3 minutes reading time

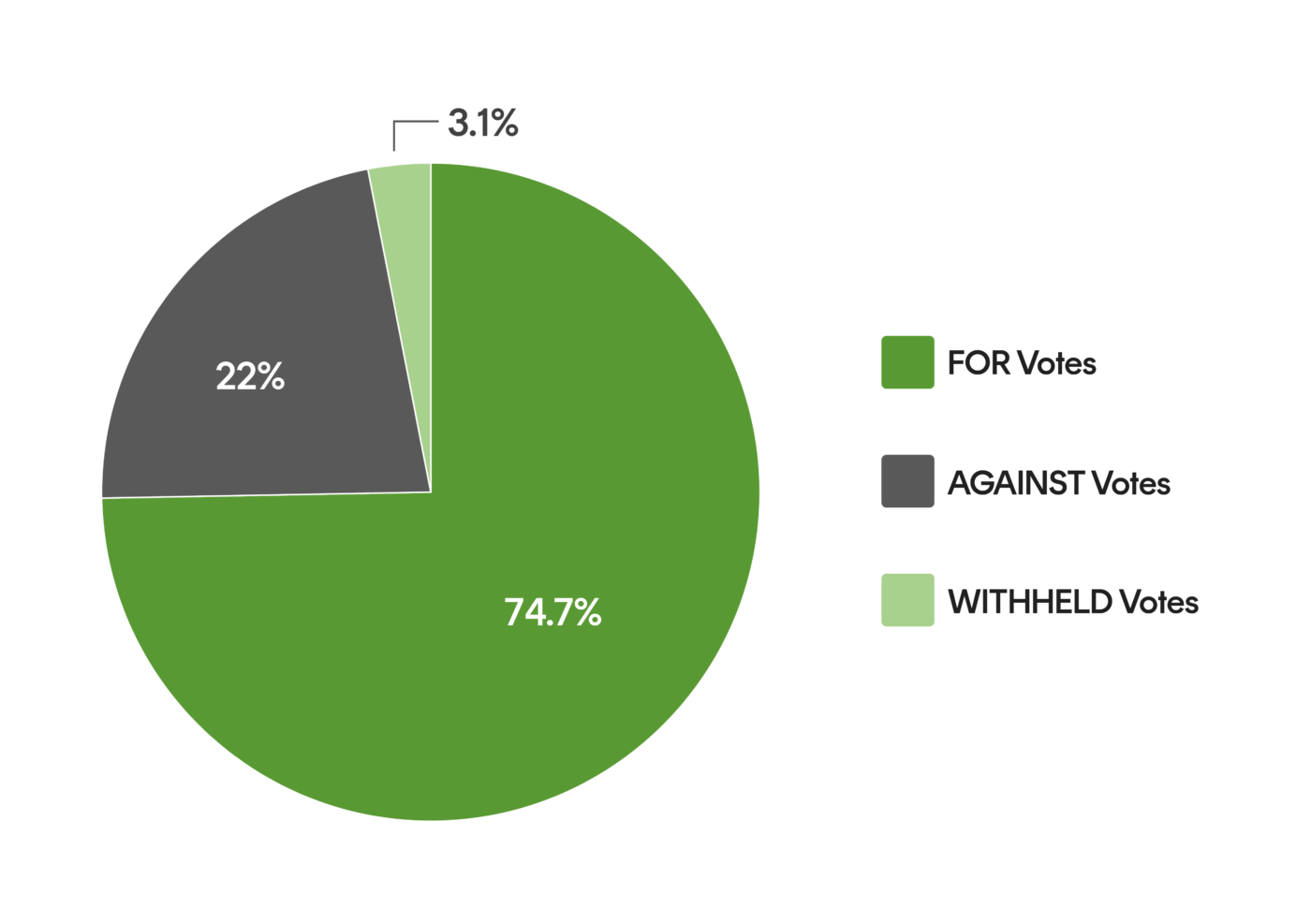

Across Betashares’ range of ethical and impact ETFs1, in the quarter ending 30 September 2024, we voted at 28 shareholder meetings on 261 individual proposals. We voted FOR 195 times, AGAINST 58 times and withheld 8 times.

We voted WITH management 199 times and AGAINST management 62 times.

Among the proposals, we supported a shareholder proposal at Snowflake Inc in favour of declassifying the Board under which all directors would stand for re-election in the same year. Declassified boards of directors improves the board’s level of accountability and is aligned with best practice in corporate governance.

Engagement activity

Engagement activity over the quarter was focused on animal cruelty, biodiversity and supply chain risks.

The Responsible Investment Committee (RIC) engaged with Sanofi to understand how it protects animals used in research based on allegations that it used “forced swim” testing as part of its medical research. These allegations were made by PETA USA activists during the company’s AGM. In its response, Sanofi confirmed that it did not undertake “forced swim” testing, nor did it have any plans to do so in the future, either directly or in collaboration with research partners. It confirmed that animal testing was only used as a last resort, based on regulatory and scientific necessity, and that it has firmly embedded the 3Rs principles (replacement, reduction, and refinement of animal use). The RIC is satisfied with this response and will continue monitoring Sanofi relating to its animal testing policies and procedures.

The RIC engaged with Woolworths Group relating to concerns about its sourcing of farmed salmon from Macquarie Harbour in Tasmania, and its seafood sustainability commitments. The RIC expressed concern about the “Responsibly Sourced” label on salmon products from Macquarie Harbour, citing potential environmental and biodiversity impacts, particularly on the endangered Maugean Skate, and urged Woolworths to cease sourcing farmed salmon from Macquarie Harbour, review its reliance on third-party certification schemes, and enhance due diligence by engaging independent sustainability experts. In its response, Woolworths said that it continues to evaluate its seafood sustainability practices and is conducting continuous ongoing assessment of its due diligence practices. The RIC has decided to support the ‘Save the Skate’ campaign and support a shareholder resolution calling on Woolworths to cease sourcing farmed salmon from Macquarie Harbour2.

The RIC engaged with Smurfit Kappa Treasury ULC, a green bond issuer, relating to allegations that it was involved in the destruction of old-growth forests in Sweden. In its response, Smurfit Kappa confirmed that it sourced all wood from third-party verified Chain of Custody suppliers. The company also engaged with all its suppliers and confirmed that all relevant declarations and attestations were current, including its main supplier (responsible for 90% of the wood used in the region), the state-owned company Sveaskog. The RIC was satisfied that Smurfit Kappa was applying appropriate governance to protect old-growth forests and high conservation value regions in its supply chain.

Footnotes:

1. Being Betashares Global Sustainability Leaders ETF (ASX: ETHI), Betashares Australian Sustainability Leaders ETF (ASX: FAIR) and Betashares Climate Change Innovation ETF (ASX: ERTH). ↑

2. https://www.six-invest.com.au/campaigns/woolworths-coles—save-the-skate ↑