5 minutes reading time

The RBA has just delivered its first rate cut of this cycle (-25bps to 4.10%), finally joining global peers, with the Fed, ECB, BoC, BoE, and RBNZ all well into their rate-cutting cycles.

With a policy shift now underway, investors who have previously favoured cash and floating rate strategies should consider fixed rate bonds. The risk is now that the RBA cuts more aggressively than currently priced in (2 more cuts this year, with a terminal cash rate priced in at 3.6%), making fixed rate bonds particularly attractive and cash and floating rate notes less appealing from an income perspective. At the same time, the potential of traditional portfolio diversifiers is growing amid stretched equity valuations, tight credit spreads, and heightened policy and geopolitical uncertainty.

Why consider allocating to Australian fixed rate bonds now?

- Investors can lock in today’s generous starting yields while also benefiting from potential capital gains if yields decline further, which is likely if the RBA moves to a “neutral” policy setting, implying a cash rate between 3.0% and 3.5%.

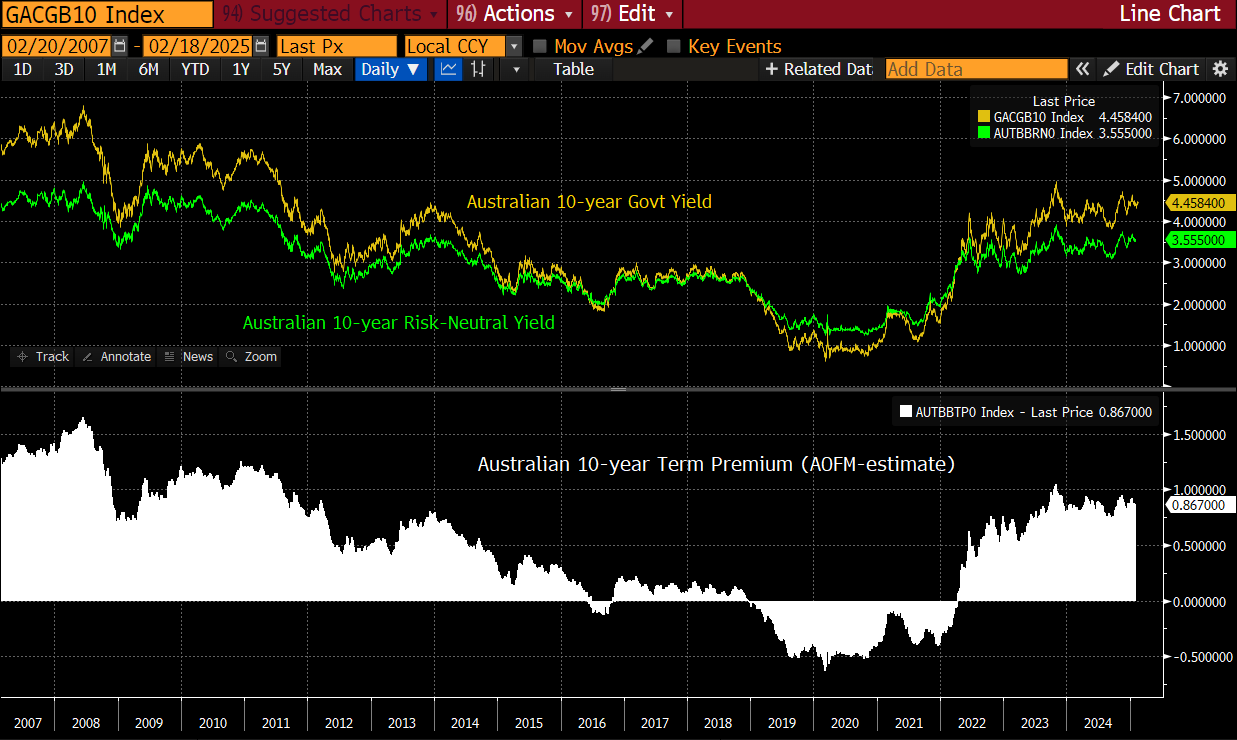

- Australian government bonds offer a substantial term premium, based on AOFM estimates, which reflects the excess return fixed rate bonds are expected to deliver above cash or floating rate notes of the same credit quality.

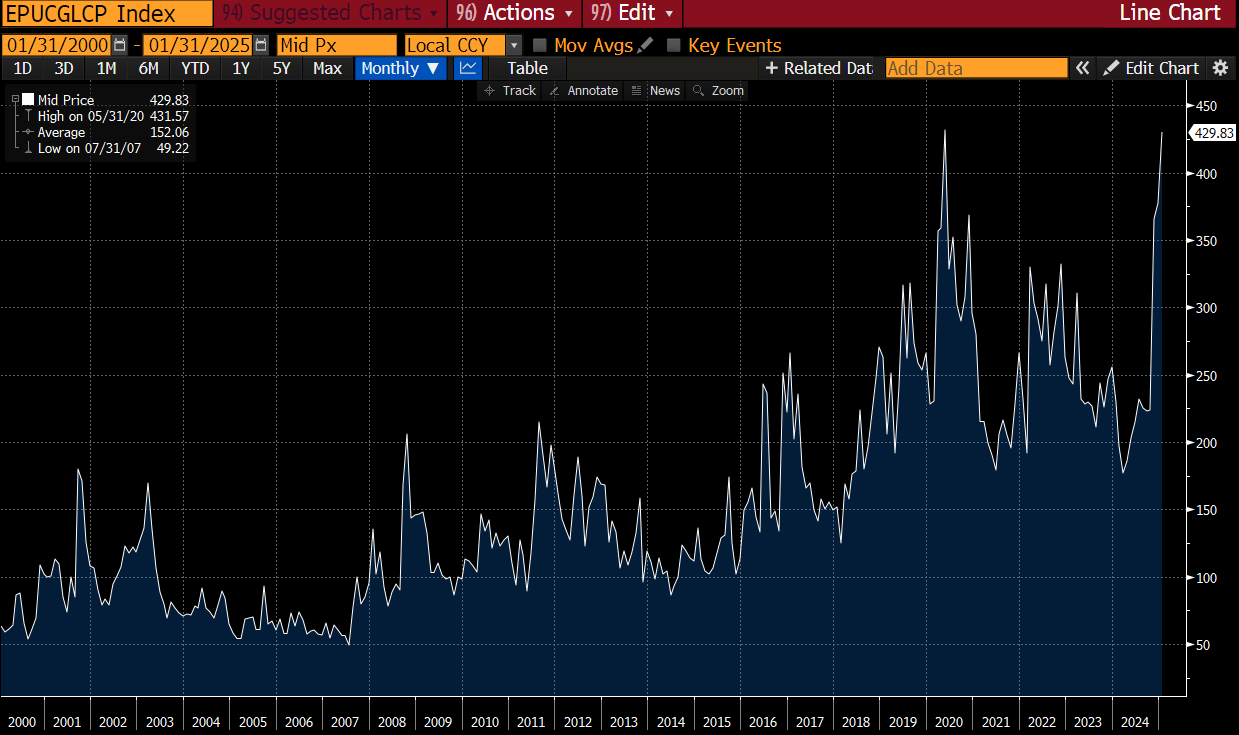

- Measures of global policy uncertainty are around their highest levels in 25 years, and with equity valuations stretched, now is the time to consider traditional fixed income for portfolio insurance.

Implementation ideas for the new easing cycle

OZBD Australian Composite Bond ETF – Rated Highly Recommended by Lonsec, with over $500m in assets, and tracking an index with a strong historical record vs. the benchmark Bloomberg AusBond Composite Index1, OZBD is our preferred all-in-one core fixed income solution (you can request the research reports from your BDM or by filling in the form on OZBD’s fund page).

OZBD provides a balanced exposure across all major investment-grade sectors (duration of 5.7yrs) through intelligent indexing that overcomes the pitfalls commonly associated with traditional fixed income benchmarks while delivering a superior yield (Yield to Worst of 4.92% compared to 4.49% for the AusBond Composite Index)2.

CRED Australian Investment Grade Corporate Bond ETF – For those willing to take on a little more credit risk in search of higher yields and income, CRED provides diversified exposure to investment-grade corporate bonds. Using an enhanced index methodology, CRED aims to maximise yield opportunities in the domestic fixed rate corporate credit universe, with the latest yield to worst of 5.63% (duration of 5.5yrs) well above that of the AusBond Credit index3.

AGVT Australian Government Bond ETF – For investors looking to reduce credit risk further and gain pure duration exposure, AGVT offers a portfolio of Australian government and government-related securities, providing a high-quality defensive allocation. With a longer duration profile (7.4yrs), AGVT is well positioned to benefit from further rate cuts while offering maximum diversification potential should the economic outlook deteriorate further4.

Chart 1: Australian 10-year term premium estimate

Source: Bloomberg; OAFM. 31 20 February 2007 to 18 February 2025. Actual outcomes may differ materially from forecasts.

Chart 2: Global Economic Policy Uncertainty Index

Source: Bloomberg; Baker, Bloom & Davis. 31 January 2000 to 31 January 2025.

There are risks associated with an investment in the Funds, including market risk, index tracking risk, interest rate risk and credit risk. Investment value can go up and down. An investment in the Funds should only be considered as a part of a broader portfolio, taking into account your client’s particular circumstances, including their tolerance for risk. For more information on risks and other features of the Funds, please see the Product Disclosure Statement and Target Market Determination, both available at www.betashares.com.au.

The Lonsec rating (assigned 20 October 2024) presented in this document is published by Lonsec Research Pty Ltd ABN 11 151 658 561 AFSL 421 445 (Lonsec). Ratings are general advice only, and have been prepared without taking account of your objectives, financial situation or needs. Consider your personal circumstances, read the product disclosure statement and seek independent financial advice before investing. The rating is not a recommendation to purchase, sell or hold any product. Past performance information is not indicative of future performance. Ratings are subject to change without notice and Lonsec assumes no obligation to update. Lonsec uses objective criteria and receives a fee from Betashares. Visit lonsec.com.au for ratings information. © 2023 Lonsec. All rights reserved.

References:

1. OZBD aims to track the Bloomberg Australian Enhanced Yield Composite Bond Index, before fees and expenses. ↑

2. Figures as at 20 February 2025 and are subject to change. See Betashares website for the latest characteristics. ↑

3. Figures are as at 20 February 2025 and are subject to change. See Betashares website for the latest characteristics. ↑

4. Figures are as at 20 February 2025 and are subject to change. See Betashares website for the latest characteristics. ↑