5 minutes reading time

As the longest bull market in history has come to an end, the phrase ‘unprecedented times’ arguably has become a cliché. Whilst admittedly there would be few of us alive to have witnessed an event-driven correction of this magnitude, from an economic standpoint we may be on familiar ground.

The last economic cycle could be characterised by low economic growth, record low interest rates and generally stagnant profit growth – an environment in which, over the past decade, investors searched for dependable, secular growth in a low-growth world.

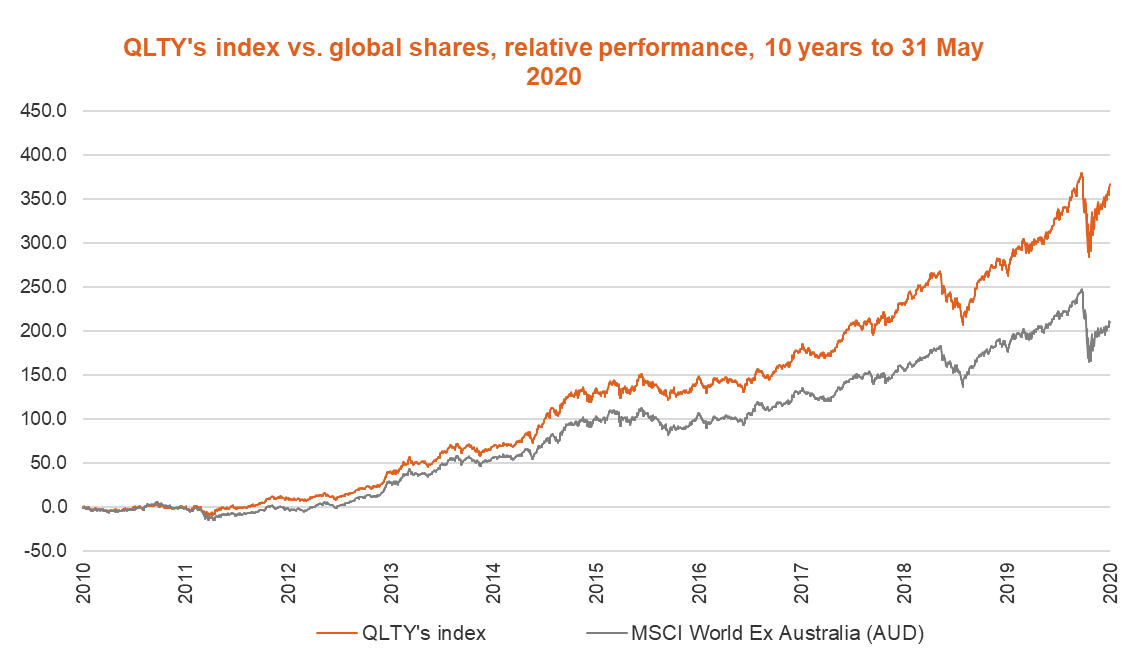

The chart below compares the performance of the index that the BetaShares Global Quality Leaders ETF (ASX: QLTY) aims to track, to the performance of broad global shares, over the decade to 31 May 2020.

Source: Morningstar Direct, BetaShares. Total returns in AUD over 10 years to 31st May 2020. You cannot invest directly in an index. Past performance is not an indicator of future performance of the index or any ETF that aims to track the index.

Source: Morningstar Direct, BetaShares. Total returns in AUD over 10 years to 31st May 2020. You cannot invest directly in an index. Past performance is not an indicator of future performance of the index or any ETF that aims to track the index.

BetaShares has also just launched a currency-hedged version of QLTY, the BetaShares Global Quality Leaders ETF – Currency Hedged (HQLT). This gives investors looking to invest in a portfolio of quality global companies a choice – to remain exposed to exchange rate movements as another source of potential returns, or to substantially remove the currency variable from the investment equation. Investors can also be more flexible with their currency exposure by using a blend of the two funds.

Looking ahead

Whilst the recent correction came unexpectedly, the next economic cycle looks set to begin on similar fundamentals.

The current economic outlook is dire, and in many cases has continued to weaken beyond expectations. This has further exacerbated the disconnect between those companies able to provide sustainable growth, and those that cannot.

From a strategic standpoint, we think high-quality growth companies that are able to offer predictable and stable return on equity (ROE) should remain attractive over the medium to long term.

Quality characteristics with lower historical drawdowns

How can we identify these sorts of companies? Typically, the metrics used to identify ‘quality’ include:

- High and sustainable ROE

- Profitability

- Earnings stability

- Financial health

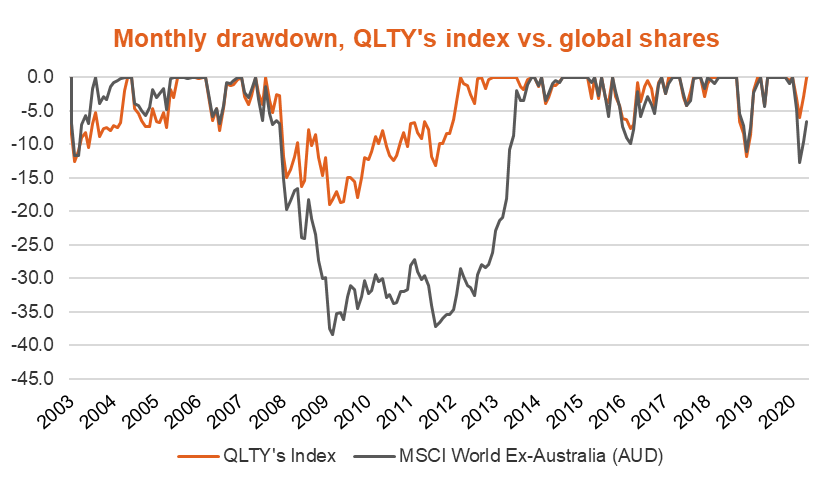

Historically, companies with these factors have tended to outperform during the slowdown and contraction phase of the economic cycle and typically have demonstrated lower volatility and lower drawdowns than the broader global market in falling markets and periods of heightened volatility.

For example, during the Global Financial Crisis (Oct 07 – March 09), QLTY’s index outperformed the MSCI World ex Australia Index by ~19%1.

Monthly drawdown

Source: Morningstar Direct, BetaShares. Data as at 31st May 2020. You cannot invest directly in an index. Past performance is not an indicator of future performance of the index or any ETF that aims to track the index.

Quality companies with durable business models and sustainable competitive advantages are potentially better-suited to weather the economic cycle – and as we have seen during the recent crisis, when the ‘flight to quality’ occurs, investor focus has tended to return to current profitability rather than promises of future revenue growth.

In addition to the drawdowns being less severe, the historical road to recovery has also tended to be shorter for these ‘quality’ companies.

How to access quality?

QLTY gives investors exposure to a portfolio of companies displaying quality characteristics.

Because the ETF aims to track an index, there are no active management fees. Annual management costs are just 0.35% p.a.2, making QLTY a cost-effective option.

The long-term value of an equity strategy that focuses on quality metrics has been demonstrated over both the long and the short term. The table below shows the performance of QLTY’s index against broad global shares over 1, 3, 5 and 10 years.

| 1 Year | 3 Years (p.a.) | 5 Years (p.a.) | 10 Years (p.a.) | |

| QLTY’s index | 27.89% | 18.40% | 14.97% | 16.69% |

| MSCI World Ex Australia (AUD) | 11.98% | 10.19% | 9.03% | 12.01% |

Source: Morningstar Direct, BetaShares. Data as at 31st May 2020. You cannot invest directly in an index. Past performance is not an indicator of future performance of the index or the ETF.

HQLT provides exposure to the same portfolio of companies3, but seeks to minimise the impact of currency fluctuations by hedging into Australian Dollars.

Summary

In a world of anaemic growth, quality companies which have been able to demonstrate consistent and sustainable ROE historically have tended to show better performance than the broader market.

After a period of extreme volatility, equity market valuations are returning to near all-time highs, leaving little buffer for leveraged companies with poor balance sheets against any future negative shocks.

Australian investors are able to access cost-effective, quality-based strategies via the BetaShares Global Quality Leaders ETF (ASX: QLTY) and the recently-launched BetaShares Global Quality Leaders ETF – Currency Hedged (ASX: HQLT).

QLTY and HQLT can form a diversified core of portfolios for investors looking to benefit from the premium associated with companies which display consistently high ROE, while the two options allow investors to manage their portfolio’s currency exposure.

There are risks associated with investment in the BetaShares Global Quality Leaders ETF (ASX: QLTY) and the BetaShares Global Quality Leaders ETF – Currency Hedged (ASX: HQLT), including market risk, index methodology risk, international investment risk and sector concentration risk, as well as currency risk (for QLTY) and currency hedging risk (for HQLT). For more information on risks and other features of each fund, please see the applicable Product Disclosure Statement.

1. Past performance is not an indicator of future performance of the index or any ETF that aims to track the index.

2. Management cost applicable to the BetaShares Global Quality Leaders ETF (ASX: QLTY). Other fees and costs, such as transactional costs, may apply. Refer to the PDS for more information.

3. HQLT currently obtains its investment exposure by investing in QLTY, with the currency exposure hedged back to the Australian Dollar.