3 minutes reading time

The world has seen significant population growth over the past 70 years, and with this set to continue, there will inevitably be continued growing demand for the thing that fuels us as human beings – food! Although the world will always have its fair share of global uncertainties (currently things like trade wars, unrest in Hong Kong etc.), one fact remains – people will always need to eat.

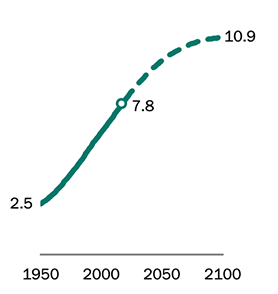

According to a recent United Nations report, the world population is forecast to be just shy of 11 billion by 2100, from approximately 7.8 billion today. And all of these people will need to eat!

World population, in billions

Source: United Nations Department of Economic and Social Affairs, Population Division, “World Population Prospects 2019″

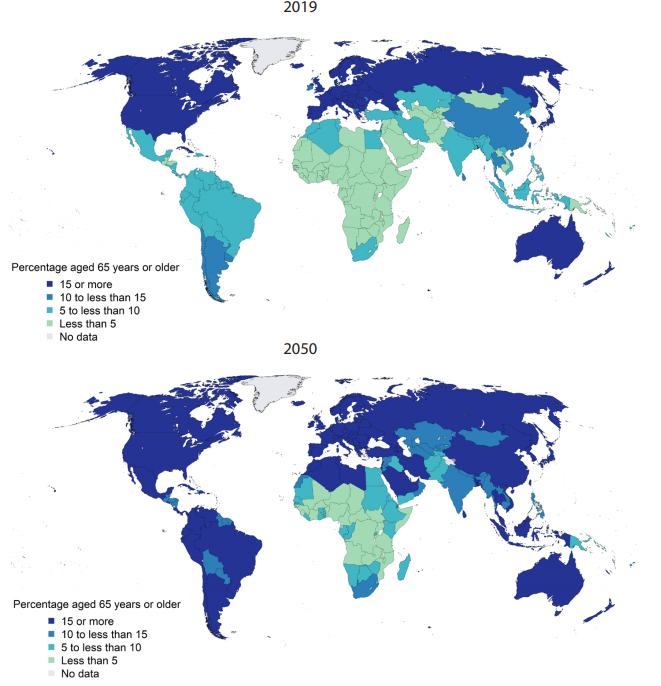

As such, it is evident that there will be a significantly larger demand for agricultural products over the next few decades, in order to generate enough food to feed these additional people. Similarly, with the current population set to age and living standards set to increase (see chart below), this will have a direct impact on specific foods, such as an increase in demand for foods like meats, sugars, oils and fresh dairy products.

An ageing population: percentage of population aged 65+, 2019 vs. 2050 (est.) by country

Source: United Nations Department of Economic and Social Affairs, Population Division, “World Population Prospects 2019″

How can I look for ways to profit from this trend/theme?

When looking at companies that may potentially benefit from an increased demand in food/agriculture, some names that come to mind:

- John Deere: manufacturing agricultural equipment that assists in the planting, maintaining, feeding and harvesting of crops.

- Nutrien: world’s largest producer of crop fertiliser.

- Tyson Foods: one of the world’s largest producers of chicken, beef and pork.

- Archer Daniels and Midland: large producers of a range of foods, oils and ingredients, such as peanuts, canola, seeds, sugars and powders.

How can you get exposure to these companies?

Fortunately, you don’t have to buy shares in each individual company.

FOOD Global Agriculture Companies Currency Hedged ETF offers investors an easy and transparent way to gain diversified exposure to some of the world’s leading agriculture companies outside of Australia (including the companies mentioned above).

These companies are just a few of the wide variety of companies in different sectors, and countries such as Japan, Canada and Norway to name a few, that FOOD provides exposure to.

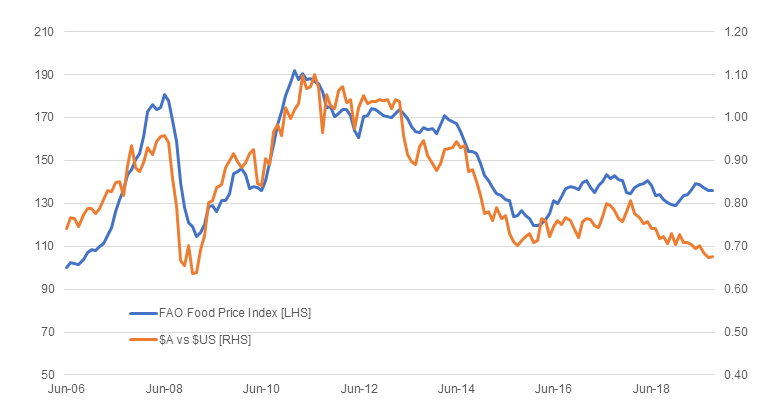

Another feature of FOOD is that it provides a currency-hedged exposure. This means that the underlying performance of FOOD will be more directly correlated with the performance of the agriculture companies in which it invests, and much less to do with currency movements.

This more ‘pure’ exposure to the underlying theme (with a currency-hedged approach) can prove particularly important for Australian investors, as in the past, when food prices have risen, the Australian Dollar (being a ‘commodity currency’) has also tended to rise (and vice versa). This can be seen in the chart below.

FAO Food Price Index vs. AUD/USD rate, June 2006 – September 2019

Source: Bloomberg

FOOD offers investors an easy and transparent way to benefit from rising agriculture demand. Although no-one can accurately predict global market moves, there is one thing that is certain… people will always need to eat.