6 minutes reading time

Global markets

Global equities retreated last week under a barrage of further announcements by US President Trump as well as early signs that his actions may be starting to negatively affect the economy.

There was little in the way of major US economic data last week, leaving Trump open to continue to dominate the headlines. His labelling of Ukrainian President Volodymyr Zelenskyy a “dictator” unnerved markets a little, as did Friday’s surprise announcement of 25% tariffs on cars, pharmaceuticals, and computer chips.

This comes after earlier plans to levy 25% tariffs on Canada and Mexico (which have since been postponed), a 10% additional tariff on China (still going ahead), tariffs on steel and aluminium (though exemptions are possible) and so-called “reciprocal tariffs” in early April after the White House reviews the trade restrictions imposed on the United States. Confused? You’re not the only one!

There is also now evidence that Trump’s various threats are starting to hurt the economy. Last Friday’s University of Michigan consumer sentiment survey showed a slump due to a rise in inflation fears.

Meanwhile, US Vice President JD Vance delivered a speech in Europe telling the continent’s leaders that it needs to beef up its own defences. This contributed to a further rally in defence stocks which, perhaps sadly, is now emerging as a new “Trump trade”. Those interested in the defence theme may want to look at our ARMR ETF.

While in Europe, Germany’s weekend election saw the conservative CDU party win the most votes (29%) as expected. This means its leader, Friedrich Merz, will become the next Chancellor once he has assembled a workable coalition. The ruling SPD party (under outgoing Chancellor Olaf Scholz) garnered only 16% of the vote while the Green took 12%.

And although it attained the second highest vote count (20%), the far right ‘Alternative for Germany’ (AfD), Merz says that party won’t be invited into the coalition. This means he’ll likely need to partner up with at least the SPD and possibly also the Greens.

For markets, the key issue now is whether the new governing coalition will ditch or loosen the legislative barrier to increased government spending – known as the “debt brake” – which limits new government borrowing each year to no more than 0.35% of GDP.

With relatively low public debt of 65% of GDP (at least by European standards) and a spluttering economy, markets would like to see more German fiscal stimulus. Although, for historic and demographic reasons, it likely will remain cautious in taking on more debt. Apart from stimulating the economy, Germany also faces the challenge of likely needing to boost defence spending in coming years.

All that said, the prospect of German fiscal stimulus, further ECB rate cuts, and a possible end to the Ukraine conflict are helping support European stocks, which have been outperforming global markets so far this year.

In other news, the Reserve Bank of New Zealand cut rates by 0.5% as widely expected, taking the cash rate to 3.75%. With growth weak and inflation back in the 1-3% target band, further rate cuts this year remain highly likely. The RBNZ itself is projecting a year-end cash rate of 3.1%.

Global week ahead

Apart from further Trump announcements, a key market focus this week will be the January US private consumption expenditure deflator (PCED). The PCED is the Fed’s preferred measure of inflation.

Details from the already released CPI and PPI January reports suggest an increase in core PCED prices of 0.3%, which would encouragingly drag down annual core PCED inflation from 2.8% to 2.6%. If it happens, it will be the first decline in annual inflation in six months.

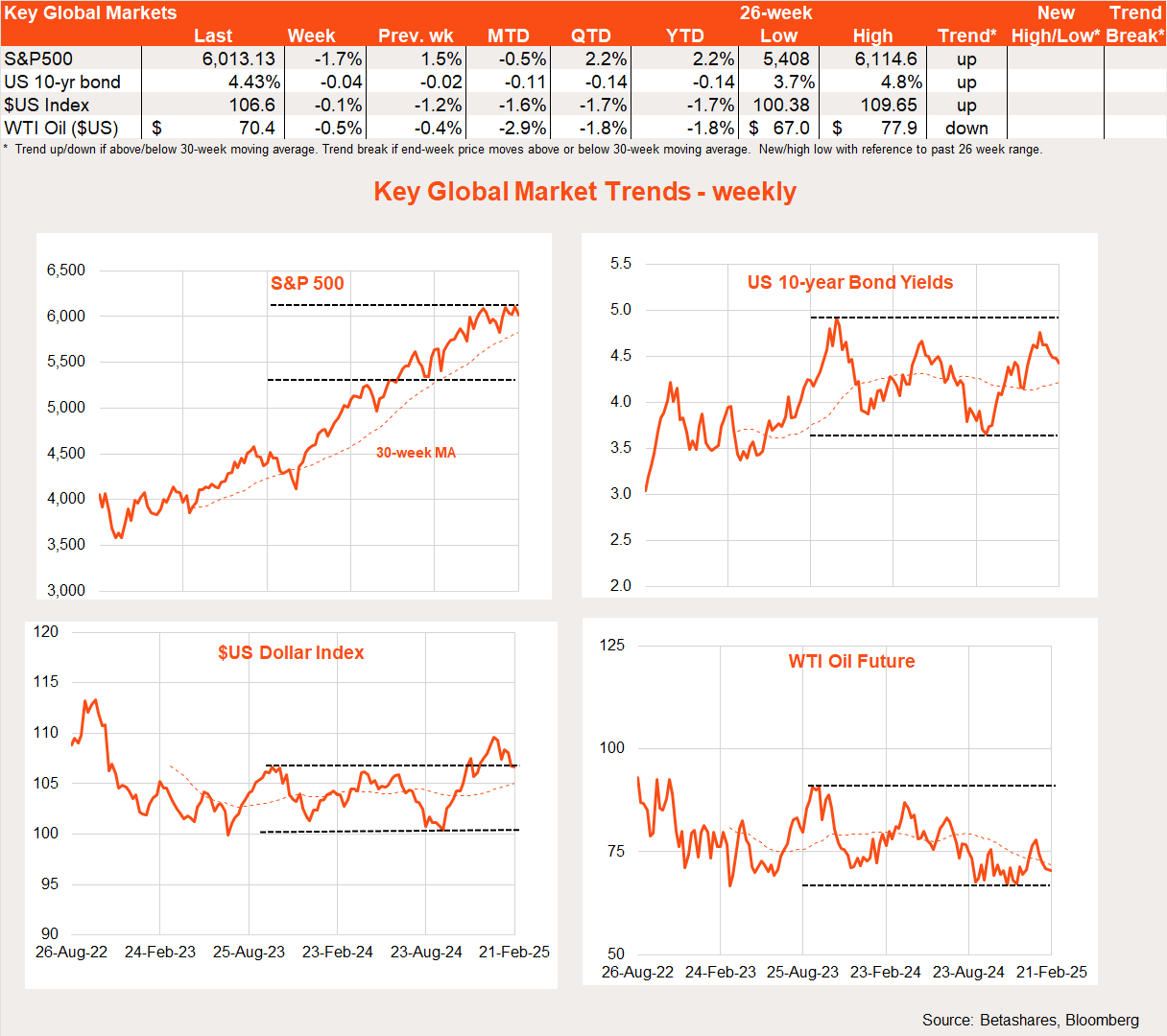

Global market trends

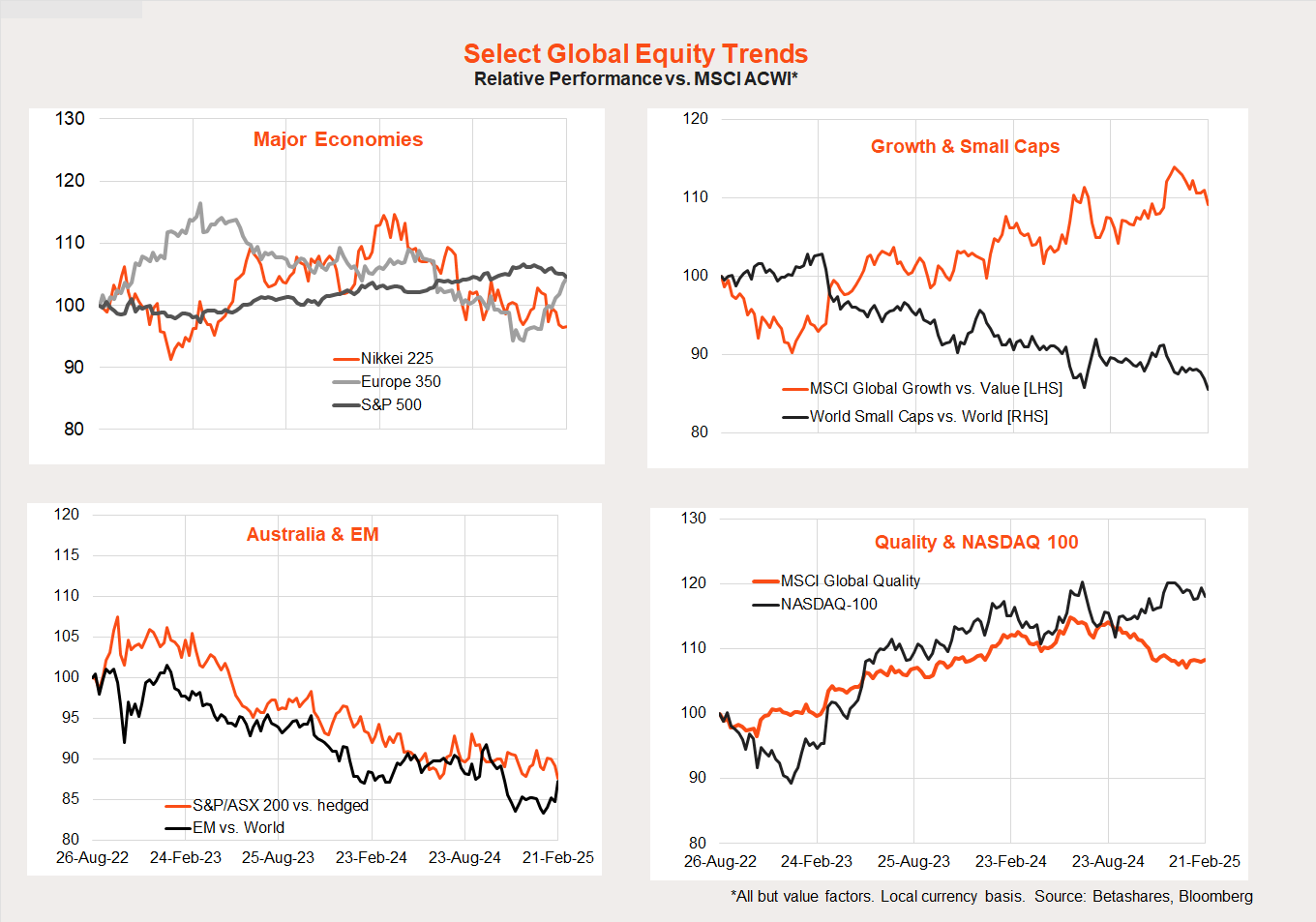

European stocks held up relatively better last week, continuing their trend of outperformance so far this year. The NASDAQ 100, meanwhile, underperformed again.

So far this year, we’ve seen a pullback in the relative performance of the NASDAQ 100 and global growth over value, replaced by a lift in Europe’s relative performance. There are also tentative signs of better emerging market performance (which rose solidly last week), along with a bottoming out of global quality underperformance.

Australian market

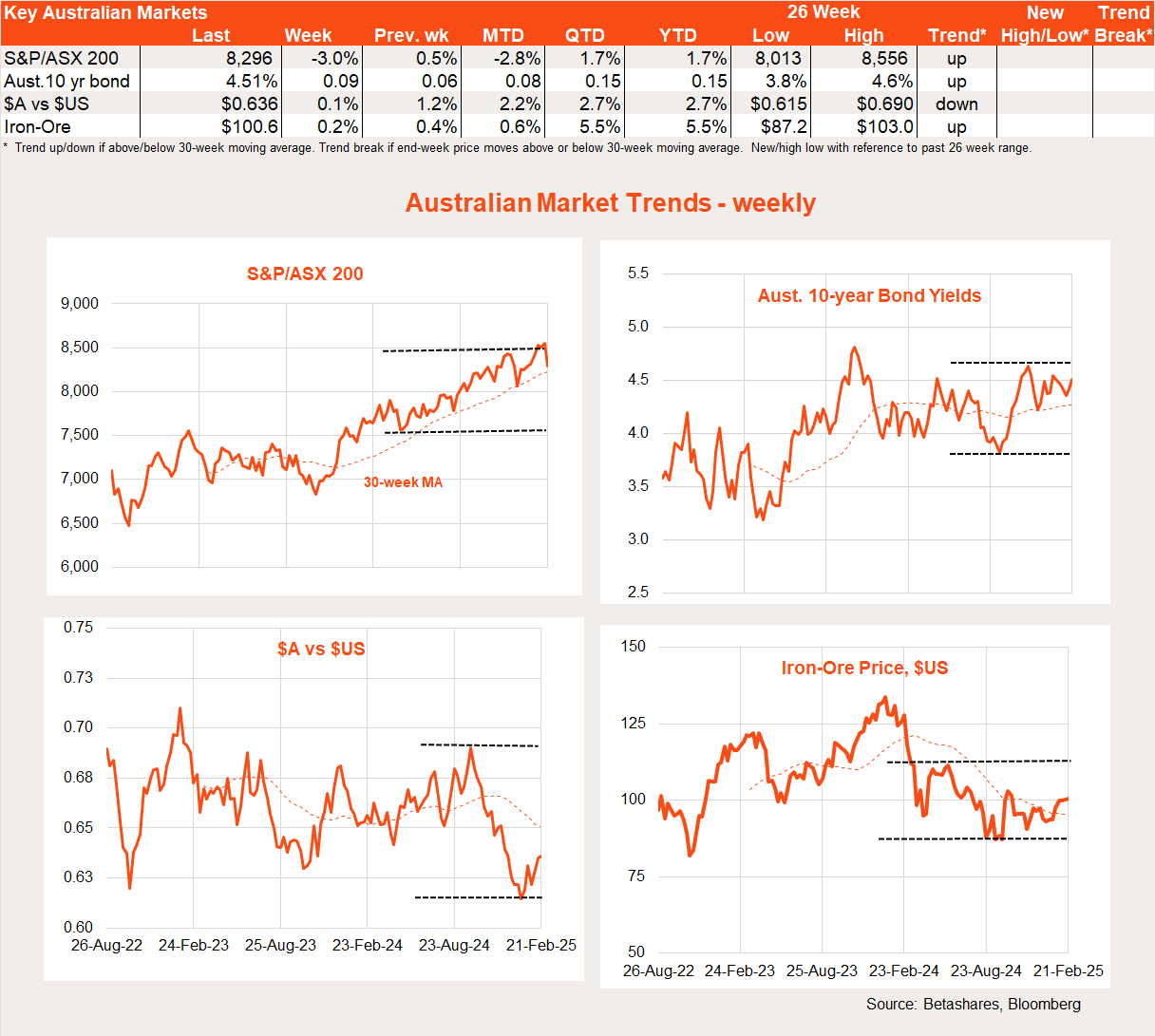

Local shares slumped last week, due to weaker global stocks, a “hawkish cut” from the RBA, and some disappointing earnings results from major banks and mining companies.

As expected, the RBA cut rates by 0.25% last week but also pushed back on market expectations for several more rate cuts this year. To my mind, the RBA is just being conservative. If its own forecasts for trimmed mean annual inflation to reach 2.7% by the June quarter proves correct (from 3.2% in the December quarter), it will likely deliver further rate cuts in both May and August.

Indeed, last week’s softer-than-expected 0.7% growth in the Q4 Wage Cost Index meant annual wage growth slowed to 3.2%. This suggests the labour market is not as tight as the RBA fears, even as last Thursday’s unemployment report showed continued solid employment growth (+44k) and a low unemployment rate of 4.1%. To an extent, employment is strong because supply is strong. Immigration is still high and workforce participation remain at record high levels.

Less encouraging were some downbeat bank earnings reports. Margins are being squeezed due to increased competition for both attracting deposits and providing home loans. Major iron-ore miner Fortescue also released weaker-than-expected profits thanks to rising costs and soft commodity prices. Along with not especially cheap valuations, a relatively softer earnings outlook highlights the challenge for the Australian market to be able to outperform its global peers.

Turning to the week ahead, investors will be focused on the monthly CPI report for January which will be released on Wednesday. Attention will be on whether the low trimmed mean annual rate of 2.7% is maintained or whether it bounces back a little (this option is more likely). We also get updates on Q4 business investment and construction which will feed into the upcoming GDP report.

Have a great week!

1 comment on this

Thanks as always David. Enjoyed the seminar this week too thank you.