Betashares Australian ETF Review: November 2025

10 minutes reading time

“We have a big currency problem” – Donald Trump, 25 June 2024

If he wins power, Trump has promised to weaken the US dollar (USD) to make US manufacturing more competitive. While his return to the White House is not guaranteed and his ability to deliver on this promise may be questioned, over the last two months the USD has weakened against the Euro, Pound and notably the Yen. This has caused many Australian investors to re-evaluate their approach to currency hedging.

For more than a decade, the Australian dollar (AUD) has been on a downward trend against the USD, creating a further tailwind for Australian investors holding global equity allocations without currency hedging.

The value of our currency relative to other global currencies tends to be driven by:

- Interest rate differentials

- Global growth and associated demand for our commodities, and

- Risk sentiment.

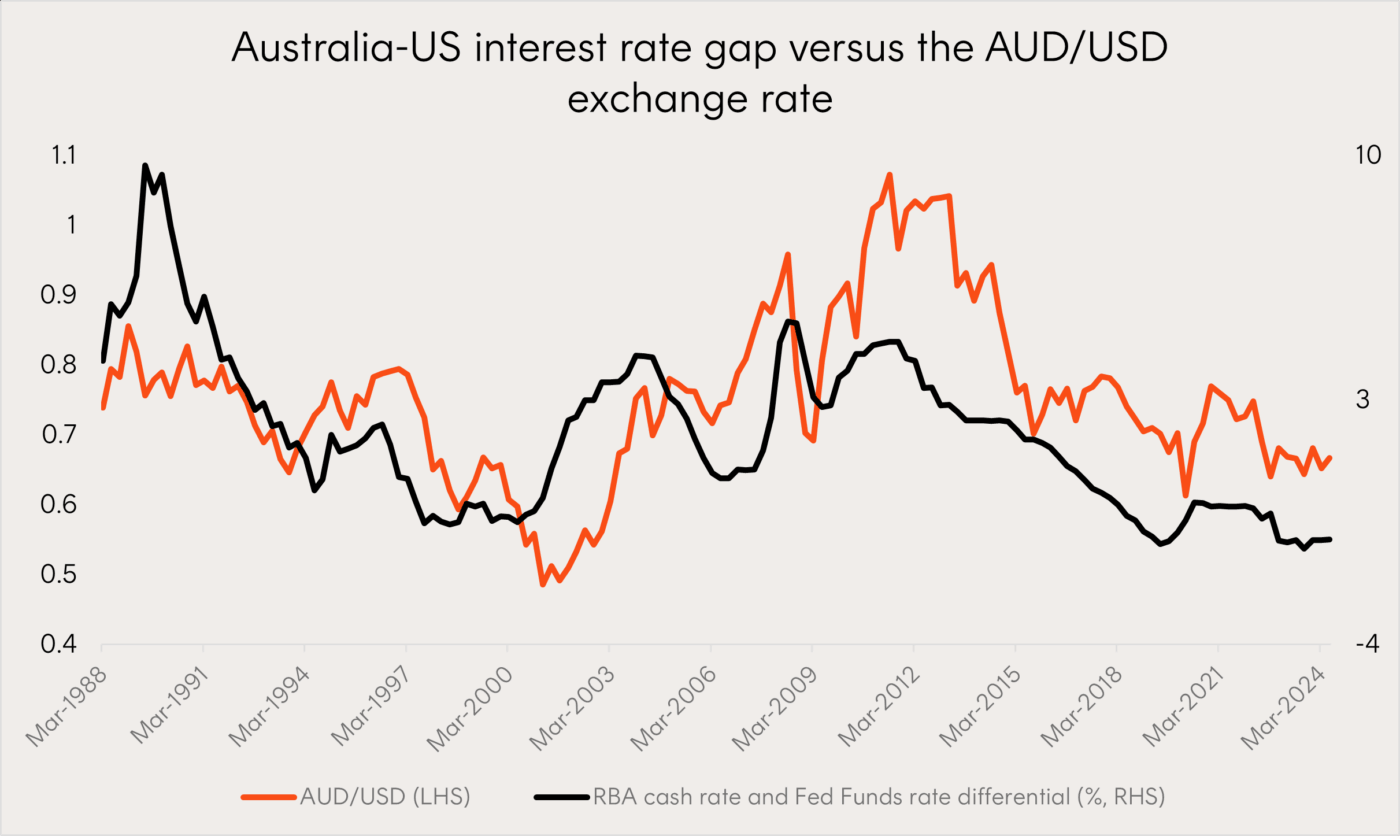

Since 2022, the interest rate differential between Australia and the US has inverted (i.e. the RBA cash rate is currently lower than the US Fed Funds rate) and the Chinese economy has failed to fire.

In contrast, the strength of the USD has been supported by higher inflation and real yields in the US, higher US terms of trade (i.e. a higher amount of exports relative to imports) and the US’ recent re-emergence as a net exporter of energy.

As a result, over recent years the greenback has become more attractive to hold vis-à-vis AUD, which has languished below US70c.

However, there are no guarantees the AUD will remain weak relative to the USD, and we may be approaching a tipping point.

Why the AUD can rise from here (a tactical view)

Policy uncertainty associated with a Trump election win is likely to increase currency volatility, however, there are arguments on both sides as to whether a Trump presidency would result in a weaker or stronger USD. Conventional thinking suggests trade tariffs, increased fiscal spending and tax cuts are USD positive. Yet USD could also weaken on a widening budget deficit, greater politicisation of the Fed and deliberate actions to devalue the currency.

Perhaps a more likely catalyst is interest rates. The US Fed Chair, Jerome Powell, has laid the groundwork for a rate cutting cycle commencing in September. In contrast, in her August post-meeting press conference, RBA Governor Michele Bullock said that the RBA board does not currently think a rate cut is likely for the remainder of 2024.

If Australia remains a relatively high interest rate economy while others are cutting, this could create a strong catalyst for the AUD to appreciate, as has historically been the case as shown in the chart below.

Source: Bloomberg, Betashares. 31 March 1988 to 30 June 2024. Past performance is not an indicator of future performance.

While China’s demand for iron ore has shown signs of further weakness, recently the AUD has actually been appreciating against the USD. This is because exchange rates are all about relativities, the Australian labour market looks in decent shape, while the US economy and US labour market is cooling slightly and currency traders are becoming more pessimistic about the US.

Purchasing power parity (PPP) also indicates the AUD has room to appreciate against the USD, as do the currencies of the US’s major East Asian trading partners.[1] Hence Trump’s concern about the competitiveness of the US economy with a strong USD.

How could an investor without a view on currency movements approach currency hedging?

Notwithstanding the points above, we acknowledge forecasting the direction, magnitude and timing of currency movements is very hard to get right. So, if you don’t hold a view on currency, is the best approach to just hedge your global equities exposure, or not? In short, there are pros and cons to either approach. Based on our analysis of historic data (as detailed below), there could be a case for currency hedging a portion of a portfolio’s global equities exposure from a return and volatility perspective.

The risk-off benefit of holding unhedged global equities

For Australian investors, leaving a portion of your global equities exposure unhedged can lower portfolio volatility and drawdowns in periods of strong equity market drawdowns. This is because the AUD is seen as a “risk on” currency, whereas the US dollar is often regarded as “safe haven” currency which historically has tended to appreciate as US dollar demand increases particularly in periods of market turmoil.

We can see evidence of this during the first half of 2020, when equity markets sold off heavily due to fear around the emergence of Covid. This sell-off coincided with the AUD falling from US67c to US58c before recovering to the same level two months later. In the chart below, we see how an unhedged global equities index experienced a smaller drawdown of -20% in March compared to -33% for the hedged index. The hedged global equities index was only able to close this performance gap in April and May when the AUD bounced back in unison with equity markets.

Source: Bloomberg. 31 January 2020 to 1 June 2020. Global equity index hedged represented by Solactive GBS Developed Markets ex Australia Large & Mid Cap Index AUD Hedged. Global equity index unhedged represented by Solactive GBS Developed Markets ex Australia Large & Mid Cap Index. You cannot invest directly in an index. Past performance is not an indication of future performance of any index or ETF.

Beyond this one event, we can also look at the impact of various levels of currency hedging of global equities (between 0 and 100% hedged) on the risk and return outcomes of a diversified portfolio[2] over the long run from 1988 to 2023.

Source: Bloomberg, Betashares. Past performance is not an indication of future performance. Provided for illustrative purposes only. Not a recommendation to invest or adopt any investment strategy.

The chart above shows the historic volatility of annual returns of the hypothetical portfolio at different levels of currency hedging over the relevant period. From a risk perspective, the volatility of the portfolio with 0 – 30% of global equities currency hedged generally produced the lowest volatility, but volatility increased significantly as currency hedging was increased to 100%.

Trend can be your friend, or foe – currency hedge in case of the latter

If remaining unhedged or having a lower level of currency hedging is better from a volatility standpoint, what about portfolio returns?

Over the long run (35 year) return period that we analysed the Australian dollar started and finished at around about US70c, and as a result the historic portfolio returns at all levels of currency hedging were approximately the same.

However, within this multi decade period, we witnessed a number of 5-10 year periods where the AUD/USD trended strongly, in both directions. For example, the AUD rallied significantly from US50c in December 2001 to nearly US90c in December 2007. Over that time period, the S&P500 Index returned 42% in USD terms, but if an Australian investor held the S&P 500 Index unhedged, their return would have been -17% in AUD terms. This illustrates the potential ‘destruction’ of investor capital that currency can wreak – a point often forgotten, given the last decade has witnessed twin tailwinds of strong global equity performance and a weakening AUD.

We considered the return implications of currency hedging over different 5 year-time frames going back to 1988, where AUD appreciation or depreciation could have had a significant impact on overall outcomes for the hypothetical diversified portfolio.

The chart below shows the range of 5-year total return outcomes over the period 1988 – 2023 as a result of using different percentages of currency hedging for the global equity allocation (again, between 0 and 100%). The range of return outcomes indicates the degree to which currency could impact investor outcomes (both negatively and positively). If an investor’s objective is to lower the impact of currency on long-term returns, they could consider an investment strategy with a lower outcome range.

Source: Bloomberg, Betashares. Past performance is not an indication of future performance. Provided for illustrative purposes only. Not a recommendation to invest or adopt any investment strategy.

Historically, we found that being completely unhedged or 100% hedged increased the return outcome uncertainty. Where the level of currency hedging employed was between 30% – 80%, there was far lower variability between the minimum and maximum 5-year return outcomes.

To hedge or not to hedge?

Investors with a view that the AUD is set to appreciate can choose to express a tactical view by increasing the hedged portion of their global equities portfolio.

For those not wishing to express a view on currency, our analysis suggests an approach of currency hedging a portion of a global equities allocation, could reduce the variability of long term return outcomes. However, the volatility benefits of a lower level of currency hedging must also be considered.

The Betashares Investment Committee currently adopts a 30% currency hedged allocation to global equities within the Strategy Asset Allocation (SAA) for Betashares Managed Accounts.

It is important for individual investors and their advisers to determine the exact level of currency hedging most suited to their own risk tolerance and objectives.

What options do investors have to currency hedge portfolios?

Australian investors ultimately have the choice of being hedged or unhedged when investing in global equities, with many ETF providers offering both unhedged and currency hedged versions of the same exposure.

However, currency hedged ETFs can come with unexpected tax outcomes where the manager has not made certain elections, which you can read more about here. Betashares offers the following range of currency hedged core global equity funds for which an election has been made that seeks to align commercial outcomes of the hedging strategy with tax outcomes:

You can find more information on currency hedging and Betashares’ currency hedged funds, including sector and regional funds, here.

You can find here a video to help explain currency hedging.

| There are risks associated with an investment in each Fund, including market risk, index methodology risk, country risk and currency hedging risk. Investment value can go up and down. An investment in each Fund should only be considered after considering your particular circumstances, including your tolerance for risk. For more information on risks and other features of each Fund, please see the Product Disclosure Statement and Target Market Determination, both available at www.betashares.com.au. |

Hypothetical balanced portfolio assumptions:

- Portfolio returns are based on cash, Australian and global equities, and Australian and global bonds using weights for the Betashares strategic balanced portfolio, illustrated below, as at June 2024:

- 50% defensive (5% cash, 27% Australian fixed interest, 18% International fixed interest)

- 50% growth (2.5% listed international listed infrastructure, 20% Australian equities, 27.5% international equities)

- The balanced portfolio is rebalanced quarterly

- The level of hedging on the global equities exposure varies from 0% to 100%. Calculations are based on data taken January 1988, when asset return performance is available on the global equities and Australian bonds exposure, to June 2023.

[1] Purchasing power parity is an economic theory used to determine long run equilibrium exchange rates, such that one country’s currency when converted into that of another country can buy the same basket of goods and services.

[2] Portfolio returns are based on a hypothetical balanced portfolio (50% defensive/50% growth), with the level of hedging on the global equities exposure varying from 0% to 100%. The portfolio is rebalanced quarterly. Calculations are based on data taken January 1988, when asset return performance is available on the global equities and Australian bonds exposure, to June 2023. Refer to end note for further detail.