7 minutes reading time

If your money is sitting in an everyday banking account—or even a low-interest savings account—you can bet that inflation will devalue it over time. Long-term investing is essential to prevent this outcome, and buying property is often touted as a sure path to building wealth.

While it’s true that investing in property can be an effective way to put your money to work, it’s important to be aware of the challenges that come with the territory. Myths relating to easy gains and guaranteed income for little or no work have misled investors into a false sense of belief.

In this blog, we’ll debunk 3 of the most common and consequential misconceptions about property in Australia and how exchange-traded funds (ETF) can help solve some of the downsides of investing in real estate.

Myth 1: Property prices always rise

For the millions of Australians living in hot property markets like Sydney, Melbourne, or Perth, it’s easy to get the impression that property prices only move in one direction—up—and often at breakneck speed.

While this can make it feel like investing in real estate is a nearly guaranteed way to build wealth, this strong upward trajectory doesn’t consistently hold true in all areas or for all properties

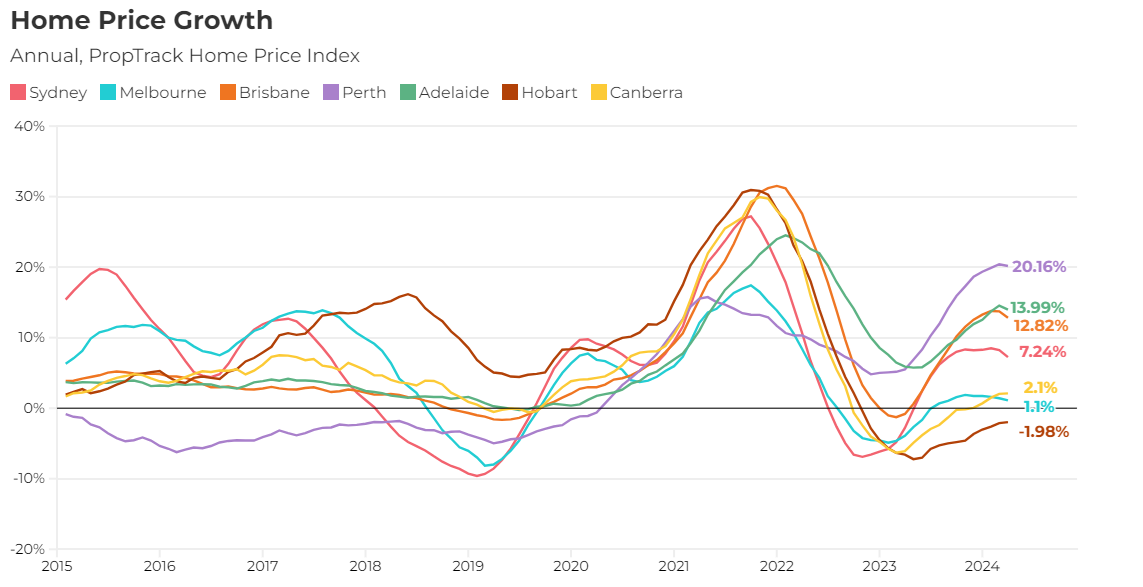

Over the past year alone, home prices in Perth have jumped by over 20%1. While Perth is currently a hot market, the chart below reveals that Perth experienced a five-year decline in prices after 2015.

Similarly, both Adelaide and Brisbane saw stagnation for long periods of time until the pandemic triggered an interstate migration boom driven by the search for affordable housing.

Source: PropTrack Home Price Index (owned by REA Group)

Local housing market trends aren’t the only factor throwing a wrench into the proposition that housing prices always rise. Much like shares, property investments can be subject to volatility and unpredictable shocks.

One example is the case of the troubled Mascot Towers in Mascot, NSW which is close to Sydney Airport and the CBD.

In 2019, significant structural defects were identified in the building, forcing residents to evacuate. Owner-occupiers and renters suddenly found themselves without a home, while landlords faced the shock of lost income.

After five years of legal battles, the NSW government intervened, offering a bailout to the unit owners at a painful 70% loss on pre-evacuation values2.

This extreme case is a reminder that real estate investments, despite being viewed as secure, can still be subject to significant risks and losses due to structural issues or other unforeseen factors.

Myth 2: Property offers guaranteed rent

Collecting rent provides real estate investors with income that can be applied towards mortgage payments and other expenses, but reliable rent is far from guaranteed.

Properties may sit empty for stretches of time between tenants, and even if you manage to find a tenant, missed payments are always a risk. Tenants may run into financial difficulties or may simply refuse to pay rent, exposing property owners to drawn out legal processes, costly eviction proceedings, and periods without rental income.

A NSW-based end of tenancy survey from 2020 found that 8.4% of leases terminated by the agent or landlord ended due to the tenant’s rent being in arrears, indicating that this is a fairly common problem faced by landlords3.

This doesn’t mean rent isn’t an attractive feature of property investment, but it does mean prospective investors should be clear-eyed about its variability—sometimes for considerable periods.

Moreover, property investors must consider that, particularly at today’s high prices, rental income often merely offsets – rather than exceeds – expenses such as interest payments, council rates, strata fees (if applicable), water charges, property management fees, and repairs.

Unanticipated factors, such as problematic tenants or vacancies, can cause significant stress if not properly budgeted for.

Myth 3: Property is a passive investment strategy

Australians looking for a hands-off approach to wealth-building won’t necessarily find it in property investment. While it’s often touted as a passive strategy, it requires considerable involvement no matter how you choose to manage your property.

Property managers can ease the workload, taking an average of 6-8% cut of monthly rent4, but even with their support landlords have the ultimate responsibility of approving repairs, reviewing inspection reports, making decisions about tenants, and maintaining financial statements.

Self-management places even greater demands on landlords, including handling complaints and other tenant communications, conducting inspections, and accounting all income and expenses yourself.

If managing multiple properties, handling all of these responsibilities can become a significant time commitment. Awareness of a landlord’s obligations also requires an understanding of local residential tenancy laws.

Property investment is better characterised as an active investment strategy best taken on by those prepared to manage the associated workload and responsibility.

So, should I buy property or ETFs?

There’s no one-size-fits-all answer to the question of whether you’re better off investing in property or ETFs: both can be effective wealth-building strategies. Like property investment, purchasing ETFs also comes with risk, particularly market volatility.

However, if you’re seeking a truly passive income source and wealth-building strategy, ETFs are a solution to consider. They don’t come with the day-to-day management demands of property—in fact, for most ETFs, the best strategy is generally to leave your investments alone and allow them to appreciate in value, resisting the urge to sell during market downturns.

In addition to price growth, many ETFs can also generate income through distributions. For example, funds that pay regular distributions like Betashares A200 Australia 200 ETF and Betashares INCM Global Income Leaders ETF provide exposure to 300 companies combined, within and outside Australia, and pay attractive distributions quarterly.

These distributions can be especially beneficial for property owners who face high expenses at the end of each quarter, such as council rates, water connection fees, and strata charges, on top of regular interest payments. Some ETFs may generate income at times when a property is incurring rental losses, making a strong complement in a diversified portfolio to achieve overall cash flow goals.

It’s also important to note that property and ETFs each have unique advantages. Property investments can offer opportunities for rental income, tax deduction and the potential to benefit from long term growth rates. On the other hand, ETFs offer advantages such as minimal cost of entry, diversification and liquidity.

While residential property provides exposure to a specific local sector, ETFs offer exposure to broader market trends, such as AI and technology, for example through the Betashares NDQ Nasdaq 100 ETF or Betashares RBTZ Global Robotics and Artificial Intelligence ETF .

It’s not one or the other—it’s what’s best for you

While property is often heralded as a foolproof path to wealth-building, it’s crucial to approach it with a clear understanding of the challenges involved.

The notions that property prices always rise, rent is guaranteed, and it’s a passive investment are misconceptions that can lead to unexpected financial stress and significant losses. Real estate investments come with inherent risks and require active management, even with the support of professional property managers.

For Australians seeking a more hands-off investment strategy, ETFs offer a compelling alternative or complement to property investment. They can provide diversification, potential for both capital growth and regular income through distributions, and minimal management demands.

To be clear, we are not suggesting choosing one over the other. Many investors already have or aspire to own property. However, when used wisely, ETFs can be an excellent complement or core component of a portfolio.

Disclaimer

Investing involves risk. The value of an investment and income distributions can go down as well as up. An investment in each fund should only be considered, taking into account your particular circumstances, including your tolerance for risk. For more information on the risks and other features of Betashares funds, please see the relevant Product Disclosure Statement and Target Market Determination, available at www.betashares.com.au.

Any Betashares Fund that seeks to track the performance of a particular financial index is not sponsored, endorsed, issued, sold or promoted by the index provider. No index provider makes any representations in relation to the Betashares Funds or bears any liability in relation to the Betashares Funds.

Sources

1. https://www.realestate.com.au/news/property-prices-keep-breaking-records-but-one-major-city-is-falling-behind/2. https://www.theguardian.com/australia-news/2024/jan/17/mascot-towers-damage-owners-debt-proposal-plan-settlement 3. https://www.fairtrading.nsw.gov.au/housing-and-property/pilot-end-of-tenancy-survey 4. https://agent.inspectrealestate.com.au/what-is-the-average-property-management-fee-for-rental-properties-in-australia-startup/

2 comments on this

My wife and I, and many of our friends, gave up on rental properties at older age. I would rather spend my time golfing than have a call from a tenant or property manager about another leak, another strata issue etc. It just became too much at old age.

Investing in property and exchange-traded funds (ETFs) are two different approaches to investing with distinct characteristics and potential benefits. Ultimately, the choice between property investment and ETFs depends on your financial goals, risk tolerance, available capital, and investment horizon. Some investors may choose to diversify their portfolio by investing in both, balancing the potential benefits and risks of each asset class