DEI: Impacts of changes to US law for companies and responsible investors

8 minutes reading time

The troubled road to Australian sustainable financial product labelling regulation.

“What’s in a name? That which we call a rose by any other word would smell as sweet. So Romeo would, were he not Romeo called, retain that dear perfection which he owes without that title.” – Juliet, William Shakespeare, Romeo and Juliet, Act 2 Scene 2

Juliet was wrong.

Names are important. Names come with promises and expectations. Shakespeare’s tragic lovers may have hoped to escape the weight of their family names, but they ultimately succumbed to the obligations that came with them. The same applies to the names of financial products. When a product is labelled “sustainable”, “green”, or “impact”, it raises specific expectations about what the product holds, and what it excludes. Green bonds that fund fossil fuel projects, sustainable funds that invest in deforestation, and impact funds with no evidence of impact are all real-life examples of how a name itself can constitute greenwashing.

This mislabelling, or greenwashing, has not gone unnoticed by regulators. The growing importance of private sector investment in achieving net-zero emissions has led to a global movement towards stricter sustainable financial product labelling regulations. The European Union (EU), United States (US), and United Kingdom (UK) have developed frameworks to address this issue. In Australia, Treasury has announced plans to introduce a labelling regime in 20271.

This article examines sustainable financial product labelling regulations in the EU, US, and UK, focusing on their implications for managers and the potential unintended consequences of these frameworks.

Europe

The EU has one of the most comprehensive and prescriptive approaches to sustainable finance, primarily through the Sustainable Finance Disclosure Regulation (SFDR), which was implemented in March 2021. The SFDR requires asset managers and financial market participants to disclose how they integrate environmental, social and governance (ESG) factors into their risk processes and investment decisions. The SFDR effectively functions as a labelling regime, classifying funds based on their ESG considerations into:

- Article 6 funds, which consider ESG impacts solely in terms of risk and return.

- Article 8 or “light green” funds, which promote environmental or social characteristics.

- Article 9 or “dark green” funds, which aim for a more explicit goal of sustainable investment.

The implementation of SFDR has been fraught with confusion, uncertainty, and scepticism. Numerous funds have altered their classifications since the regulation’s introduction. Article 9 funds were downgraded to Article 8, and Article 6 funds with no claims of sustainability were upgraded to Article 8 to remove ambiguity around reporting obligations. Media reports frequently highlight examples of Article 8 and Article 9 funds that hold investments in industries such as fossil fuels or fast fashion—holdings that many investors do not associate with sustainability2.

One key problem with SFDR is its inconsistent use of the term “sustainability”. According to a recent report by the CFA Institute, SFDR uses “sustainability” in at least three different ways, none of which aligns with the widely accepted Brundtland Commission definition of sustainability as “meeting the needs of the present without compromising the ability of future generations to meet their own needs”3.

In May 2024, the European Securities and Markets Authority (ESMA) introduced guidelines for funds with names that use ESG or sustainability-related terms. These guidelines require that funds using such terms must invest at least 80% of their assets in alignment with sustainable investment objectives and must exclude sectors like fossil fuels. According to Morningstar, as of June 2024, 30 Article 8 and Article 9 funds had removed ESG-related terms from their names, with more expected to follow by year’s end4.

United Kingdom

The UK’s approach to sustainable finance regulation shares similarities with the EU’s SFDR, though it offers its own nuances. The proposed Sustainability Disclosure Requirements (SDR) aim to prevent greenwashing and offer clear information to consumers about the sustainability of their investments. The SDR proposes four labels for sustainable financial products:

- Sustainability Focus – products that are sustainable based on an absolute, robust measure of sustainability.

- Sustainability Improvers – products that invest in assets with potential to improve their sustainability over time.

- Sustainability Impact – products that seek to achieve a measurable, positive social or environmental impact.

- Sustainability Mixed Goals – products that invest across a range of sustainability objectives in a blend of strategies.

Notably, products that merely integrate ESG factors without substantial sustainability goals do not qualify for these labels. Additionally, products relying on negative screening (e.g. excluding certain industries) or basic ESG tilts will also not qualify. Labelled products must invest at least 70% of their assets in alignment with their sustainability objective, while the remainder must not conflict with that objective.

Products that do not meet these standards must remove certain terms from their names by December 2024, such as “impact” or “sustainability.” This change will affect approximately 1,200 financial products, half of which are exchange-traded funds (ETFs)5.

United States

Unlike the EU and UK, the US has yet to implement a comprehensive regulatory framework for sustainable financial products. In 2022, however, the Securities and Exchange Commission (SEC) proposed rules to standardise climate-related disclosures for investors. The key components of the SEC’s proposals include:

- Disclosure – Firms offering ESG-related products must provide consistent, transparent information about how they integrate ESG factors into their decision-making processes.

- Strategy type – Firms must disclose the specific ESG strategies they employ, whether integration, focused, or impact-oriented.

- Specific metrics – Funds must disclose the criteria and metrics they use to evaluate ESG factors, including whether third-party ratings or proprietary methods are employed.

- Impact reporting – Funds marketing themselves as “impact” funds must offer detailed reporting on how they assess and measure ESG-related impacts.

The SEC has faced considerable opposition to these proposed rules. As of September 2024, the issue remains before the U.S. Eighth Circuit Court of Appeals, delaying the adoption of a clear regulatory framework6.

Common Challenges

Across all three regions—EU, UK, and US—regulatory frameworks for sustainable financial products face several common challenges, including inconsistent terminology, overly broad objectives, and insufficient categories to cover the full spectrum of responsible investment approaches:

- Poorly defined or too many objectives – Regulators have attempted to create frameworks that not only define sustainable products but also serve as classification systems, disclosure requirements, and greenwashing deterrents. However, achieving these multiple goals with a single framework has proven difficult. Clear, unambiguous objectives are crucial for regulatory standards to be effective.

- Insufficient categories – The broad label of ethical and responsible investment encompasses a variety of approaches, including ESG integration, negative screening, and impact investing. Ideally, a classification system would have enough mutually exclusive categories to accommodate all possible approaches. The problem arises when categories are too few, leading to fundamentally different strategies being lumped together under the same label. This problem is made worse if there is explicit or implied ordinality (i.e. good, better, best).

- Integrous Criteria – the criteria used to classify products should be objective, measurable and evidenced-based. For example, in the UK’s proposed SDR framework, a “Sustainability Improvers” fund might include companies with the potential to improve their sustainability performance. However, potential improvement does not guarantee actual progress. Similarly, companies should not be included in a ‘transition’ fund based on published emissions targets. Such inclusion should be based on real outcomes and where capital has been deployed.

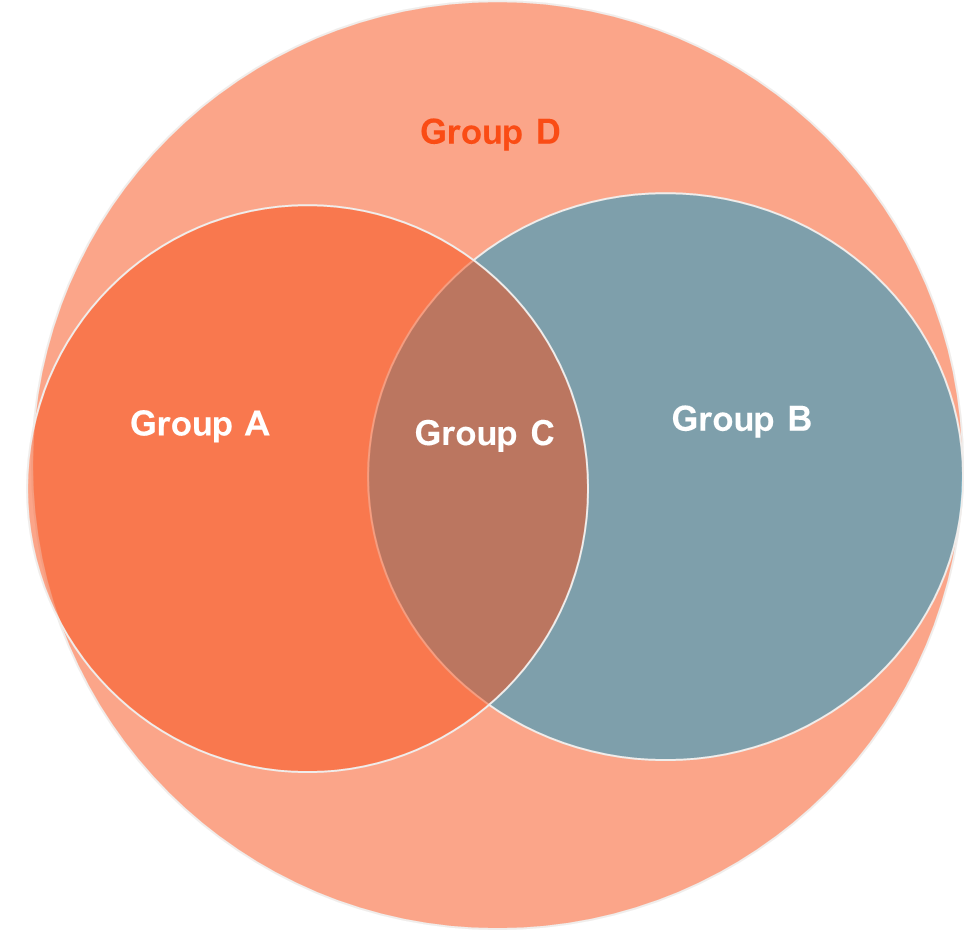

- Poorly or inconsistently defined terms –“sustainable” has been inconsistently defined across jurisdictions, causing confusion for stakeholders. To highlight some of the problems that arise, let’s divide the universe of companies into four groups:

Figure 1: Mutually exclusive groups based on positive and negative externalities

- Group A companies have positive social or environmental impacts

- Group B companies have negative social or environmental impacts

- Group C companies have both positive and negative social or environmental impacts

- Group D companies have neither positive nor negative social or environmental impacts

If we use the term ‘sustainable’ to describe an investment product:

- A portfolio comprising Group A and Group D companies would meet the Brundtland Report definition of ‘sustainable’ due to the exclusion of companies that ‘constrain the ability of future generations to meet their own needs’. This portfolio would not however meet a criterion that required a certain threshold of companies to contribute to a ‘sustainability objective’.

- A portfolio comprising Group A and Group C companies would meet a ‘sustainability objective’ criteria but would not comply with the Brundtland Commission definition of ‘sustainability’ due to the inclusion of companies with negative externalities.

- A portfolio comprising only Group A companies would meet both definitions of sustainability. It should be noted such a portfolio would, ipso facto, be less diversified.

Conclusion

The evolution of sustainable financial product labelling regulations is essential to combat greenwashing and ensure transparency in global financial markets. While the EU, UK, and US are making significant strides, each faces challenges in consistency, clarity, and applicability. Australia’s upcoming labelling regime in 2027 will benefit from lessons learned globally. Clear definitions, precise categories, and objective criteria are critical to creating a regulatory framework that effectively supports sustainability without misleading investors.

Footnotes:

1. Announced June 2024, https://treasury.gov.au/sites/default/files/2024-06/p2024-536290.pdf ↑

2. Hanging by a thread? Responsible Investor 27 August 2024 ↑

3. September 2024 https://rpc.cfainstitute.org/-/media/documents/article/industry-research/esg-fund-classification.pdf ↑

4. https://assets.contentstack.io/v3/assets/blt4eb669caa7dc65b2/blt8d7c67f2f5f003c1/66a15f8a34fa9a94ac3bd747/SFDR_Article_8_and_Article_9_Funds_Q2_2024.pdf ↑

5. https://www.etfstream.com/articles/half-of-1-200-funds-impacted-by-sdr-esg-fund-naming-rules-are-etfs ↑

6. https://www.esgtoday.com/sec-defends-its-climate-disclosure-rule-in-court/ ↑