On again, Off again

4 minutes reading time

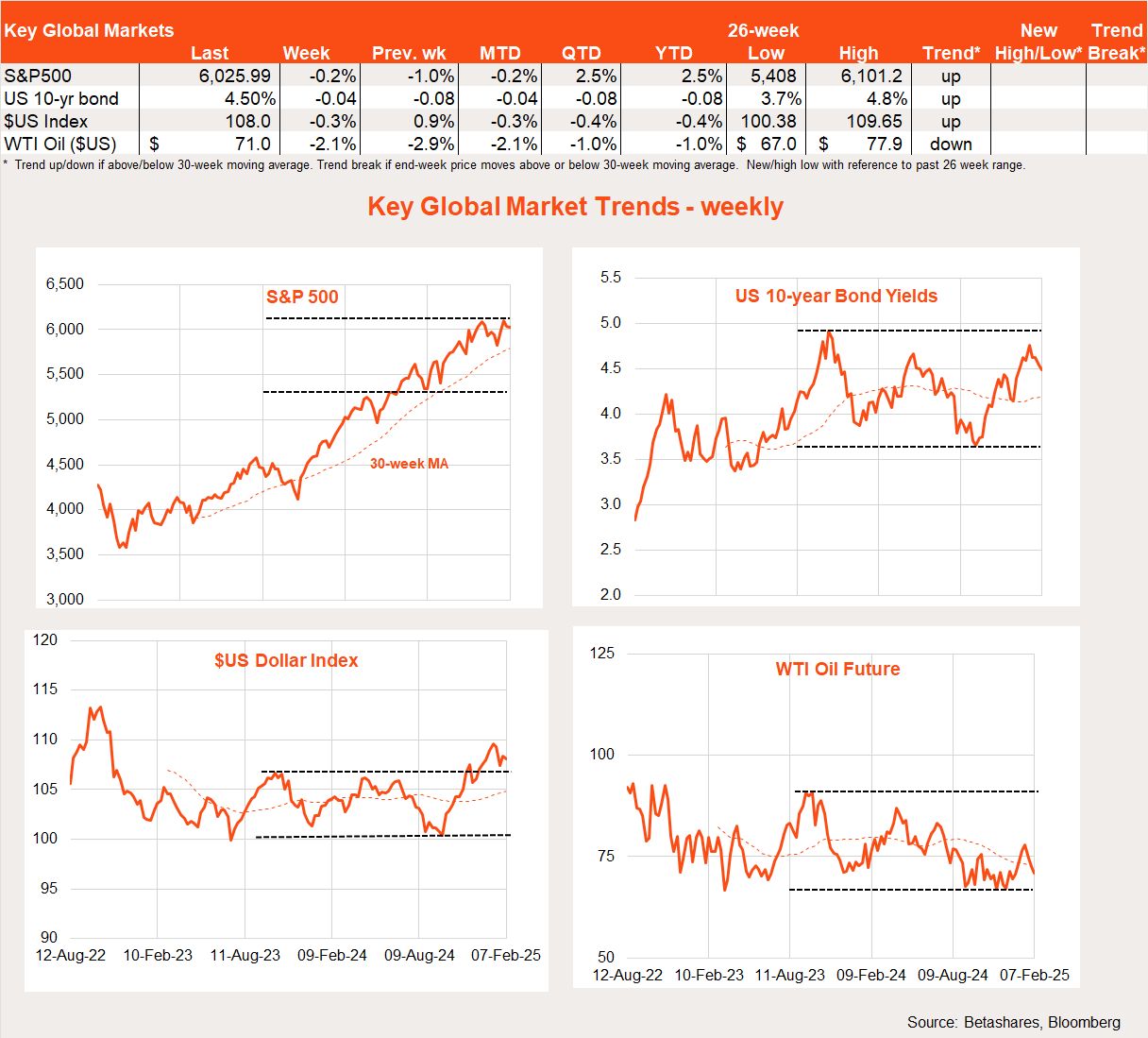

Global markets

Global equities softened further last week reflecting lingering concerns over US tariffs and inflation.

Global equities enjoyed a modest relief rally early last week as US President Trump delayed his proposed 25% tariff on Mexican and Canadian imports – following promises by both countries that they would do more to stop the illegal flow of drugs and people across their borders. China was not spared, and announced its own retaliatory measures.

The market relief was short-lived, however, with the latest Trump thought bubble coming on Friday, with news the US would instead impose “reciprocal tariffs” – namely tariffs on trading partners in line with the tariffs they imposed on US imports. On Sunday, Trump announced new 25% tariffs on all steel and aluminium imports.

One lingering question is the purposes of tariffs – in the trade war 1.0 they were seen as temporary measures to force various concessions from other countries. But under trade war 2.0 Trump has at times talked in terms of using tariffs to permanently raise revenue to help fund tax cuts. Which is it? Only time will tell, but if they are permanent they lose their negotiating value and risk a sustained increase in US inflation and retaliation from other countries. We’ll see – but I suspect Trump’s utopian vision of huge protective tariffs and low income taxes will crash on the rocks of reality soon enough.

In other news, Friday’s US January payrolls report was mixed – with weaker-than-expected employment growth (+143k vs +170k market expectation), yet a lower-than-expected unemployment rate (4.0% vs 4.1%) and higher-than-expected growth in wages (+0.5% vs +0.3%). Also noted by Wall Street on Friday was a drop in US consumer confidence and spike in household inflation expectations – likely reflecting concerns over the potential price impact of tariff increases. Along with Trump’s reciprocal tariffs announcement, all this was enough to send the S&P 500 down 1% on Friday.

Outside the US, European inflation was a touch stronger than expected in January, due mainly to higher energy prices. New Zealand unemployment lifted to 5.1% in Q4, a bleak result though in line with market expectations.

Global week ahead

Apart from likely further Trump noise, a key focus for global markets this week will be the US CPI January inflation report on Thursday (US time). Core prices are expected to rise 0.3%, after a benign 0.2% in December, which would keep annual core inflation steady at 3.2%.

US Fed chair Powell returns to the spotlight this week with his semi-annual testimony to Congress. He is likely to remain open to the idea of lower interest rates this year, though note it obviously depends on further progress in lowering inflation. Trump likely won’t miss the opportunity to chime in with his view (that rates should fall) potentially sparking another misguided media frenzy around Fed independence and Powell’s future.

Global market trends

In terms of global trends, so far this year we’ve seen a pull-back in the relative performance of the NASDAQ-100 and global growth over value, replaced by a lift in Europe’s relative performance. There are tentative signs that underperformance of global quality through last year appears to be bottoming out.

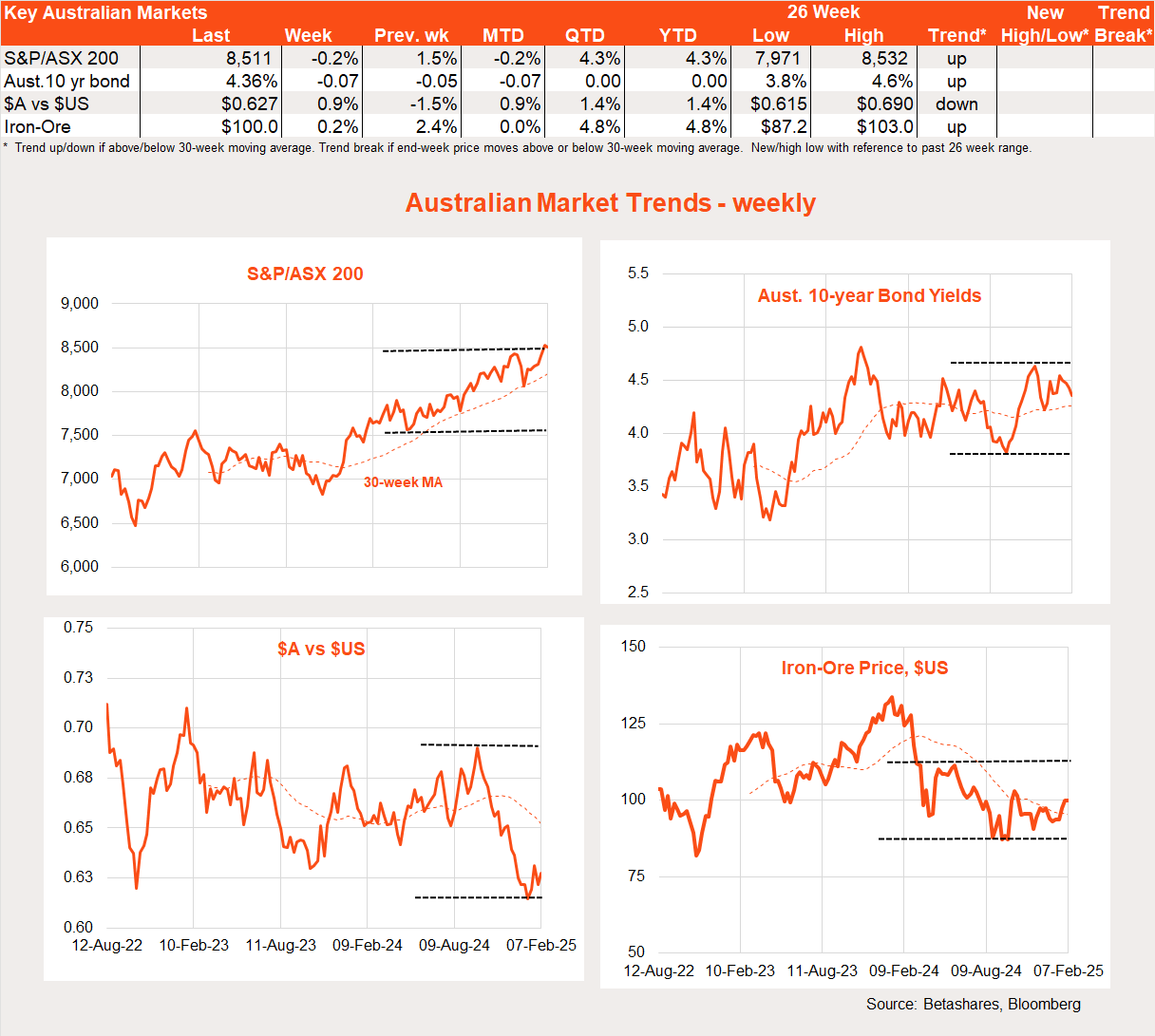

Australian market

Local stocks were dragged lower by global events last week, with little on the local data front to divert attention. Local markets remain fixated on the hope the RBA will cut rates at next week’s policy meeting following the recent benign Q4 CPI report.

Among the modest news last week, December retail sales were a bit firmer than expected, declining 0.1% after a solid 0.7% gain in November. Real spending in the quarter was up a respectable 1%, suggesting tentative signs that consumer spending could be starting to revive as real incomes start to recover.

House prices slipped a further 0.2% in January – the fourth modest monthly decline in a row, likely reflecting affordability constraints and slower immigration growth. RBA rate cuts could, however, breathe new life into house prices later this year.

We’ll get updates on business and consumer confidence from the NAB and Westpac surveys this week – while Trump tariffs could be a negative, some bounce in both seems likely as excitement builds around potential near-term RBA rate cuts.

Have a great week!

2 comments on this

Thanks as always David.

good rounded comments eliminating the noise