Is your portfolio really diversified?

6 minutes reading time

- Australian shares

Stock market concentration in the US has risen to all-time highs with large cap technology companies solidifying themselves as key drivers of index returns. The top 5 companies in the S&P 500 account for around 25% of the index1.

But the US equity market concentration problem arguably pales in comparison to Australia, where the top 20 stocks in the ASX 200 made up a whopping 63% of the total index weight as at 11 September 2024. CBA alone accounts for 10% of the index.

And whilst revenue and earnings growth has helped drive S&P 500 returns over the year, the Australian stock market’s returns were largely the result of expanding multiples (i.e. shares becoming more expensive) rather than improvements in underlying fundamentals.

Indeed, it has been reported that the most recent FY24 earnings season saw an expansion in the price to earnings multiple that accounted for around 90% of the gains of the top 20 performers on the ASX2 – painting a dire picture of the earnings outlook for these companies.

Iron ore prices have fallen this year as continued weakness in China’s property market lowered steel production. BHP, which generates about two thirds of its earnings from iron ore, saw profit from operations fall by 24% over the last financial year3.

Fortescue and Rio Tinto are other iron ore producers within the top 20 also facing pressure from lower iron ore demand – with their shares down over 40% and 20% respectively in the year to date.

And while the Big 4 banks have had a good run so far this year, there are early signs of asset quality deterioration with the impact of higher interest rates and cost of living pressures impacting loan serviceability. As a result, earnings are currently forecast to be flat for the S&P/ASX 200 Banks Index over the next 12 months4.

Clearly there are earnings headwinds for the banks and miners – and with 35% of the ASX 200 Index being made up of just 3 iron ore producers and 4 banks (based on market capitalisation), investors may find better opportunities elsewhere to diversify their portfolios in other growing sectors of the Australian market.

Diversifying beyond the banks and miners

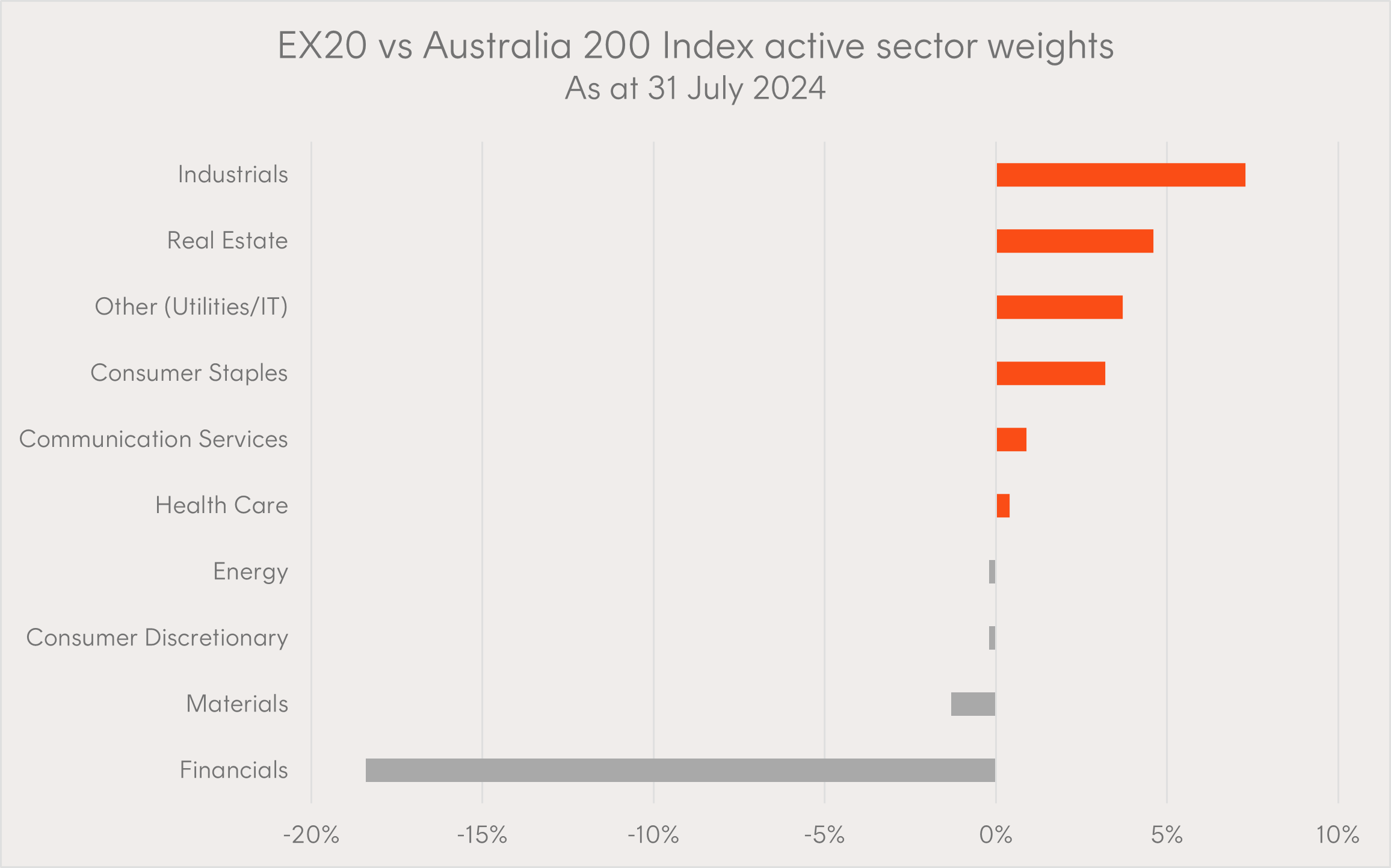

By avoiding the largest 20 companies on the ASX, the Australian share market can help to provide broader sector diversification as shown in the chart below.

Source: Betashares. As at 31 July 2024.

For example, the Solactive Australia ex-20 Index (the index that the EX20 Australian Ex-20 Portfolio Diversifier ETF seeks to track, before fees and expenses) has higher weightings to Industrials, Real Estate, Utilities and IT sectors relative to the broader Australia 200 Index.

This means that an investor can use EX20 as a tool to seek to reduce sector risk within a portfolio – i.e., the risk that a certain sector may underperform the broader market due to industry specific factors, such as falling commodity prices impacting the Materials and Energy sector.

Additionally, diversifying beyond sectors can also help to reduce overall portfolio volatility as each sector/industry tends to perform differently at different points in the business cycle.

Earnings growth potential

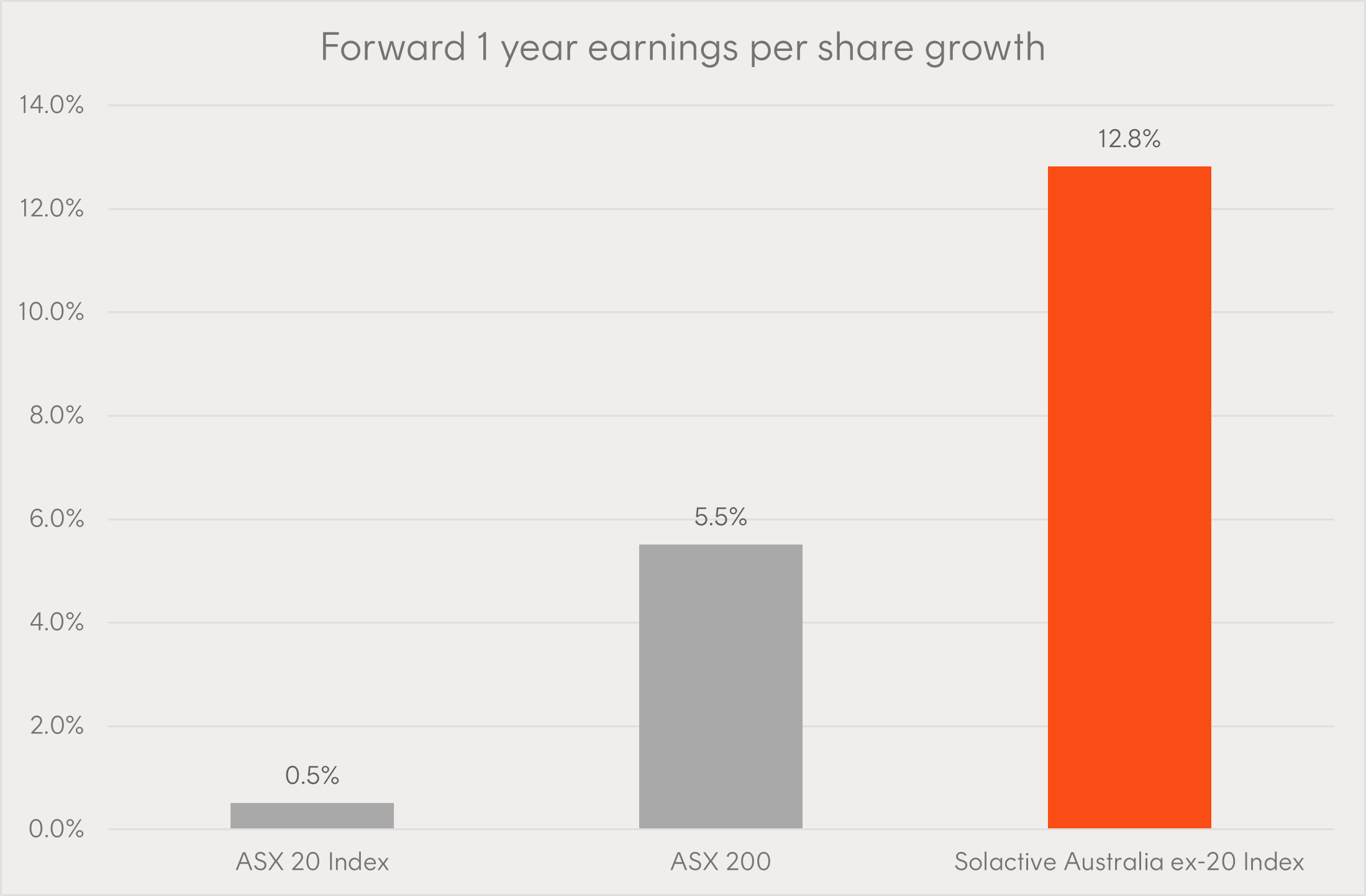

Another advantage that the companies outside of the ASX top 20 can provide is the potential for attractively priced earnings growth.

Where many of the 20 largest companies are now mature businesses with arguably less potential structural growth opportunities, the companies within EX20’s Index generally tend to have greater earnings prospects. They’re also more likely to have established a recurring revenue business model and have overcome early growth hurdles relative to smaller sized companies.

The earnings per share of EX20’s Index are forecast to grow by nearly 13% over the next year compared to just 0.5% for the top 20 companies and 5.5% for the broader index – whilst trading at similar forward valuations.

Source: Bloomberg, Betashares. Based on Bloomberg consensus earnings forecasts. As at 9 September 2024. Actual results may differ.

Digging into some bright spots within this dynamic part of the Australian equity market, we find home growth tech leaders such as REA Group, Carsales and WiseTech delivered strong top line revenue growth for the FY24 reporting season.

With rising input costs a common theme across the Australian reporting season, many technology companies with pricing power seem to have been able to withstand much of this by having inherently lower cost, online business models.

Time to shine?

Companies in EX20’s Index largely performed in line with the ASX top 20 companies until 2022 when the Reserve Bank of Australia began aggressively raising interest rates.

However, with Australian bank net interest margins falling for decades and commodity prices structurally under pressure due to an economic slowdown in China, it may be time for sectors beyond banks and miners to shine.

Source: Betashares, Bloomberg. As at 10 September 2024. Performance shown since EX20 inception date. Past performance is not indicative of future returns of any index or ETF.

Investing in Betashares Australian Ex-20 Portfolio Diversifier ETF

US equity market concentration has driven a large portion of many investors’ portfolios to a few single stock names within the Information Technology sector. Here in Australia, investors have been facing a similar issue and tend to have very heavy concentrations to several companies within the Financials and Materials sectors.

EX20 Australian Ex-20 Portfolio Diversifier ETF provides a simple-to-access, transparent and cost-effective way to diversify investment portfolios beyond the top 20 companies on the ASX, but also provides return opportunities among more moderately sized companies across a diverse range of sectors.

There are risks associated with an investment in EX20, including small-mid cap securities risk, market risk and liquidity risk. Investment value can go up and down. An investment in the Fund should only be made after considering your particular circumstances, including your tolerance for risk. For more information on risks and other features of the Fund, please see the Product Disclosure Statement and Target Market Determination, both available on this website.

References:

1. Bloomberg. As at 9 September 2024. ↑

2. Goldman Sachs Investment Research: Key themes from FY24 Earnings Season ↑

3. BHP Financial results for the year ended 30 June 2024 ↑

4. Based on Bloomberg consensus estimates. As at 9 September 2024. Actual results may differ. ↑