The strategy that has generated $3.6 billion in returns over 10 years

7 minutes reading time

- Australian shares

This information is for the use of financial advisers and other wholesale clients only. It must not be distributed to retail clients.

Large Cap Australian equities has been a challenging asset class for active managers, according to SPIVA.1 AQLT Australian Quality ETF , provides a low-cost alternative for investors looking beyond Australian equity market capitalisation index exposure. In the 12 months to 31 July 2023 AQLT’s performance placed it within the top 10% of Large Cap Australian equities funds2, and has seen increased interest and inflows from investors.

In finance theory, ‘quality investing’ typically relates to selecting companies that have high profitability, low financial leverage and relatively stable earnings over the cycle.

Investing in ‘quality’ companies has been a successful long term investment strategy historically in global sharemarkets. For example, the index that the QLTY Global Quality Leaders ETF aims to track (before fees and costs) has outperformed the benchmark MSCI World ex AU Index by 2.4% p.a. from Dec 2002 to July 2023. For more information on QLTY, please click here.

Quality investing in Australia, the right way

It stands to reason that quality investing should work in the Australian market. However, the opportunity set of companies in Australia is very different to broader global markets. In particular:

- Our home market has significant concentration in the largest names. The largest 11 companies make up close to half the weight in the S&P/ASX 200 Index.

- Many of these companies are considered cyclical, with over half the total market capitalisation in Financials or Materials sectors.

- The majority of companies that typically screen well for quality are found in mid/small cap part of the market.

- Australia has one of the highest yielding equity markets in the world, and many investors have become accustomed to the large dividends and franking on offer.

In order to create a core Australian equity fund with quality characteristics, AQLT’s index balances representation across both large and mid/small cap segments of the market. Specifically, AQLT’s Index breaks the investment universe into two groups, a large cap group (the top 50% by market cap) and a mid/small cap group (the bottom 50% by market cap). It then selects, ranks and weights the highest quality companies within each group.

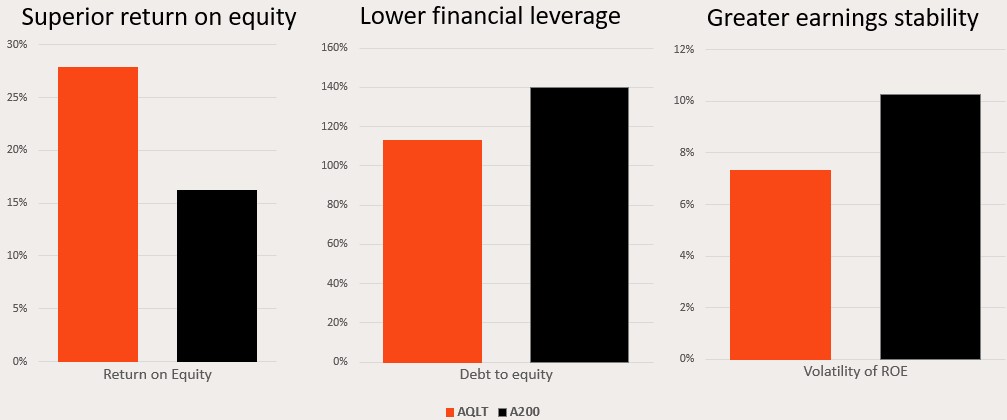

The results are a portfolio of companies that is superior to the broad market in terms of key quality metrics – return on equity, financial leverage and earnings stability.

Source: Solactive, Betashares. As at 31 May 2023. Compares “quality” metrics of AQLT’s portfolio against A200’s portfolio. Past performance is not an indicator of future performance.

Choosing a quality fund

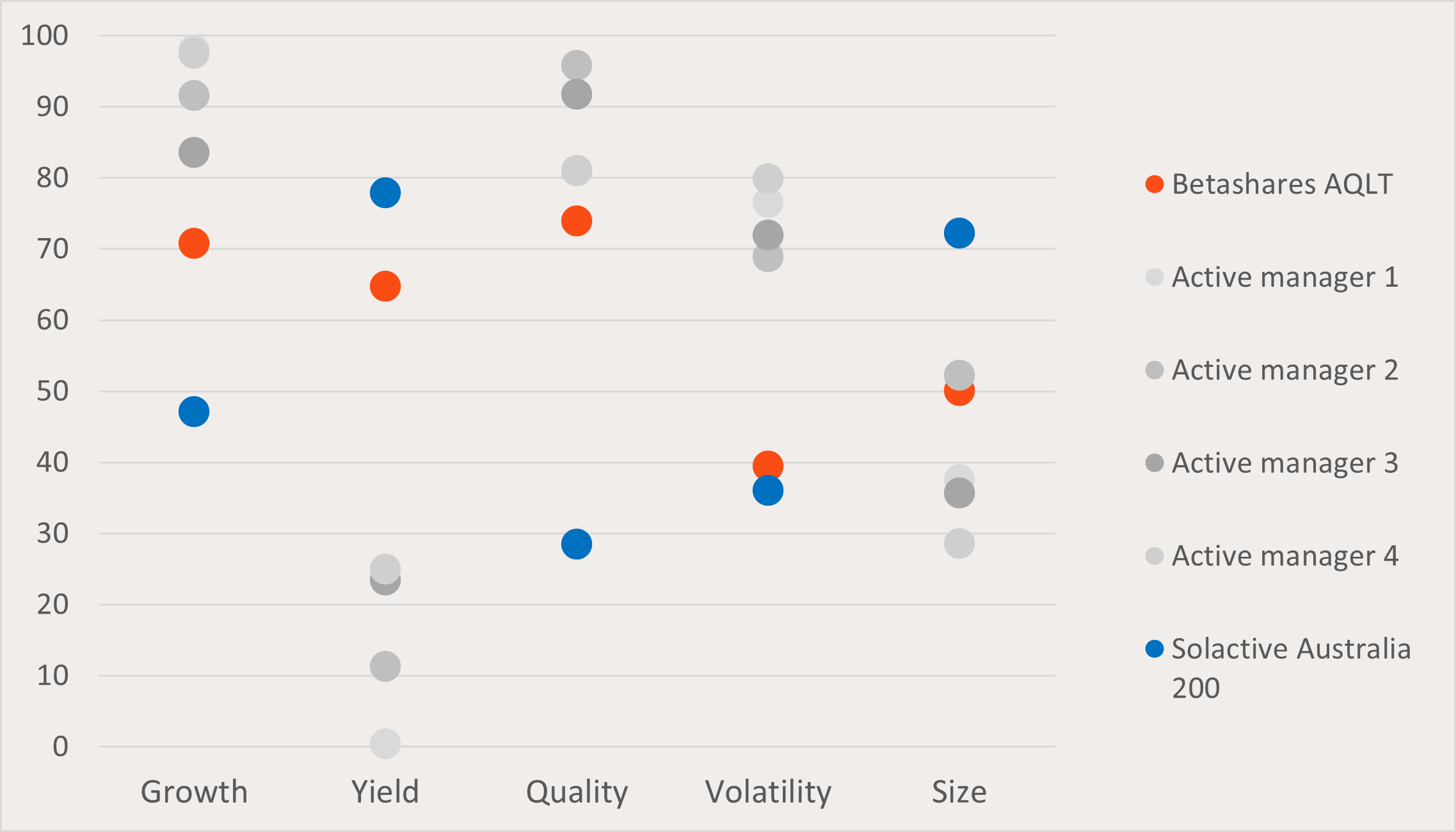

But equally important is the fact that AQLT provides a quality focused investment without inadvertent biases to other investment factors. The chart below compares AQLT and the factor profile of Australian equity actively managed funds that rank top quartile for the quality factor. As you would expect, AQLT and the active managers all have a stronger quality score than the broad market (as represented by the Solactive Australia 200 Index). However, these actively managed peers have far more growth, lower yield, higher volatility and smaller size biases than AQLT, which tracks more closely to the broad market on these other factors. By preserving a more balanced exposure to yield, for example, AQLT is likely to generate dividend income more consistent with that of the broader market.

AQLT factor profile against benchmark and selected active quality peers

Source: Morningstar. As at 30 June 2023. Selected Active Quality Peers selected from Australian domiciled Australian equity active funds with similar factor profile to Betashares Australian Quality ETF (ASX: AQLT) (as determined by Betashares). You cannot invest directly in an index. Past performance is not indicative of future performance of any index or fund.

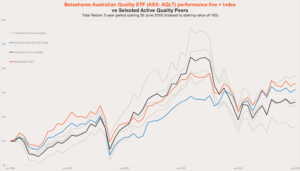

While AQLT’s performance since fund inception on 4 April 2022 has been strong, we can also compare the 5-year performance of AQLT’s strategy, by combining actual fund performance since fund inception with the performance of it’s index less MER for the period prior to fund inception, against other active Quality peers. On this basis, AQLT’s strategy has outperformed the broader market and all bar one peer on an absolute return basis, and given its much lower level of volatility, AQLT’s strategy has outperformed the peers on a risk adjusted basis.

Source: Morningstar. As at 30 June 2023. 5-year period starting 30 June 2018. Active quality peers selected as funds in the top quartile for quality factor with 5 years track record from Morningstar Australian domiciled domestic equity active funds in the Large Blend, Large Value, and Large Growth categories. AQLT’s performance is a blend of live fund performance for the period since fund inception (4 April 2022) and historical index performance less AQLT’s MER for the period from 30 June 2018 to 3 April 2022). You cannot invest directly in an index. Past performance is not indicative of future performance of any index or fund.

Given AQLT is designed to be a low-cost diversified exposure, it also has:

- A much lower MER drag to the actively managed peers, 0.35% versus 0.95-2.23%; and

- A lower degree of concentration in its top 10 holdings, 45% versus 56-89%3

Hence it is somewhat unsurprising that AQLT has the potential to outperform this peer group, on average, at a lower level of volatility.

AQLT as a core Australia equities allocation

Investing in companies that have generated consistently high profits, are efficient with shareholder capital while maintaining conservative levels of financial leverage is intuitively appealing, with extensive historical evidence of long -term outperformance. More immediately, the focus on profit margins, cashflow and debt servicing during the current ASX reporting season has arguably strengthened the case for looking at the quality of clients’ Australian equity allocations.

AQLT provides investors with a ‘true to label’ Australian quality exposure suitable as a core allocation for Australian investors seeking the best of both worlds:

- The potential for outperformance against a market capitalisation weighted index.

- A cost- effective, diversified approach typically expected an of ETF.

You can find more information on AQLT at its fund page here.

AQLT is rated ‘Investment Grade’ by Lonsec. You can request the research reports from your BDM or by filling in the form under the following link.

For more information on Betashares ETF platform availability please use the following link.

2. Based on a peer group of 487 funds categorised by Morningstar as “Australia Fund Equity Australia – Large Blend, Large Value or Large Growth”.

3. Morningstar. As at 30 June 2023.