5 minutes reading time

Week in review

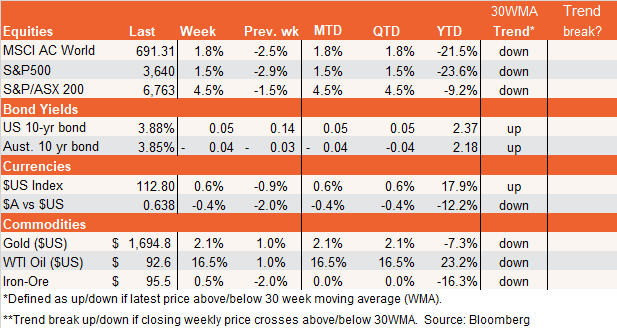

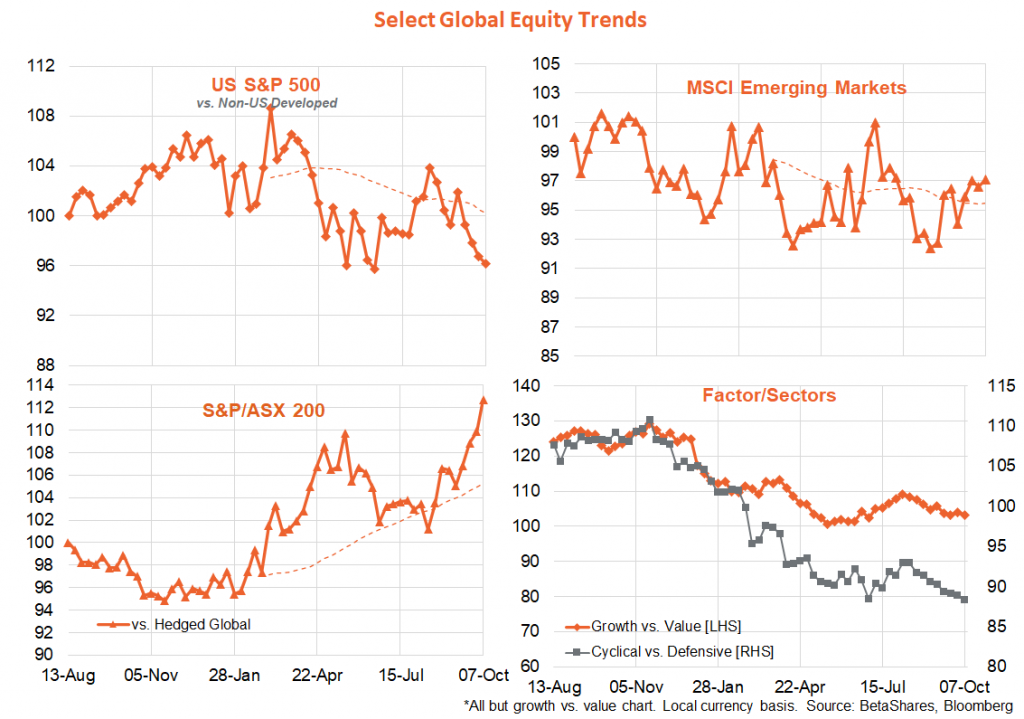

Last week can be divided into two halves. In the first half, weaker than expected US economic manufacturing data saw Wall Street bond and equity traders get excited about yet another potential ‘pivot’ by the Federal Reserve. Alas, the week ended with still strong US labour market data and unrelenting hawkishness from Fed officials – such that pivot hopes were quickly quashed. September US jobs growth was stronger than expected (+263k vs market +250K) with the unemployment rate sinking to 3.5% and annual growth in average hourly earnings remaining firm at 5.0%. While the focus remains on hopes of an easing in consumer price inflation, the other burning issue in the US is that the labour market remains too hot – meaning economic growth and earnings growth must slow by a lot more than we’ve seen to date.

Adding insult to injury, OPEC saw fit to slash oil production by 2 million barrels per day (in a sop to Russia), causing oil prices to surge 16.5% last week. With the EU also looking to completely embargo Russian oil imports later this year, the risk of a rebound in oil prices back above $US100 barrel could frustrate market hopes for a speedy reduction in inflation pressures. Indeed, there’s now a growing risk of a rebound in headline inflation in coming months, with would further quash hopes of a Fed pivot any time soon.

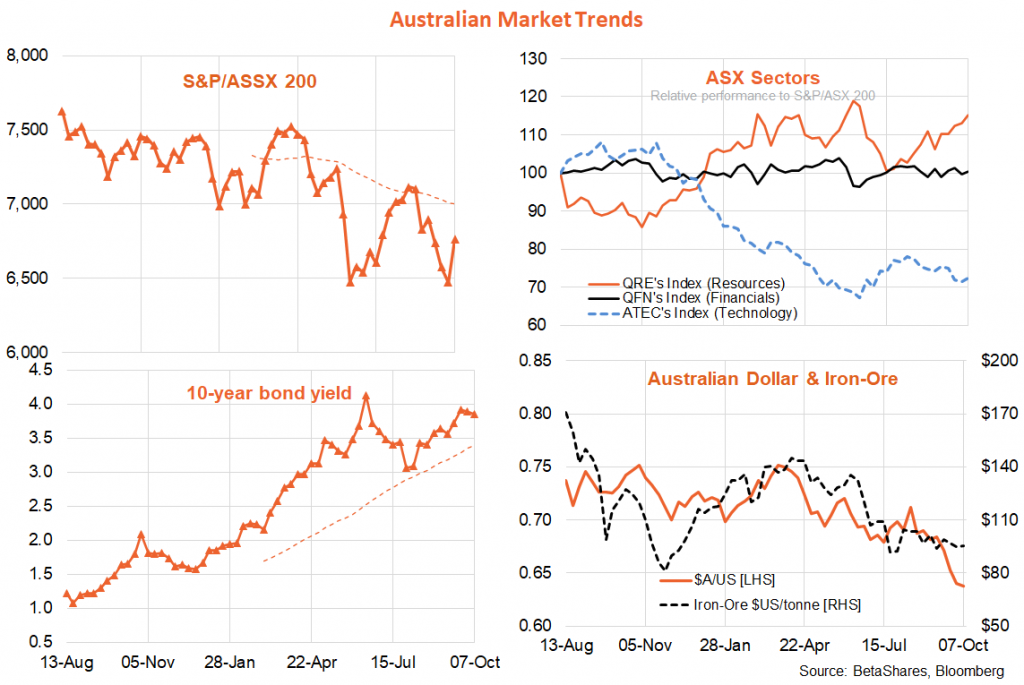

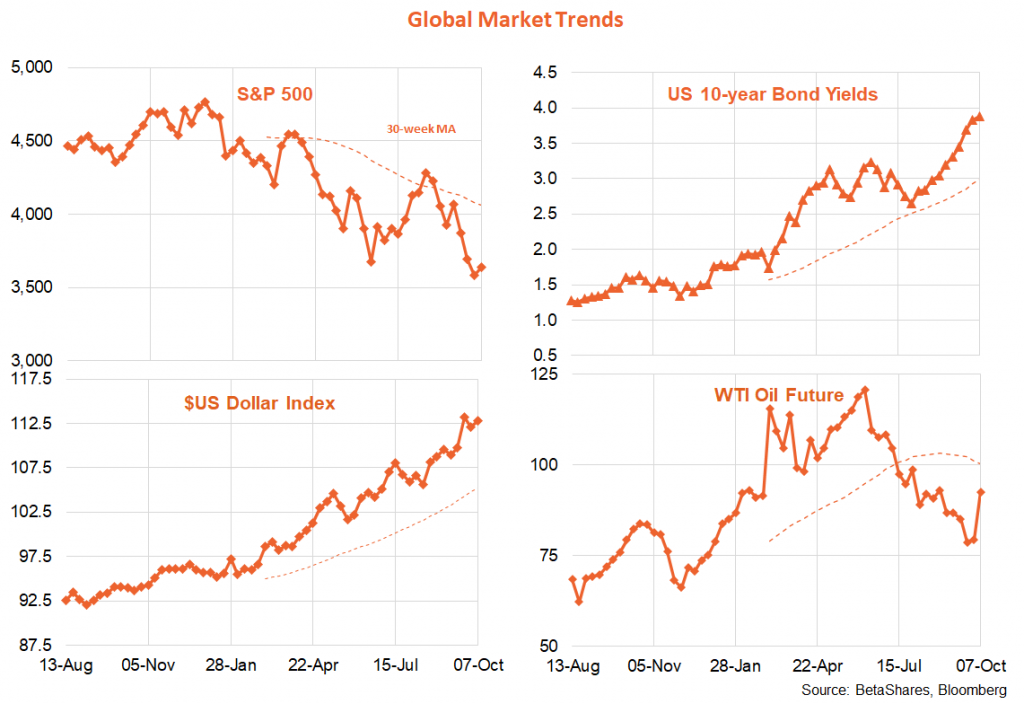

As would be expected, the global energy sector enjoyed a good week – up 10.4% versus only a net 1.8% gain for global stocks. The outperformance bias of Japan (owing to a cheap currency) and Australia (owing to still firm commodity prices) continued, with the Nikkei 225 and the S&P/ASX 200 up 4.5% for the week. US bond yields inched further upwards, continuing the unrelenting push higher since late July. Notably, Australian bond yields have not matched US gains in recent months, with the 10-year spread ending the week in negative territory for the first time this year. The $US remains strong, helping push the $A closer to US 60c – despite strength in commodity prices last week.

Speaking of Australia, the RBA’s surprise decision to raise rates by only 0.25% was welcome news, and supports my long-held expectation that it would raise rates a lot less than the Fed over the coming year. Markets have now settled on an expected cash rate next year of around 3.5% – versus 4.5% in the US. I still think the RBA may only raise rates to 3.35% – or three further 0.25% rate hikes. Meanwhile, last week’s hot US payrolls report keeps the Fed on track to hike rates by another huge 0.75% next month.

We also saw a further decline in local house prices in September. According to Core Logic, national property prices are now down 5.5% from their April peak, while the decline in Sydney has been 9.0% from its January peak.

Week ahead

In terms of the week ahead, the US September CPI on Thursday will be the highlight. Sadly, the market does not expect much joy from the outcome, with core inflation expected to rise by a still firm 0.5% in the month, pushing up annual core inflation from 6.3% to 6.5%. The best that can be said is the market is at least already expecting disappointing news, and any downside surprise would likely see a big bounce in both bonds and stocks. Annual headline inflation is only expected to ease from 8.2% to 8.1%. The other US data highlight will be retail sales on Friday, with the market hoping for signs of a weakening in still fairly robust consumer spending.

Minutes to the latest Fed meeting are released on Wednesday, and a range of Fed officials will likely continue to espouse their hawkish views. We should also keep a watch on oil prices, with a move above $US 100 a barrel potentially likely to unnerve the markets. We are also about to begin the Q3 US earnings reporting season, with several major banks reporting on Friday. According to FactSet, annual growth to end-Q3 is expected to be around 2.2% – which is a notable downgrade from expected growth of 9.9% three months ago. So far at least, among the few companies (4%) that have reported, the upside earnings surprises are below their long-run average.

In Australia, we get updates on business and consumer sentiment from the NAB and Westpac/Melbourne Institute respectively tomorrow. The theme of recent months has been continued upbeat business sentiment and relatively downbeat consumer sentiment – though this as yet has not caused any material slowdown in consumer spending.

Have a great week!