How Liberation Day upended markets: A timeline

8 minutes reading time

The ‘Magnificent 7’ tech stocks again delivered strong earnings growth for the Q3 2024 quarter with all companies beating market expectations. The results highlighted continued strength in core business segments across search, advertising and e-commerce.

Cloud services continue to be a bright spot with enterprises increasingly migrating their AI workloads to the cloud. Amazon and Google announced quarterly revenue in Amazon Web Services (AWS) and Google Cloud accelerating year over year (yoy).

However, beating expectations is not always enough for investors, and the post-announcement share price performance was mixed.

While Amazon and Google traded higher on reporting shares in Microsoft fell slightly as its cloud services offering in Azure marked a slight deceleration in yearly growth.

Below is a summary of the key players.

Q3 2024 Earnings Dashboard

Source: Bloomberg. Market capitalisation and P/E (2025 being next 4 quarter estimates) estimates data as of 22 November 2024. Revenue, earnings and capital expenditure data as at relevant company’s earnings date. In US dollars. Tesla excluded on the view that its business model is not within the same supply chain as the companies represented above.

Market reactions and key takeaways

![]()

- Alphabet (Google’s parent company) shares traded 5% higher after hours following exceptional growth in its cloud services division. Google Cloud revenues increased to $11.4B up from $8.4B a year ago (+35% yoy) contributing to ~15% of total revenues.

- Google Cloud provides enterprise customers such as Volkswagen and Warner Bros a platform to build powerful AI models.

- Notably, Google reduced the cost of producing AI answers in search queries by over 90% in 18 months and has invested heavily in new forms of energy including nuclear to handle the increasing energy demand from AI workloads.

- Amazon also had a very positive report built on broad strength across its core e-commerce, advertising and cloud services business units.

- Despite higher operating and capital expenditure spend, shares traded higher as investors focused on the company’s push to cut costs.

- AWS revenue rose 19% yoy to $27.5B for the quarter, and operating margins reached 38%, up from 30% in the same period last year.

![]()

- In an environment where mega cap tech stocks are priced for perfection, a slight deceleration in earnings growth rates overshadowed Microsoft’s strong underlying fundamentals.

- Despite strong growth in its Azure cloud computing division which posted a +34% revenue gain for the quarter, shares in Microsoft fell slightly as this marked a slight deceleration from the +35% yearly growth in the prior quarter.

- Whilst the deceleration in Azure earnings is forecast to continue with Microsoft guiding towards a 31-32% yoy growth rate for the December quarter, the silver lining is that Azure revenue growth attributed to AI is now up to 12 percentage points (up from 8 percentage points just one quarter ago).

- Even as expense growth continues from the build out of data centre and computing infrastructure, Meta’s profit rose +29% yoy. Despite user growth decelerating, Meta is well-positioned to extract more revenue from existing users using AI tools it has developed to display more content aligned with users’ interests.

- Indeed, Meta has been able to demonstrate its ability to monetise AI through higher user engagement and higher ad revenue with the average price per ad increasing 11% yoy.

- While Apple’s revenue slightly surpassed projections, its net income declined due to a one-time charge from a European tax decision. Additionally, there were concerns around slowing China sales amid increased competition from local brands.

- However, its services division remains a bright spot, boasting a 74% gross margin and achieving an annual run rate of US$100 billion.

- Positively, Apple’s CFO Luca Maestri noted that the “active installed base of devices reached a new all-time high across all products and all geographic segments”.

- The largest company in the world, Nvidia, has risen 200% YTD and continues to be a major driver of US equity market returns.

- Quarterly revenues rose 94% yoy to $35.1 billion and Data Center revenues reached $30.8 billion driven by continued demand for AI accelerator chips.

- Investors focused on concerns around marginally lower Q4 revenue guidance ($37.5 billion, plus or minus 2%) and a compression in gross margins toward the “low-70s” which saw shares in Nvidia fall marginally.

- However, the core business remains strong with Nvidia’s CFO Colette Kress noting that “Blackwell demand is staggering, and we are racing to scale supply to meet the incredible demand”.

- Sales in Blackwell chips are expected to reach over 3.5 million units throughout 2025 according to estimates from Goldman Sachs.

Why the outlook ahead remains positive for the Magnificent 7

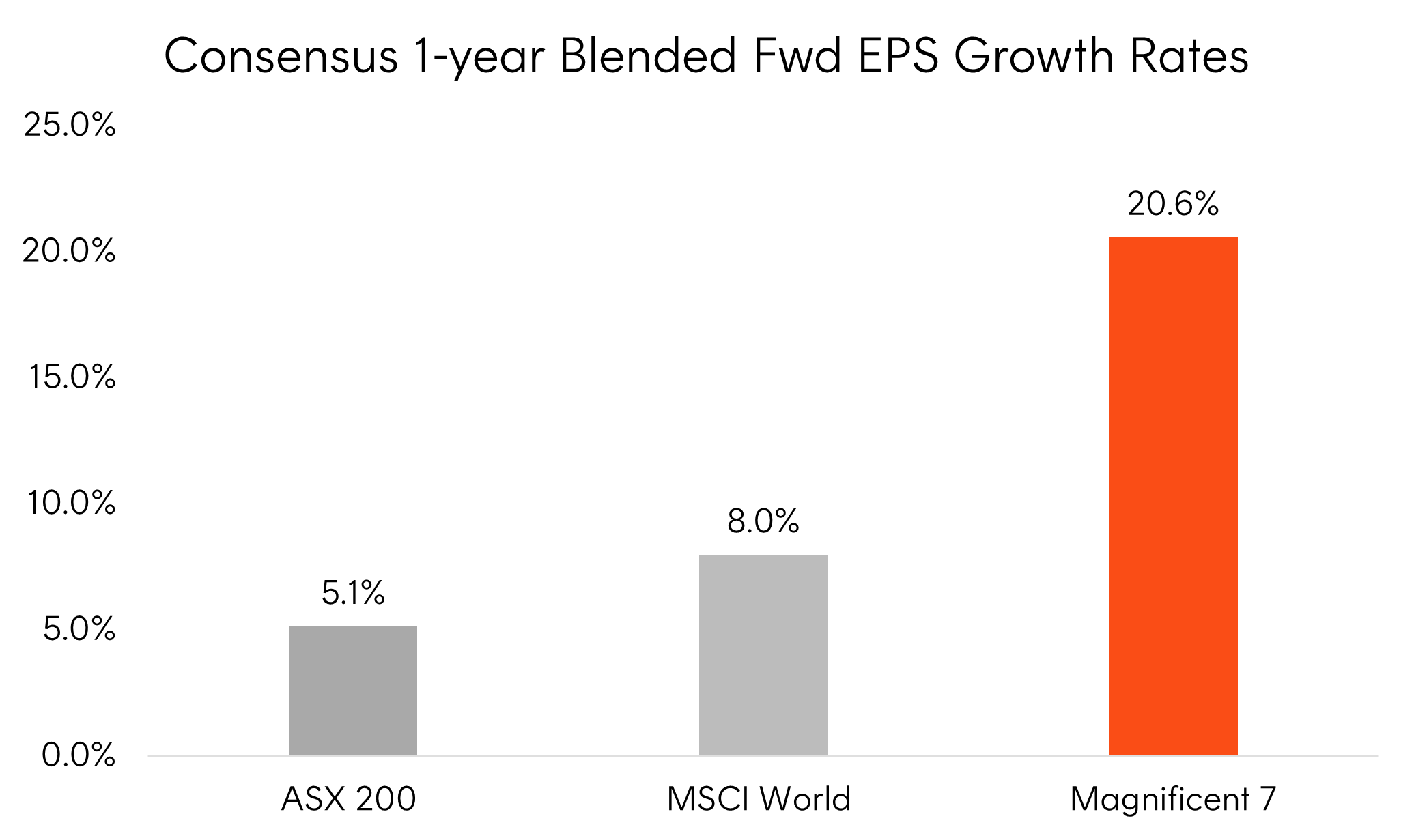

The outlook over the next year remains positive, with forward earnings per share growth rates for the ‘Magnificent 7’ expected to outpace that of the MSCI World and ASX 200 benchmarks by a significant margin.

Source: Bloomberg as of 22 November 2024. Bloomberg blended forward 12 month EPS combines actual results that have been reported and estimated results that have yet to report. You cannot invest directly in an index. Past performance is not indicative of future performance.

Expectations continue to be elevated for these companies with the probability of a large “beat” and increase in share price becoming more difficult as each quarter passes.

But it is hard to ignore the structural growth story of this index which has driven US equity market exceptionalism and is home to the most innovative businesses promising AI productivity gains downstream to end consumers and enterprises.

Investment opportunities beyond the Nasdaq 100

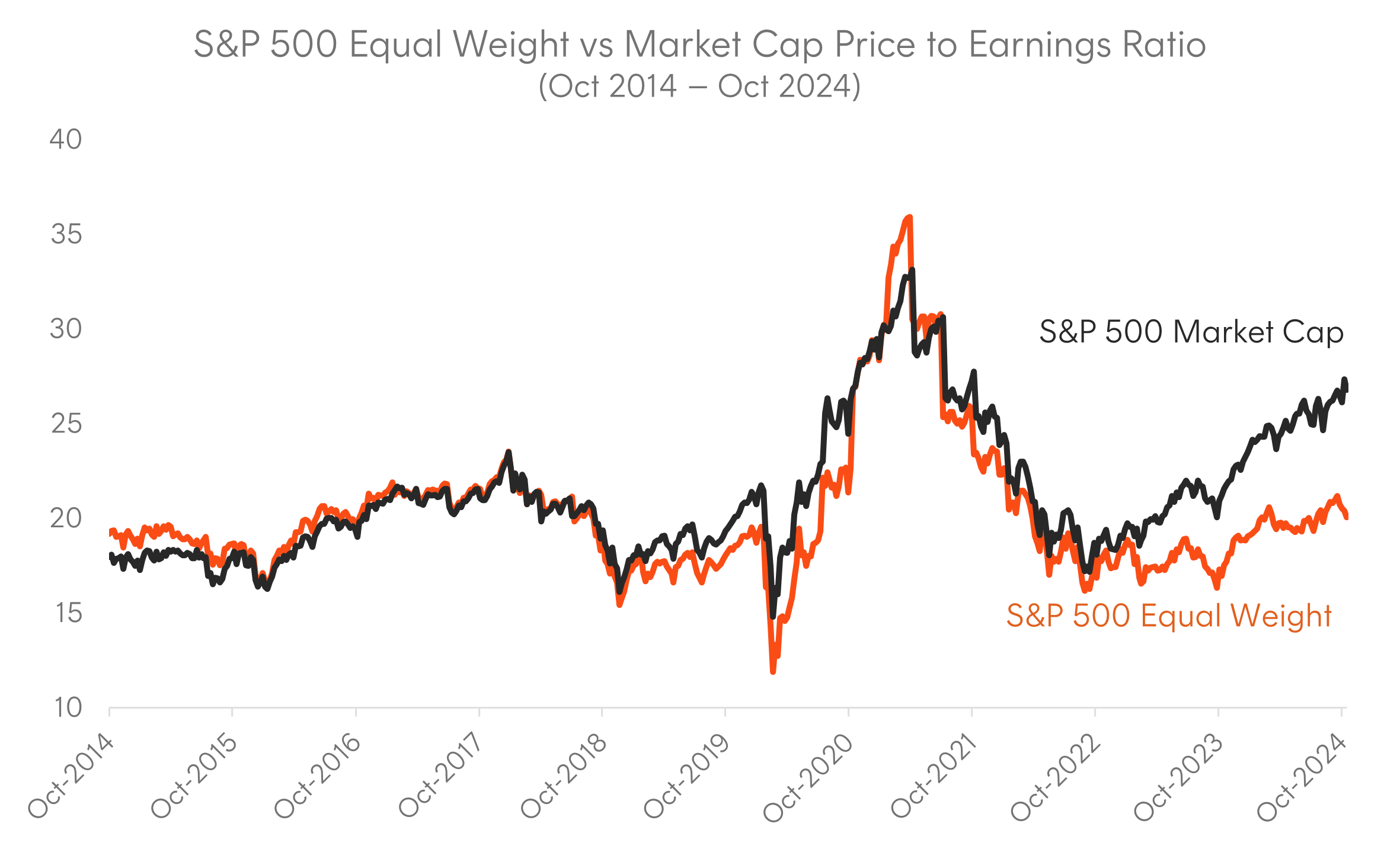

However, with an ‘America First’ populist agenda under a second Trump administration, there may be a broadening out of equity market performance into sectors beyond Information Technology such as Industrials and Financials.

An equal-weighted S&P 500 exposure provides a greater weighting to these sectors and can provide investors access to the dynamic US equity market at cheaper valuations (~20% cheaper on a forward P/E basis) than a market cap weighted index, with forecast earnings growth of ~13% over the next year.

Source: Bloomberg. Trailing price to earnings ratio shown. As at 19 November 2024. You cannot invest directly in an index. Past performance is not indicative of future performance of any index or fund.

QUS S&P 500 Equal Weight ETF provides investors immediate portfolio diversification to the US equity market and reduces the risk of the portfolio being heavily exposed to a small number of ‘mega cap’ companies.

Since July, we have seen the S&P 500 Equal Weight index outperform the S&P 500 Market Cap and Nasdaq 100 index in a rotation away from mega caps.

Source: Bloomberg. As at 19 November 2024. You cannot invest directly in an index. Past performance is not indicative of future performance of any index or fund.

There are risks associated with an investment in QUS, including market risk, index methodology risk, country risk and currency risk. Investment value can go up and down. An investment in the Fund should only be considered as a part of a broader portfolio, taking into account your particular circumstances, including your tolerance for risk. For more information on risks and other features of the Fund, please see the Product Disclosure Statement and Target Market Determination, both available at www.betashares.com.au.