5 key takeaways: Trump 2.0, geopolitical risk and investment landscape

4 minutes reading time

- Global shares

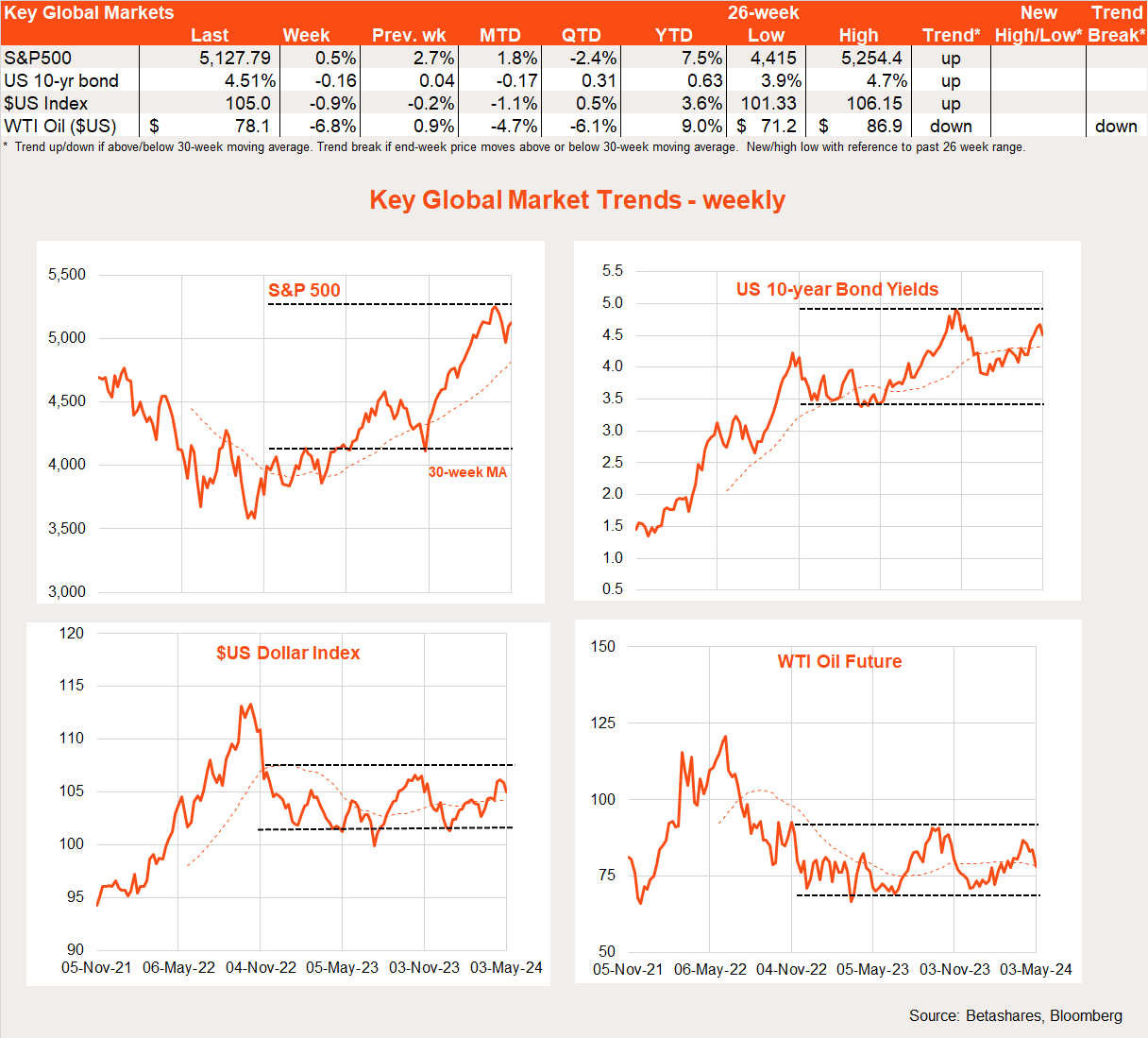

Global markets – week in review

The global equity market rebound continued into its second week following a less hawkish-than-feared Fed meeting and a soft US payrolls report.

Markets were relieved Fed chair Powell played down the risks of another rate hike, even while conceding there’s less scope to cut interest rates anytime soon. US bond yields and the $US declined, while equity markets popped higher. Encouraging US corporate earnings – especially among the Magnificent 7 – further supported equity sentiment.

Overall US economic data last week was mixed. The week began with a stronger-than-expected Q1 wage cost index, though this concern eased later in the week with a larger-than-expected fall in job openings and a softer-than-expected growth in average hourly earnings and employment in Friday’s payrolls report. Bottom line: growth is holding up and labour market pressures still appear to be gradually easing.

Of course, the highlight last week was the Fed meeting. While rates were left firmly on hold as widely expected, markets took heart from Powell’s comment that a further rate hike in light of recent higher than expected inflation reports remained unlikely. The Fed still sees inflation coming down, albeit a bit more slowly than expected and it appears is willing to wait and is comfortable with current monetary settings.

Amazon and Apple also both produced earnings beats, with the former also pleasing investors with a share buyback announcement.

In Europe, economic news was also encouraging with a better-than- expected 0.3% gain in Q1 GDP (ending Europe’s mini-recession) and a April CPI result confirming a further gradual decline in annual core inflation from 2.9% to 2.7%. Markets are increasingly confident the ECB will cut rates early next month – well ahead of the Fed.

Meanwhile in Japan, the BOJ is trying to stem the slide in the yen (largely caused by reduced US rate cut expectations) by cloak and dagger intervention.

The week ahead

There’s little key data in the US this week, with attention likely to focus on the extent to which a range of Fed speakers agree with Powell in playing down the prospect of a rate hike.

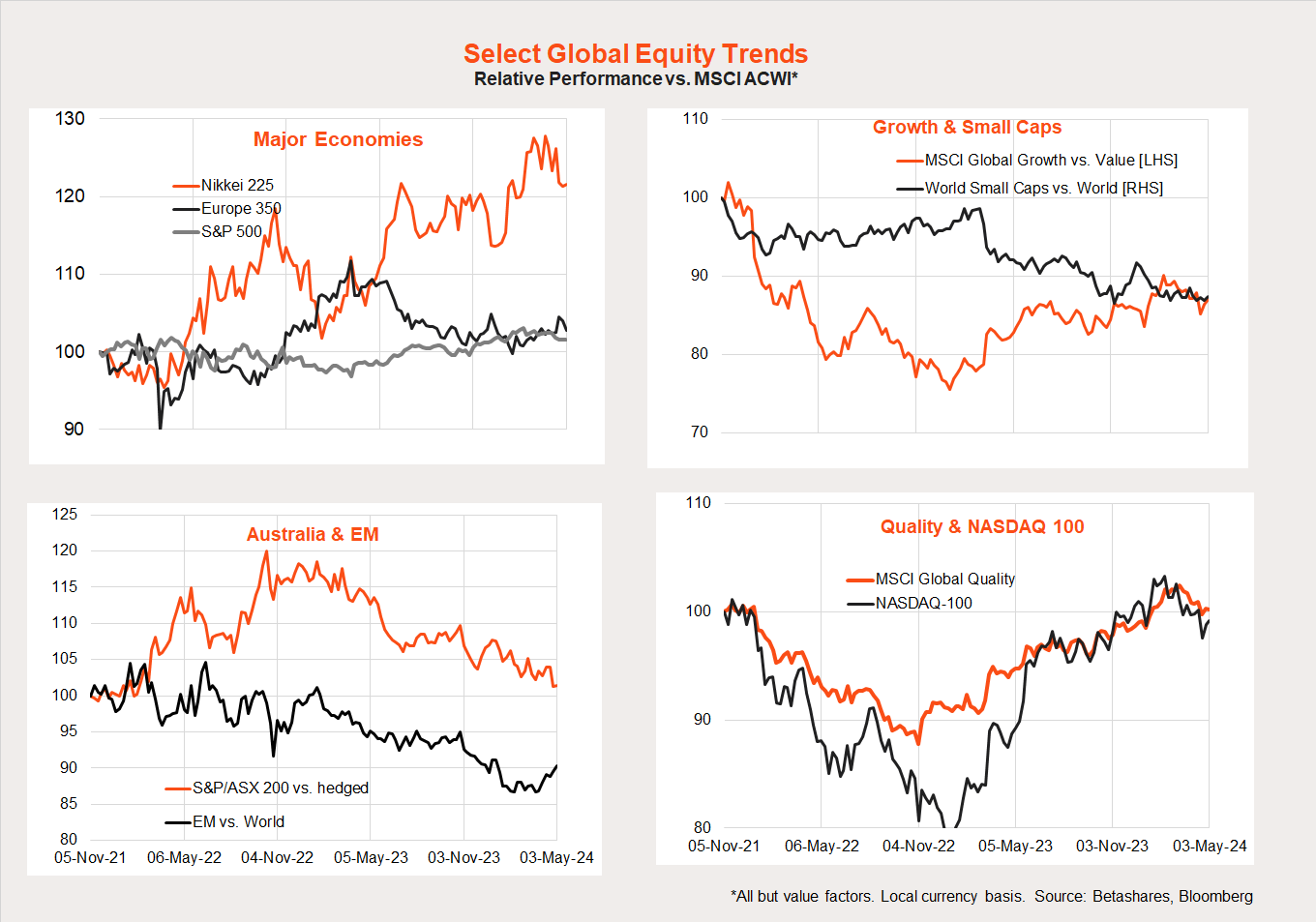

Global equity trends

Looking at global equity trends, the easing back in bond yields and good Magnificent 7 earnings results has helped growth/technology exposures such as the NASDQ-100 bounce back a little in terms of relative performance – after several weeks of under performance. Japan’s performance has pulled back of late, to the benefit of Europe and emerging markets – though not as yet Australia.

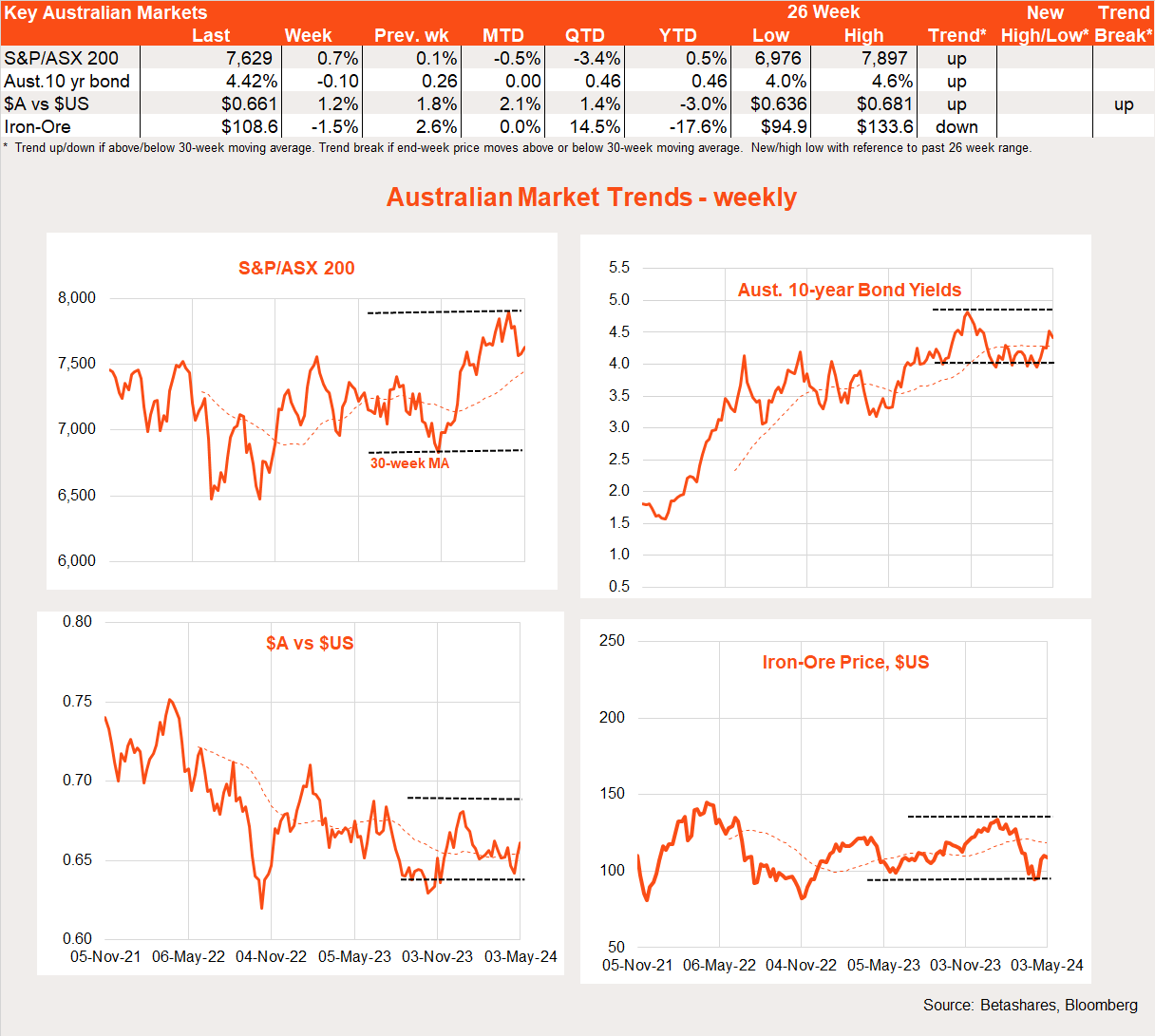

Australian markets

The S&P/ASX 200 lifted 0.7% last week, helped by stronger global markets and mixed local economic reports.

The main local highlight last week was a softer than expected March retail sales report. Nominal sales fell 0.4% in the month as Taylor Swift left the country and perhaps an element of retail price discounting returned in the quarter. House prices, however, continued their ascent, rising 0.6% in April to be up 9.4% over the year. Price gains in the usually hot markets of Sydney and Melbourne, at least, appear to be moderating.

This week’s highlight will be tomorrow’s RBA extravaganza. While rates are expected to remain firmly on hold at the policy meeting, we’ve also got the post-meeting policy statement, the Governor’s press conference and updated set of forecasts in the May Monetary Policy Statement to mull over. Bottom line: the RBA is likely to maintain a modestly more hawkish tone than the Federal Reserve – like Powell, discounting the chances of a rate cut anytime, though perhaps not being as willing to play down the risks of another rate hike.

After all, tomorrow’s Monetary Statement is likely to contain a modest upward revision to the RBA’s near-term inflation outlook in light of the higher-than-expected Q1 CPI report. The RBA is likely to express ongoing concern with sticky services inflation, though it’s not clear higher rates can do much to stem rising housing rents and insurance costs.

That said, there’s also a good chance that tomorrow we’ll learn real retail sales (i.e. after inflation) went backwards in Q1 (market expectations -0.3%) which sets us up for another likely soft Q1 GDP report.

Have a great week!

2 comments on this

Surprised! Not one word about the Govt spending like a drunken sailor. Bassanese must be a LaborGreensTeal Coalition voter.

Each week, there are more excuses in these reports. We have inflation checked, interest rates will go down. The past weeks have all pointed towards the FED making moves that inflation is now on its way down.

Quote “Markets were relieved Fed chair Powell played down the risks of another rate hike, even while conceding there’s less scope to cut interest rates anytime soon.” Sure did, Played it down nicely. If Powell had not played it down, “there would be panic” Even our Australian Treasurer plays it down, keeps stretching his words looking for excuses and an easy way out and yet, our money printing never ends.

There is no one out there will the Balls to call it as it is. Meanwhile petrol keeps going up, all food items in our supermarkets are going up weekly. Meat, Fish and Lamb is all sky high. Electricity charges are up. Council rates are up and keep going up. GMW announced further increases in water charges to farmers. All sectors have increased their fees and charges. Someone is lying to us big time. Covid has taught us heaps. Never trust those in Authority to tell us the truth. David, You can do better.