9 minutes reading time

Financial adviser use only. Not for distribution to retail clients

This article may include opinions, projections and other forward-looking statements which are subject to various risks and uncertainties. Actual events may differ materially from those reflected or contemplated in such forward-looking statements.

Key points:

- As the global monetary policy cycle shifts towards easing, and a “soft landing” for both the Australian and US economies grows in likelihood, we’re entering the perfect environment for the performance of both duration and credit.

- In contrast to USD credit spreads, AUD investment grade corporate spreads are still well off the early 2021 tights, and arguably offers greater spread compression potential in a soft-landing scenario.

- As the AUD rates curve is embedding far fewer rate cuts than the US curve, longer dated fixed rate AUD corporate bonds arguably have more potential upside for a repricing through the rates channel as we enter a global easing cycle.

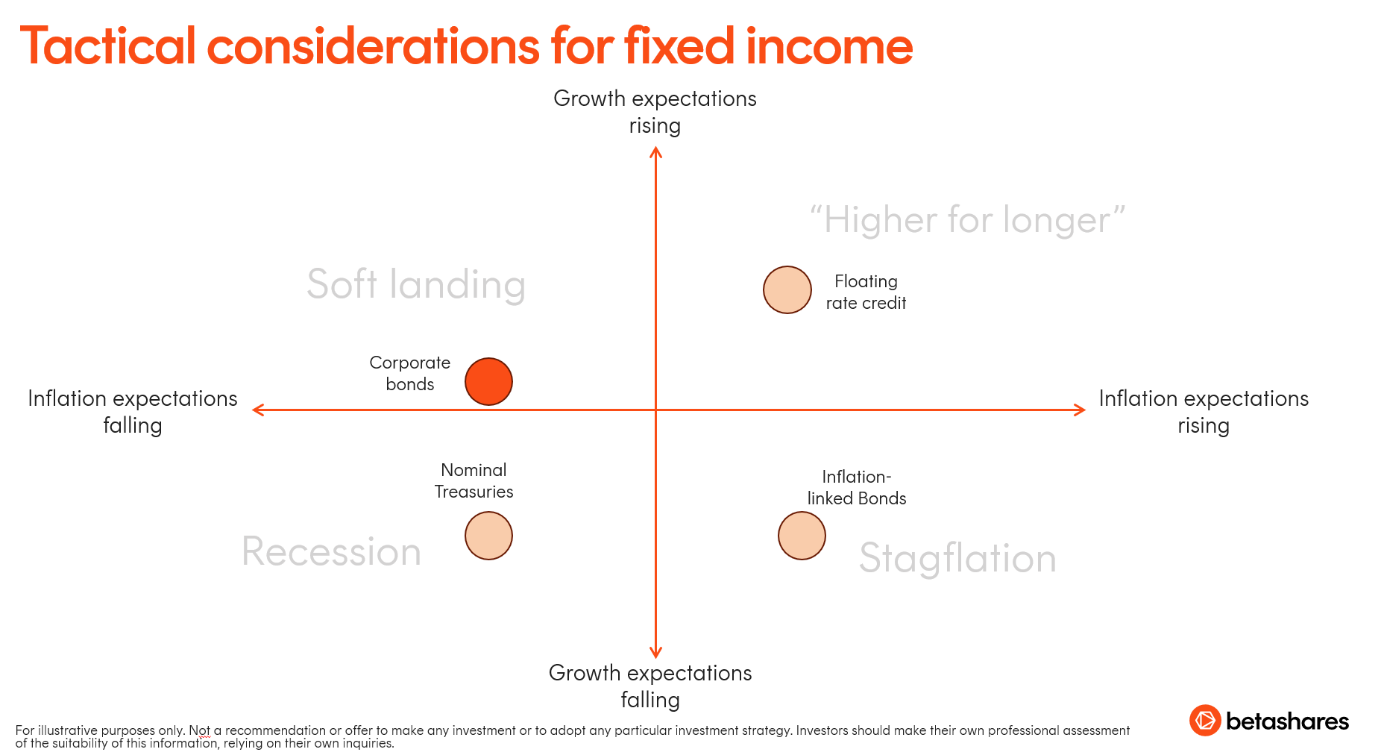

Figure 1: Soft-landing favours fixed rate credit

For illustrative purposes only. Not a recommendation or offer to make any investment or adopt any particular investment strategy.

The ‘ultimate’ soft-landing trade

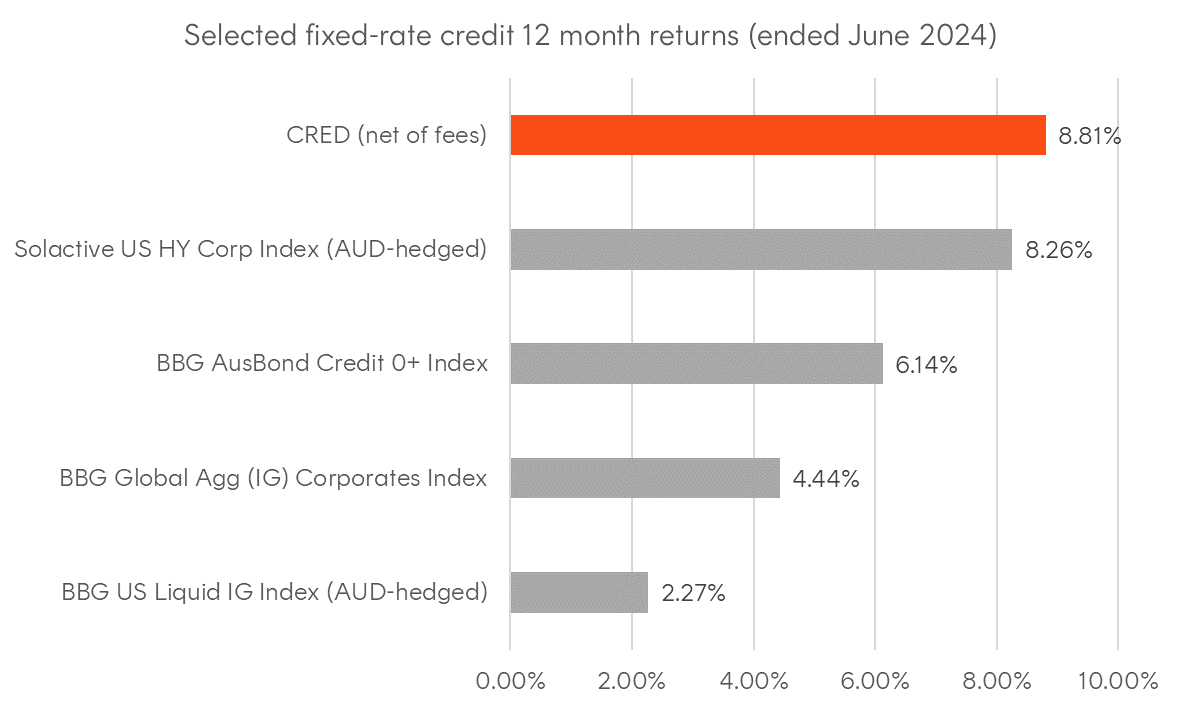

Just as the soft-landing narrative started to gain traction this year, Betashares CRED Australian Investment Grade Corporate Bond ETF came into its own, outperforming major fixed rate credit benchmarks over the 12 months to June 2024, and did this without a rates tailwind.

CRED not only outperformed the Bloomberg AusBond Credit Index and AUD-hedged versions of global and US investment grade corporate indices, but also outperformed US junk bonds on an AUD-hedged basis.

Duration and credit don’t always move together, but we now seem to be entering that “goldilocks” zone for fixed income where:

- Inflation expectations are falling, and the balance of policy priorities has been shifting away from fighting inflation towards supporting growth and employment, allowing central banks to cut rates and ease financial conditions further

- Economic activity and employment in Australia and the US have been slowing, but not to recessionary levels

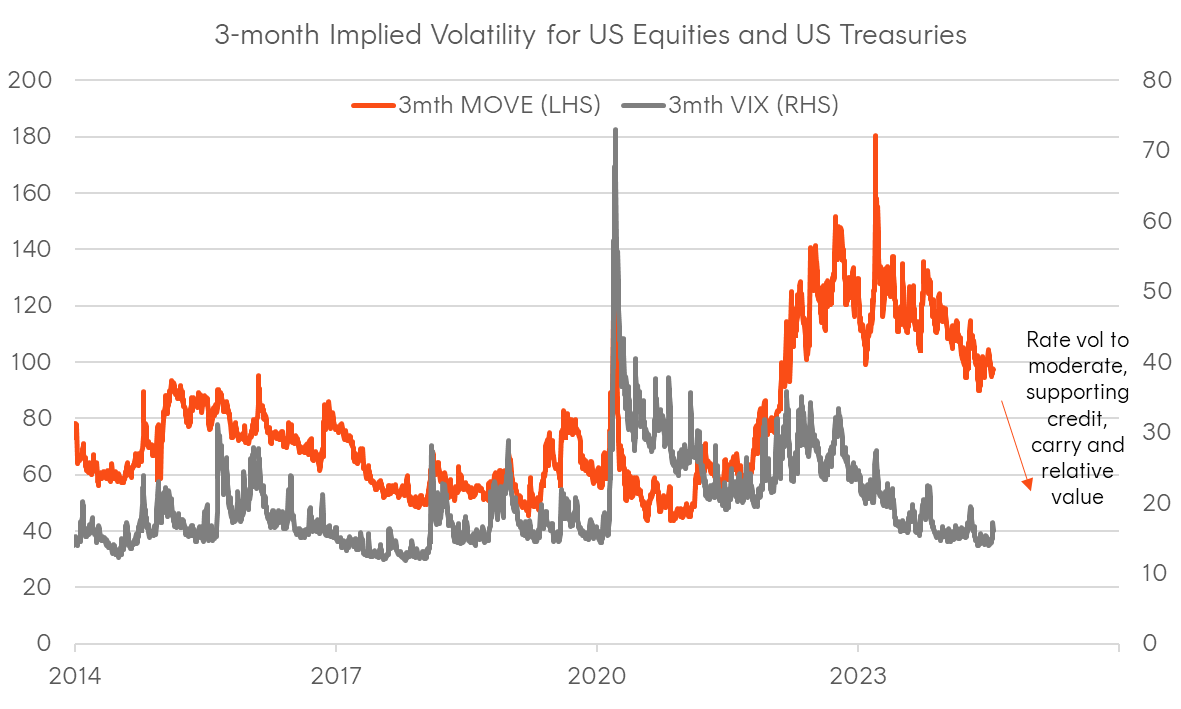

- Interest rate volatility has been declining, supporting a further compression in spreads and outperformance from relative value trades.

CRED seeks to maximise the harvesting of risk premia available in the AUD investment grade corporate bond universe, and we’re now in an environment of risk-premia compression. With an interest rate duration and credit spread duration of around 6 years each, CRED is well positioned to benefit from the current environment.

Figure 2: CRED against selected fixed-rate credit indices

Source: Bloomberg. Past performance is not indicative of future performance. You cannot invest directly in an index.

Slowing inflation and rate cuts a tailwind for duration

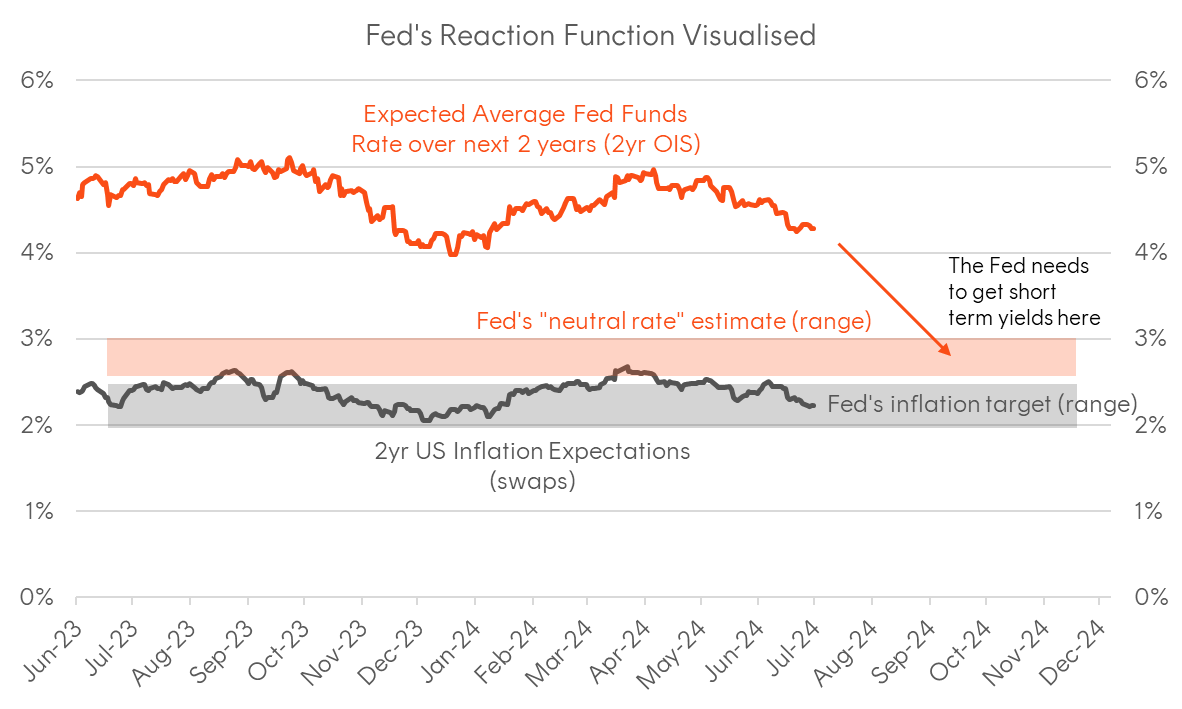

Duration has had a challenging past three years, with returns generally poor and volatility elevated. However, with the global inflation cycle finally turning, central banks have shifted to easing cycles, with cuts already underway from the ECB and the Bank of Canada. Furthermore, the recent US CPI data has provided enough justification for the Fed to start cutting this quarter, and according to the Fed’s reaction function, a failure to do so would impose an unnecessary tightening in monetary conditions by keeping real interest rates too high. In addition to the Fed, we also have the Bank of England and RBNZ signalling an easing bias.

Figure 3: The Fed’s reaction function visualised

Sources: Bloomberg; Betashares. As at 24 July 2024.

Although the August RBA decision will hinge on the Q2 CPI data due on 31 July, Australian is a small, open economy and rate cuts from the Fed, ECB, BoC and BoE will only reinforce market expectations the RBA will soon be cutting, regardless of what they do in August. Outright returns will be heavily influenced by US Treasuries (the correlation of monthly changes in 10-year Australian and US yields is +0.791), and as we head into a global easing cycle, fixed rate bonds even domestically will likely receive a tailwind.

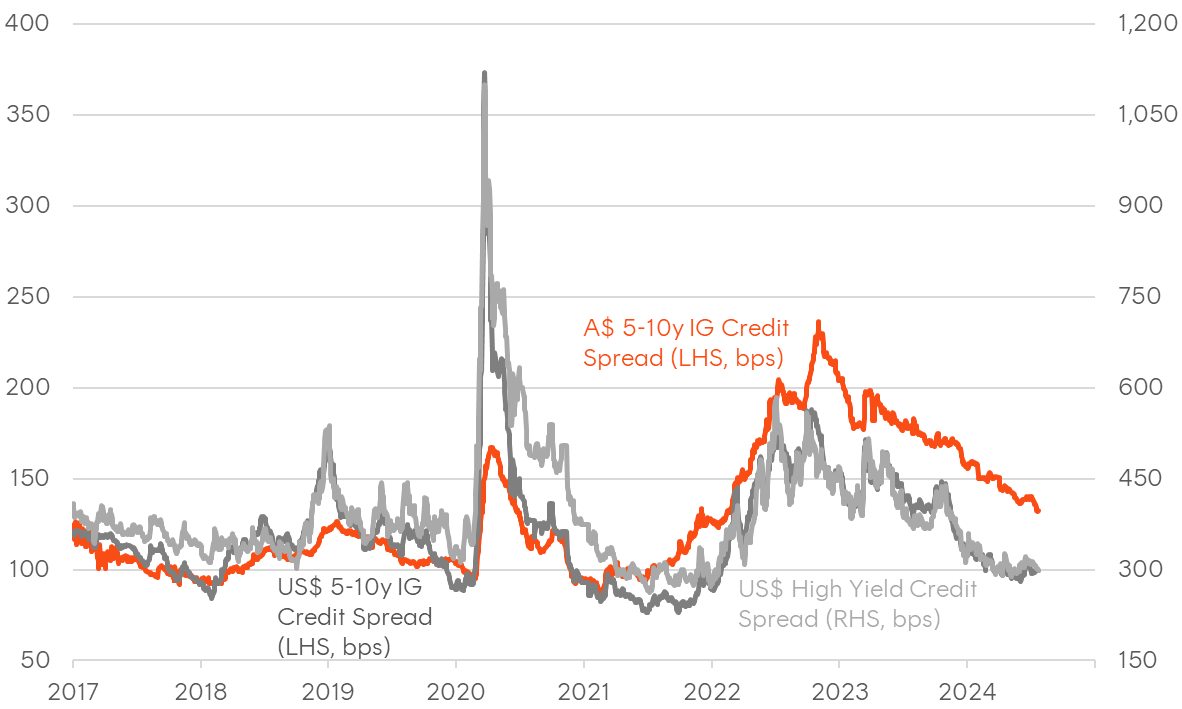

Relative value in both the AUD credit and rates channels

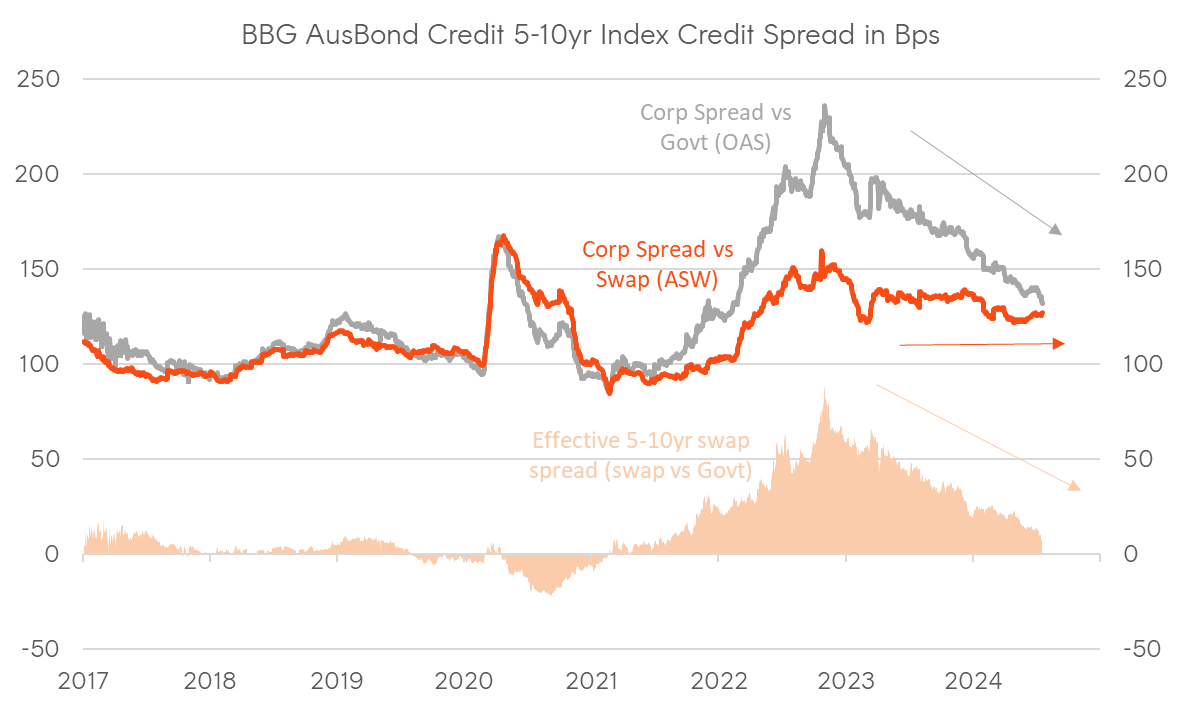

In contrast to other soft-landing expressions in the global fixed income landscape being fully priced, AUD-credit still offers significant upside potential. Both USD Investment Grade and High Yield spreads have been trading around the 2021 tights, and High Yield is currently offering especially poor asymmetry, given its beta to US equities. In contrast, longer-dated AUD Investment Grade corporate spreads are still well off the early 2021 tights, and arguably offers greater spread compression potential. Furthermore, most of the spread compression in AUD corporates vs government bonds over the past 18 months has been driven by a compression in AUD swap spreads, with corporate spreads to swap (the true measure of credit risk premia) only tightening modestly, meaning further compression potential in a soft landing environment (see Figure 6).

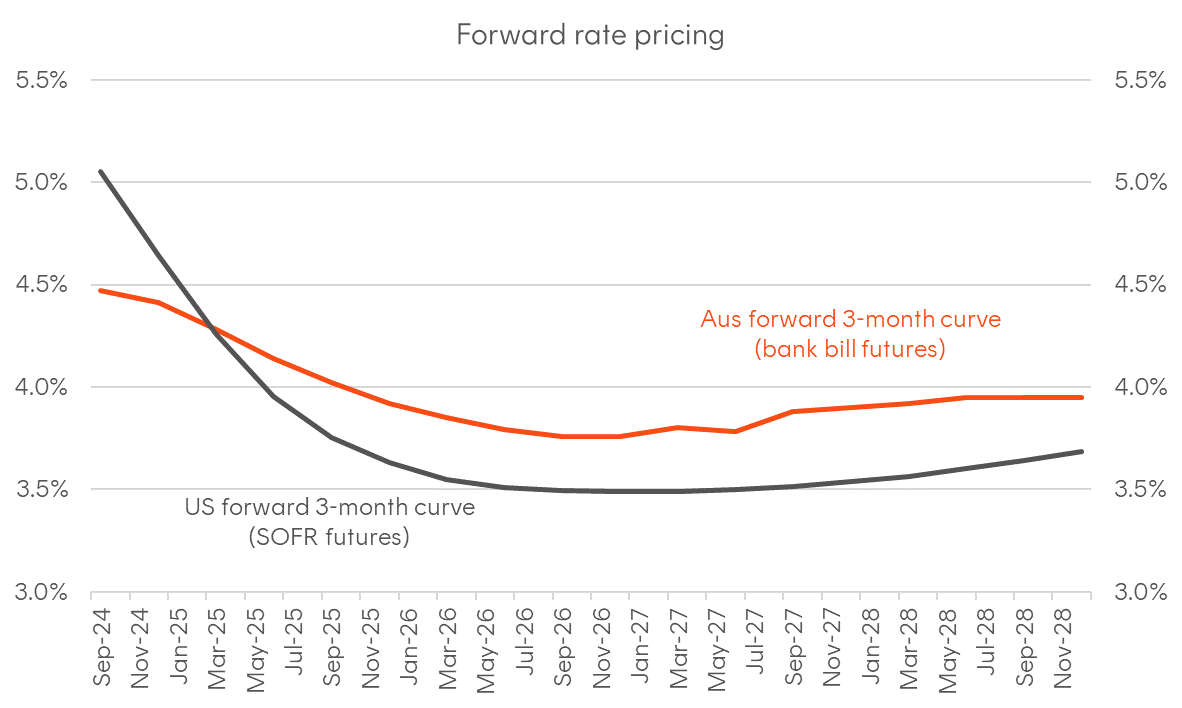

On the rates side, while the RBA might be late to the easing cycle, there is more scope for a greater repricing in the curve and a larger decline in AUD yields in the belly and long-end of the curve. An aggressive easing cycle is already priced into the US curve, while the AUD curve is still embedding a small probability of further hikes and an extremely shallow easing cycle. Ultimately, the August meeting notwithstanding, the RBA would struggle to maintain a neutral or hawkish stance if the Fed is cutting rates. Furthermore, as inflation continues to recede as a concern for markets and policymakers, we should expect interest rate volatility to subside, supporting both credit, carry trades, and other forms of relative value, including AUD vs USD in in both rates and credit.

Figure 4: Relative value in AUD credit; Option-adjusted spreads (OAS) to Treasuries shown

Source: Bloomberg. As at 24 July 2024. Credit spreads defined by option-adjusted spreads against equivalent government bonds.

Figure 5: Decomposition of AUD 5-10yr credit spreads

Source: Bloomberg. As at 24 July 2024. Credit spreads defined by option-adjusted spreads against equivalent government bonds.

Figure 6: Relative value in AUD rates compared to USD rates; A$ Bank bill and US$ SOFA futures curves

Source: Bloomberg. As at 24 July 2024. Forward 3-month interest rates from US SOFR and Australian Bank Bill Futures curves.

Figure 7: Interest rate volatility likely to subside further

Sources: Bloomberg; CBOE, ICE. As at 24 July 2024. MOVE index reflects yield-curve weighted average of 3-month implied volatility on 2-year, 5-year, 10-year and 30-year Treasury yields. 3-month VIX is a volatility index derived from S&P 500 options, with each option representing the US equity market’s expectation of 90-day forward-looking volatility.

Putting it all together

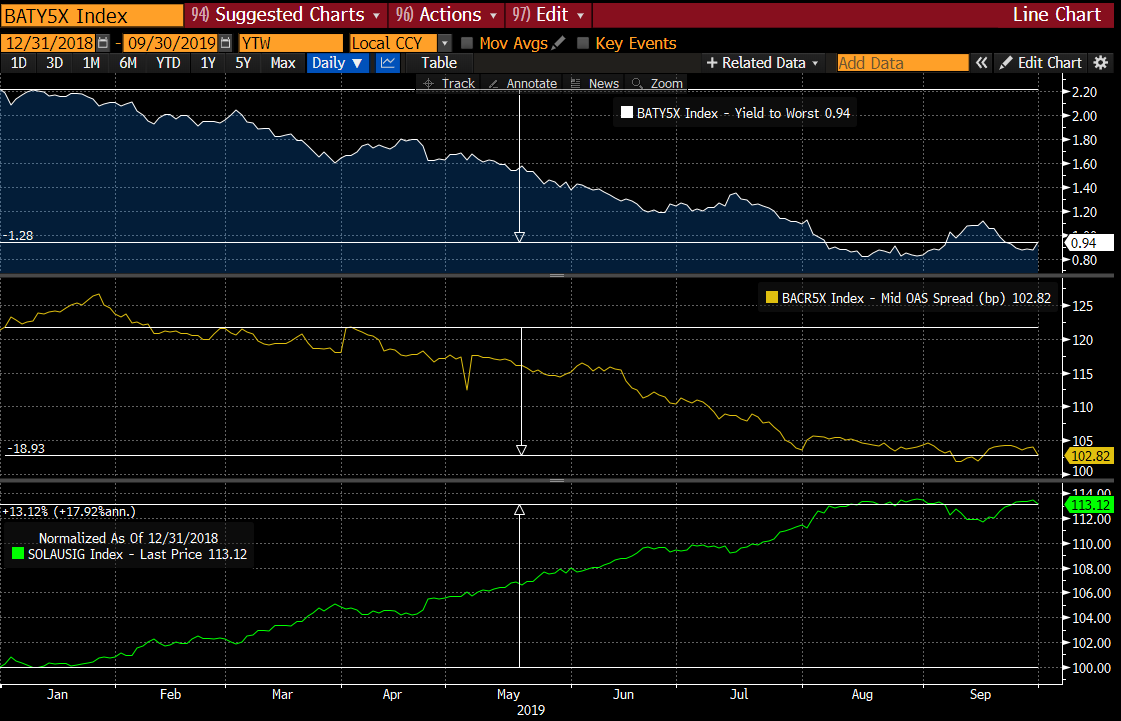

The last time we saw a simultaneous compression in spreads and a sustained move lower in government yields was in Q1 to Q3 of 2019, as the global market responded to the Fed’s dovish pivot in late 2018. Between 31 December 2018 and 30 September 2019, we saw: 1) a 128 basis point decline in average 5-10 year Commonwealth Government Yields (CGS; from 2.22% to 0.94%); and 2) a 20 basis point compression in 5-10 year AUD IG spreads (from CGS +120bps to CGS +100bps). The combination of these two forces produced a 13% non-annualised 9-month return for CRED’s index over the period.

As the soft landing combined with global rate cuts is still our base case, it’s extremely hard to look past CRED. Assuming the RBA cuts back towards its most recent neutral rate estimate of 3.5%, we could potentially see a 50-basis point decline in 5-10 year Australian CGS yields. Furthermore, with swap spreads likely to compress by another 20 basis points as financial conditions ease on top of a 20 basis point compression in the corporate spread to swap, we may get a 40-basis point compression in spreads to government bonds.

Such an environment may help drive an expected return higher than cash, floating rate credit, private credit and arguably even US high yield over the next 12 months, which could make CRED a compelling global easing and soft landing expression.

Figure 8: December 2018 to September 2019; Top panel: 5-10yr CGS yields (BBG AusBond Treasury 5-10yr); Middle Panel: 5-10yr A$ Credit Spreads (OAS);

Lower Panel: 9-month return on CRED’s index

Source: Bloomberg, Solactive. Past performance is not indicative of future performance. You cannot invest directly in an index. Shows performance of index that CRED seeks to track. Does not take into account CRED fees and costs (0.25% p.a.).

There are risks associated with an investment in CRED, including interest rate risk, credit risk, market risk and index tracking risk. Investment value can go up and down. An investment in the Fund should only be considered as a part of a broader portfolio, taking into account your particular circumstances, including your tolerance for risk. For more information on risks and other features of the Fund, please see the Product Disclosure Statement and Target Market Determination, both available on this website.

Footnotes:

1. Bloomberg. As at 31 July 2024 ↑