Bitcoin ETFs: What are they and how do they work?

5 minutes reading time

Bitcoin and the broader crypto market ended the week lower. Weighing on the market were regulatory concerns, with news that Kraken had agreed to discontinue its crypto staking service to settle US Securities Exchange Commission (SEC) charges that it had failed to register the program. The bitcoin price hit a low not seen for three weeks.

As at 12 February 2023, bitcoin was trading at US$21,820. Ethereum underperformed bitcoin over the week, down 8.18% vs bitcoin’s 6.75% loss. Bitcoin’s market capitalisation fell to US$420.8 billion, with the total crypto market sitting at US$1.02 trillion. Bitcoin’s market dominance was at 41.3%.

| Price | High | Low | Change from previous week | |

| BTC (in US$) | $21,820 | $23,423 | $21,539 | -6.75% |

| ETH (in US$) | $1,532 | $1,688 | $1,504 | -8.18% |

Source: CoinMarketCap. As at 12 February 2023. Past performance is not indicative of future performance. Performance is shown in US dollars and does not take into account any USD/AUD currency movements.

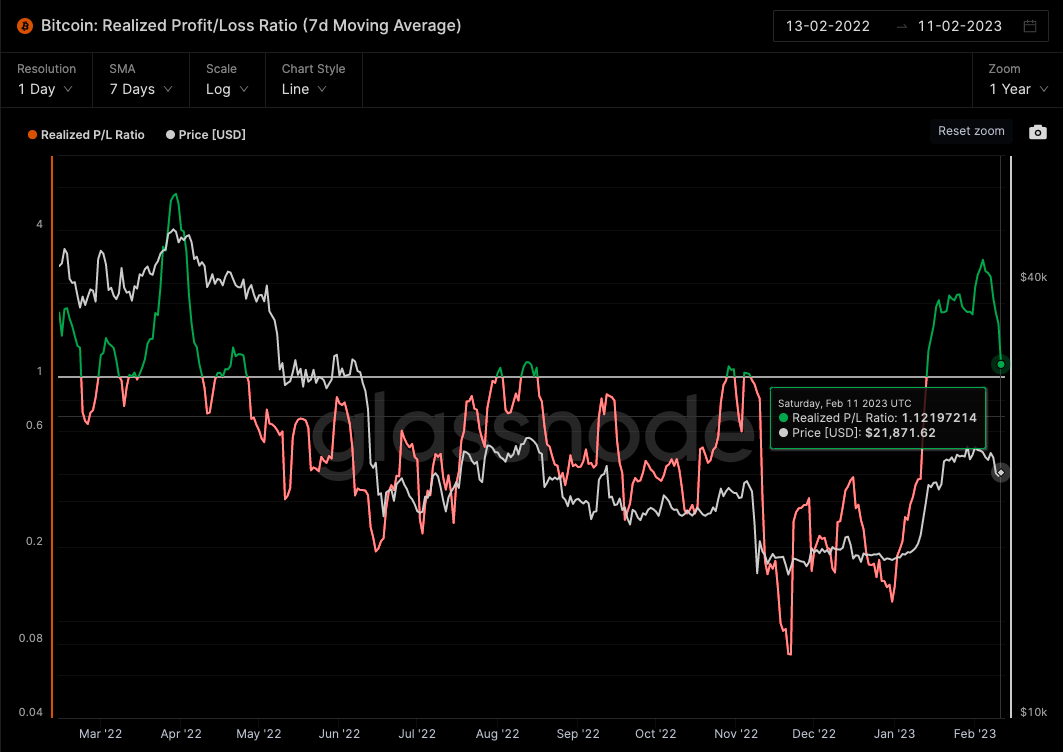

Source: Glassnode. Past performance is not indicative of future performance.

Source: Glassnode. Past performance is not indicative of future performance.

Crypto news we’re watching

SEC cracks down on staking services

Cryptocurrency exchange Kraken has settled its charges with the SEC by agreeing to halt its crypto staking services and programs and paying a US$30 million fine. The firm had been offering staking services since 2019.

In a blog post, Kraken stated that it will continue to offer staking services for non-US clients through a separate Kraken subsidiary, however it will automatically unstake all US clients’ assets enrolled in the on-chain staking program.1

SEC Chair, Gary Gensler, said: “Whether it’s through staking-as-a-service, lending, or other means, crypto intermediaries, when offering investment contracts in exchange for investors’ tokens, need to provide the proper disclosures and safeguards required by our securities laws. Today’s action should make clear to the marketplace that staking-as-a-service providers must register and provide full, fair and truthful disclosure and investor protection.”2

PayPal pauses stablecoin plans

PayPal was planning on launching a stablecoin in the upcoming weeks but has announced it is putting those plans on hold, due to the changing regulatory landscape, according to a person with knowledge on the matter, reported by Bloomberg. The firm Paxos Trust Co., with whom PayPal was working on the stablecoin, is currently under investigation by the New York State Department of Financial Services.

PayPal spokesperson, Amanda Miller, said: “We are exploring a stablecoin. If and when we seek to move forward, we will, of course, work closely with relevant regulators.”3

Tether increases profits in Q4

The company behind the largest stablecoin USDT, Tether Holdings Limited, reported US$700 million in net profits for Q4 2022, in its latest attestation reports. Tether ended the year with at least $67 billion and excess reserves of $960 million in total assets. It also reported it no longer holds any commercial paper, with exposure of over 58% to US Treasury Bills and the remainder held in money market funds, cash and other items at the end of 2022. Tether also reduced its secured loans by $300 million and reported liabilities of $66 billion, almost all which relates to digital tokens issued.4

On-chain metrics

Source: Glassnode. Past performance is not indicative of future performance.

Bitcoin (BTC): Number of Transactions (7d Moving Average)

This metric shows the total number of transactions on the Bitcoin network.

According to data from Glassnode, the number of transactions on the Bitcoin network started to pick up towards the end of December and has continued to increase, reaching new 1-year highs.

Source: Glassnode. Past performance is not indicative of future performance.

Altcoin news

In altcoin news, The Graph (GRT) surged over 44% in the seven days to 12 February to enter the Top 40 cryptocurrencies. Helping push the token higher is the positive growth in its network. GRT recorded 66% quarter-over-quarter growth in its revenue from query fees in Q4 2022.5

According to The Graph’s website, ‘The Graph is an indexing protocol for querying networks like Ethereum and IPFS. Anyone can build and publish open APIs called subgraphs, making data easily acceptable.’6

|

Investing in crypto assets or companies servicing crypto-asset markets should be considered very high risk. Exposure to crypto assets involves substantially higher risk when compared to traditional investments due to their speculative nature and the very high volatility of crypto-asset markets. Investing in crypto assets or crypto-focused companies is not suitable for all investors and should only be considered by investors who (i) fully understand their features and risks or after consulting a professional financial adviser, and (ii) who have a very high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment. Any investment in crypto assets or crypto- focused companies should only be considered as a very small component of an investor’s overall portfolio. |

1. https://blog.kraken.com/post/17619/settlement/

2. https://www.sec.gov/news/press-release/2023-25

3.https://www.bloomberg.com/news/articles/2023-02-10/paypal-pauses-stablecoin-work-amid-regulatory-scrutiny-of-crypto?leadSource=uverify%20wall

4. https://tether.to/en/tether-continues-to-demonstrate-strength-of-reserves-reveals-dollar700m-profits-for-q42022-in-latest-attestation-report/

5. https://cointelegraph.com/news/end-of-bull-run-the-graph-awaits-correction-after-a-200-grt-price-rally

6. https://thegraph.com/en/

Past performance is not indicative of future performance.

Off the Chain is published every Tuesday. It provides the latest news on bitcoin and the rest of the crypto market, along with analysis and insights into the world of crypto.

1 comment on this

The SEC & the Chair Gary Gensler have become much more anti-crypto recently. Each time SEC has taken an action or Gensler made a decision, this would somehow benefit the Wall Street (or SBF & FTX Alameda in past). In general, the establishment Wall Street finance & banking system has always viewed cryptocurrencies and the blockchain tech as the potential foe and threat. Therefore, this finance lobby power had indirectly (with the help of political lobbyists and favorable Fed bureaucrats) blocked or slowed crypto regulatory & legal processes/procedures. That’s why the US crypto market has to operate under legal uncertainty where each US Federal agency treats them differently in terms of how this agency legally views cryptocurrencies – some treating crypto as assets, others as securities or a property.

The EU is far ahead of the US with the MICA Act. That’s why the US has to move swiftly and adopt much cleaner & well-defined set of rules and regulations, overall regulatory framework. And this is an absolute must for the crypto mass adoption, blockchain tech’s more rapid growth & development.

And those on the Wall Street who saw significant potential in the crypto & blockchain have become major actors, investors and crypto asset holders. This is exactly what had fueled the past bull run, the entrance of the smaller scale and individual organizational money & funds.

Hopefully more crypto-knowledgeable and crypto friendly politicians lead this policy debate and legal & regulatory changes.

Gensler did an extremely good job in not answering any questions during the grilling and that’s precisely what he was there at the hearing for: Not to answer any questions! I don’t think the crypto & blockchain community of USA will see any significant policy shifts very soon.