Staying the course

6 minutes reading time

- Global shares

Global markets

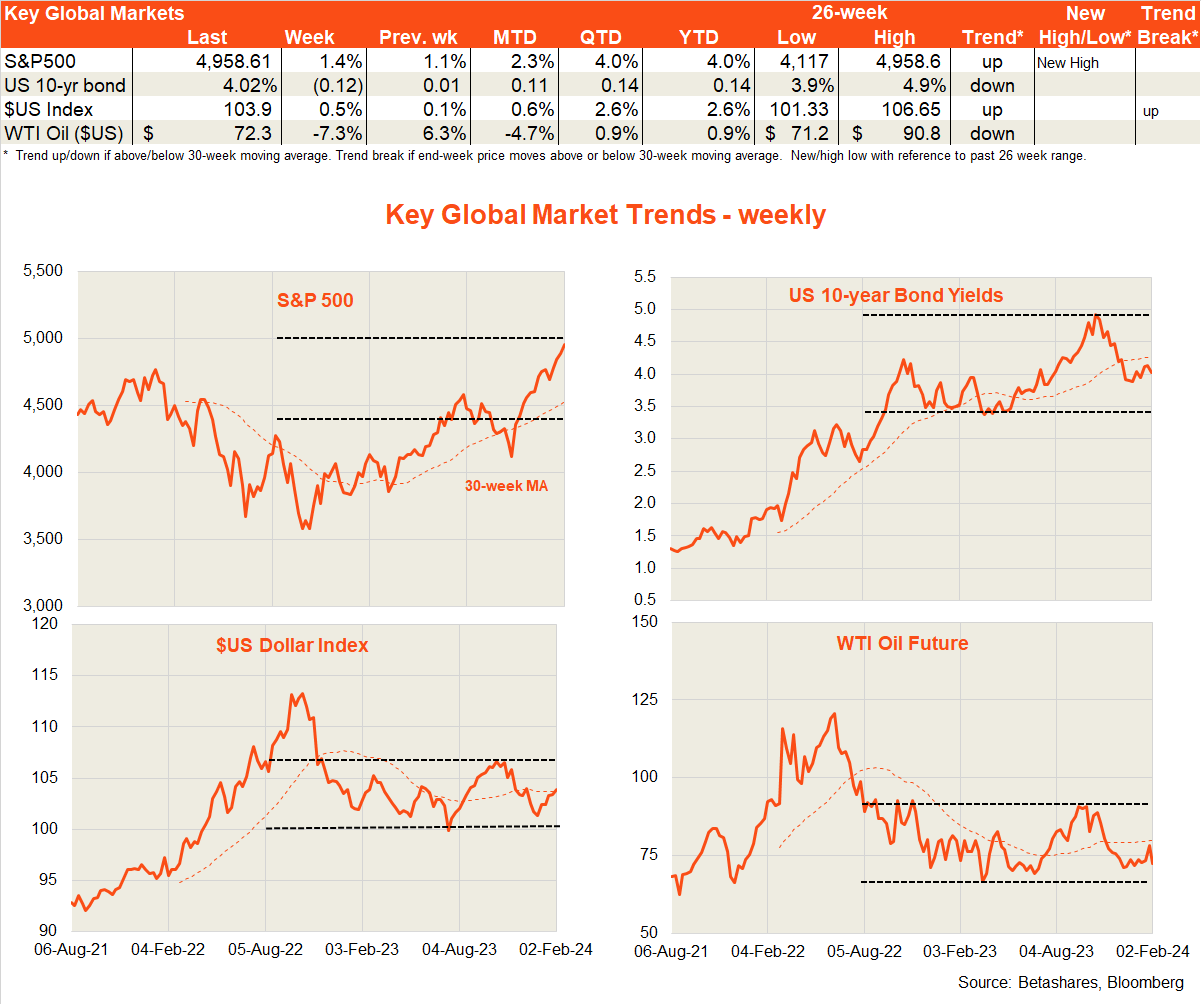

The US S&P 500 rose further last week – the fourth weekly gain in a row and a new record high – and remains in a strong uptrend. US bond yields edged lower last week after a mini-move higher in previous weeks, as markets reduced the odds of a March rate cut.

The highlight of the week was the US Fed meeting, which initially disappointed investors as it played down the chance of a March rate cut. Within 24 hours, however, markets reconsidered – realising that the Fed is now at least signalling a clear easing bias. Solid US tech earnings reports – especially from the likes of Meta and Amazon – also helped markets last week.

Wall Street is also back to playing the game of “bad news is good news” – selling off on stronger-than-expected job openings data mid-week and then unsure whether to laugh or cry at Friday’s much stronger-than-expected January payrolls report.

What’s clear is that the US economy retains a strong head of steam heading into 2024, with back-to-back monthly payroll gains of +300K and a somewhat worrying bounce back in annual growth in average hourly earnings from 4.3% to 4.5%. The unemployment rate, at least, held steady at 3.7% – suggesting strong gains in labour force growth are underpinning the strong gains in employment. If there’s any consolation, some suggest seasonal quirks may be behind the lift in wages growth in January. We’ll see!

All that said, what really matters is not whether US economic activity remains strong, but whether inflation continues to decline – if disinflation remains firmly in place, then even a stronger-than-expected economy should be good news for stocks through a lift in corporate earnings, though a little less positive for equity valuations or bonds as it may delay the speed with which the Fed cuts rates. Indeed, it could be that falling inflation simultaneously helps boost economic growth through improvements in real incomes and confidence.

Global data highlights this week include the US services PMI index, which is expected to show a firming in growth. The US earnings reporting season also rolls on, with key results this week from Disney and Pepsi. China also reports consumer prices on Thursday, which are likely to show a deepening in the annual rate of deflation from -0.3% to -0.5%.

US Fed chair Powell also speaks on the Sunday evening US ’60 minutes’ program, which airs at 11am Sydney time.

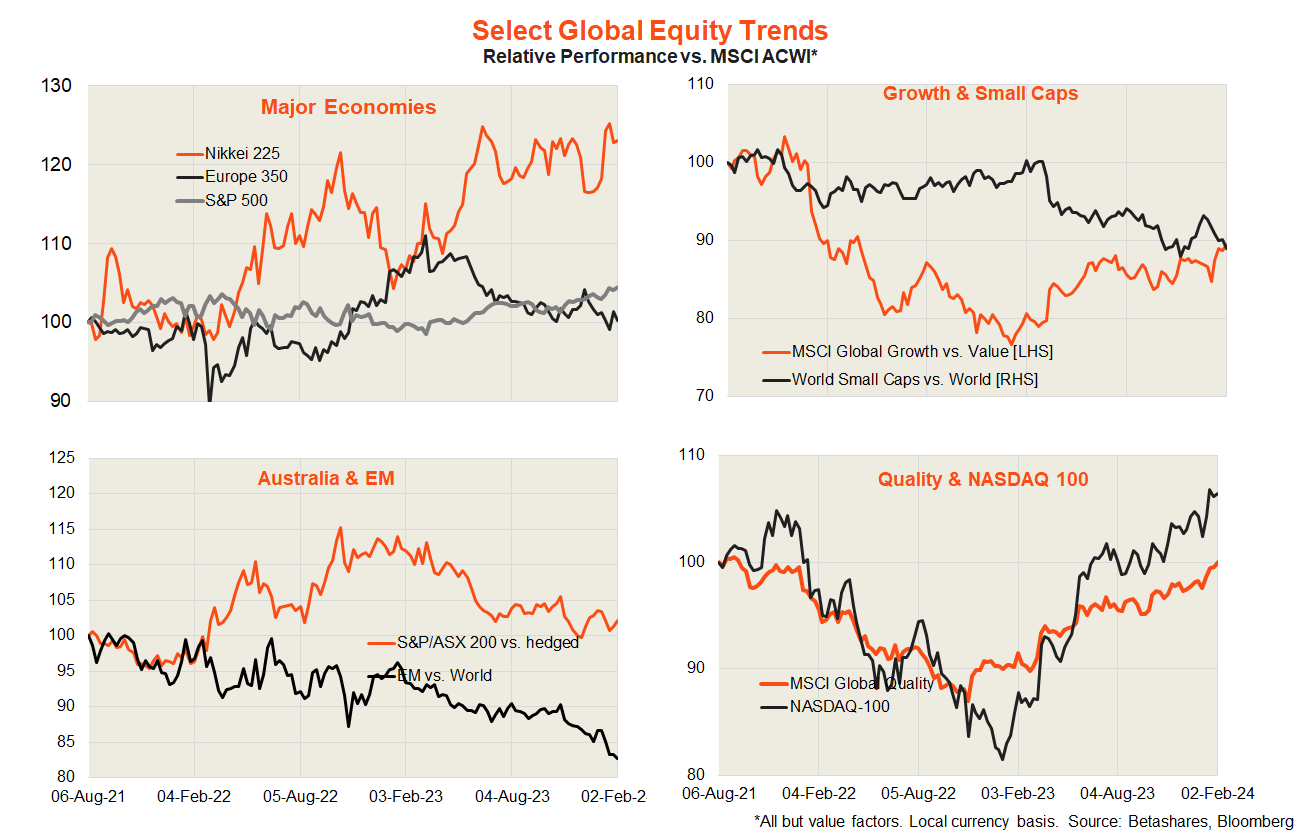

In terms of global equity trends (see chart set below), recent weeks have seen a rebound in the performance of growth over value and large caps over small caps – helped by a solid US large-cap technology earnings outlook. Quality continues to do well, while the downtrend in Australian and emerging market relative performance has yet to be convincingly challenged. The US is still beating Europe, while Japan’s relative performance has been choppy since late last year.

Australian markets

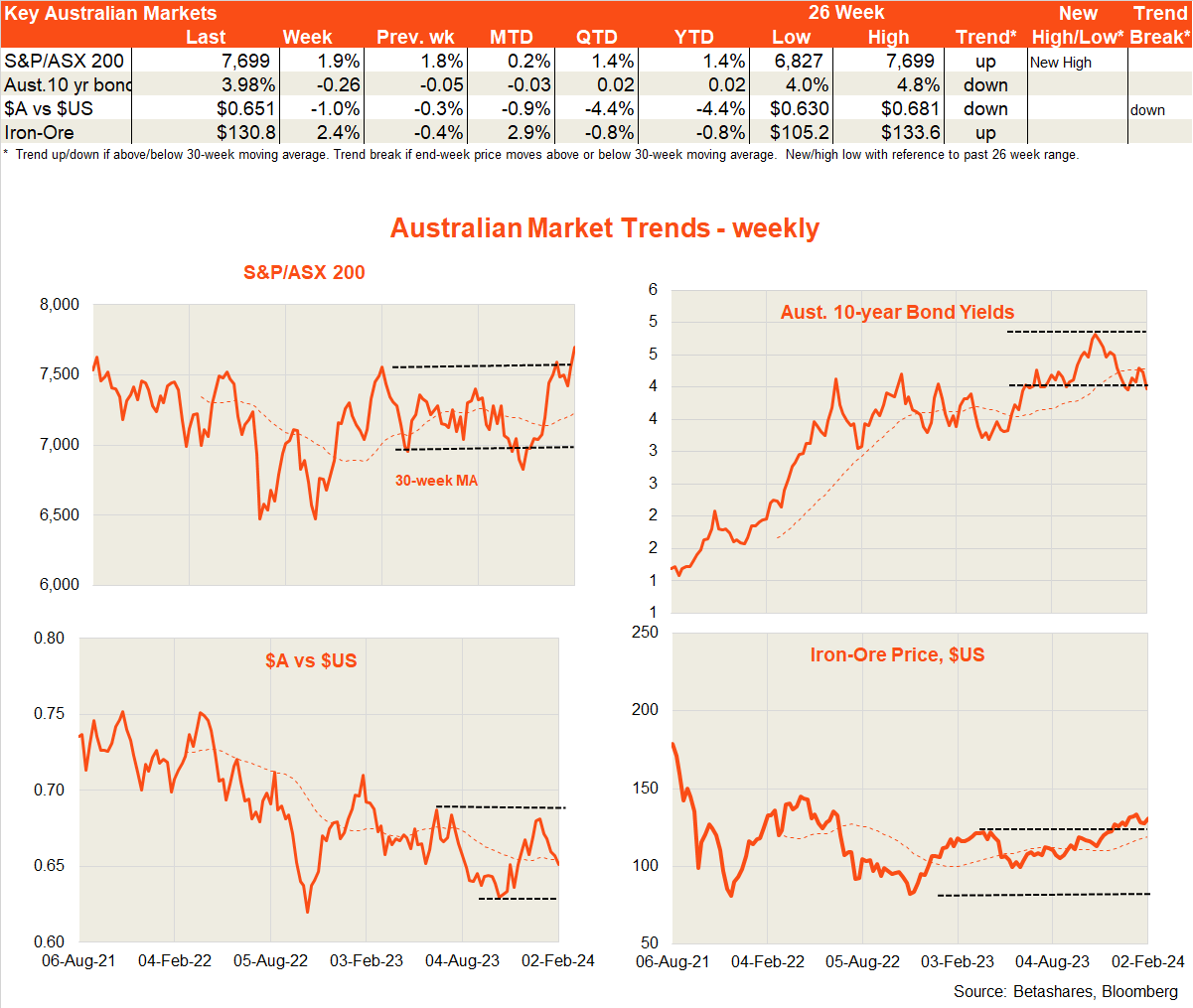

Helped by a lower-than-expected Q4 inflation report, Australian stocks enjoyed a strong week with the S&P/ASX 200 lifting 1.9% and breaking above its recent range to a new record high. 10-year bonds yields, meanwhile, fell 0.25% and appear to be breaking below their 4% support level.

Local markets have swung towards expecting two rate cuts this year. Last week’s CPI is consistent with my view that inflation will drop more quickly than the RBA expects this year, with trimmed mean annual inflation down to 2.75% by the December quarter.

Also of note last week was the 2.7% slump in December retail sales – which was partly payback from the Black Friday/Cyber Monday sales-driven 1.6% gain in November. All up, however, real retail spending appears to have been abysmal in Q4 – supporting the idea that the RBA should be on the cusp of reverting to a clear easing bias. Of course, whether the RBA cuts rates or not, house prices keep rising – with Core Logic reporting another 0.4% gain in January.

Turning to the week ahead, Tuesday will see confirmation of a likely decline in real (inflation-adjusted) retail spending in Q4. But Tuesday also sees the start of the new RBA circus act, with the usual post-meeting statement but also a press conference by RBA Governor Bullock and updated forecasts and Monetary Policy Statement.

The new RBA circus

As outlined by John Kehoe in today’s AFR, the RBA Board will now be required to sit in a room and deliberate for twice as long as previously over whether to shift the interest rate dial.

- It starts with a 3.5 hour meeting on Monday afternoon, dominated by RBA presentations on the economy and markets.

- Monday night will then allow Board members to “reflect overnight and raise any further issues or questions before the policy decision is made”.

- After a potentially fitful sleep, Board members will then endure another 4-hour meeting on Tuesday morning, part of which will focus on finessing “the post-meeting communication to appear in the written statement from the board, instead of a statement solely from the governor.”

- The post-meeting statement (from the Board not just the Governor) will be released at the usual time of 2.30pm Tuesday.

- A slimmed down Monetary Policy Statement (including updated economic forecasts) will also be released on Tuesdays at 2.30pm – rather than on the Friday – at every other meeting in February, May, August and November.

- Following each meeting, RBA Governor Bullock will then face up to the media with a press conference at 3.30pm.

That’s not all! According to former RBA Governor Phil Lowe in a speech last year, Board members “will have the opportunity to attend an internal staff meeting some time before the Board meeting. This will allow them to hear directly from, and ask questions of, a broader range of staff.”

Phew! At least meetings will now take place only eight times per year. Of course we’ll still get the usual range of speeches from RBA officials, which will now also include presentations from RBA Board members themselves.

Whether it improves policy decisions remains to be seen – I suggest not – but the new process will certainly add to financial market noise and keep financial media and RBA watchers such as myself gainfully employed!

Have a great week!