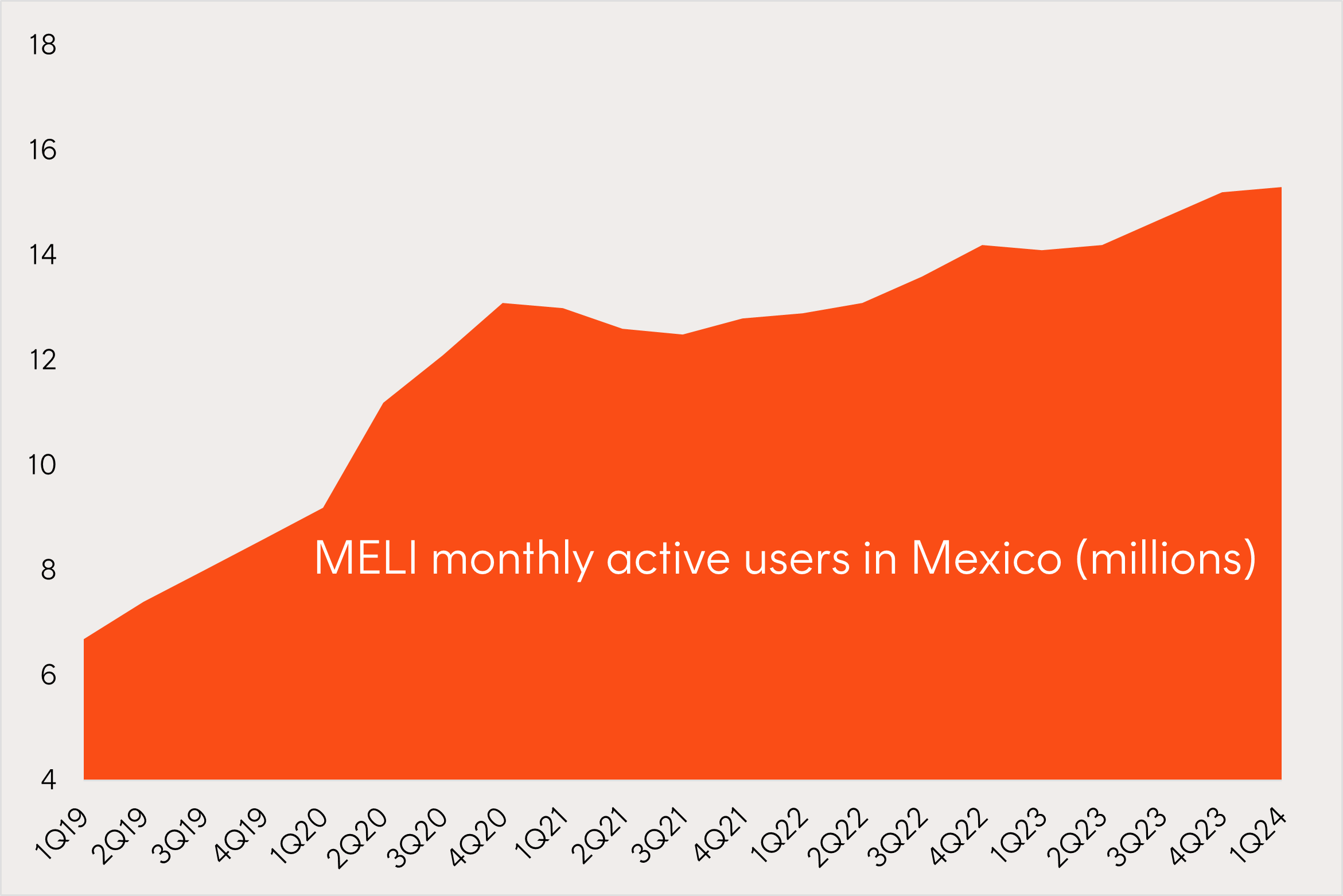

Mexico, going through its own internet penetration surge, has quickly become the fastest growing country from a revenue perspective for MELI – contributing just $17 million in the first quarter of 2018 to over $970 million in the most recent. The country now accounts for over 20% of MELI’s total revenue, up from 12% in 20195.

Source: Statista as at May 2024. Past performance is not an indicator of future performance.

Recognising the importance of Mexico to its overall business strategy, MELI recently invested $2.5 billion this year to expand warehouse facilities, enhance logistics networks and boost marketing and technology6.

Fast growing e-commerce businesses like MELI are able to aggressively capitalise on growth opportunities where internet usage is still rapidly growing in regions like Latin America.

Despite other Asian disruptors in the market, like Temu and Shein, MELI’s revenue has grown its monthly active user base by an 18% CAGR over the last 5 year period from 6.7 million users in 2019 to 15.3 million users today7. MELI’s competitive advantage is in higher service quality and providing faster shipping speeds from its vast infrastructure networks.

Source: Goldman Sachs Global Investment Research, Betashares.

Growth at a reasonable price

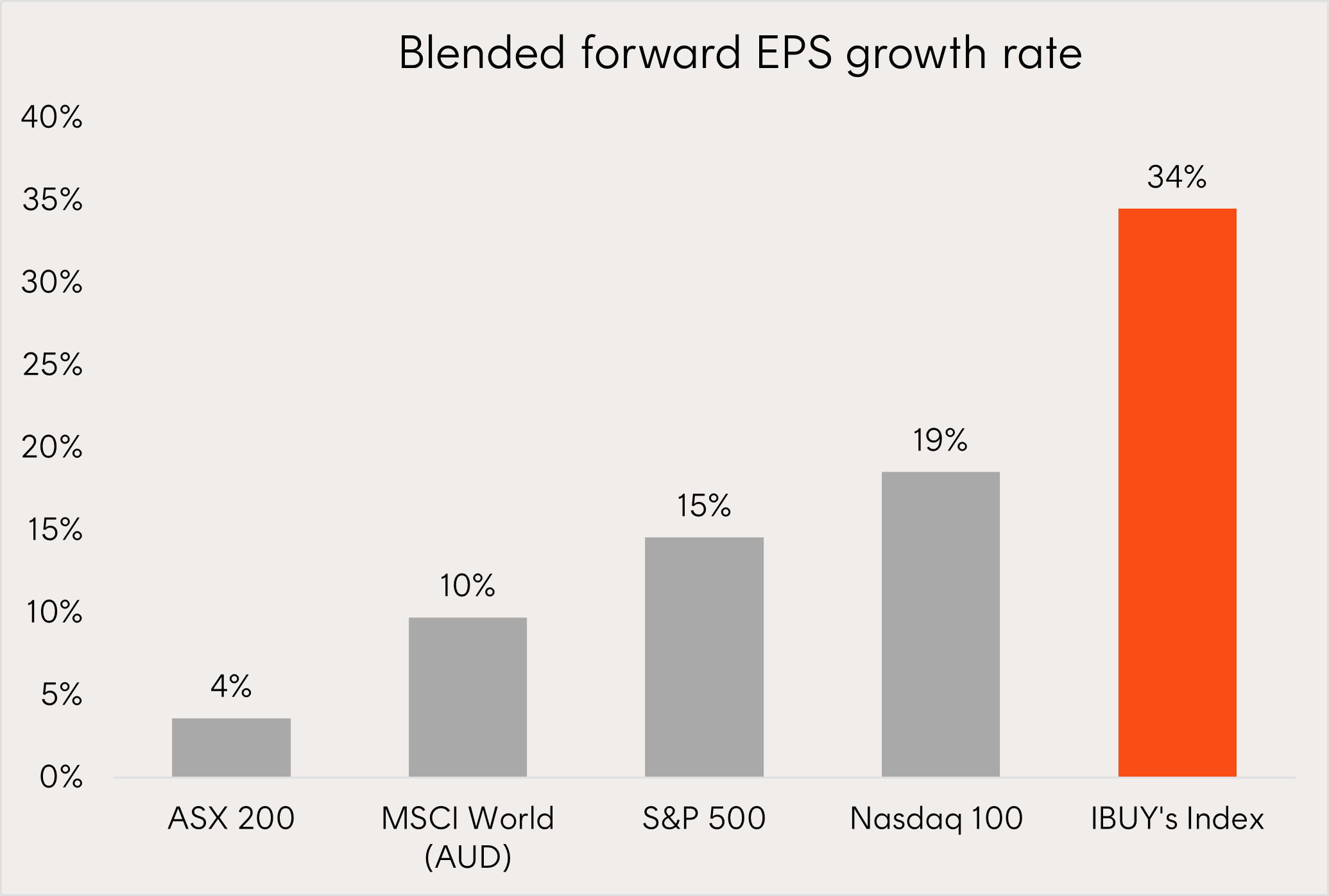

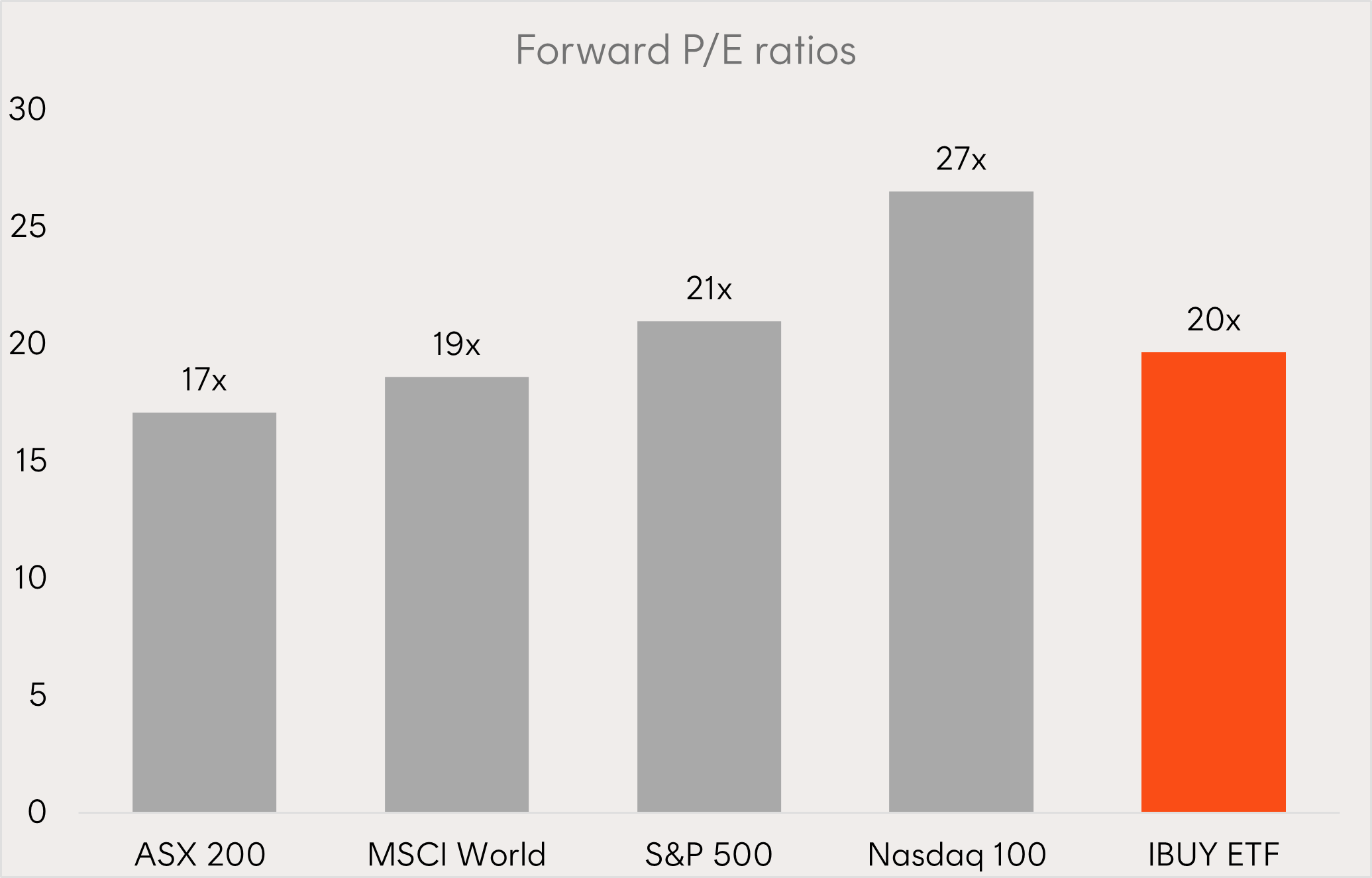

Finding growth at a reasonable price can be difficult with valuations of several market indices at all time highs, however as the metrics show in the tables below, the online retail and e-commerce sector offers growth opportunities at attractive valuations.

Based on consensus earnings forecasts, companies held within IBUY’s index are predicted to grow earnings by around 34% over the next year – which is substantially higher than broad-based market indices.

Source: Bloomberg, Betashares as at 25 June 2024. All indices denominated in AUD. Bloomberg blended forward 12 month EPS combines actual results that have been reported and estimated results that have yet to report. You cannot invest directly in an index. Past performance is not indicative of future performance.

Currently trading at a forward price to earnings ratio of 19.7x, investors can access a portfolio of online retailers that have the potential to grow fast with lower valuations than US equity benchmarks as shown in the chart below.

Source: Bloomberg, Betashares as at 25 June 2024.

Portfolio Implementation

Investors may consider IBUY:

- to complement a broader global equities allocation,

- to use as a tactical exposure to the online retail and e-commerce sector,

- or to seek capital growth within in an existing portfolio.

IBUY provides exposure to up to 100 of the world’s leading global e-commerce companies. As the metrics above demonstrate, the online retail and e-commerce sector offers growth potential higher than broad market indices and also offers potential portfolio diversification benefits to Australian investors, given that e-commerce is a sector that is under-represented in the Australian market.

You can find more information on IBUY at its fund page.

Glossary:

– CAGR – Compound annual growth rate. The rate at which a given metric – usually earnings or revenue – grows over time.

– EPS – Earnings per share. The net profit a company produces, divided by the number of shares on issue. For an index, this is generally quoted as a weighted average of the index constituent.

– P/E ratio – Price to earnings ratio. A common measure of value obtained by dividing the share price by the earnings per share.

Future results are inherently uncertain. The information above may include opinions, views, estimates, projections, assumptions and other forward-looking statements which are, by their very nature, subject to various risks and uncertainties. Actual events or results may differ materially, positively or negatively, from those reflected or contemplated in such forward-looking statements. Forward-looking statements are based on certain assumptions which may not be correct. You should therefore not place undue reliance on such statements. Betashares does not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date such statements are made or to reflect the occurrence of unanticipated events.

There are risks associated with an investment in IBUY, including market risk, international investment risk and online retail and e-commerce sector risk. Investment value can go up and down and Betashares does not guarantee the performance of the Fund. An investment in the Fund should only be considered as part of a broader portfolio, taking into account your particular circumstances, including your tolerance for risk. For more information on risks and other features of the Fund, please see the Product Disclosure Statement and Target Market Determination, both available on this website.

Sources:

1. Source: Boston Consulting Group, October 2023. ↑

2. No assurance is given that these companies will remain in IBUY’s portfolio or will be profitable investments. ↑

3. Goldman Sachs Investment Research. ↑

4. https://www.roymorgan.com/findings/9552-roy-morgan-future-of-retail-presentation-april-2024 ↑

5. Source: https://www.bloomberg.com/news/articles/2024-03-15/mercadolibre-meli-plans-more-mexico-warehouse-space-in-2024-investment ↑

6. Source: https://www.bloomberg.com/news/articles/2024-03-15/mercadolibre-meli-plans-more-mexico-warehouse-space-in-2024-investment ↑

7. Source: Goldman Sachs Investment Research ↑